Precious metal prices (especially silver) began a brief rally on July 12 before retreating again. Whether or not the bulls are here to stay is a question up for debate. Many remain optimistic that gold prices will continue upward until the end of 2023. However, gold and other precious metals markets still face some bearish pressure. As the USD dropped, precious metals became more affordable for investors. However, many are still expecting another interest rate hike from the hawkish Fed, which is dampening the optimism of the bulls.

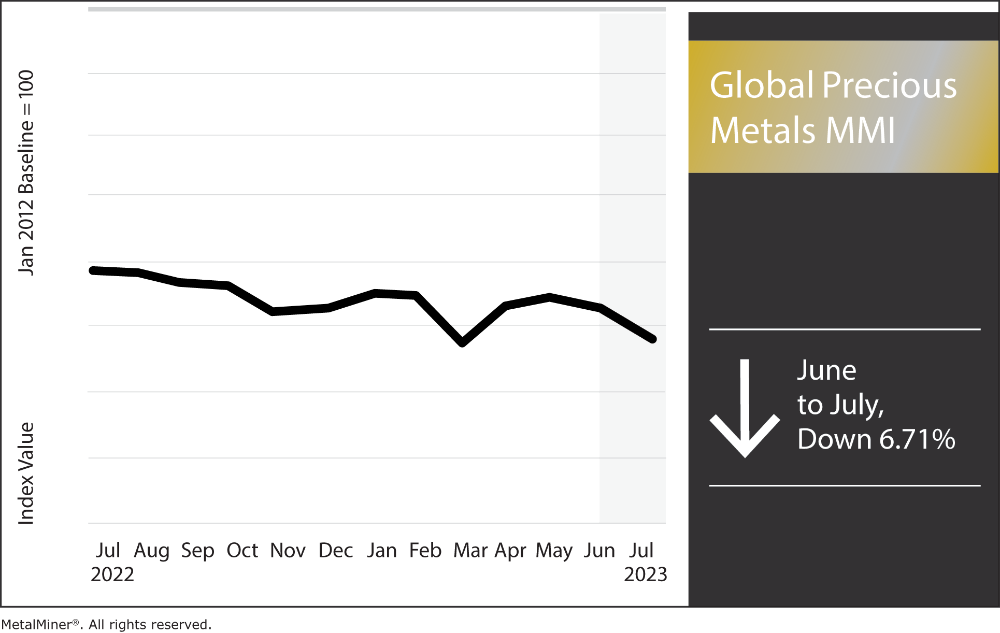

Between June 1 – July 1, prices of precious metals fell somewhat drastically, which ultimately pulled the index down. The Precious Metals MMI (Monthly Metals Index) fell by 6.71% month-over-month.

It’s that time again – annual contract negotiations are coming up. Negotiate your 2024 metal contracts with confidence, join MetalMiner’s August fireside chat: 2024 Annual Budgeting & Forecasting Workshop

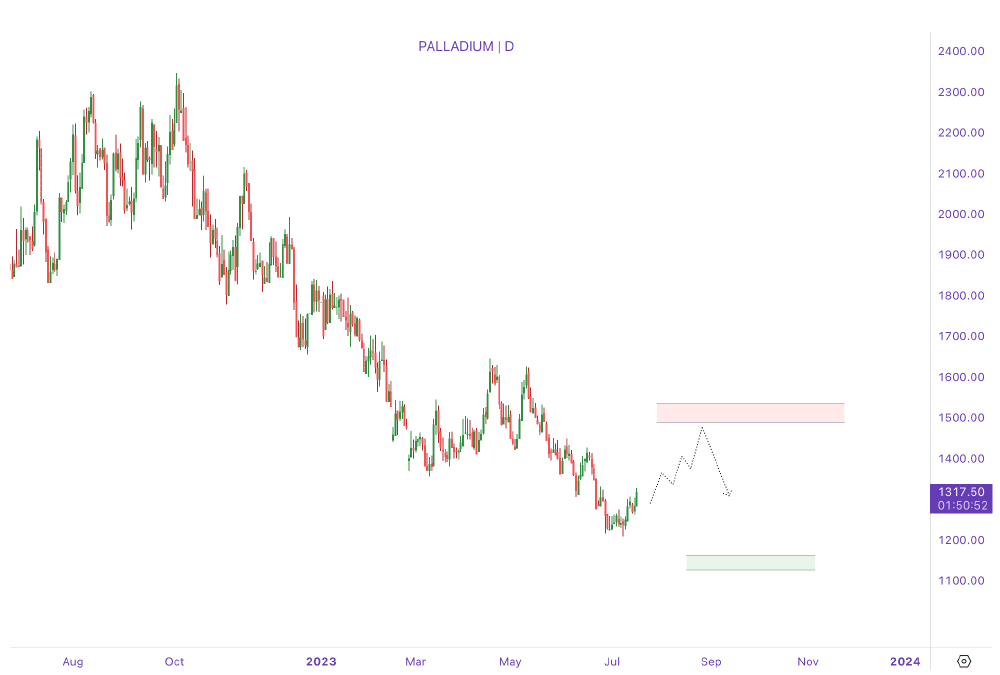

Unlike other precious metals, palladium markets have been in consistent decline over the past year. In July, prices increased slightly in comparison to the overall downtrend within 2023. Upward momentum followed by confirmation to the upside will support a bullish market for palladium.

