In recent weeks, leading up to the end of the month, indices like the S&P500 and metals like silver and gold began to run out of steam. The impetus for the decline in stock and precious metal prices was recent Fed comments regarding higher interest rates in the foreseeable future.

Meanwhile, other indexes such as oil, 10Y, and 2Y treasuries have all remained poised to see higher prices. Treasuries have since pushed to new highs, increasing a total of 38% since the low of May 2023. This indicates a risky environment for investors in indices. Since the October all-time high within the treasuries broke to the upside, further uptrend within prices could see a boost from multiple drivers. The most notable include a falling stock market, weak buyer momentum within metals markets, and potential further government data.

The US dollar index also created new highs this month. As the summer season ended, the dollar index rebounded off a longer-term historical support zone. This helped drive prices past short-term price ceilings, creating an uptrend that will continue to pressure assets against the dollar. Indeed, since July, prices for the index have increased over 6%, pushing them just beyond the May 2023 high.

Like the dollar and treasuries, oil prices also pushed higher as the summer ended. In total, prices jumped just over 25% over the past couple of months, potentially reaching the November 2022 high. Many analysts see oil as forming short-term bullish structures and breaking through price ceilings, indicating an uptrend continuation.

All of that said, further government data will help clear up market trends across indices, commodities, and various other pairs against the dollar index. Still, considering recently released comments and data from the Fed, it is important to note that volatility and uncertainty remain a high risk to investors across markets.

Gain access to expert-driven market insight on commodities like precious metals and oil, ensuring your company is well-informed about market trends. Opt into MetalMiner’s free weekly newsletter.

How Metal Prices and Oil Prices Correlate

Numerous variables affect the pricing of commodities, from supply and demand and geopolitical developments to financial market circumstances. Yet, according to several studies, there remains a favorable association between metal and oil prices. Independent of whether they are base or precious metals, most metal prices have generally similar trends, often positively correlating with one another.

Research published in ScienceDirect indicates that rising energy costs will increase the price of producing precious metals, mainly due to rising oil prices. This means that the output of precious metals would decline throughout this time, resulting in reduced supply and a further increase in precious metal prices.

Although most metals have a positive association with oil prices, each metal’s correlation intensity differs. For instance, a recent study discovered that the price of copper had a slender positive association with the price of crude oil. The study also discovered that maize prices and crude oil prices are more positively correlated than copper prices.

When precious metal prices fluctuate, it’s vital to know how to generate the most savings. Read how here.

Correlations Between Crude Oil and Precious Metal Prices

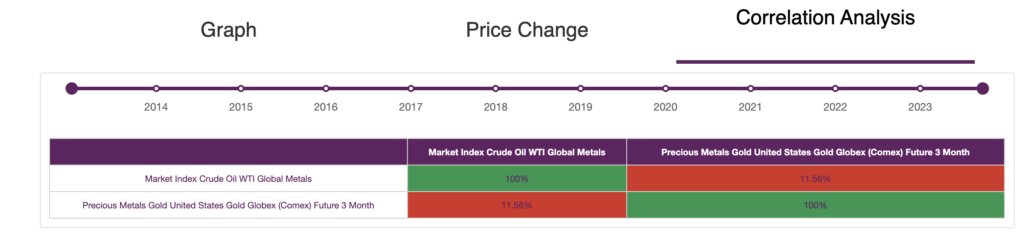

MetalMiner Insights indicates that, in general, gold prices and crude oil price correlations aren’t always positive. However, at the moment, they hold a very strong negative correlation. Both very strong, and very negative correlations warrant close attention.

The past 50 years have seen a positive price connection between gold and oil prices over 80% of the time. However, this association is not always reliable. Various variables, including geopolitical tensions, economic turbulence, and inflation, can significantly affect it. Crude oil prices typically rise alongside increasing gold prices, and the reverse is true. This occurs primarily because investors frequently turn to both assets during periods of economic unpredictability, as they are both regarded as safe-haven investments. In fact, a clear correlation between gold and crude oil prices exists more than 60% of the time.

Still, several factors can impact this correlation. For instance, political unrest or armed conflict in oil-producing countries tends to drive up crude oil prices, which can also boost gold prices. Inflation is another element that may affect the relationship between gold and crude oil prices.