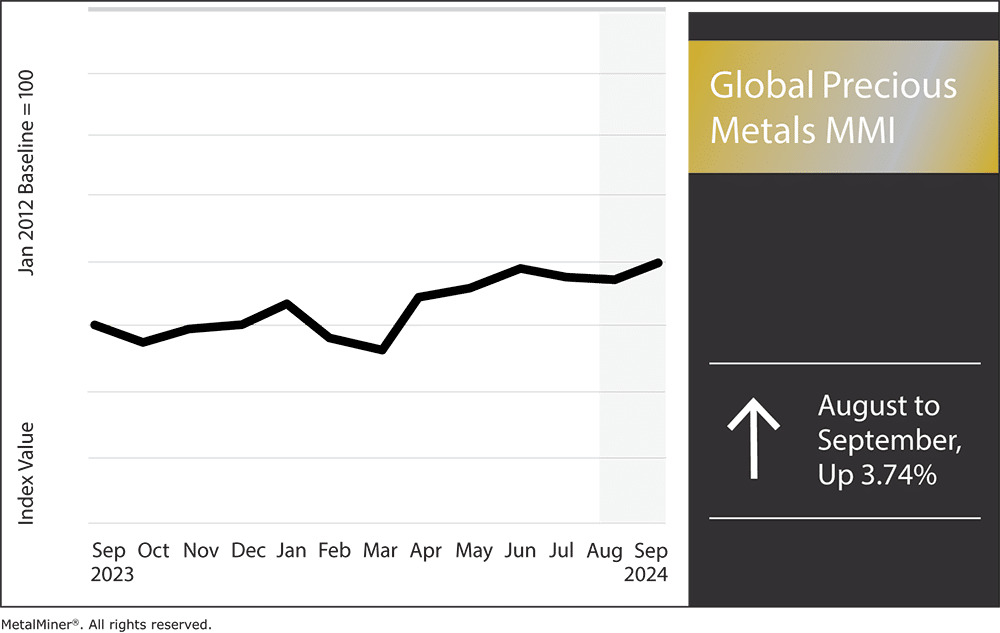

The Global Precious Metals MMI (Monthly Metals Index) showed some bullish momentum month-over-month, rising by 3.74%. Except for platinum, all precious metals prices saw increases. This uptick in movement was mainly thanks to the anticipation of interest rate cuts. The USDX (U.S. Dollar Index) also weakened slightly month-over-month, which offered prices more bullish pressure. With the U.S. presidential election close at hand, precious metals prices could witness even more volatility, as these vital hedging commodities often do when the country’s future is up in the air.

Make informed precious metal purchases and buy at the right time to save the most amount of money. Subscribe to MetalMiner weekly newsletter with important macroeconomic information to purchase precious metals with power.

