Support CleanTechnica’s work through a Substack subscription or on Stripe.

When the world’s biggest battery maker and one of the world’s largest container shipping lines announce a strategic partnership, it is not a coincidence of scale. It is a signal that two of the most energy-intensive parts of the global economy are finally starting to converge. On October 10, 2025, Maersk and CATL signed a memorandum of understanding to collaborate on decarbonizing logistics, port operations, and supply chains. For Maersk, it is an extension of its long campaign to pull carbon out of shipping. For CATL, it is a way to move beyond the factory gate and embed its technology across the full chain of global trade.

This partnership follows a quieter but equally significant agreement from June between CATL and Maersk’s terminal subsidiary, APM Terminals, to electrify port equipment and deploy advanced battery systems. The logic behind these deals is simple. Maersk controls the movement of goods through more than 60 ports, hundreds of vessels, and thousands of trucks and cranes. CATL has the largest portfolio of lithium-based products in the world, from small cells to containerized battery energy storage systems. Put together, they can turn ports into energy nodes rather than carbon chokepoints.

Shipping is one of the last major sectors to start cutting emissions at scale. Global trade has depended on cheap bunker fuel for decades, and the path away from it has been slower than in aviation or road transport. Maersk was early to invest in biofuels and methanol, ordering dozens of dual-fuel ships. But liquid fuels alone cannot meet long-term climate targets or the local air-quality standards that port cities are now enforcing. Batteries are the next step, not for crossing oceans yet, but for what happens close to shore.

Ports are where the energy transition in shipping becomes real. Every large terminal concentrates thousands of small energy loads into one dense cluster. There are cranes lifting containers, yard tractors shuttling them, refrigerated stacks running nonstop, and ships plugged in for hotel loads while docked. All of that power can be electrified, but it creates enormous peaks that existing grids cannot easily absorb. A battery buffer between the grid and the port smooths those loads, letting equipment run on clean power while avoiding costly substation upgrades. Maersk and CATL are betting that standardized battery systems can turn that solution into a template rather than a one-off engineering exercise in each location.

A single large battery system at a port can act like a quiet power plant. During low demand periods, it absorbs cheap or renewable electricity. During peak activity, it releases that power to cranes, chargers, and shore connections. It can even earn revenue from grid services when the port is quiet. As I’ve noted recently with the Teeside, UK example, multi-gigawatt-hour battery buffers at ports could be the cheapest schedule insurance available for electrification. They eliminate delays tied to grid capacity and make every connected load more predictable. With CATL supplying modular battery systems and service contracts, Maersk can replicate the same model across dozens of terminals worldwide.

On the equipment side, the changes will start with yard tractors, reach stackers, and cranes. These machines are perfect battery candidates. They have predictable duty cycles, stay within a defined area, and can share charging infrastructure. APM Terminals has already begun to replace diesel equipment with electric versions at several sites. The missing link was long-term battery support and recycling. CATL’s involvement closes that loop. It can provide cell chemistry tuned to heavy cycling, replace packs through leasing programs, and take back end-of-life modules for second use in stationary storage. That financial predictability matters as much as the technology itself.

The other side of the partnership is at sea. Batteries are already common on ferries and harbor craft, where they cover entire routes or provide redundancy. On deep-sea container ships, the energy density challenge is harder, but the economics are shifting. Batteries can already handle maneuvering, hotel loads, and port approaches, cutting fuel use and emissions in the most sensitive areas. As battery prices fall, the optimal size of onboard packs grows. In hybrid configurations, batteries smooth engine loads and reduce generator cycling, improving both efficiency and maintenance costs. Pairing those systems with port-based batteries makes the operation even more effective, since ships can reliably charge during short berths without overloading the grid.

For container ships, I’m bullish on containerized batteries, swapped in ports and in known dwell points like major canals, and charged on shore. There are already smaller container ships running 1,000 km river routes in China and shorter routes in northern Europe operating under this model, and I expect it to become a major part of maritime decarbonization moving forward.

The Maersk–CATL partnership is also about integration across scales. It links the smallest forklift battery to the largest grid-connected BESS. It treats the port as a single energy ecosystem rather than a collection of separate machines. Once ports have large buffers in place, they can deliver shore power to ships, charge electric drayage trucks, and still have reserve capacity for grid support. The battery becomes the anchor for everything else. This is the kind of systems thinking that has been missing in much of the maritime transition conversation.

There is also a materials story underneath it. CATL’s recycling capability allows Maersk to plan for residual value from the start. Yard equipment batteries can serve for a decade, then move into stationary service for another. The same chemistry supports both use cases. That circularity lowers the total cost of ownership and builds a predictable supply of recovered lithium and nickel. It is the sort of vertical integration that could make ports self-sustaining energy hubs rather than dependent on a constant stream of new imports.

The early deployments will likely focus on ports with easy access to renewable electricity. Northern Europe’s wind-heavy grids are ideal, and APM Terminals’ footprint in the Netherlands and Scandinavia makes them natural test beds. As templates solidify, the model can spread to Asia and North America. The pattern could even extend inland, where logistics hubs and warehouses share similar peak loads and vehicle fleets. Each success reduces perceived risk for the next one, making large-scale electrification less about pilots and more about replication.

