Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Any of our readers who have been following my reports know that Latin America’s EV sales are rising. In some countries, they may not be growing as fast as we would wish; in others, they’re faster than we ever expected; but the trend remains clear regardless.

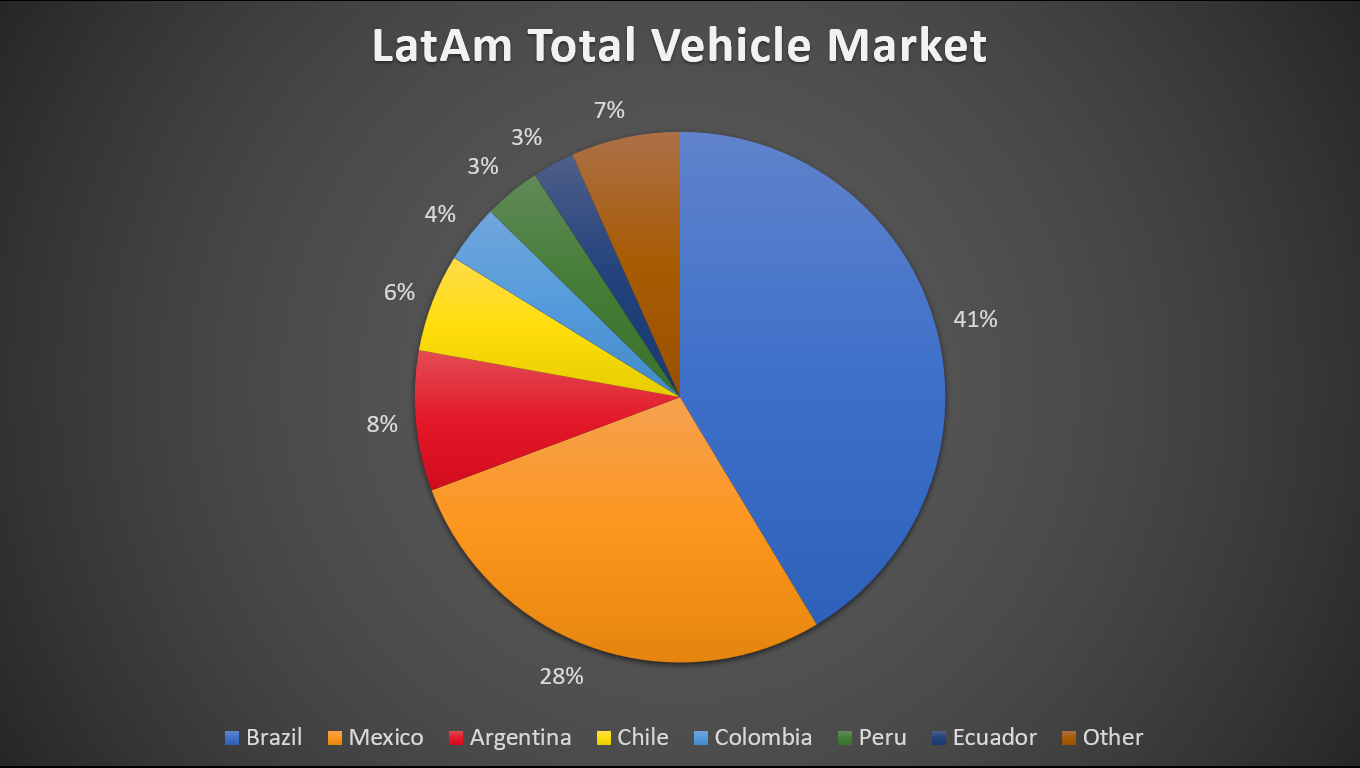

Latin America’s* market amounts to some 5 million vehicles a year, 70% of which corresponds to only two countries (Brazil and Mexico), with another 20% belonging to four countries (Argentina, Chile, Colombia, and Peru). The remaining 10% is left to another dozen countries or so. (*Minus the Caribbean, which isn’t a big market in any case.)

The region is also known for being highly protectionist, with tariffs to promote local industry, be it by pressure from the US (as is the case of Mexico) or because of a regional interest (as is the case in Brazil, Argentina, Uruguay, Ecuador, Colombia, and Peru). This means that local production is imperative if the EV revolution is to succeed. So, how are things going on that front?

