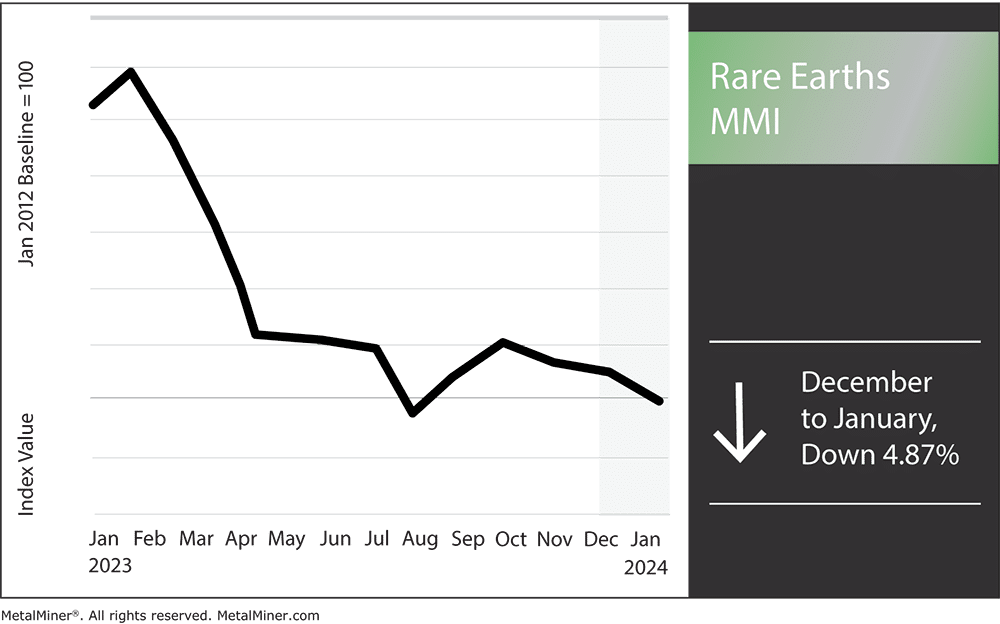

Overall, 2023 proved volatile for the Rare Earths MMI, with the sector experiencing sharp declines at the beginning of the year. This mainly stemmed from decreased Chinese production, supply chain disruptions, and the numerous nations seeking non-Chinese sources of rare earth metals. During Q2 and Q3, price action remained sideways, but global supply dynamics continued to witness further strain. Meanwhile, Australia, the U.S., and several other nations continued to push their rare earths game to seek independence from Chinese supply.

While Q4 didn’t witness as much price volatility as Q1 of 2023, it proved the most active in terms of global rare earth supply shifts. For instance, Myanmar, a major source of rare earths for China and other nations, implemented a mining suspension. Vietnam, which contains the second largest rare earth metals reserves next to China, arrested the heads of two major mining corporations due to illegal activities.

Finally, China instituted a ban on rare earth technology exports right before Christmas. Indeed, some analysts believe this could trigger a trade war between China and other nations competing for rare earth dominance. These Q4 events ultimately placed bearish pressure on the index, and the Rare Earths MMI (Monthly Metals Index) ended 2023 by dropping 4.87%

Receive weekly updates and market intelligence on rare earth metals and China’s latest export ban, helping your company adapt and thrive in the face of changing demand dynamics. Opt into MetalMiner’s free weekly newsletter.

China’s New Export Ban on Rare Earth Tech

On December 21, China officially instituted an export ban on the technology necessary to produce rare earth magnets. The ban affects both the crafting of rare earth magnets and the refining of rare earth metals, as well as technologies related to extracting, segregating, and manufacturing rare earth substances. Many perceive this action as a response to the efforts made by the U.S. and Japan to reduce their reliance on Chinese suppliers.

China still commands the majority of the world market for rare earth processing. Therefore, most experts anticipate that this export limitation will substantially affect the American market. The United States and its allies could find it difficult to maintain a reliable supply of rare-earth materials. This development occurs within the context of a growing trade conflict between the U.S. and China, with both nations placing restrictions on the transfer of vital technological equipment and materials to one another.

Don’t miss out. Join the MetalMiner LinkedIn group today for daily posts on rare earths, aluminum, steel and other industrial metals.

Battle for Rare Earth Metals Dominance Rages On

In addition to the rare earths embargo, the U.S. and China implemented export limits or bans on cutting-edge chips for AI and sophisticated machinery used in semiconductor manufacturing. These steps highlight the growing rivalry and tense diplomatic ties in the global technology arena. Both countries remain fixated on maintaining their technological superiority while attending to relevant national security concerns at any cost.

China’s intent to maintain rare earth metals supremacy and protect its strategic interests is clear from the recent export ban. With nations outside of China actively seek alternative sources of rare earth minerals and technological solutions, the repercussions of this embargo will reverberate across a spectrum of high-technology sectors, encompassing electronics, electric vehicles, and renewable energy.

Rare Earths MMI: Notable Price Shifts

- Yittria witnessed a significant drop of 20.61%, which left prices at $6,200.33 per metric ton

- Neodymium experienced a significant decrease as well, totaling 7.57%. Prices started the month at $79,083.76 per metric ton

- Rare earth carbonate followed suit, this time dropping by 4.85%. This left prices at $5,124.40 per metric ton

- Finally, neodymium oxide suffered a 7.11% decrease. After the drop, prices started the month at $64,608.61 per metric ton

Make informed rare earth sourcing decisions, especially in the face of shifting supply chains. Access MetalMiner’s free Monthly Metals Index report to understand economic metal price drivers through metal price charts and expert analysis.