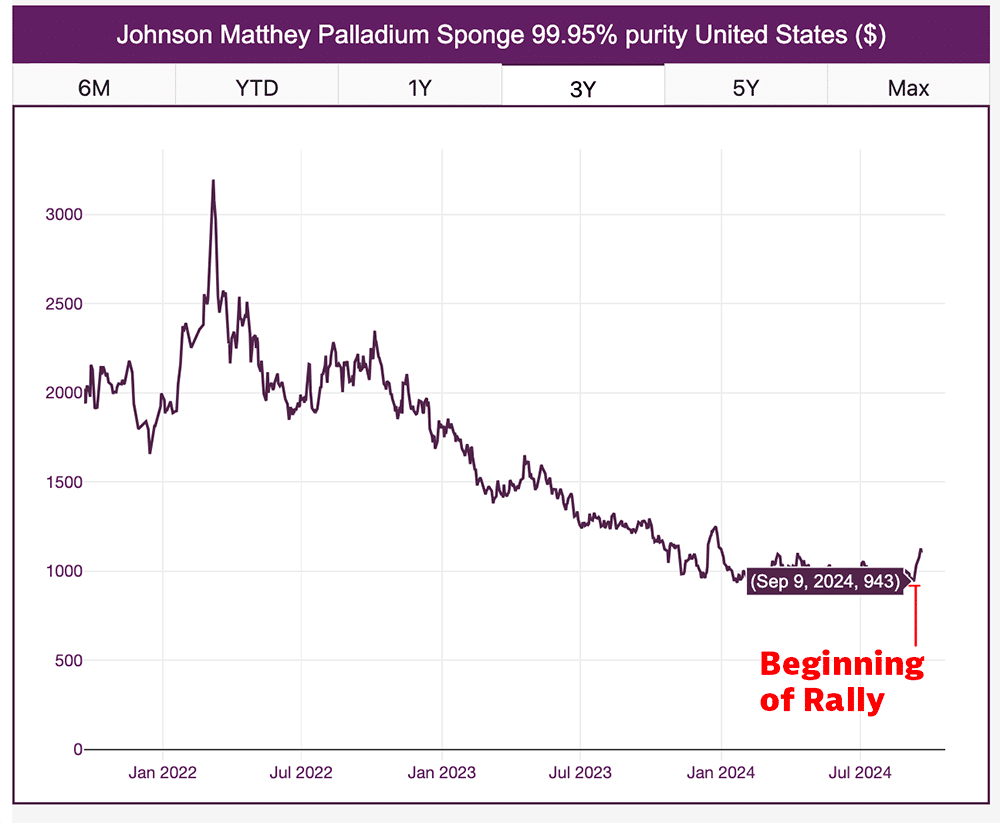

Palladium Finally Breaks its Sideways Trend, Shooting Up

Pent-up automotive demand significantly impacted palladium prices month-over-month, along with a massive production cut in supply announced by Sibanye-Stillwater, a leading miner of palladium and other precious metals. These fears in supply constraints proved instrumental in sparking a rally.

Looking ahead, palladium prices are likely to experience fluctuations, with short-term increases due to supply constraints tempered by long-term shifts in demand. Investors and analysts continue to keep a close eye on how these trends evolve, especially with the added volatility of global economic conditions and shifting commodity markets.

MetalMiner’s monthly free MMI report gives monthly trends for 10 different metal areas, including copper, stainless, aluminum and precious metals prices. Sign up here.

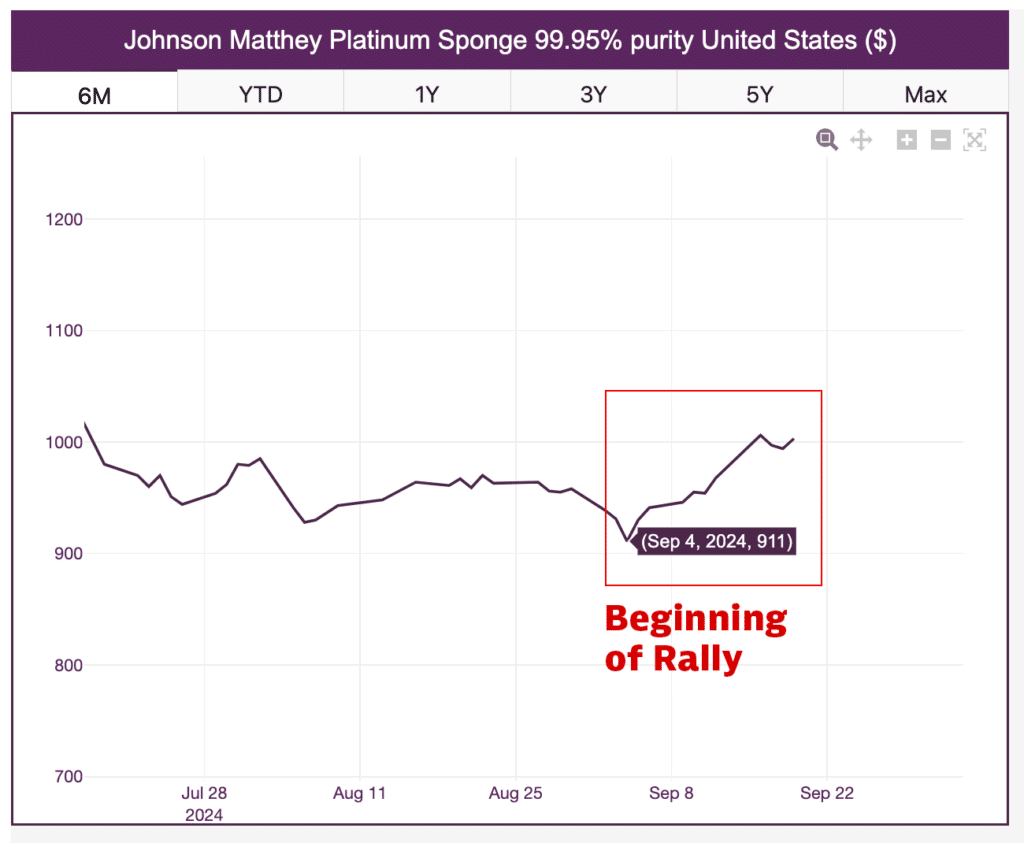

Precious Metals Prices: Platinum

Platinum prices saw a slight drop over the past month due to multiple contributing factors. One of the primary reasons was the continued decline in demand from the automotive sector. Additionally, global economic uncertainty has negatively impacted the industrial sectors that traditionally consume large amounts of platinum, leading to further price drops. However, by September 1st, platinum prices reversed again and began rallying.

Experts predict that platinum prices may remain under bearish pressure. While demand from the automotive sector could see a minor recovery in the coming months, the overall outlook is uncertain. However, any supply disruptions could provide temporary support to prices.

Enjoying this article? MetalMiner’s monthly MMI report gives you price updates, market trends and industry insight for precious metals and 9 other metal industries. Sign up for free.

Silver Prices Rise at the Beginning of September

Silver prices experienced a slight drop over the past month before reversing upward again. Overall, silver remains up compared to one year ago. Increased economic volatility and geopolitical unrest continue to support silver’s appeal as a safe-haven investment. Despite occasional declines, silver prices are generally rising because of robust industrial demand, particularly in electronics and renewable energy.

Many experts think investors looking to protect themselves from currency depreciation may become more interested in silver as long as inflationary pressures continue. Meanwhile, analysts have set high goals for silver in the future. However, the commodity needs to continuously maintain itself above critical support levels, namely $27.59, to hit those targets.

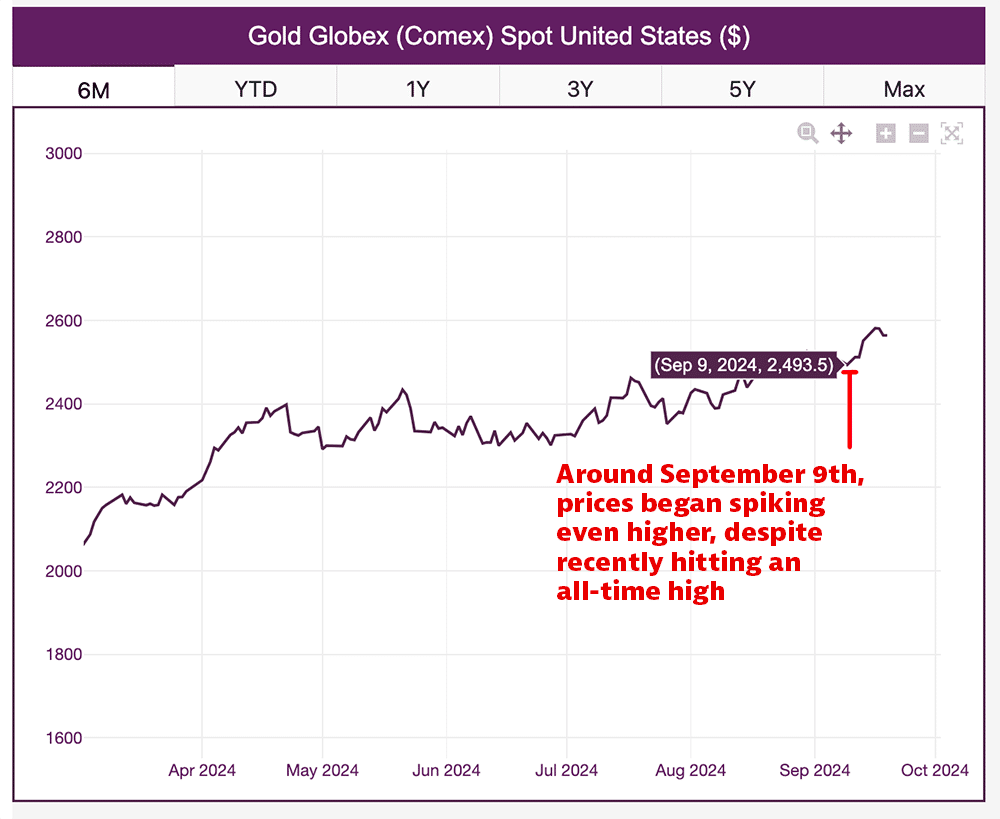

Precious Metals Prices: Gold

A change in market sentiment, inflationary pressures, and economic uncertainty have all contributed to the steady increase in gold prices over the past month. A significant contributing element has been the anticipated interest rate changes by the U.S. Federal Reserve, as lower rates generally increase the appeal of non-yielding assets like gold.

Looking ahead, many analysts expect gold prices to remain strong. With gold’s long-standing reputation as a stable store of value, prices will likely maintain an upward trajectory into the final quarter of 2024.

Precious Metals MMI Price Shifts

Ditch inaccurate precious metal price forecasts for targeted precision and save on you COGS with MetalMiner Insights. View our full catalog of metals.

- Palladium bar prices rose by 6.12% to $971 per ounce.

- Platinum bar prices moved sideways, dropping by just 2.07%. This left prices at $944 per ounce.

- Silver ingot prices also moved sideways, increasing by 2.01% to $29.41 per ounce.

- Finally, gold bullion prices rose by 3.35% to $2,516.40 per ounce.