Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

It’s incredibly rare that any hydrogen for energy play pencils out compared to alternatives. There’s a village in the African country of Mali where geological hydrogen vents up through the ground and is burned to generate electricity for the 4,000 person village.

And then there’s Prince George, British Columbia, which I mostly know as a remote city I’ve never been to that has an incredible history of welcoming refugees. A long-time co-worker was from Prince George, which had embraced Vietnamese refugees fleeing brutal conditions in that country in the late 1970s. Unsurprisingly, it’s been welcoming Ukrainian refugees as well, a couple of hundred of them with that last count I was able to find.

It’s a city of about 76,000 that’s about 500 kilometers from the ocean and as far north as Edmonton, Alberta. Its economy is a mix of health care, education, pulp and paper, a refinery and a chemical plant or two. Remarkably for a distinctly remote and not very large city, its average age in the last census was 40, which makes it young and dynamic by Canadian standards. They are clearly doing something right to attract and keep younger people. That said, the largest demographic segment of growth over the last two censuses was in the over 65 population.

It’s a 10 hour drive through mountainous terrain, over 500 kilometers as the obsessive compulsive crow flies, and it’s not on the way to the Okanagan, so I’ve never visited.

The chemical plant and refinery are the center of this actually and unusually intelligent hydrogen for energy story.

The chemical plant, Chemtrade, makes sodium chlorate, a white crystalline powder that is used to make herbicides, explosives, dyes, cosmetics, pharmaceuticals, paper, and other chemicals. Without digging into Chemtrade’s customer lists, it’s used in bleaching paper, so the local pulp and paper mill probably takes a lot of it off its hands.

The manufacturing process for sodium chlorate is straightforward. Put table salt into water. Pass an electrical current through it. Get sodium chlorate out the other end. But sharp eyes will have spotted that bit about running a current through water, which is to say electrolysis which makes hydrogen.

And that’s a byproduct of Chemtrade’s plant, about 12 tons of it a day. That’s a lot of hydrogen, and it’s in a small city a long way from anywhere that doesn’t have an ammonia or methanol plant, although it does have an oil refinery.

