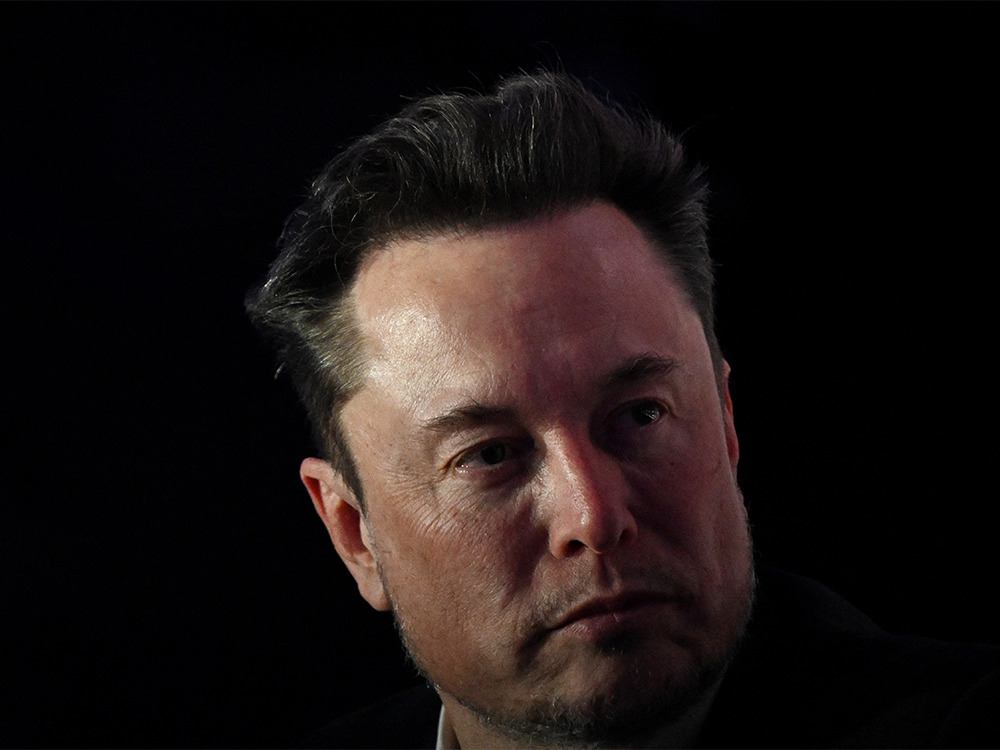

Elon Musk’s Robotaxi Reboot Plunges Struggling Tesla into Chaos

Strategic shift comes as carmaker prepares Tuesday to report its first revenue decline in four years

Bloomberg News

Elon Musk’s underlings at Tesla Inc. are accustomed to chaos. It comes with the territory of working for a chief executive who sets exacting targets and often abruptly switches directions — whose biographer describes his more intense moods as “demon mode.”

Tesla recalls nearly 4,000 Cybertrucks due to accelerator pedal fault

But even by Tesla standards, this year has been unruly. Its stock has slid more than 40 per cent amid slumping sales, confusing product decisions and more price cuts. Its once-dominant position in China’s EV market is under assault. A visit with India’s Prime Minister Narendra Modi for an anticipated investment announcement was called off at the last minute. All the while, the board has tried to revive a US$56 billion payout to Musk that a judge voided in January, on the grounds that directors had acted as “supine servants” to the CEO.

On Tuesday, Tesla is expected to report a 40 per cent plunge in operating profit and its first revenue decline in four years. Musk has ordered up the company’s biggest layoffs ever and staked its future on a next-generation, self-driving vehicle concept called the robotaxi. People familiar with his directives, who asked not to be identified discussing internal deliberations, are unsettled by the changes the chief executive wants to push through.

The idea of creating an autonomous taxi service has been kicking around Tesla for at least eight years, but the company has yet to stand up much of the infrastructure it would need, nor has it secured regulatory approval to test such cars on public roads. For the moment, Musk has put off plans for a US$25,000, mass-market vehicle that many Tesla investors — and some insiders — are pushing for and believe is crucial to the carmaker’s future.

In the wake of media reports on the strategic shift, key managers including Drew Baglino, an 18-year company veteran who headed Tesla’s powertrain engineering and energy business, have left.

Steered Tesla

Musk, 52, has steered Tesla out of many jams in the past. At US$469 billion, the company is still valued at more than nine times the market capitalization of General Motors Co. or Ford Motor Co. But after losing almost US$350 billion in market cap over four months, employees, investors and analysts alike are bewildered and second-guessing the company’s strategy.

“The stock will need to undergo a potentially painful transition in ownership base, with investors previously focused on Tesla’s EV volume and cost advantage potentially throwing in the towel,” Deutsche Bank AG analyst Emmanuel Rosner said last week, downgrading the shares from a buy and slashing his price target by more than a third.

The stock continued its slide Monday, trading down as much as 5.6 per cent shortly after the start of regular trading. The shares are on their longest losing streak since December 2022.

Musk has signalled on his social media network that the recent moves amount to activating wartime CEO mode. He liked a post saying as much after sending a company-wide email announcing that Tesla was cutting more than 10 per cent of global headcount, which would mean eliminating at least 14,000 jobs.