Platinum Markets on the Rise in the Short-Term

Like gold, silver and other precious metal prices (except palladium), platinum markets have increased in price since the start of July. However, with platinum, it is unclear whether or not this bullish momentum will continue. Minor pullbacks in trend may occur. However it is not enough evidence to confirm a true reversal to the downside.

Stay ahead of ever shifting precious metal market. MetalMiner Insights provides comprehensive precious metal price forecasting and AI so buyers know how much to buy, when to buy and how to save money. Talk to us.

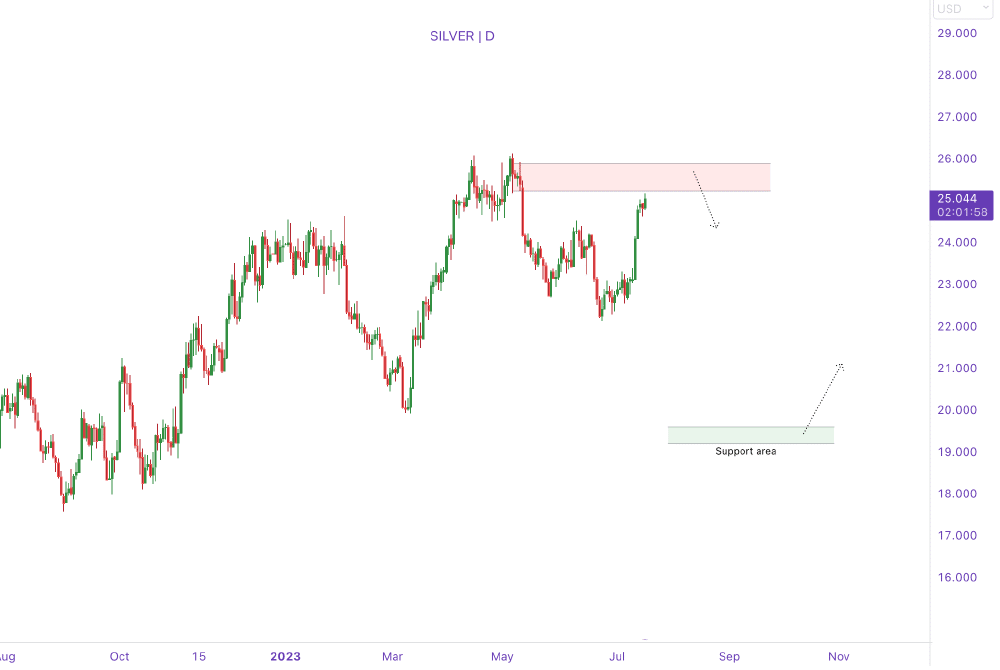

Precious Metal Prices: Silver

Silver managed to rise more than any of the other precious metal prices throughout early and mid July. Similar to gold, silver displays bullish momentum in the short-term. However, it remains unclear if silver will continue this upward price movement considering prices are nearing resistance zones. This could increase bearish pressure on silver markets. Pullbacks appear likely to occur in the event of a rejection in price.

Gold Bulls Come In, but Will They Stay?

Although gold prices have been in a rally since the start of July, showing bullish strength and consistent upward momentum, gold prices are now near resistance zones. This could apply bearish pressure. However, market trend for gold prices appear upward. Bearish price action could drive prices back down in the event of a pullback.

Stop obsessing about the actual forecasted gold prices. It’s more important to spot the trend. Read why.

Precious Metal Prices: Notable Price Movements

- U.S. palladium bars dropped drastically in price by 12.92% between June 1 – July 1, which left prices at $1,200. Despite this, prices began rising again as of July 12.

- U.S. platinum bars fell in price almost as much as platinum. All-in-all, prices dropped by 12.16% and as of July 1, prices sat at $896 per ounce.

- U.S. silver ingots traded sideways, moving down a slight 2.72% bringing prices to $22.53 per ounce.

- U.S. gold bullions also traded sideways, this time decreasing in price by 2.61%. Prices as of July 1 sat at $1908.10 per ounce.

View MetalMiner’s track record of forecasting where industrial and precious metal prices are headed.