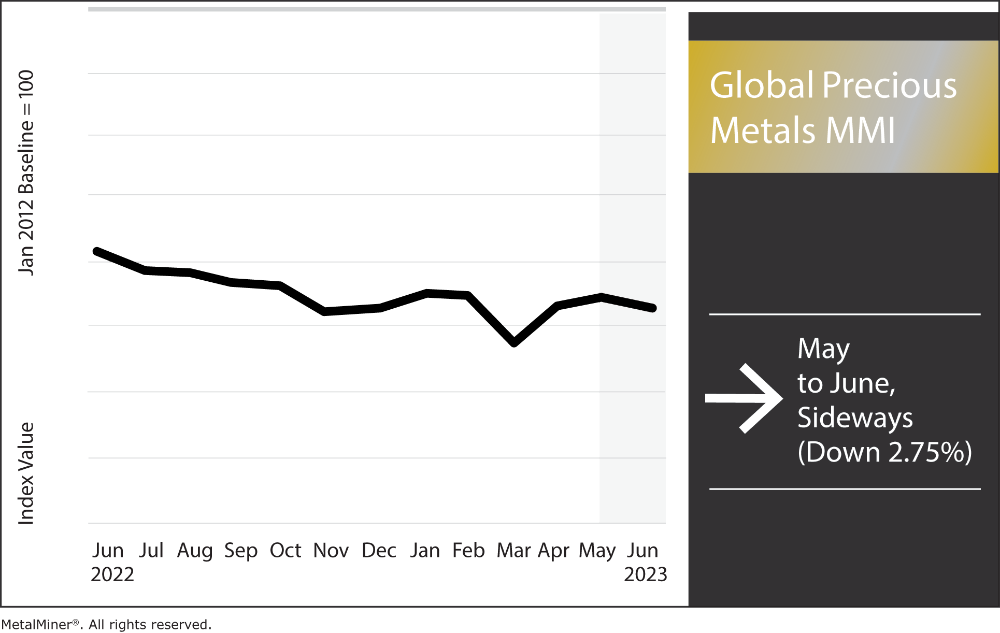

The Global Precious Metals MMI (Monthly Metals Index) traded sideways month-on-month. Overall, the index fell 2.75% as numerous components lost upward price momentum. All parts of the index moved sideways or fell slightly, except for Indian silver ingots and U.S. gold bullions. Though Fed’s hawkishness has managed to impact precious metal prices in the U.S, prices still maintain some long-term bullish sentiment thanks to high inflation. That said, inflation also appears to be slowing down.

Gold Losing Strength in the Short-Term

Price action for gold is beginning to show a slowdown in terms of bullish strength. Indeed, gold prices recently fell just under 2,000/oz once again. Therefore, it is safe to say precious metals prices (namely gold and silver) are beginning to pull back into support zones.

Not sure if MetalMiner can help you with your specific metal purchases? Check out our full metal catalog.

Precious Metal Prices: Silver

As with gold, the silver price rally continues to slow down. At the beginning of the month, prices began to pull back into demand zones. This could help drive prices once the index establishes support.

Palladium prices continue to show range trading, with a slight decline. There are no signals of bullish anticipation, considering the index continues to demonstrate zero bullish price action patterns.

Precious metal markets shift quickly. Get weekly market updates and other commodity news with MetalMiner’s free weekly newsletter. Click here.

Platinum Remains Within a Sideways Range

Prices for platinum markets appear rather similar to gold prices. Specifically, there is a pull back driving platinum into support zones while bullish strength continues to slow down. Prices will need a breakout to the upside to establish an uptrend once again.

Precious Metal Prices: Notable Price Moves

- U.S. gold bullions traded sideways The 1.42% drop brought prices to $1,962.40 per ounce.

- U.S. palladium bars fell by 7.02%, leaving prices at $1,337 per ounce.

- U.S. silver ingots fell by 6.19%, bringing prices to $23.49 per ounce.

- U.S. platinum dropped by 7.45%, putting prices at $994 per ounce.

Buy precious metals with confidence. MetalMiner Insights offers in-depth purchasing advice, price comparison tools, forecasts and comprehensive should-cost models. Click to schedule a consult.