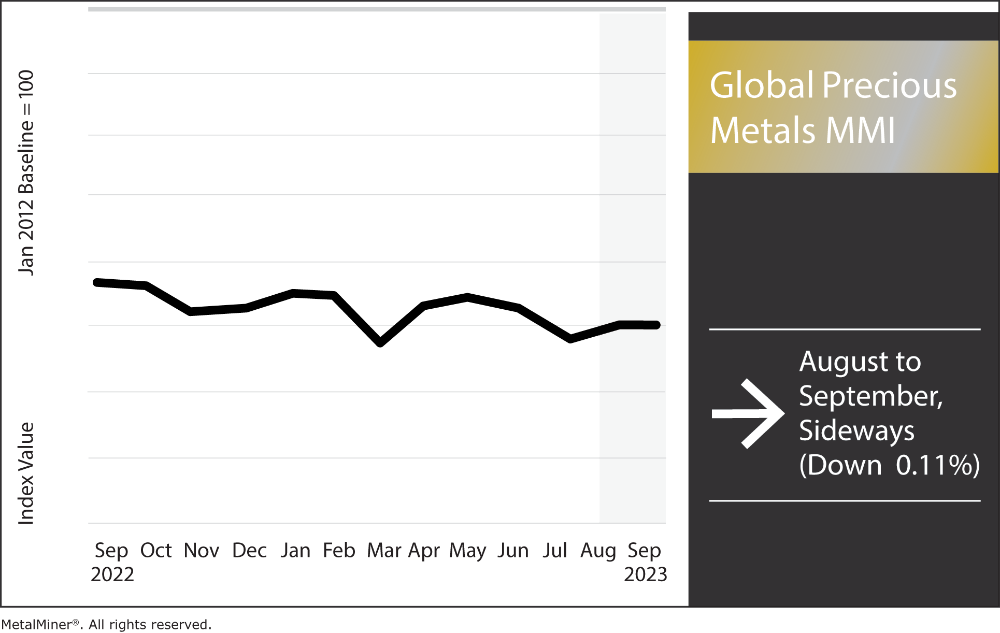

Month-over-month, the Precious Metals MMI (Monthly Metals Index) witnessed almost no movement and narrowly missed trading flat. Indeed, the index remained sideways, only dropping by a slight 0.11%. That said, the Fed’s stance on holding interest rates at an elevated level could impact precious metal prices in the near future.

Interestingly enough, scrap precious metal prices (namely gold) experienced a bit of a spike at the beginning of August. Precious metal prices also initiated a climb starting September 15, but ultimately flattened out again. This may have been due to the Fed’s coming meetings (which at the time were five days away). Once the Fed concluded its conferences, Comex gold and silver dropped again. That said, both have remained close to support zones since the beginning of September, and both hold the potential to reverse.

Subscribe to MetalMiner’s free weekly newsletter now and reduce your COGS in falling demand markets.

Precious Metal Prices: Palladium

Like other precious metals, Palladium markets do not show a clear trend in either direction. Although prices have been sliding for palladium over the summer, its support zones continue to keep markets from breaking down past support. This indicates that a downside trend is not confirmed. Since palladium markets currently show unclear signals, future bullish breakouts to the upside or stronger downtrend patterns will create a much clearer trend.

Platinum Holds Rebound Potential

Platinum markets recently began showing signals of a range-bound trend. Prices have yet to breach resistance or support zones within the market, indicating sideways market behavior. Moreover, platinum price action has shown indecisiveness this month. The market would need to see a reversal or breakdown in price action to establish a clearer trend.

Plan your precious metal purchases with precision, ensuring maximum profits using MetalMiner Insights’ comprehensive short and long-term precious metal price forecasts. Click here.

Precious Metal Prices: Silver

Meanwhile, silver prices do not appear as bearish as gold. Prices have not quite breached their support zones with significant strength. This, combined with an unclear market direction, shows neither bullish nor bearish momentum is currently driving prices. Silver markets would need more price action to demonstrate a clear direction.

Gold Reversal?

This month, prices for gold markets continued to show bearish signals and a lack of bullish momentum. Earlier last month, gold prices began to breach support zones, indicating a future downtrend continuation. The market would need to see a bullish reversal with volume to establish buyer strength.

Global Precious Metals MMI: Biggest Price Shifts

- Palladium bars saw yet another drop month-over-month, this time falling 5.08% to leave prices at $1,196 per ounce.

- Platinum bars fell within a sideways range, only moving moving up by 1.79%. Prices month-over-month hit $969 per ounce.

- Silver ingots continued showing slower momentum in price movement, moving sideways with only a 1.24% increase to $24.40 per ounce. This indicates a possible reversal.

- Gold bullions moved sideways, decreasing by a modest 1.32%. This brought prices to $1939.6 per ounce.

MetalMiner’s MMI report includes 10 metal price reports and can serve as an economic indicator for contracting, price forecasting, and predictive analytics. Sign up here.