Economic fallacies are a booming business in an inflationary era. Recent attempts to promote the idea that corporations raised prices in the pursuit of higher profits, creating the last three years’ inflation, are not new. As inflation reached its apex in 2022, that claim (along with a handful of others) became common, as it has been many times before that. It’s an assertion readily embraced by the large number of individuals who, seeing poor or declining economic conditions, are naturally predisposed to blame producers and the productive more generally as opposed to politicians and technocrats.

Over the past few years, US citizens have been told that gas station owners, Vladimir Putin, ocean shippers, and other entities are to blame for prices rocketing up. Efforts have been made to confuse Americans (and anyone else following along) between month-to-month and year-to-year inflation statistics. Americans have also been lied to regarding prices in the United States versus other nations. Fortunately, this bit of misinformation — the idea that hundreds of thousands of businesses have colluded to raise prices to boost their profit margins and in so doing, engineered the inflation that continues to afflict Americans — is easily disproven.

Those who argue that businesses, not monetary policy, are responsible for inflation have already anticipated the criticism that the purposeful coordination of prices of uncountable private entities strains credibility. They argue instead that a sort of follow-the-leader effect occurred where the increase of certain prices led to increases in others and, ultimately, in a bacchanal of price gouging. From a theoretical perspective, this is absurd. Anyone who has purchased jewelry or an airline ticket is familiar with the concept of elastic demand in the same way in which consumers of insulin, food, and electricity understand inelastic demand. The idea that essentially all goods and services could rise in price and profit margins would expand across the board should at least raise doubts.

We can readily discredit the idea that intentionally raising prices across an entire economy, in the pursuit of meatier profits, accounts for the awful inflation seen since 2020. When a firm raises its prices, or the prices of a particular good in an economy rises (gasoline, for instance), consumers have less money to spend on other goods and services. Indeed, this is the cause of the high discontent when energy prices rise. When prices at the pump rise enough, people cut back on travel, vacations, and the like. Rising prices constrain household budgets, as households respond to new prices by adjusting their spending.

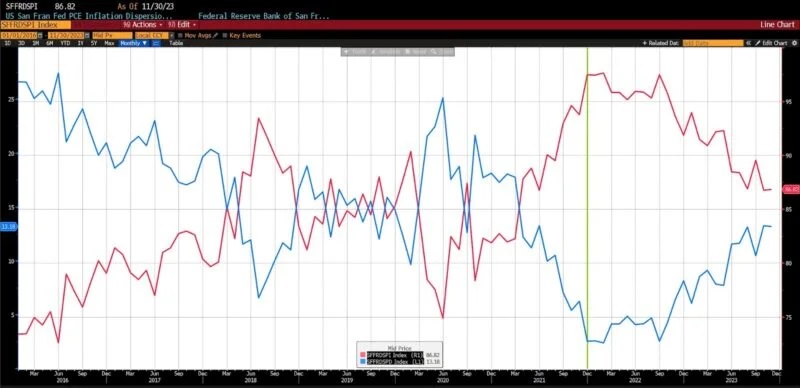

Below is the Federal Reserve Bank of San Francisco Fed PCE (Personal Consumption Expenditure) Inflation Dispersion metric, which tracks the number of goods and services within the index increasing or decreasing over a three-month, smoothed period.

(Source: Bloomberg Finance, LP)

The red line indicates the percentage of indexed goods and services that were rising (averaged over three months); the blue the percentage, those that were falling. Between roughly July 2021 and June 2023, over 90 percent of the thousands of prices in the constituent members of the index were rising, while less than 10 percent had falling prices. In December 2021, a three-month, smoothed percentage of PCE constituents with rising prices stood at 97.45 percent. Those with falling prices totaled a negligible 2.55 percent. As of the end of November 2023, nearly 87 percent of the prices of goods and services in the PCE (again, smoothed over three months) were rising, with just over 13 percent declining over the same period.

The share of items/expenditures and expenditure categories shows price increases two standard deviations above the 12-month inflation rate over a five-year average.

(See this site for the complete data and references.)

Firms deliberately raising prices would explain an increase in one or a handful of prices, but not a nearly simultaneous increase in practically every conceivable price in the economy. As mentioned previously, when oil or gas prices (or the prices of haircuts, or milk, or tractor tires) increase, consumers adjust and prices of other goods and services tend to fall. These are relative price changes: adjustments in the prices of goods and services to one another. In contrast — and as revealed by the charts and data above — inflation is an increase in the general price level of goods and services available in an economy over a defined period of time. The only economic phenomenon which can result in nearly all of the prices in an economy rising at once is a rapid increase in the total amount of money in an economy, such as the purposeful Federal Reserve policy response to the COVID-19 outbreak in 2020.

But do painful rising prices, for which the Federal Reserve alone is at fault, result in higher profits? Not really, for several reasons. First, while consumers understandably focus on consumer prices, input prices, and in particular the prices of capital inputs (commodity prices, for example) rise during inflationary periods as well. Second, not all prices in an economy rise at the same time. Lags between increases in consumer, producer, and capital good prices make the calculation of profits at a given moment subject to distortions owing to injection (Cantillon) effects. It’s additionally worth noting that businesses can and do, at times, make higher profits without raising the prices of final goods in markets, and that inventory gains can increase profits during inflationary periods. Also worth noting is the vast difference between nominal profits, which do not account for inflation, and real profits, which do. The former are largely ignored in the breathless attempts to blame private firms, rather than Fed policy, for rapidly dwindling purchasing power.

In the midst of all this, a fall in the rate of inflation has again been confused with a decline in prices — particularly in political speech. Prices, which began rising owing to the Fed’s massively expansionary monetary policy measures in 2020, have overwhelmingly not fallen; only their rate of increase has declined. Prices are still rising faster than they were prior to the pandemic.

Attempts to attribute inflation in whole or even part to corporate profits extend beyond economic misconceptions and politically animated social science, combining post hoc ergo propter hoc fallacies, naive oversimplifications, and hasty generalizations into a simplistic political ideology. The myth is as seemingly as contagious as it is easily debunked.

Only a substantial increase in the money supply within an economy can lead to a swift rise in overall price levels and the associated consumer pain and distress. Look past your local shopkeeper, beyond the big-box store on the highway, and even further than the big banks in the city beyond. It is the central banker standing at the money spigot who accounts for the financial hardship that still, four years after the ravages of the pandemic, plagues American citizens.

Article courtesy of AIER.org and originally published here.

*********