The PBoC is in a hurry to buy enormous amounts of gold, indicating it’s preparing for substantial changes in the dollar-centric international monetary system.

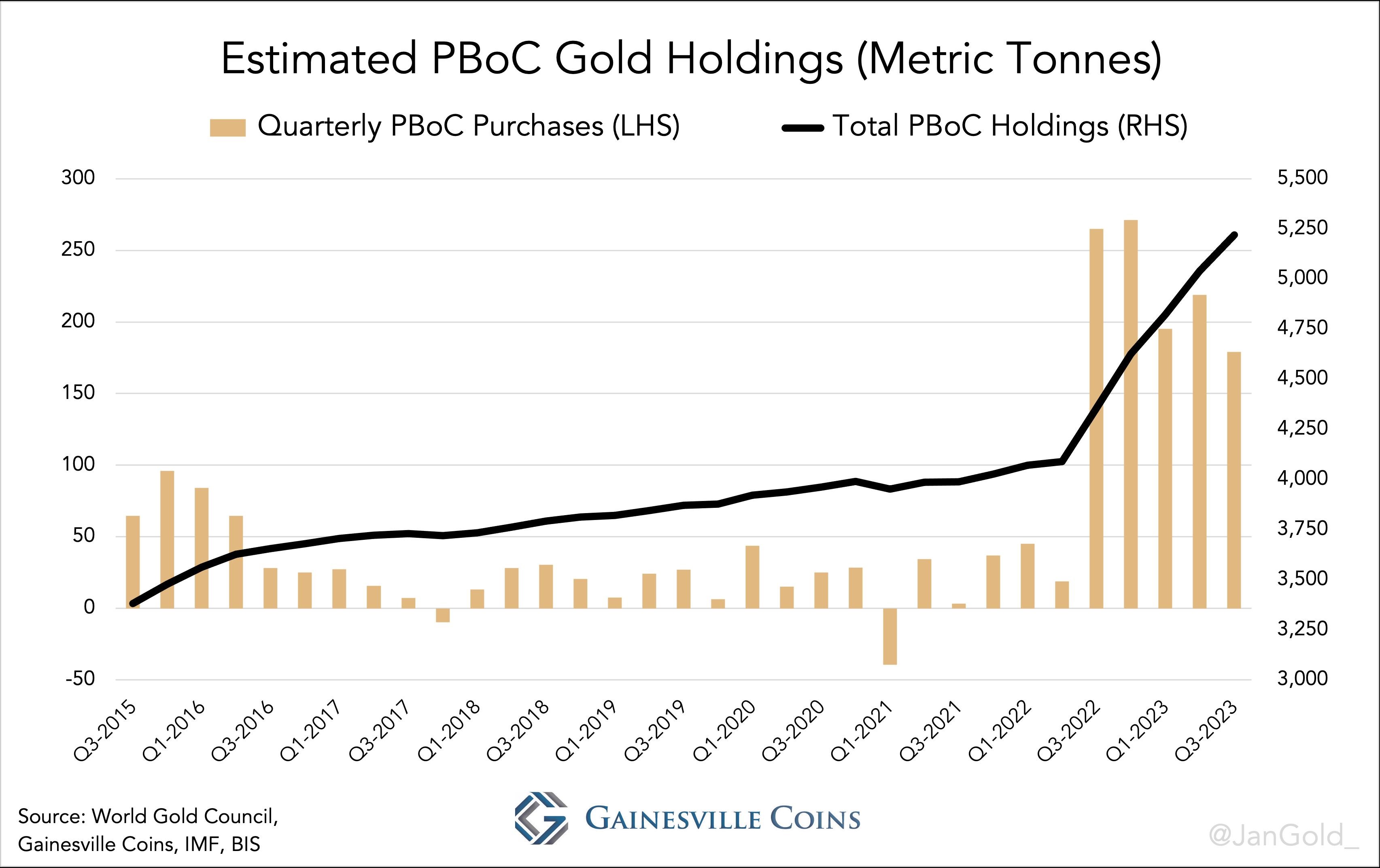

Based on information from industry sources and my personal calculations, total gold purchases by the Chinese central bank (reported and unreported) in Q3 accounted for 179 tonnes. Year-to-date the PBoC bought 593 tonnes, which is 80% more than what it bought in the first three quarters last year. Its total estimated gold holdings are 5,220 tonnes, more than twice what’s officially disclosed at 2,192 tonnes.

The movement towards gold by central banks is showing no sign of slowing down. Mainly the Chinese central bank is on a voracious buying spree since 2022, and it’s obtaining way more metal than what is officially reported. The People’s Bank of China (PBoC) buys gold off the radar, not to send shockwaves through the market, allowing it to exchange its dollars for more bullion in anticipation of shifts in the international monetary order.

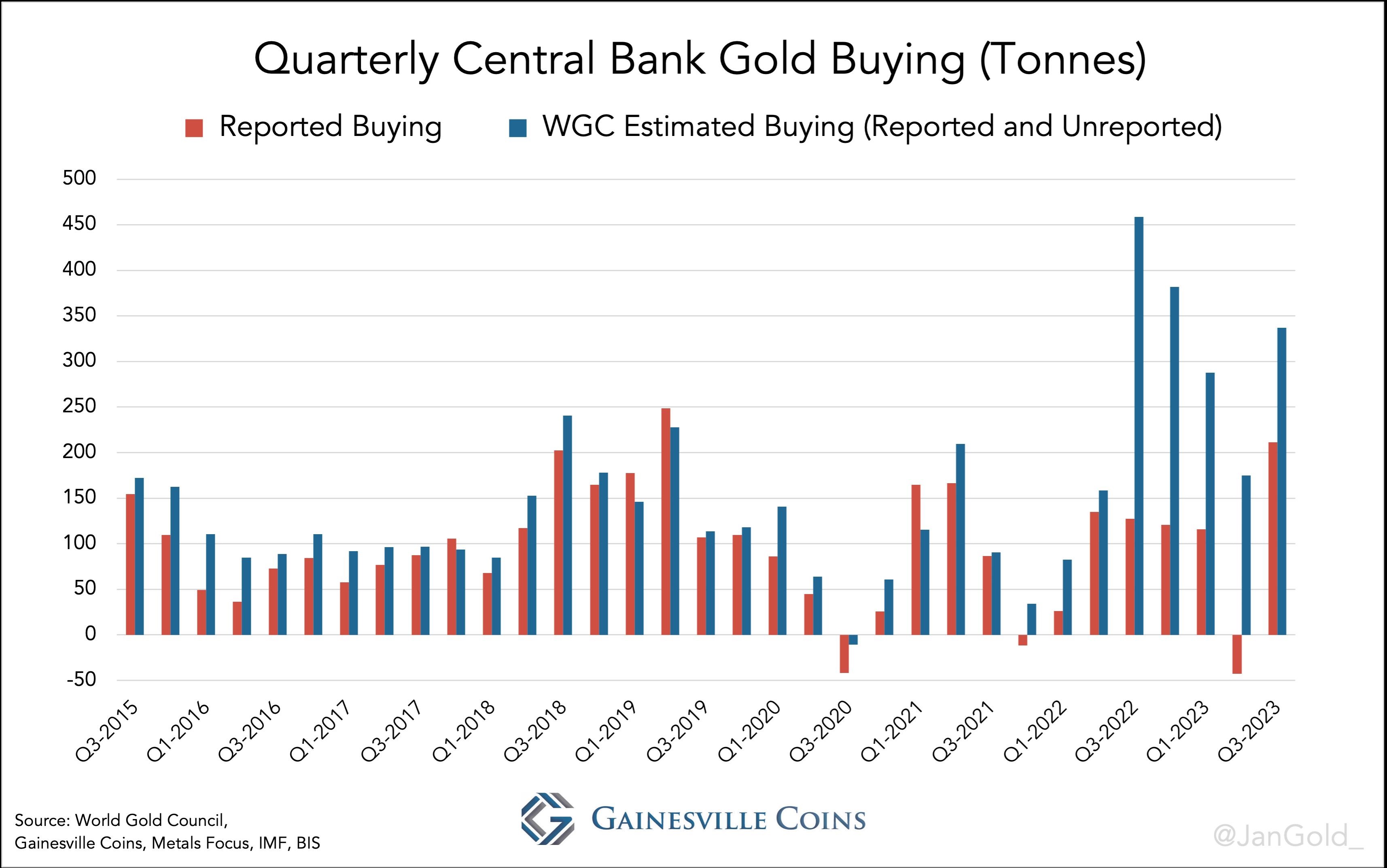

Every quarter we at Gainesville Coins compute an estimate of how much gold is bought by central banks surreptitiously. Of these unreported purchases about eighty percent is bought by the Chinese central bank; the other twenty percent is acquired by central banks from, for example, Saudi Arabia, according to industry sources that prefer to stay anonymous.

In the Gold Demand Trends Q3 by The World Gold Council (WGC) total estimated gold purchases by central banks, derived from publicly available data and field research, accounted for 337 tonnes. Reported gold acquisitions by central banks—data collected by the International Monetary Fund (IMF)—accounted for 211 tonnes. Eighty percent of the difference is 101 tonnes, which, added to what the PBoC publicly states to have bought in the third quarter, compounds to 179 tonnes. Year-to-date the PBoC has bought a record 593 tonnes, which is 790 tonnes annualized! (For more details on how I calculate PBoC gold holdings please read my previous article).

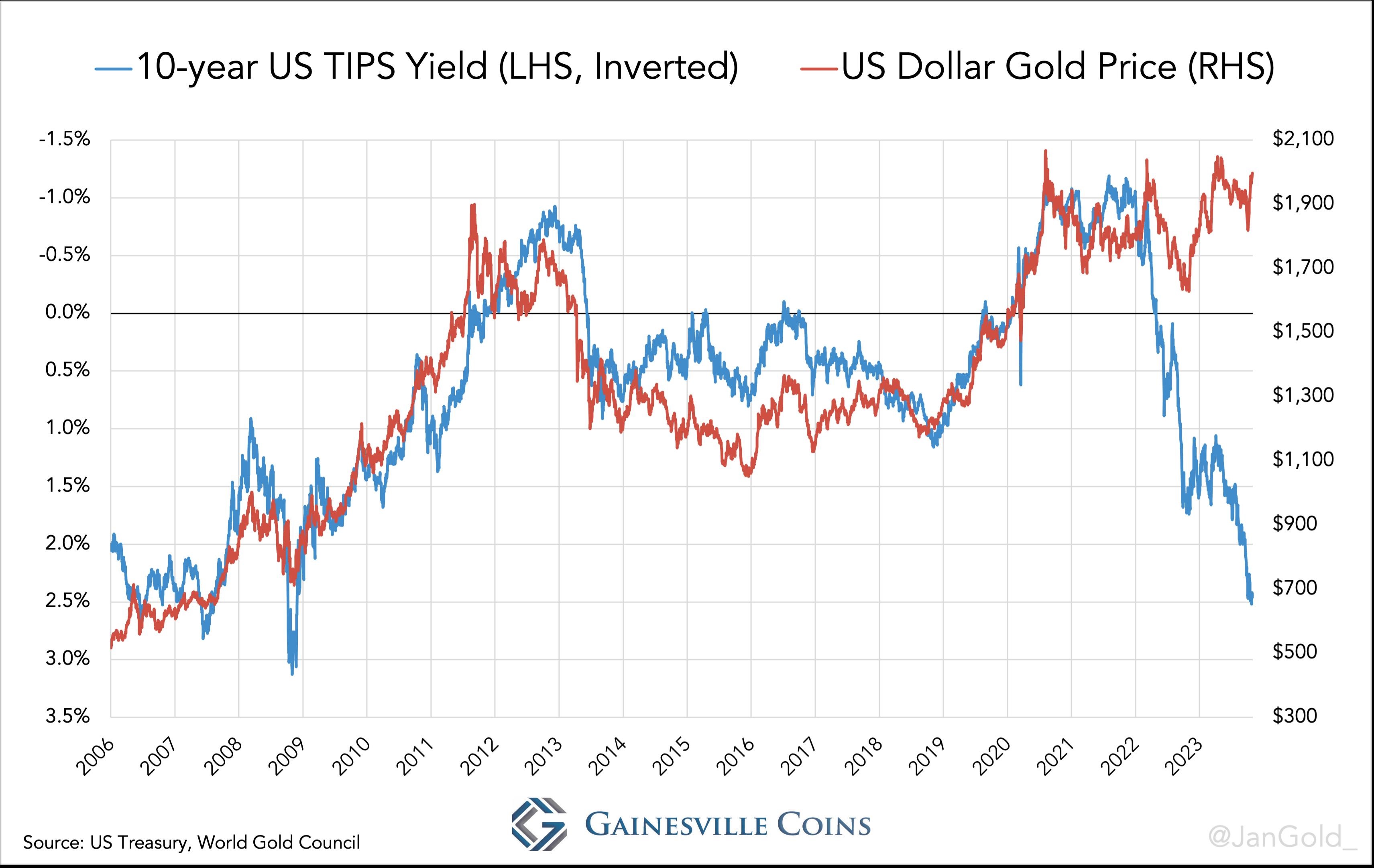

The start of the Ukraine war, early 2022, sparked the US to optimal dollar weaponization, which made the PBoC ramp up gold buying aggressively. Ever since, the Chinese central bank’s shoppings have been a huge support for gold as evidenced by the spread between the price of bullion and the TIPS yield. Although the (inverse) correlation between gold and the TIPS yield has always been nonsensical, it took a war for the PBoC and market participants with similar interests to end it, because time was running out to diversify their dollars.

Now that the TIPS model to price gold is of less relevance (in October real rates and gold went up together), we can extend our discussion of de-dollarization. Some pundits claim there is no de-dollarization, or, even, there will be no de-dollarization. Although I agree the role of the dollar in international finance is not quickly to wane, we must make an important distinction between the dollar as a trade currency and a reserve currency. As a reserve currency there is no fiat currency that can replace the dollar. The US has broad and (usually) liquid financial markets, no capital controls, and it’s running sizable fiscal and current account deficits that can supply the world with debt securities to store dollars in.

