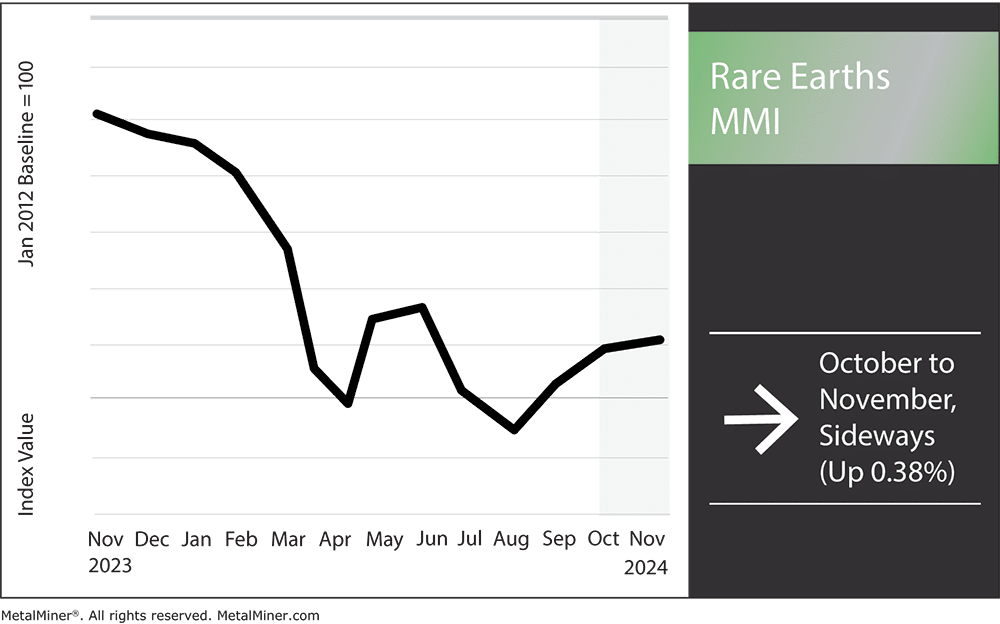

The Rare Earths MMI (Monthly Metals Index) saw its upward price action slow as prices experienced only a slight uptick of 0.38%. While upward price action for rare earths did lose steam month-over-month, prices could soon witness another bullish boost. Not only did China’s rare earth export ban go into effect as of October 1, but Australia, a large manufacturer of rare earths, is now experiencing supply chain disruptions.

Australia’s Rare Earth Manufacturing Disruptions

The rare earths industry in Australia has witnessed numerous supply chain interruptions in recent months. Thanks to these occurrences, the pricing of rare earths and the business plans of companies that rely on these vital resources have seen supply impacts. These, in turn, continue to cause reverberations throughout the worldwide market.

Australia established itself as a major player in the global rare earths market in recent years. This is due in large part to the country’s determination to diversify its supplies away from China, which currently controls most rare earth manufacturing. Large projects like the refinery at Iluka Resources and Lynas Rare Earths processing facility in Kalgoorlie exemplify this pivot.

That said, Australia’s position has been under strain due to recent supply chain challenges and finance issues related to these projects. Stay on top of REE metal market shifts like these and prepare metal spending accordingly. MetalMiner’s monthly free MMI report gives monthly price trends for 10 different metal areas, including rare earths. Sign up here.

Iluka Resources’ Refinery Funding Stalemate

One of Australia’s biggest mineral sands firms, Iluka Resources, recently encountered a significant obstacle with its Eneabba rare earths refinery. Iluka originally possessed backing from a $1.25 billion loan from Export Finance Australia. However, growing costs have forced the project to request more money, bringing its anticipated expenditures to somewhere between $1.7 billion and $1.8 billion. As a result of this funding stalemate, Iluka had had to place a number of important contracts on hold.

Both the project’s schedule and Australia’s goals to increase rare earths independence saw significant impacts from the Iluka delay. When the refinery is up and running, it processes heavy rare earth elements, which are hard to get outside of China.

Lynas Rare Earths’ Sulphuric Acid Supply Disruptions

Over the past month, the largest non-Chinese manufacturer of rare earths in the world, Lynas Rare Earths, has also experienced supply problems regarding sulfuric acid, a necessary ingredient for rare earth processing. The problem emerged when BHP Group decided to halt its nickel activities in Western Australia.

This had an impact on Lynas’ supply of sulfuric acid from BHP’s nickel smelter at Kalgoorlie. Despite BHP’s commitment to providing imported acid through “reasonable efforts,” the circumstances have added an element of unpredictability to Lynas’ supply chain.

Before low material availability hurts you, get ahead of the curve with MetalMiner’s weekly newsletter and stay informed on important market insights.

The Global Rare Earths Price Impact of Australia’s Rare Earth Setbacks

The ongoing issues in Australia have contributed to fluctuations in rare earth prices worldwide. In fact, Lynas recently reported a nearly 6% decline in its first-quarter revenue. Due to supply chain concerns and shifting market demand, their average selling price dropped from A$46.9 per kilogram to A$42.5. And with all of the recent dynamic shifts in the global market, it’s unclear if the market will experience any bullish pressure.

The entire rare earths market has been under significant pressure due to China’s attempts to control the price of these minerals. Given China’s supply management strategies, the recent overproduction and strategic actions are most likely meant to maintain competitive pricing, keeping global prices at a three-year low.

Navigating a Complex Market

Recent supply chain interruptions for rare earths in Australia demonstrate the challenges associated with developing a dependable supply outside of China’s hegemony. As companies like Lynas and Iluka Resources continue struggle financially and logistically, Australia’s position in the future global rare earth supply chain remains uncertain. These incidents emphasize the need for diversified supply chains, robust contingency planning and regulatory support to mitigate the impacts of market volatility and geopolitical pressures.

Rare Earths MMI: Noteworthy Price Shifts

MetalMiner customizes price points, price forecasts and procurement solutions based on the specific metal type your company purchases. See MetalMiner’s full metal catalog.

- Terbium oxide moved sideways sideways, budging up by 1.3% to $831.03 per kilogram.

- Dysprosium oxide also moved sideways, dropping by $2.31%. This left prices at $244.81 per kilogram.

- Yttrium moved sideways, rising by 0.07% to $38.41 per kilogram.

- Lastly, Neodymium moved sideways, dropping by 1.7% to $73,478.69 per metric ton.