It should come as no surprise that the two largest markets, and two largest producers, are also the two pioneers in EV production in Latin America: Mexico and Brazil. Together, these two countries account for at least five plants already producing EVs, and at least six coming up with production planned prior to 2027.

Their stories, however, are very different.

Mexico

Mexico is a globalized player, an extremely competitive producer, key to the massive North American market thanks to the defunct NAFTA and the USMEC that replaced it. Mexico has free-trade agreements with half the world and it has become a hub for manufacturing and innovation. As such, the country started its journey as an EV producer when legacy auto started pivoting to EVs, starting in 2019 when Ford started to produce the Mustang Mach-E.

Back then, China was just another player as far as EVs went. BYD had not yet presented its Blade Battery, Chinese EV adoption was suffering the blues from a sudden reduction on incentives, and the strategy of several legacy brands still seemed reasonable. China, though already the largest EV market in the world, was not yet the behemoth posed to conquer the globe and destroy legacy auto and their ICEVs.

This means that Mexico’s early start was not influenced by the (now) omnipresent presence of Chinese EV brands, instead being led by legacy auto aiming to get a larger cut on this growing market. Nowadays, Mexico’s EV production is heavily skewed towards legacy auto, with Ford, GM, and Stellantis leading in production, and JAC standing far behind them.

JAC’s case is quite particular. Mexico’s richest man, Carlos Slim, wanted to get in on the business of car manufacturing and decided to choose JAC as his partner. Initial operations back in 2017 focused mainly on ICEV models. Even today, EVs correspond to only 1/6 of JAC’s total assembly in Mexico.

This means that the Chinese are actually latecomers in Mexico as far as EV production goes: Dongfeng (through its ally SEV), BYD and Jetour are only starting production in the next two or three years. MG is also interested in turning Mexico into a local development and manufacturing center, but the announcement was made in August and there is no information on timing yet.

Now, this does not mean that legacy auto is safe, nor that the Chinese won’t succeed in Mexican lands, of course. But it does mean that alongside these Chinese brands, some legacy brands have also made Mexico a cornerstone of their EV plans: Kia is expected to start the production of its Kia EV3 at some point in the future, and BMW has made Mexico one of the main epicenters of its Neue Klasse platform, which should be up and running by 2026.