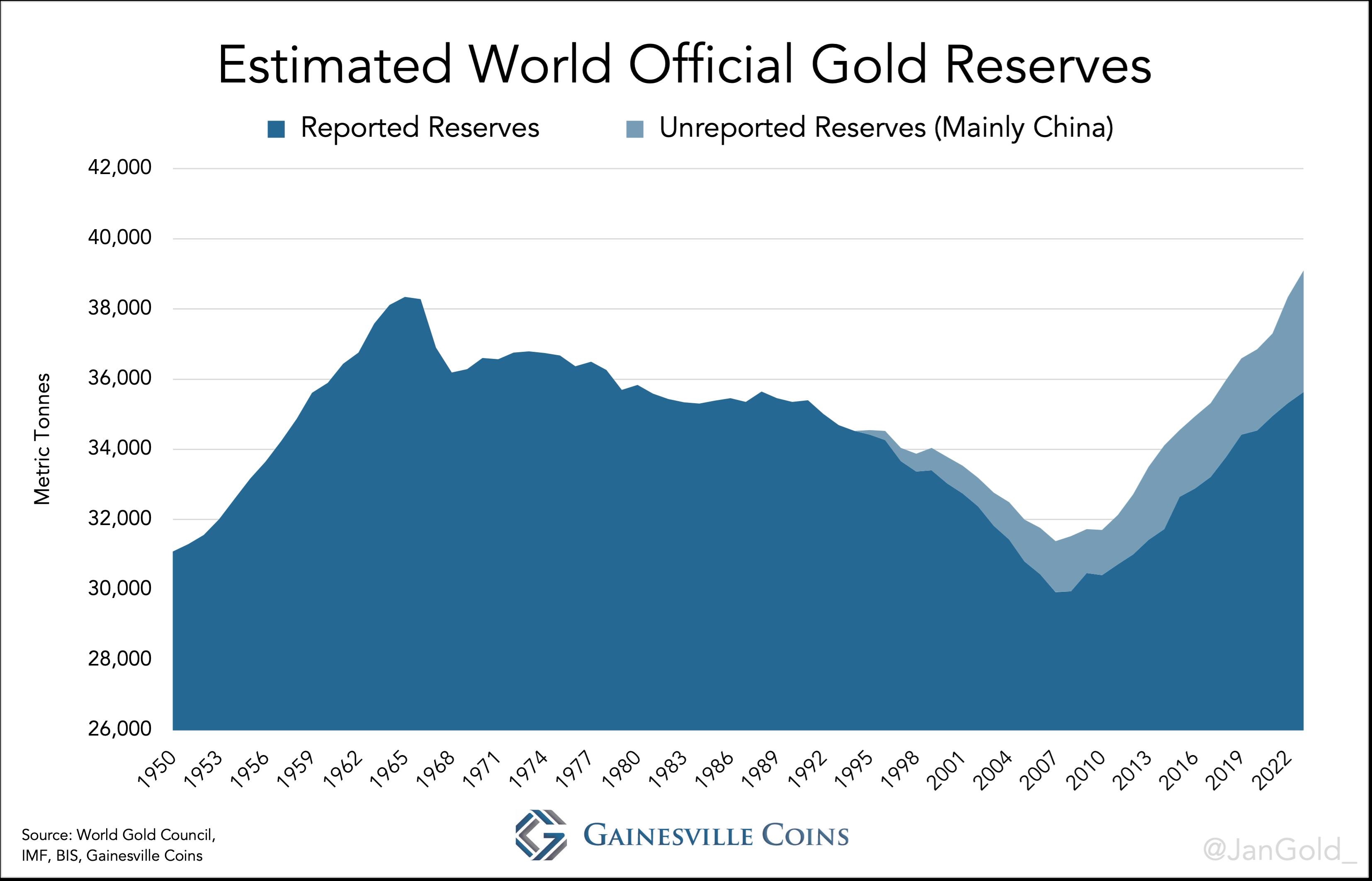

But that doesn’t mean that gold, which has no counterparty risk, is universally accepted, and evenly distributed, can’t replace the dollar as the world’s reserve currency. Not only are China and other countries in the Global South preparing for this scenario, the European Union is doing the same. And with more war in the Middle East, and few solutions other than inflation to resolve the global debt overhang, gold’s time to shine comes closer and closer.

Tweet by the author

Regarding trade currencies, the Chinese have set up the Shanghai International Gold Exchange (SGEI) in the Shanghai Free Trade Zone that facilitates “offshore” gold trading in renminbi. The SGEI empowers foreigners to use renminbi as a trade currency that can be converted into gold to store any surpluses without affecting China’s balance of payments. (For more information read “The Shanghai International Gold Exchange and Its Role in De-Dollarization.”)

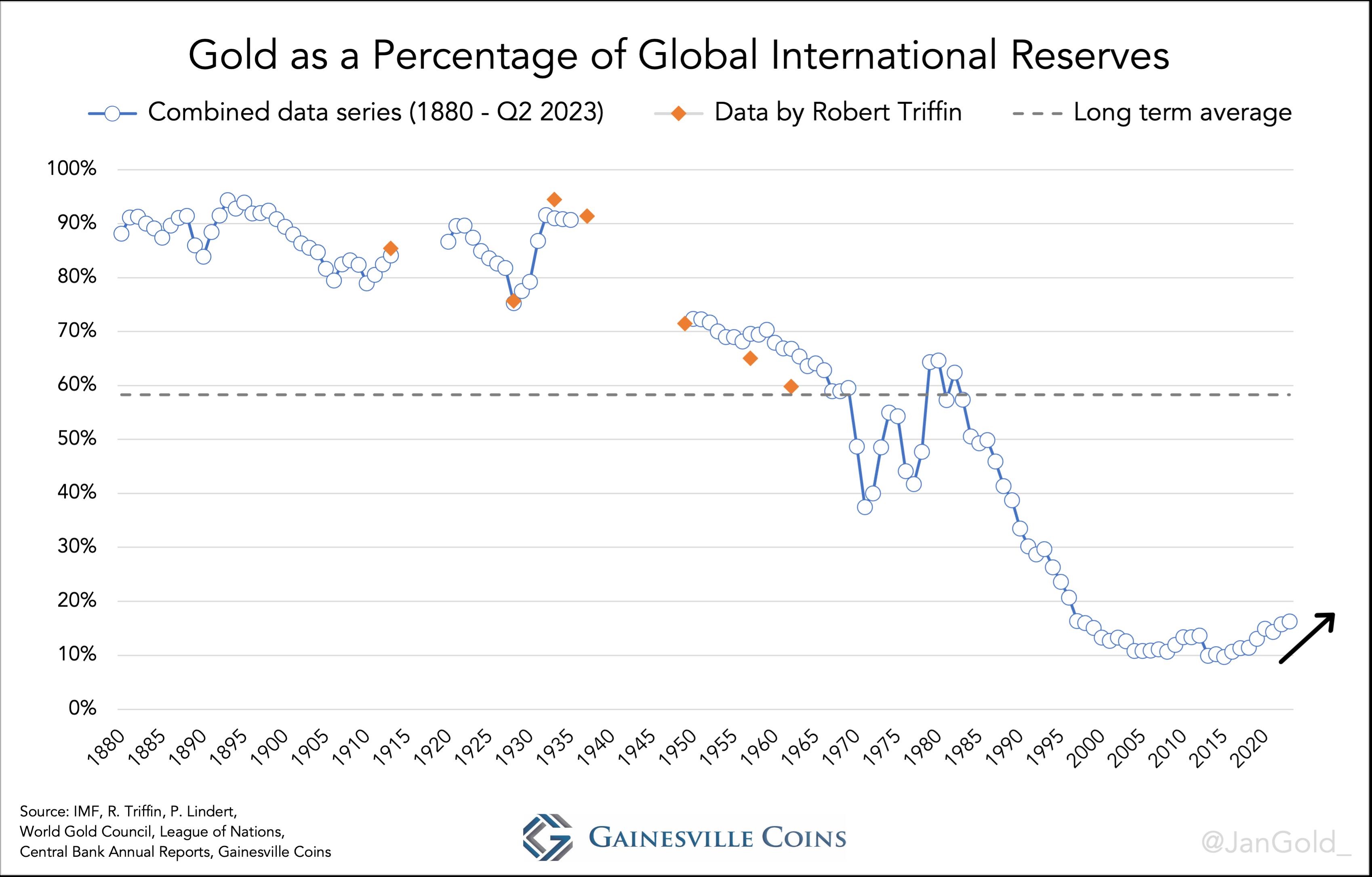

My estimate of world central bank gold holdings is at an all-time high, and gold’s share of global international reserves has been steadily increasing in recent years, from a historic low that was formed during a time of financial stability and relative peace. My expectation is that gold holdings relative to foreign exchange (mostly dollars) will continue to grow in the foreseeable future.