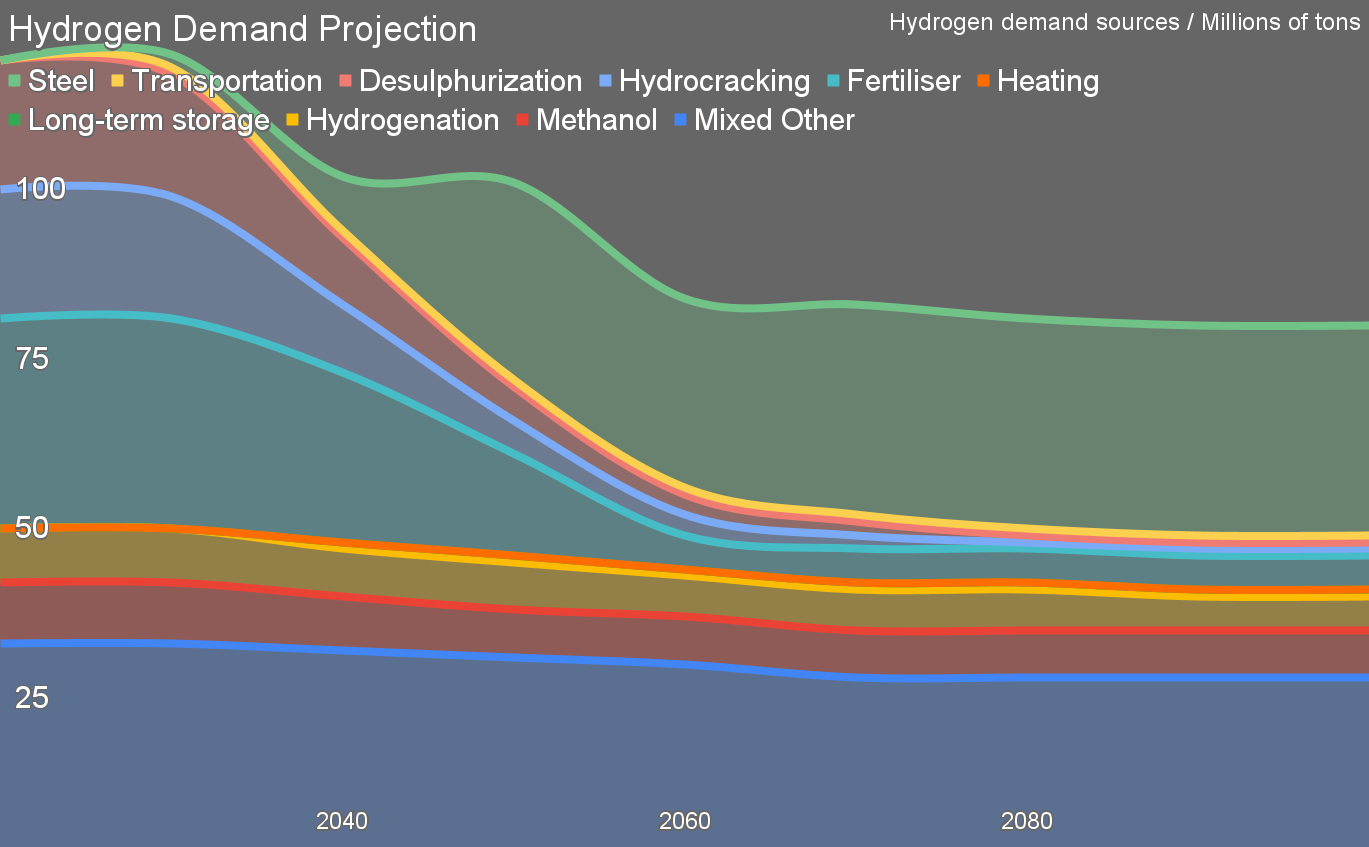

As a reminder, hydrogen today is an industrial feedstock. We manufacture about 120 million tons of the stuff, almost entirely at the point where it is used because it’s so expensive to move around.

The biggest consumers are oil refineries which use it to take excess water out of crude oil, remove sulfur from crude oil and crack crude oils into lighter and heavier components. Oil sand crude is high in all three of excess water, sulfur and heaviness, so require an awful lot of hydrogen to refine, about 7.7 kilograms per barrel per my assessment from a couple of years ago that it was another knife in the back of Alberta’s crude oil export hopes in the age of peak oil demand and industry emission caps.

But the Prince George refinery takes light oil from northeastern BC, not heavy oil. The oil is conventionally pumped, so water content is likely lower. There’s no evidence I could find that it as high sulfur either. The demand for hydrogen in the refinery, in other words, isn’t high. Oil refineries being what they are, they really prefer to turn fossil fuels into hydrogen in any event.

So no natural buyers of the excess hydrogen for what it is best used for, an industrial feedstock.

Despite the pleadings of the Rocky Mountain Institute, hydrogen has turned out to be a fairly potent greenhouse gas, albeit indirectly. It interferes with the decomposition of methane in the atmosphere, extending its persistence period. That means that every ton of hydrogen released into the air is equivalent to about 12 tons of carbon dioxide.

With 12 tons a day of hydrogen venting from the Chemtrade plant, that’s 144 tons of CO2 a day or about 53,000 tons a year. Oops.

Chemtrade tried to figure out something to do with the stuff, but as the quick gloss about hydrogen consumers above shows, there are no natural customers anywhere near the plant, and Prince George is a long way from pretty much everywhere.

Enter Teralta. It’s a BC-based firm launched in 2021. Some of its stuff is nonsense, like providing hydrogen generators for the film industry. Par for the course for BC’s weird hydrogen for energy fixation. We’re the home of perpetual failure Ballard, which as I noted recently, has managed to lose an average of $55 million every year since 2000, a stunning $1.3 billion of other people’s money, often governmental. There’s an entire odd ecosystem of hydrogen for energy firms in town. Given the density of the rubber around the hydrogen for energy bubble, I make no assumptions that anyone here knows my name despite me being local.

I’ll get more backstory on Teralta specifically, as coincidentally I’m having lunch with the co-founder tomorrow on his side of False Creek in Olympic Village (which very sensibly captures the heat from waste water to cut two-thirds of power requirements for heating for the thousands of condo-dwellers, offices and brewpubs in the neighborhood).

At some point, someone associated with Teralta figured out that hydrogen was coming off of existing industrial processes, being vented and that it was an opportunity.

They looked around a bunch of data sets and one of the plants they found was the Chemtrade plant in Prince George. They talked with them, they scratched their heads, they looked around the town, and probably smelled that distinctive odor of rotten eggs coming off of the nearby pulp and paper mills. At the time, there were three of them, but Canfor, which operated all three of them, closed one of the bigger ones last year.

That odor, by the way, is a source of perverse pride, some sort of nasal Stockholm Syndrome, in the city, where memes refer to it as the smell of money and put up social media bits extolling its virtues and being welcomed home by it after a spell away.

Pulp and paper mills are big energy consumers. A bunch of that comes from electricity, and many of the mills have agreements with BC Hydro that allows the utility to shut off their thermal units in 5 and 10 MW chunks automatically from the archaic green screen electricity management system through SCADA, the industrial precursor to IOT and the internet.