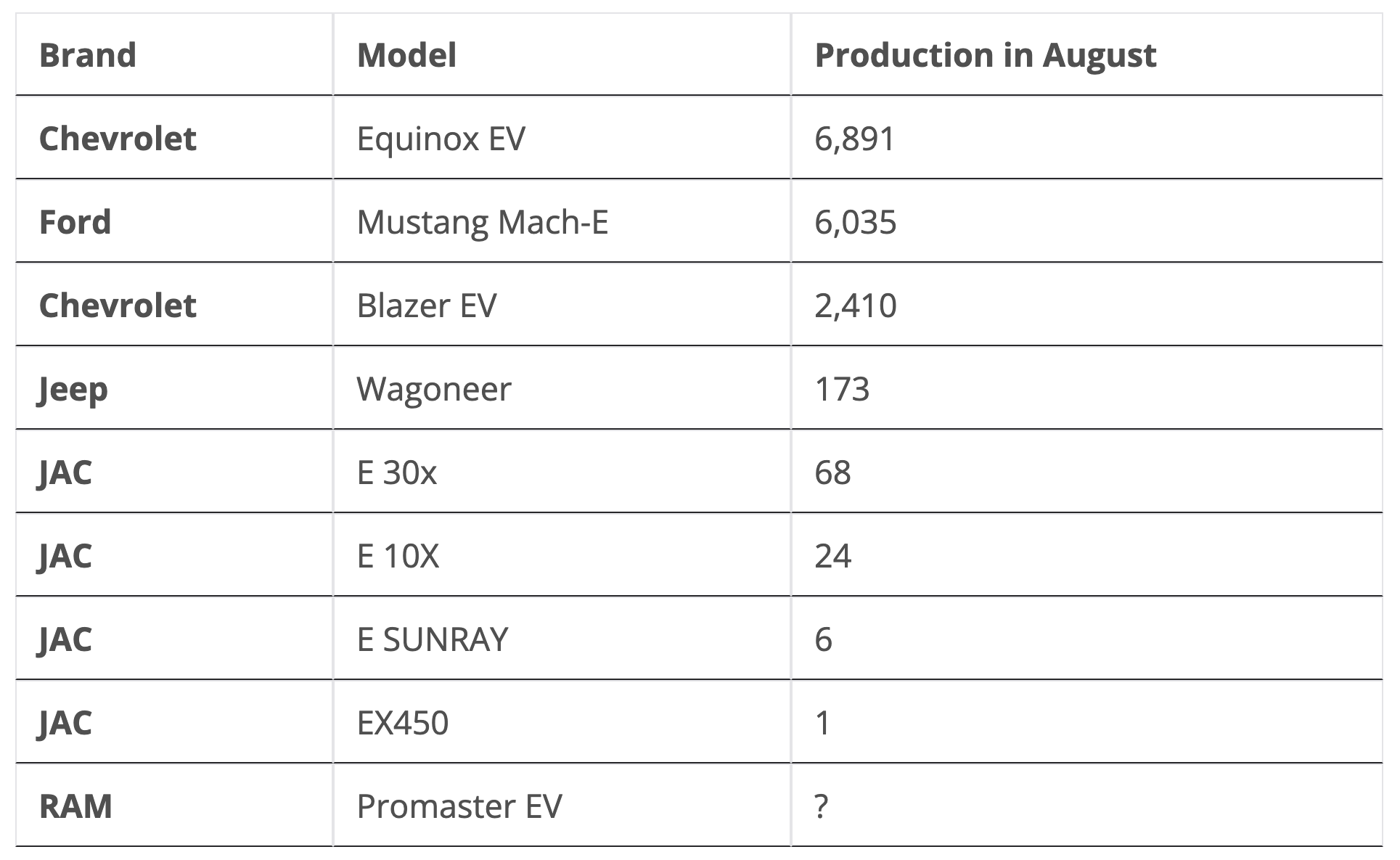

Overall, however, the indisputable leaders as far as EV production goes in Mexico are GM and Ford, as the data for August clearly shows (with an undetermined number of RAM Promaster EVs, which sadly isn’t listed separately from the ICEV version):

Aside from these, 7 International and 10 Kenworth EV Trucks were built last month.

One last line of thought: with the Ultium siblings more or less cruising at 10,000 units produced a month, plus the Lyriq and the Honda Prologue in the US, and the upcoming Optiq, I feel GM may not be too far away from the magic number as far as EV profitability goes (which is 300,000 a year according to Hyundai, 500,000 according to BYD).

Brazil

Unlike Mexico, Brazil is a less globalized market, with production focused on South America. Though, it’s also heavily protected, in this case being the largest member of Mercosur. Brazil did not have early interest in EVs, and therefore its progress in this direction has been entirely influenced by the arrival of Chinese brands.

Like in Mexico, some of these brands already arrived in the past decade with ICEV options and are now pivoting to EVs (Great Wall Motors and Chery), whereas BYD arrived in 2023 and focused entirely on EVs. Some legacy auto companies have claimed interest in building EVs in Brazil, but for now, these three Chinese companies are the only ones set on doing it in the next three years.

Brazil is also a very important market for flexi-fuel vehicles (perhaps the most important one in the world), so there’s a huge ethanol lobby interested in making biofuel the future of zero-emissions transportation, instead of electricity.

Aside from Mexico and Brazil, EV manufacturing is limited to the assembly of two-wheelers, three-wheelers, and a few local brands of quadricycles (including Quantum in Bolivia, Tito in Argentina, and Eolo in Colombia) that only sell a few hundred units a month at most, and a dozen at worst. The absence of competitive EVs in these segments (something evident in their small sales numbers) is frankly worrying, and particularly so in the case of two-wheelers, which have not improved their value-for-money in the region in six years. Electric cars keep getting cheaper and better, but electric motorcycles are completely stagnant … and the latter are much more important to bringing EV manufacturing to smaller countries.

At last, I did focus on BEVs for this analysis, as I found it much harder to get numbers for PHEVs, many of which are also built as HEVs and ICEVs.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy