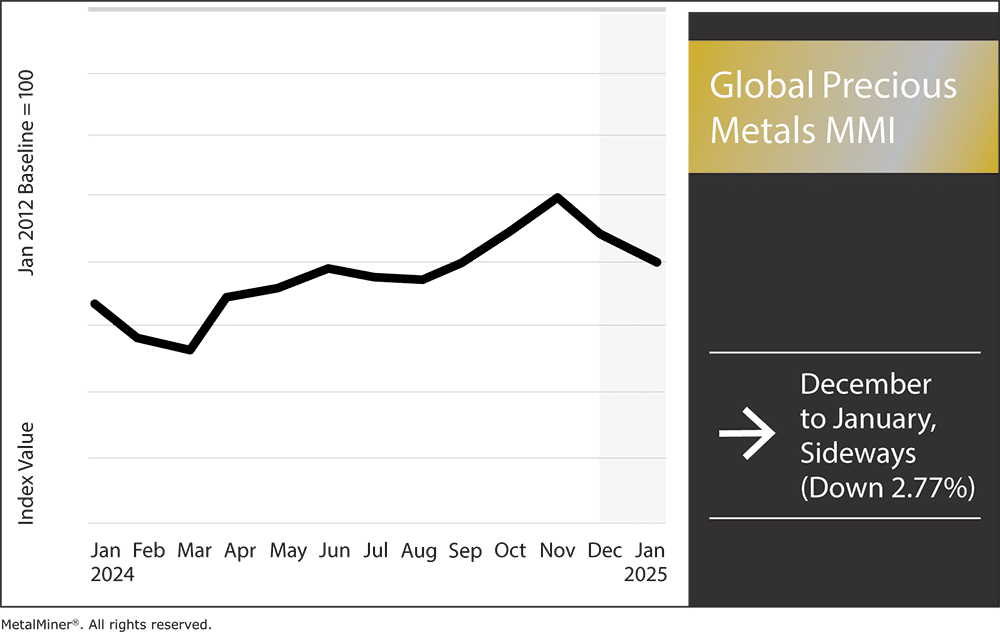

The Global Precious Metals MMI (Monthly Metals Index) moved sideways from December to January, trending downward by 2.77%. Over the past month, precious metal prices in the U.S. witnessed significant fluctuations, driven by a mix of economic trends and global political developments. The increase primarily stems from speculation amongst investors regarding President Trump’s trade strategies and a declining U.S. dollar.

How will Trump’s new policies impact precious metal prices? Opt into MetalMiner’s Weekly Newsletter.

Precious Metal Prices: Palladium

Over the past month, palladium prices have been on a downward trajectory, closing at $903.55 as of December 31.

Looking forward, industry experts predict that palladium may experience continued price pressure in 2025. Many anticipate a drop in demand, driven by reduced support for electric vehicle production under the new Trump Administration. Additionally, Sibanye-Stillwater’s ongoing production cuts will likely continue influencing palladium prices.

Download MetalMiner’s free Monthly Metals index report to stay updated on price trends, market intelligence, and outlooks for 10 distinct metal industries.

Platinum Prices Coming Into 2025

Over the last month, platinum prices in the U.S. have experienced slight changes. As of January 21, 2025, the metals’ value stands at roughly $946.74 per troy ounce.

Looking forward to 2025, experts have differing views on the outlook for platinum prices. For instance, Heraeus Precious Metals expects the market to remain undersupplied. Meanwhile, J.P. Morgan predicts prices may rise to $1,200 per ounce, citing possible supply shortages as a contributing factor.

Precious Metal Prices: Silver

Over the past month, silver prices in the United States experienced a slight upward movement, reaching about $28.85 per troy ounce on December 31, 2024.

Looking ahead to 2025, analysts have offered mixed predictions for silver’s performance. For instance, many expect industrial demand to play a key role in potentially pushing prices above $30 per troy ounce. This outlook reflects cautious optimism, supported by silver’s broader economic factors.

MetalMiner customizes price points, price forecasts and procurement solutions based on the specific metal type your company purchases. See MetalMiner’s full metal catalog.

Gold Prices Continue to Rise

Over the past month, gold prices in the U.S. have risen steadily, reaching $2,744 per troy ounce on January 21, 2025.

Looking to 2025, analysts have differing views on gold’s trajectory. Goldman Sachs, for one, predicts prices could hit $3,000 per ounce by mid-2026. This estimate mainly stem from expectations that there will be limited interest rate cuts in the coming year.

Precious Metals Prices: Noteworthy Price Shifts

Stop obsessing about the actual forecasted nickel price. It’s more important to spot the trend. See why.

- Palladium bar prices dropped by 7.17% down to $894 per ounce.

- Platinum bar prices moves sideways, dropping by 2.9% to $905 per ounce.

- Silver ingot prices dropped by 4.02% to $28.80 per ounce.

- Finally, gold bullion prices moved sideways, dropping by 0.86% to $2,624.60 per ounce.