Today’s CPI inflation measure follows a PPI report showing that the enemy the public continues to obsess over is in the rear view mirror.

It was well over two years ago that we noted the tardy Fed and its “transitory inflation” shtick had finally started to take the inflation problem it was primary in creating seriously. You can click Lael Hawk-eye Brainard for that May 2, 2022 post I made noting the Fed had finally started taking its mess seriously and begun cleaning it up.

Subsequently, and on many occasions I illustrated the vigor with which the Fed had finally begun tilting at the windmill of its own creation (you can insert here a Frankenstein monster, a Genie out of the bottle or other such imagery of something going decidedly NOT to plan for our trusty policy-making eggheads).

Which leads us to today, as the CPI number…

…follows a PPI number indicating that our plan is on track. The plan being something like this, spanning from 2020 to today: Inflation creation in the face of deflationary panic > Inflation hysteria/Fed tilts hawkish > Forever and a day go by as inflation remains headline news and Jerome tilts > Moderation > Disinflation, and…

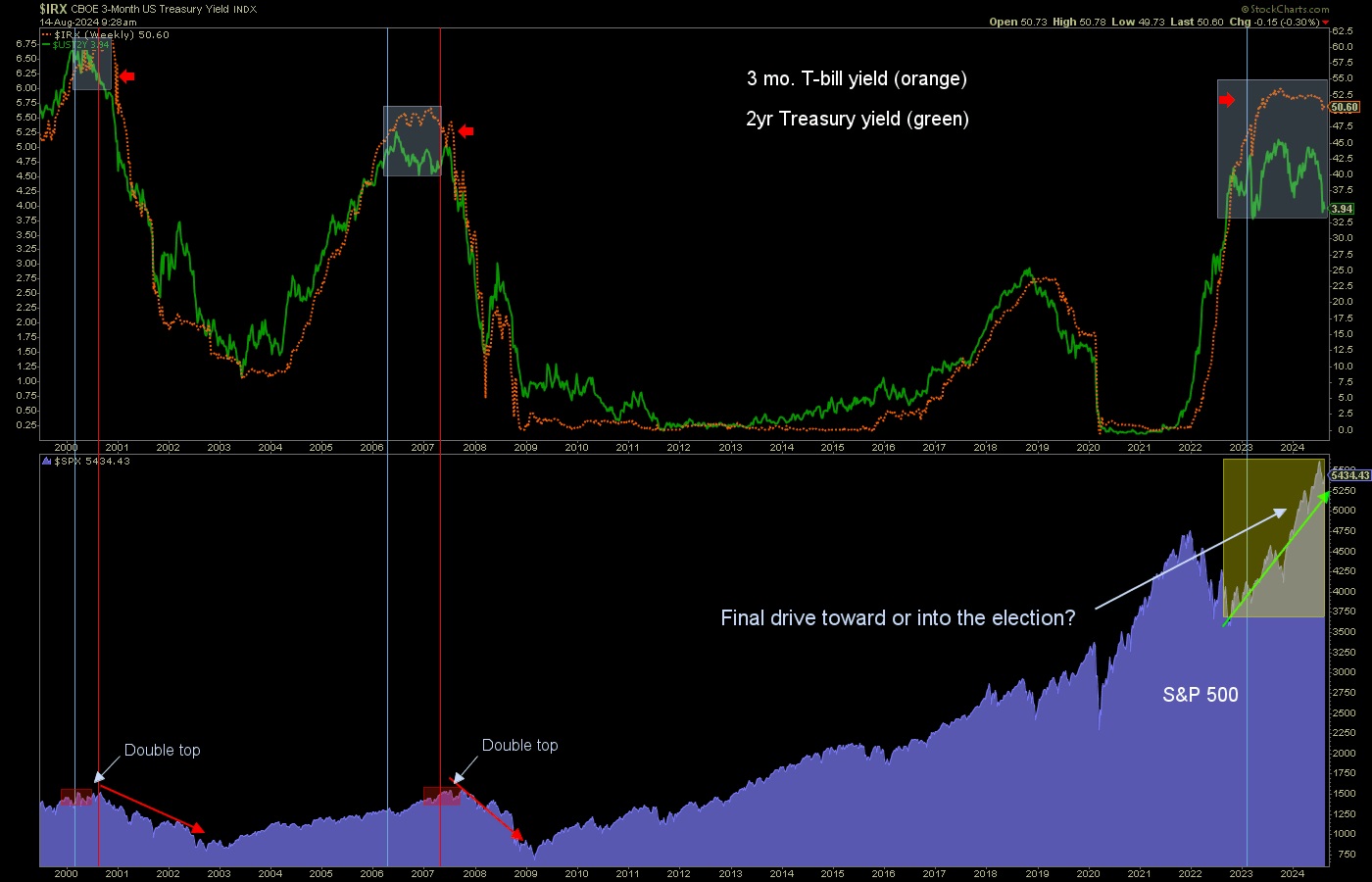

If the history of this chart proves to be prologue for what is ahead, the next top in stocks (I continue to lean toward the top not being in yet, but remain open minded in a market at high general risk) is going to lead to a bear market. When you consider the extremes in time and price that are ongoing during the divergence of the 2 year Treasury yield to the T-bill (Fed proxy) yield, I don’t think it’s going to be a routine bear market either. I think it is going to be a deep and painful one.

But with the market’s trends remaining up, it is important to realize that as of today it is a bull, not a bear market. A lot will depend on how long man, woman, machine and media wish to interpret the easing of inflation in a “Goldilocks”, “soft-landing” sort of way. That is interim to our favored plan and we are still in that interim. If I am right though, there will be transition. PPI and CPI are on plan, not to mention slowing employment, ramped up (non-productive) government hiring or not.

Dis-inflation is not deflation or a deflation scare. It is currently interpreted positively by a hopeful collective of market participants. Here is one final image, that of the Pit And The Pendulum. The pendulum goes both ways.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by Credit Card or PayPal using a link on the right sidebar (if using a mobile device you may need to scroll down) or see all options and more info. Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter@NFTRHgt.

*********