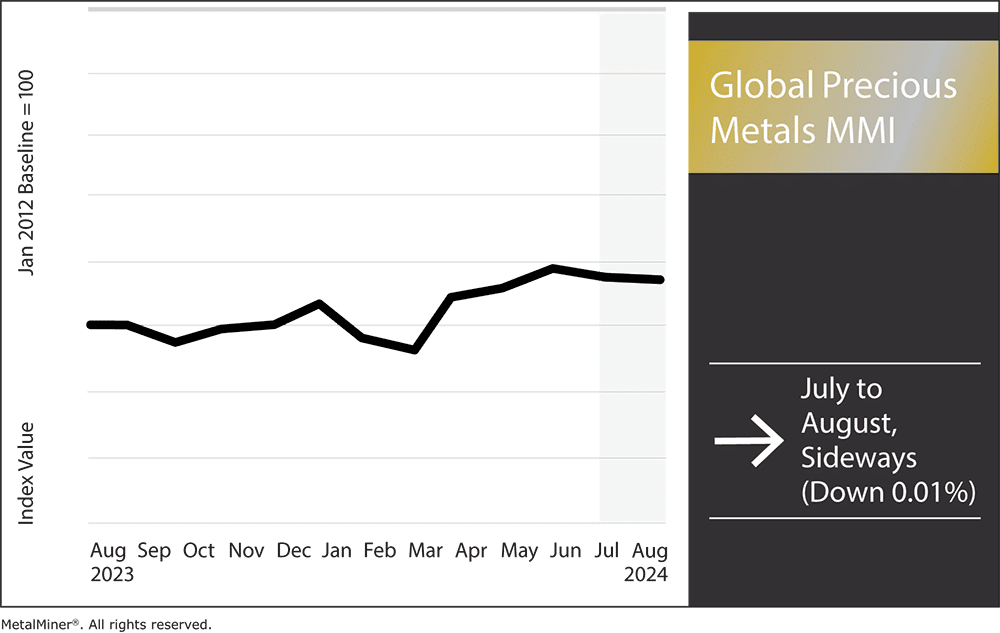

The Global Precious Metals MMI (Monthly Metals Index) narrowly missed trading flat, only budging down a mere 0.01%. Precious metals prices experienced an array of volatility in both directions, which held the overall index firmly in a sideways trend. Gold prices continue to rise while other precious metals like palladium and silver dropped (price trends and updates covered weekly in MetalMiners’s newsletter). With gold prices hitting brand new highs, many are beginning to question just how high prices will go before dropping.

Precious Metals Prices: Palladium

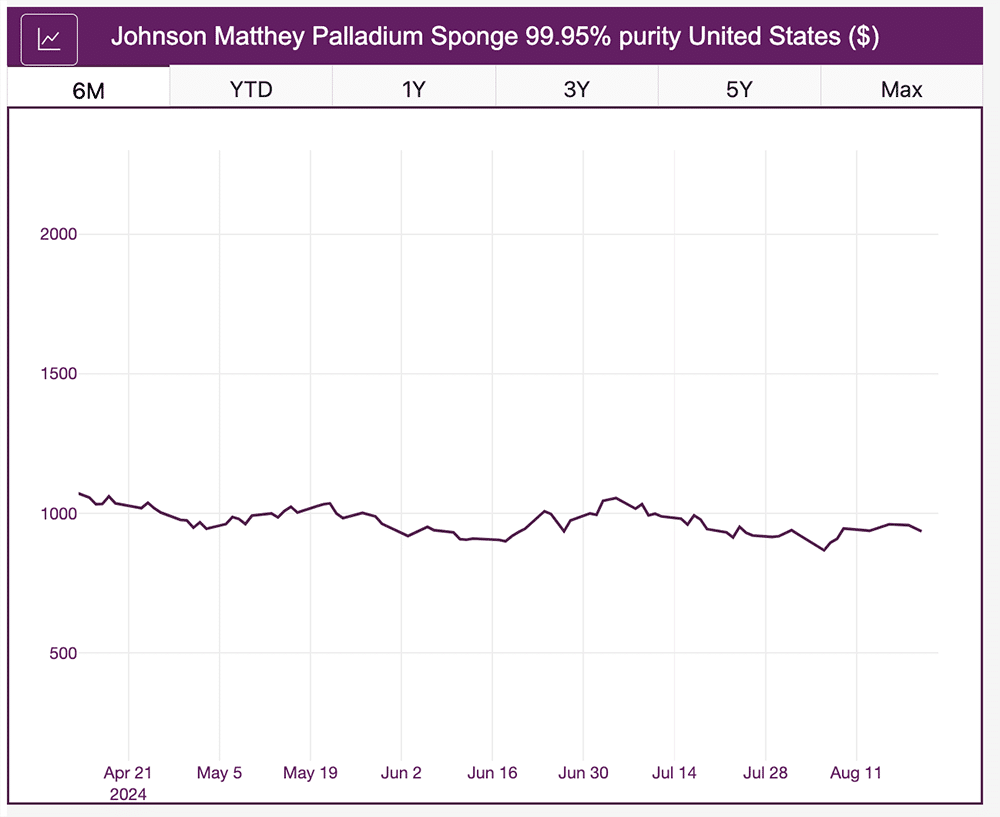

Palladium prices continue to edge downward, following a long-term downward trend since July 17th. Even though prices experienced brief bullish momentum between July 25 dnd August 1, this upward movement proved to be short lived. Falling demand for palladium in the automotive sector played a major role in 2024 price drops for the precious metal.

In the upcoming months, palladium prices could witness bearish pressure due to a mix of stable supply levels and sluggish demand from the automotive sector. Furthermore, the use of platinum instead of palladium in industrial applications could put additional pressure on pricing.

Platinum Prices Face Bearish Sentiment

Platinum prices, along with other precious metals prices, declined month over month, shifting from their previous steady trend. Concerns about a global economic slowdown and weaker demand from the car industry drove prices down. Additionally, increased platinum recycling boosted supplies, adding further pressure on pricing.

Platinum prices will likely continue to face bearish pressure in the upcoming months. The market will likely encounter persistent challenges from weak industrial demand and the potential for a global economic recession, which may further reduce consumption. Despite the ongoing supply deficit that might offer some support, general sentiment suggests prices may remain toward the lower end of the current range.

Elevate your precious metals hedging and market intelligence, Subscribe to MetalMiner’s free Monthly Metals Index report to gain a deep understanding of the dynamics affecting precious metals prices, along with 9 other metal industries.

Silver Prices Rally Before Faltering

Unlike other precious metals prices like gold, The price of silver experienced ample volatility month-over-month, rising for some time before declining again. Early in July, market confidence and a few encouraging economic data points propelled a rally in silver prices. But this rally didn’t last long. By the end of July, prices started to decline.

Silver is anticipated to experience more bearish sentiment in the near-term. The market is expected to continue to experience difficulties from weak industrial demand and possible global economic slowdowns, despite bullish sentiment from supply shortages. Analysts estimate that although silver prices might rise somewhat in the near future if economic conditions improve, they might find it difficult to break out much higher.

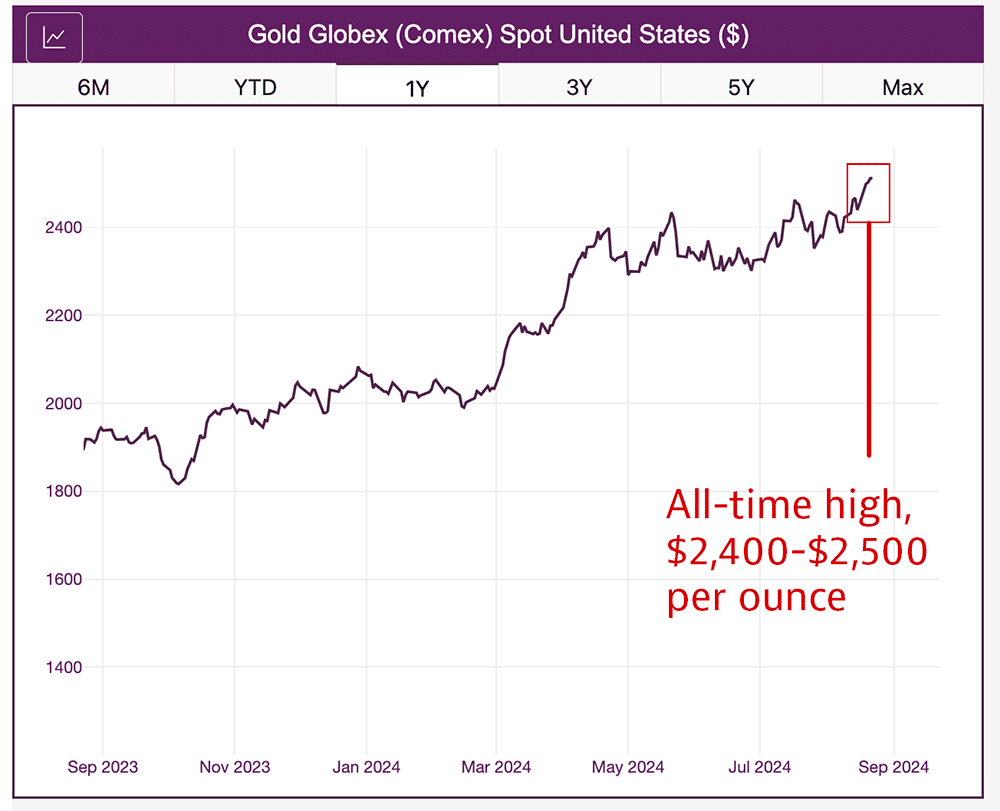

Precious Metal Prices: Gold

Out of all of the precious metals prices, gold proved the outlier month-over-month. Gold prices surged to all-time highs in the months of July and August, as geopolitical tensions and economic instability converged. Predictions that the U.S. Federal Reserve would lower interest rates in response to weak inflation and rising unemployment pushed gold prices beyond $2,483 per ounce in July, setting new records.

In early August, gold prices peaked once again at over $2,500 per ounce, driven by worse-than-expected U.S. labor market statistics and escalating geopolitical concerns, particularly in the Middle East.

If the Fed does decide to go dovish and decrease interest rates within the remainder of 2024, analysts predict that gold prices could stay robust and may even reach new highs. Strong technical indicators, combined with economic and geopolitical uncertainty, suggest that gold will continue to attract more investors. However, as markets react to impending data and global events, some turbulence is anticipated.

Global Precious Metals MMI: Notable Price Shifts

Stop scrambling to react to “black swan” events in the precious metals market. MetalMiner Insights gives you the foresight to proactively hedge precious metals. Learn more.

- Palladium bar prices dropped 5.67% down to $936 per ounce.

- Platinum bar prices managed to move sideways, dropping in price 2.33% to $958 per ounce.

- Silver ingot prices moved sideways, dropping in price by 1.17% to $29.50 per ounce.

- Finally, gold bullion prices rose in price by 4.7% to $2,505.80 per ounce.