The actual number of people ushered out may exceed 20,000, according to people familiar with the company’s planning. Musk’s reasoning, according to one person with direct knowledge of his edicts, was that Tesla should reduce headcount by 20 per cent because its vehicle deliveries dropped by that amount from the fourth quarter to the first quarter.

For those still among Tesla’s ranks after this culling, Musk has radically altered the marching orders. The company is “going balls to the wall for autonomy,” he declared last week. The robotaxi is now taking precedence over a cheaper car he first teased four years ago, both with respect to setting timelines for prototypes and arranging production capacity, one person familiar with the planning said.

Musk has talked a big game about autonomy for over a decade, and has convinced customers to pay thousands of dollars for a product Tesla has marketed as Full Self-Driving, or FSD. The name is a misnomer — FSD requires constant supervision and doesn’t render vehicles autonomous — but Musk has repeatedly predicted it’s on the verge of measuring up to the branding. “I’m the boy who cried FSD,” he said in July.

Bullish on FSD

Musk and top engineers are particularly bullish about a major change in how FSD now works. A recently released version is the first to take a new approach to using raw camera footage to produce actions that drive the vehicle, Ashok Elluswamy, a director of Tesla’s Autopilot program, said on X last month. This should lead to “unprecedented progress,” he wrote.

But optimism around FSD and Musk’s belief that this new approach could bring about robotaxis is clouding the future of Tesla’s US$25,000 car project. People with knowledge of Tesla’s plans disputed the notion that the program has been cancelled altogether. All along, the company has been pursuing a low-cost vehicle architecture that will underpin several different types of models, one of which would have no steering wheel or pedals.

While these people confirmed the robotaxi is being prioritized, one described the next-generation vehicle project as an effort to wring cost reductions out of components and production methods, then apply those innovations to cheaper iterations of the Model Y and Model 3, the company’s two most popular EVs. Teams are placing particular emphasis on bringing these cost savings to bear with the Model Y.

It’s unclear just how much solace this might be to investors who’ve been spooked by reports that Tesla’s answer to affordable options like the Toyota Corolla has been scrapped entirely. Many are concerned that the only new model the company will offer to consumers in the half decade after the Model Y’s debut will be the Cybertruck, an expensive pickup that’s difficult to build. Last week, the company recalled the almost 3,900 trucks it’s sold to fix faulty accelerator pedals.

“Investors, particularly institutional ones, are losing patience,” said Bloomberg Intelligence analyst Steve Man. “The initial hype around Full Self-Driving and robotaxis has waned, and the pendulum has swung in the opposite direction.”

Reorienting Tesla around robotaxis is risky. While federal agencies have taken a permissive approach to regulating technology that has the potential to make roads safer, scrutiny at the state and local level has proven difficult to navigate.

Former Arizona governor Doug Ducey welcomed Uber Technologies Inc.’s self-driving vehicles to the state “with open arms and wide-open roads” in 2016, only to ban them after one fatal collision with a pedestrian in 2018. Uber sold off its autonomous-vehicle unit two years later.

Robotaxi testing

More recently, GM’s Cruise has spent the last six months working its way back to robotaxi testing after one of its cars struck and dragged a pedestrian in San Francisco. California also is holding up an expansion by Alphabet Inc.’s Waymo after several incidents, including one of its vehicles hitting a cyclist.

Musk nevertheless is betting Tesla can make robotaxis a reality by making FSD available to more consumers and cutting prices. He’s pushing test drives and free 30-day trials to promote the feature, buoy revenue and ingest more camera footage.

Tesla is building data centres in Buffalo, N.Y., and Austin, where it’s headquartered, to process the footage captured by its vehicles and train its driving systems. The Buffalo site is further along, while the Austin one is struggling with cost overruns, people familiar with the projects said.

The rationale for Tesla’s layoffs was not to squeeze savings from parts of the company and redirect spending to robotaxis, according to a person with direct knowledge of how job cuts were drawn up. Teams across the organization — including those working on autonomy — were given equal targets for headcount reduction, this person said.

Based on interviews with more than a dozen employees affected across the U.S., the firings were poorly organized and executed.

Emails that began “Dear Employee” were sent to personal addresses after midnight. At Tesla’s battery factory in Nevada, many staff started their Monday with gridlock at the front gate. They were diverted to a parking lot where security guards scanned badges to discern who still had jobs and who had been laid off. One person who learned they had been let go this way said it was the coldest and most humiliating experience of their career.

“A lot of people found out they were no longer employed in the middle of their shift, or after arriving for what was thought to be just another Monday,” Jordana Hernandez, a former service manager in Virginia, wrote on LinkedIn. “That’s the part that hurts. Giving literal blood sweat and tears to a company that showed zero humanity for the people that have sacrificed more than anyone outside of Tesla can imagine.”

The Saturday night before the layoffs began, Musk was striking dramatic poses on the red carpet and joking about who should play him in an upcoming biopic.

Days later, Tesla chair Robyn Denholm criticized a Delaware court for throwing out the board’s pay package for Musk and urged shareholders to re-approve it. Around this time, the chief executive learned the company had skimped on what it was offering staff whose jobs were just eliminated.

“It has come to my attention today that some severance packages are incorrectly low,” Musk wrote in an email to Tesla’s remaining employees. “My apologies for this mistake. It is being corrected immediately.”

Share This: