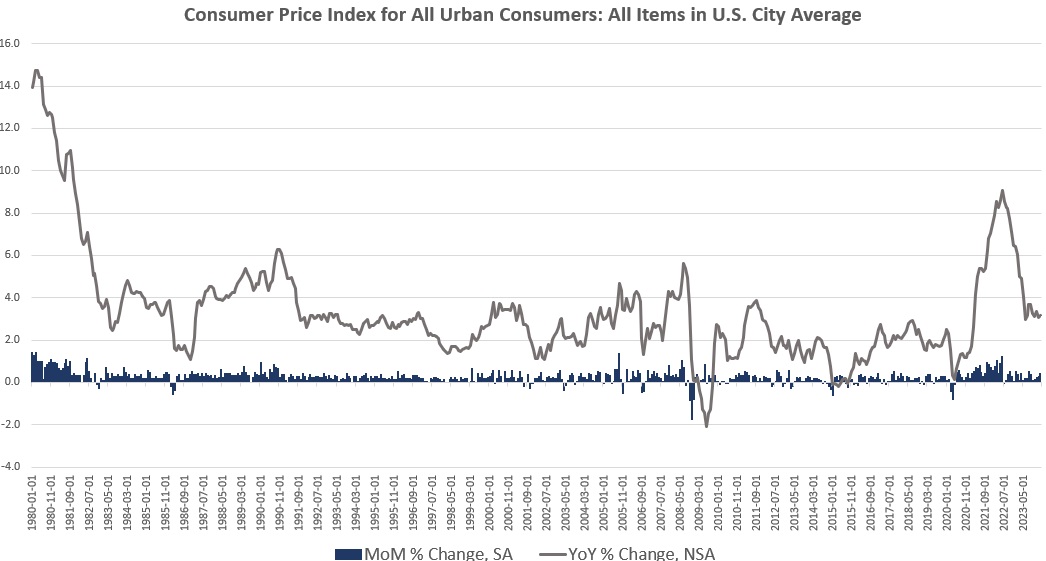

According to the Bureau of Labor Statistics’ latest price inflation data, CPI inflation in February accelerated for the second month in a row, and price inflation hasn’t proven nearly as transitory as the regime’s economists have long predicted.

According to the BLS, Consumer Price Index (CPI) inflation rose 3.2 percent year over year during February, without seasonal adjustment. That’s the thirty-sixth month in a row of inflation well above the Fed’s arbitrary 2 percent inflation target.

Month-over-month inflation accelerated, with the CPI rising 0.4 percent from January to February, with seasonal adjustment. Month-to-month growth had been 0.3 percent from December to January.

The ongoing price increases largely reflect growth in prices for food, services, electricity, and shelter.

For example, prices for “food away from home” were up 4.5 percent in February over the previous year. Gasoline prices fell 3.9 percent over the period, but electricity was up 3.6 percent. Prices for “services less energy services” rose 5.2 percent, year over year, while shelter rose 5.7 percent over the period.

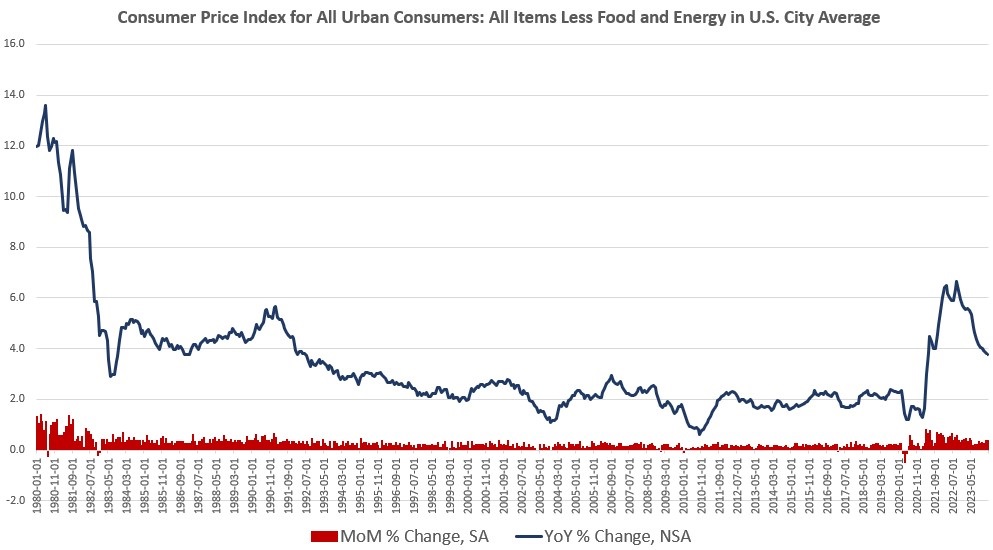

Pulling out volatile energy and food prices, we find price inflation remains stubbornly high. So-called core CPI growth remains near four percent—double the “two-percent target”—keeping price inflation growth near thirty-year highs. In other words, core CPI is a long way from returning to “normal.” Moreover, February’s month-over-month increase hit 0.4 percent, which is the largest increase recorded in any month since April 2023.

Biden Blames Corporate Greed

In recent months, supporters of the current regime have repeatedly claimed that inflation is “falling” or otherwise rapidly disappearing. Paul Krugman has been one of the most vocal cheerleaders claiming the problem of price inflation is “solved.” The February numbers, however, have proven troublesome for this narrative because it is becoming increasingly clear that price inflation is not, in fact, rapidly disappearing. Rather, the month-to-month numbers suggest price inflation is growing.

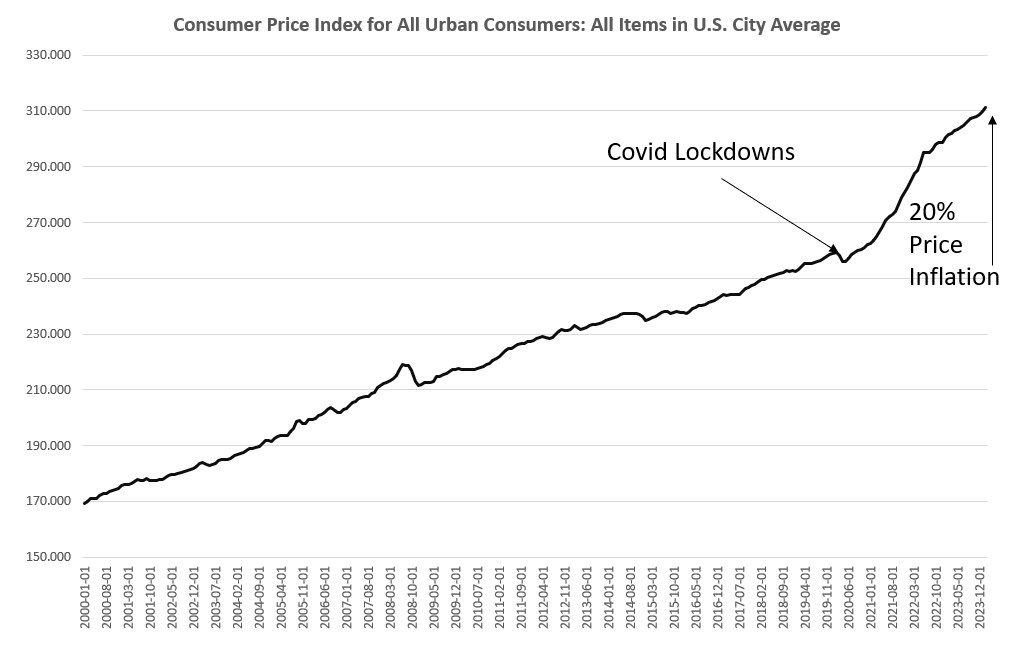

Moreover, cumulative price inflation over the past four years has been enormous. The CPI increased by 19.9 percent from February 2020 to February 2024. In other words, assuming the CPI is correct—and isn’t low-balling the real extent of price inflation—the dollar has lost one-fifth of its value in just four years. This has been devastating for many savers and for those on fixed income.

The Biden administration’s response to this has been predictable in that the President has blamed “corporate greed” when the real causes are runaway deficit spending and the central bank’s easy-money policies.

Biden has repeatedly blamed the private sector for “price gouging” and so-called shrinkflation, which is the term for a reduction in the size of a product while the product’s price stays the same.

A Rapidly Increasing Money Supply

We can get a better view of the real causes of price inflation only if we look somewhere other than the private sector. More specifically, the acceleration in price inflation that we are now being forced to endure is the result of unprecedented increases in the money supply that have occurred since the government-forced covid lockdowns began in the spring of 2020. Faced with a forcibly “closed” economy, the federal government called upon the central bank, the Federal Reserve, to create vast new sums of dollars for distribution to the millions of Americans whose jobs and earnings were destroyed by government lockdowns. These were essentially bribes designed to pay Americans to sit at home and spent their newly-printed money. This created an immediate inflationary boom by mid-2020. It’s easy to see why. The money supply increased by 40 percent between February 2020 and February 2021, rising by $5.7 trillion.

The money supply has shrunk somewhat since early 2022, but on net, the money supply is up by $4.7 trillion since February 2020. That a 32 percent increase. With a current total money supply of approximately $19 trillion, this also means that 25 percent of all the dollars that have ever existed were created after 2020.

In other words, the covid-fueled monetary inflation set up today’s continuing price-inflation spree. The regime economists have repeatedly attempted to gaslight the public with claims of “falling inflation,” but consumers can see that groceries, housing fuel, and services are all significantly more expensive than they were just a few years ago.

Some economists might claim this is no big deal because there has also been price inflation in wages. Unfortunately for regular people, real wages fell throughout most of 2022 and 2023, and continue to show only very anemic growth.

Courtesy of Mises.org

********