A lot of it comes from burning natural gas. The specifics of any mill depend on whether gas or electricity is cheaper, of course, and pretty much nothing else. In the case of Prince George, it’s an awful lot of natural gas. Hydrogen burns, much more cleanly than natural gas.

If it’s made from water using low-carbon electricity, it’s a much lower carbon burnable fuel, albeit usually eye wateringly expensive so we never do that. Is Chemtrade’s electricity low carbon? Hard to say. BC Hydro’s electricity is really low carbon because it’s almost entirely from old hydroelectric dams. But FortisBC also serves Prince George, and it burns natural gas in its natural gas plants as well as providing natural gas to consumers to burn. It’s hard to say from a distance whether Chemtrade is a FortisBC or HydroBC customer, and it really would matter to the carbon footprint of the process. But still, in this case, hydrogen is a by product, not the initial point, so maybe it’s okay.

Nah, let’s work it out. FortisBC burns natural gas. I’ll assume that they use combined cycle generators which produce about 400 grams CO2e/kWh. Add another 100 grams CO2e/kWh for upstream methane emissions, assuming that they are moderately careful in their supply chain. So 500 grams CO2e/kWh.

It takes electricity to manufacture a kilogram of sodium chlorate. Eyeballing the chemical process formula — NaCl + 3H2O + 6e → NaClO3 + 3H2 — suggests about 35 tons of sodium chlorate per ton of hydrogen. Global stats are that the 3.6 million tons of sodium chlorate manufacturing consume 20 TWh of electricity, so about 6 MWh per ton. Other sources suggest higher, but I’ll go with the lower one.

If FortisBC is supplying the electricity, that would be 105 tons of CO2e for the electricity for the 35 tons of sodium chlorate and the single ton of hydrogen. Assuming that was allocated across the sodium chlorate and hydrogen on a per ton basis, that would mean each ton of hydrogen would have a carbon debt of about 8.5 tons of CO2e. That’s much higher than just burning natural gas for heat, which is a weird argument FortisBC has used in submissions to attempt to slow electrification.

Ugly, which is why FortisBC has been engaged in an increasingly desperate set of actions to fight against, well, the entirety of decarbonizing BC’s economy in every way it can. It’s one of the main sources of disinformation and delay, and their PR flak is very good at their soul-destroying job.

One hopes Chemtrade is buying electricity from BC Hydro, which is running 7.6 grams CO2e/kWh, which would only give a carbon debt of about 1.6 tons of CO2e for the process and hydrogen’s shared would be 0.1 tons, much lower than burning natural gas. Who knows, however, as once again, it’s all a question of cheapest supplies.

In any event, Teralta did a bunch of work with Chemtrade, Canfor, the city, likely the province and probably others. Prince George had received $150,000 from the province as part of its hydrogen strategy to see if the city could become a hydrogen hub. Yes, the province throws money at hydrogen plays constantly, and has done so for decades, having been captured by the illusion that hydrogen for energy will be a massive growth opportunity to replace the oil and natural gas it extracts and hopes, vainly, to ship to China.

Prince George is or potentially was in Andrew Forrester’s sights. The Fortescue mining billionaire is enthralled with the prospects of hydrogen for energy even though his own mining firm has made it clear that they are just going to electrify mines and not waste money and energy turning it into hydrogen first. There were numbers like $3 billion being thrown around for investment in Prince George.

The premier of the province showed up in Prince George for the Chemtrade-Canfor-Teralta announcement and said the global hydrogen economic opportunity could grow to $305 billion.

Yes, in BC, this is a big deal. I was vaguely aware of it.

Okay, so we have a supposed carbon debt of 0.1 tons of CO2e for the hydrogen. It’s captured by Teralta and cleaned up — mostly removing excess water, one of those pesky balance of plant things that most hydrogen for energy calculations ignore — and piped half a kilometer to one of the Canfor plants through an 20 centimeter stainless steel pipe. That pipe is about 20 times more expensive than PVC pipes that are often used for natural gas, one of the many economic hits that moving hydrogen around takes that make it uneconomic in most cases.

But this is a special case, one of the few where this pencils out. Waste hydrogen. A big burner of natural gas half a kilometer away. No other consumers of hydrogen anywhere nearby.

So the hydrogen gets piped to the paper mill, blended with the natural gas and burned for heat. The case study suggests that it will displace about 25% of the natural gas and save about 700,000 tons of CO2 emissions annually. That likely doesn’t account for the upstream methane emissions for the natural gas that reaches the paper mill, and it probably doesn’t account for the 0.1 tons of CO2e assumed debt per ton of hydrogen either, but it’s definitely better than venting the hydrogen and burning natural gas instead.

It’s a bit Rube Goldberg, isn’t it? This actually sensible hydrogen for energy use case depends on an industrial process that creates a bit of hydrogen as a byproduct of its main production efforts and a really close by burner of natural gas. It required an entire new, if small, chemical processing plant be established between the two facilities to cleanse the hydrogen. It undoubtedly required adjustments in the burners as well.

There’s nothing special about the pulp and paper process chemically that it requires burning gas. It’s just a source of heat. All industrial heat can electrify except the ones that require burning gases as part of the chemical process, and those are fairly rare. The Canfor mills are burning gas because it’s cheap.

That 700,000 ton CO2 (likely 800,000 ton CO2e) savings implies the sole Canfor mill is producing 3.2 million tons of CO2e annually, and even after the hydrogen arrives — it’s not in operation yet — will still be producing 2.4 million tons of CO2e a year.

The numbers from the Teralta case study suggest that they are consuming about 2 million gigajoules of natural gas a year. That’s about 600 GWh per year or about 70 MW of power if they are running 24/7/365. Non-trivial amounts of electricity, but let’s assume that they are getting that from BC Hydro at it’s very low CO2e per kWh.

7.6 grams of CO2e per kWh is 7.6 kilograms per MWh and 7.6 tons per GWh. That suggests that if they electrified the pulp and paper mill, they would producing about 4,500 tons of CO2e per year.

So, electrifying the plant, if that were fiscally and technically viable, would save about 3.2 million tons of CO2e a year, and hydrogen effort is going to save about 0.8 million tons a year.

The 53,000 and 700,000 avoided tons with the hydrogen approach pale by comparison. Real decarbonization is electrification with renewably generated electricity. But avoiding 700,000 tons a year is better than a kick in the head with a frozen mukluk, as we say here in the frigid north as we huddle around the seal oil lamps in our igloos.

Is it fiscally viable to switch to electricity? Well, let’s play a little game and assume that Canfor has to pay the carbon price for natural gas per gigajoule. I worked out a few years ago that Canada’s 2030 peak carbon price of C$170 per ton of CO2e would add C$8.50 to the price of a gigajoule of natural gas.

FortisBC’s Rate 5 suggests that Canfor is paying around $2.50 per gigajoule all in right now, which globally is an absurdly low price. Europe is paying about C$15.60 right now and before the invasion of Ukraine and energy crisis, were paying about $7 per gigajoule. Incidentally, western Canada’s cheap natural gas is running out. Regardless, right now their natural gas energy costs are around $5 million excluding the carbon price. If the 2030 price were applied, however, their energy price would be $22 million.

What would 600 GWh cost at BC’s industrial rates? Well, a kWh is around C$0.06 — which is really cheap electricity by global standards because of the amortized hydroelectric dams —, so that’s about $60 per MWh and $60,000 per GWh. That’s about $36 million per year, so well above the cost of natural gas.

What about at Canada’s social cost of carbon for 2030? What’s the social cost of carbon? It’s the cost of every marginal ton of CO2e we emit in any year. Canada, the USA and the EU have harmonized the calculations sufficiently that they are very close every year. In 2030, the social cost of carbon for Canada will be C$294.

That will make very gigajoule of natural gas that’s burned cost about $17.20, turning the 2 million gigajoules into a $34 million annual cost. In 2040, the social cost of carbon will be $341, pushing the cost of energy from natural gas to close to $20 per gigajoule. In 2050, $394, pushing the cost to $22.

The Teralta deal is pretty good for Canfor. Presumably the cost per gigajoule for the excess hydrogen is in the same range as the cost per gigajoule of natural gas, but they avoid the carbon price on it. That’s going to save them a lot of money in the coming years. That was probably part of the negotiation with Chemtrade and Teralta, as they aren’t doing this as a charity. I’d certainly be pricing out the carbon price and social cost of carbon into my business cases for the deal, as well as looking at the likely lifespan of the projects given that Canfor already shut down one of the mills in the area and their energy prices are only going up, one way or another.

Is it technically viable? The Site C dam with its 800 MW capacity is coming on line in 2025. It doesn’t currently have anything to do because a big part of its existence is due to the dream of exporting liquified natural gas to China, and the LNG port that remains in development is just going to burn natural gas for the liquification process. A 70 MW customer would help things along quite nicely. Right now, of course, the province has dreams of using all of that electricity to make hydrogen for the hydrogen for energy economy which isn’t going to exist.

The window for burning natural gas is closing. Efforts like the Teralta hydrogen plant help, but taking perhaps a quarter of annual emissions out of the process is inadequate. To be clear, it makes sense to do this given the specific circumstances, but the likelihood of those circumstances existing is low. It’s much more likely that chemical industry hydrogen by products will be used for methanol or ammonia, existing and large scale markets for the chemical.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Our Latest EVObsession Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.