Australian Mining sat down with some of the biggest players in Australia’s rare earths sector to discuss where the industry is heading.

Rare earths aren’t such a rare phenomenon anymore.

With industry majors and minors alike keenly invested in the future of Australian rare earths, there’s never been a better time to lift the lid on what’s going on in the sector.

Leaders from VHM, Hastings Technology Metals, Arafura Rare Earths and Iluka Resources offered up insights into where the industry’s at and where it’s heading.

But first, what are rare earths? And why is this commodity group becoming such an industry hot topic?

A set of 17 nearly indistinguishable metallic elements with names that can only be described as a mouthful, rare earths have diverse applications in everything from electronic components to magnetic materials.

The most well-known and currently sought-after rare earths are neodymium and praseodymium, affectionately dubbed NdPr.

The products created from the NdPr mix are a crucial part of our renewable energy future. Every electric vehicle (EV) drivetrain requires up to two kilograms of NdPr oxide, whereas a three-megawatt (MW) direct-drive wind turbine uses 600kg.

It’s an undoubtedly useful cocktail, one the world is going to need more of as the race to net-zero intensifies.

So, who is sourcing rare earths for Australia – and the world’s – critical future?

VHM

One prospective producer set to make an impressive debut into the rare earths sector is VHM.

The company’s flagship Goschen project in a premier mineral sands province in north-west Victoria boasts a proved and probable ore reserve of 199 million tonnes (Mt).

Image: VHM

The scalability of the project is underpinned by a significant mineral resource inventory of 629Mt comprising measured, indicated, and inferred resources with further resource expansion potential.

Goschen was recently announced as the lowest capital cost project among Australia’s rare earths mine development opportunities following a recent optimisation review that saw a capital expenditure reduction for Phase 1 from $483 million to $337 million.

Having recently completed the bilateral government public hearing process for the project’s environmental permitting assessment, Goschen is primed to take the next steps towards production. And VHM chief executive officer Ron Douglas is confident the rare earths industry has a bright future ahead.

“Based on just the expected future sales of EVs, the global market is heading into a period of under-supply where producers like VHM will be well positioned to step up and meet demand,” Douglas told Australian Mining.

Of course, any industry has its challenges, and Douglas said the rare earths industry is facing one major trial ahead.

“Right now, the industry is dominated by China,” Douglas said. “It’s hold on the supply chain can change supply and pricing quickly, requiring nations around the world to ask the question: how can we create diversity in supply chains?”

Douglas said the Federal Government is working to shift the ball out of China’s court – a mammoth task for Australia’s nascent rare earths sector.

“The industry is changing,” he said. “One example is we are seeing more detail being provided about pricing mechanisms in offtake agreements.

“There isn’t a handy index for rare earths in China, so the more we participate, the easier it becomes for Australian players to navigate these relationships.”

Looking ahead, Douglas emphasised VHM’s industry readiness aided by the benefit of dual commodities, with Goschen set to produce both rare earths and mineral sands products.

“The chance of both our commodities experiencing economic lows at the same time is small,” he said. “It puts the rare earths industry in a great position to operate with stability, especially given rare earths and critical minerals are having their moment in the sun.”

“The timing is perfect for VHM to debut, now we just have to grab the opportunity and deliver.”

Hastings Technology Metals

Hastings Technology Metals’ Yangibana project in the Gascoyne region of Western Australia it touted to contain a rare earth oxide ratio of up to 52 per cent in some areas.

The company is currently progressing the construction of a beneficiation plant at the project, expected to produce up to 37,000 tonnes of rare earth concentrate per year.

Image: Hastings Technology Metals

The project is well underway with production set to begin in the second quarter of the 2024–25 financial year.

But there’s still a road ahead, according to Hastings chief operating officer Tim Gilbert.

“Due to a lack of diversification in the supply chain for rare earth materials, the market for rare earths remains challenging in the short-term,” Gilbert told Australian Mining.

But Gilbert agreed with Douglas that the long-term outlook is bright, with technologies like EVs and wind turbines likely to drum up rare earths demand.

“We believe the Yangibana project is well-timed to begin production in line with the growing supply gap, which is expected to grow to the size of around 13 Yangibana projects by 2032,” Gilbert said.

In 2024, Gilbert said Hastings will continue putting the building blocks in place to commence construction of the beneficiation plant at Yangibana.

With a 17-year mine life under its belt, Hastings has a long-term vision to unlock the value of Yangibana through downstream processing opportunities.

“Most recently, we announced a multi-stage processing and offtake agreement with Baotou Sky Rock – a privately-owned Chinese magnet manufacturer – which will allow Hastings to realise higher value rare earth oxide pricing for our concentrate product and deliver attractive project economics,” Gilbert said.

“The increased payability for our rare earth concentrate secured through the offtake with Baotou Sky Rock provides a strong basis from where we can advance project financing discussions.

“We remain focused on ensuring any financing agreement will not only provide for our current and future funding requirements but will be agreed upon in terms that most benefit our shareholders.

“The team will continue to review opportunities to further de-risk the project execution schedule and enhance economic returns.”

Arafura Rare Earths

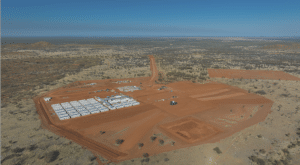

Situated 135km north of Alice Springs in the Northern Territory, Arafura’s Nolans project is fully permitted and construction-ready, aiming to become Australia’s first ore-to-oxide rare earths processing facility.

The project has an initial life of more than 38 years, which Arafura managing director Darryl Cuzzubbo said could be extended even further.

Image: Arafura

“Nolans is one of the few large, hard-rock projects in the world that has the potential to help address the significant supply gap forecast to emerge in the global rare earths market over the next few years,” Cuzzubbo told Australian Mining.

Cuzzubbo is another rare earths leader all too aware of the challenges facing the industry.

“The key challenge for the rare earths industry – and it has been this way for some years – is establishing a global supply chain beyond China,” he said. “Currently, China processes 90 per cent of the world’s NdPr. That has led to a very fragile situation around supply security.”

Cuzzubbo said from a risk management perspective, US, Korean and European car and wind turbine manufacturers are eager to support the development of alternative sources of rare earths.

“This is evident in the support Arafura has garnered from car makers Hyundai and Kia and wind turbine manufacturer Siemens Gamesa RE, all of which have signed up as offtake partners for Nolans,” Cuzzubbo said.

“It is also evident in the support the company has received from government agencies Export Finance Australia, Northern Australia Infrastructure Facility and Export Development Canada.”

These agencies have conditionally committed a combined $US525 million ($785 million) in senior debt for Nolans development.

“Reducing Chinese dominance in the rare earths sector won’t be easy on account of the processing capacity and expertise that reside there, but you can see other countries are motivated,” Cuzzubbo said.

“Arafura looks forward to playing an important role by introducing Nolans as another alternative source.”

Forecasts from the likes of Wood Mackenzie have rare earths supply needing to increase at a compound annual growth rate of 6.9 per cent out to 2032 to meet projected demand.

Cuzzubbo believes Arafura is ready to meet that demand into the future.

“The primary objectives for the company this year are to finalise financing for Nolans and begin full-scale construction of the project,” he said.

“From there, we want to ensure that construction and ramp-up to nameplate capacity goes as smoothly as possible and that the company develops into a sustainable, reliable and globally significant supplier of rare earths.

“We want to be able to provide our customers with confidence that the rare earths they are using have been sourced responsibly and in accordance with best-practice mining and processing principles.”

Iluka Resources

Since the 1990s, Iluka has strategically stockpiled monazite, a rare earths-rich mineral produced from the Narngulu mineral separation plant that forms part of the company’s Eneabba operations in WA.

Now the miner is building a fully integrated rare earths refinery at Eneabba, which has been fully funded under a risk sharing arrangement between Iluka and the Federal Government.

Image: Iluka

Iluka managing director Tom O’Leary reflected on the future of the rare earths industry at the company’s 2024 annual general meeting.

And like Douglas, Gilbert, and Cuzzubbo, O’Leary is familiar with the challenge posed by China.

“China’s influence over the global rare earths market is pervasive, including through pricing indices such as the Asian Metals Index,” he said. “For rare earth oxides, China accounts for approximately 90 per cent of all production, and for key heavy rare earths, effectively 100 per cent.”

O’Leary said Iluka has taken a number of concrete steps to catalyse an Australian rare earths industry that is genuinely independent.

“We have entered into a concentrate supply agreement with Northern Minerals that ensures that, upon the development of the strategically significant Browns Range deposit, rich in heavy rare earths, those minerals will be refined in Australia,” he said.

“Discussions with other potential third party concentrate suppliers are ongoing.”

Iluka is progressing key mining developments at Balranald in New South Wales and Wimmera in Victoria, and is commencing a feasibility study into metallisation – the next stage of the rare earths value chain.

O’Leary’s hope is to spread the opportunities provided by Eneabba beyond Iluka to emerging mining companies.

“The principal purpose of these initiatives is to secure the longevity of the Eneabba refinery,” he said.

“But they also serve to spread the opportunities provided by Eneabba beyond Iluka to emerging mining companies, beyond Western Australia to other states, and even beyond Australia producing rare earth oxides for our allies and partners, which is itself a game changing step.”

A strong Australian rare earths industry is steadily coming to fruition every day as operators commence or ramp up production at new mining projects and processing facilities.

While all four of these leaders are keeping a level head when it comes to the future of the industry, there’s no doubting the growing rare earths demand trajectory, with prospective producers like VHM, Hastings, Arafura, and Iluka ready to reap the rewards.

This feature appeared in the July 2024 issue of Australian Mining.