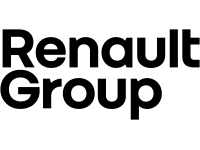

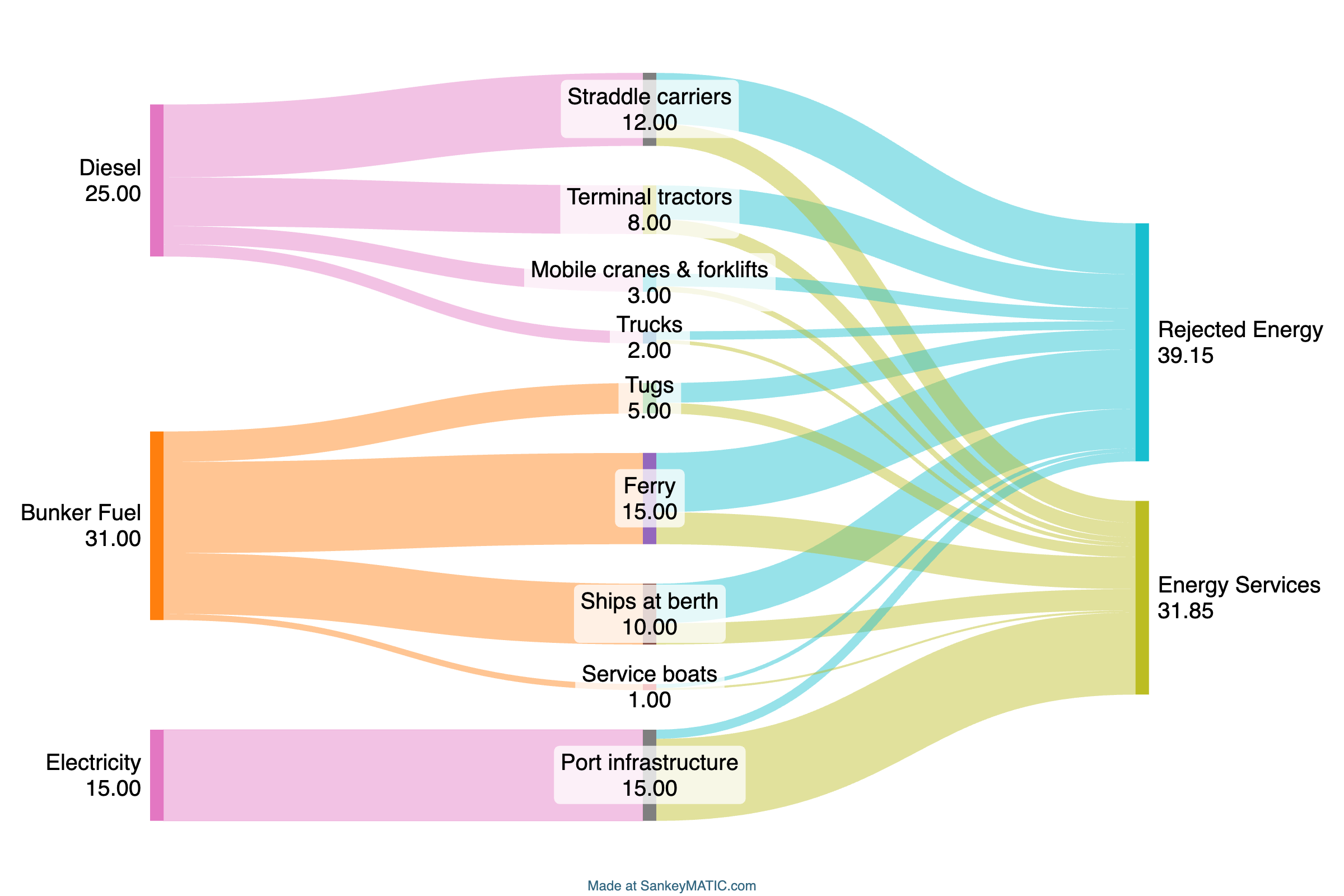

This pathway is one I’ve explored at high level in the white paper I assembled after working through a 30 year strategic electrification pathway for ports recently. The Sankey diagrams above are two of the several I created for different stages in the electrification journey.

Maersk’s bet on methanol was a first step away from oil. The partnership with CATL is the next step toward electricity. Both directions matter. Liquid fuels will still move the biggest ships for decades, but their efficiency will depend on how well the electrical systems around them are built. Batteries are not just another fuel alternative. They are the connective tissue between renewable generation, shore power, and propulsion.

In practical terms, this partnership is an inflection point. It shifts battery technology from being an equipment option to being core maritime infrastructure. It also shifts Maersk’s identity from shipper to energy integrator. CATL gains a global showcase for its products across every environment from factory to dock to vessel. Together they have the chance to prove that ports are not the end of the logistics chain but the new center of the clean energy system. That possibility, if realized, will make the next decade of maritime decarbonization look very different from the last.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy