Although nickel prices rose more than 8% during July, prices found a peak at the beginning of August and fell to create a higher high. Indeed, prices began to retrace downward as bearish patterns became apparent in price action. While prices have yet to substantially break below monthly support or create a new lower low, they continue to trend downward, nearing their late-June bottom.

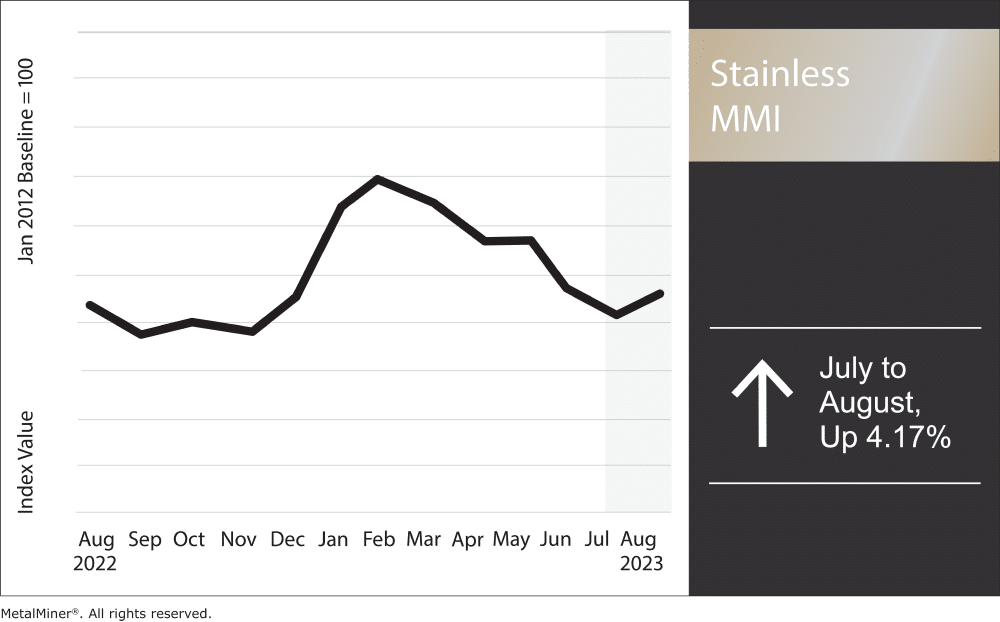

Overall, the Stainless Monthly Metals Index (MMI) inverted upward, with a 4.17% increase from July to August.

Empower your nickel purchasing with the latest market analysis and strategic advice during times of fluctuating metal demand. Learn about MetalMiner Insights.

Outokumpu Looks to Expand North America Stainless Operations After Q2 Earnings Plunge

According to its recent earnings report, Outokumpu saw a sharp downturn during Q2. Indeed, the company’s net income (EBITDA) fell 62.32% year over year, marking a 6.57% decline from Q1. Meanwhile, stainless steel deliveries fell 10% from 2022, but remained stable quarter over quarter, with a modest 1% decrease. Net income more than halved from H1 2022 to H1 2023, indicating a 54.51% decline. Amid the plunge in earnings, the company projects continued downside in Q3. The group estimates stainless steel deliveries will decline by 5-15% from Q2.

Outokumpu attributed the sharp drop to softness in the European market, as the company noted a “solid” performance in the Americas. Indeed, stainless steel deliveries in Europe declined from Q1, while deliveries in the Americas increased (though Outokumpu declined to specify to what extent). The split has led Outokumpu to focus operations more heavily on the U.S. market. CEO Heikki Malinen stated, “We have successfully turned around our business in the U.S. and aim to strengthen our position further in this attractive market with a favorable regulatory environment.” He went on to note that the company is currently “conducting a feasibility study to investigate options to expand operations in the U.S.” This would potentially include the expansion of domestic cold rolling capacity and the construction of a new hot rolling mill.

View MetalMiner’s track record of forecasting where industrial metal prices are headed.

Stainless Surcharge Bearish, Nickel Prices Trend Higher

Despite Outokumpu’s optimism, the domestic stainless market remains pressured. Some service centers report having to compete with other suppliers for customers amid high inventories from end users and competitive import pricing. Relative to last year, price adjustments have been notably absent from the market thus far in 2023.

Meanwhile, the surcharge remained bearish in August, continuing its downtrend after prices peaked in January. Still, the average nickel price is currently trending higher than last month, which could pressure the overall surcharge next month.

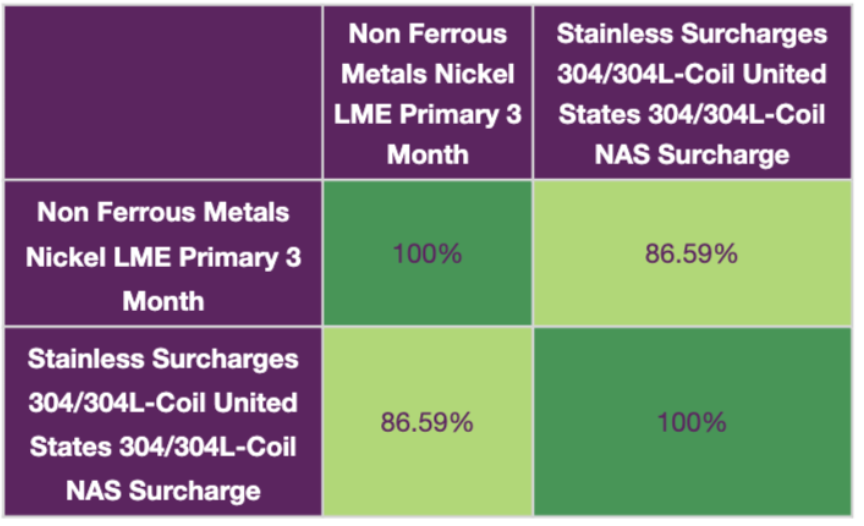

However, This outlook could change if nickel prices can sustain enough downside momentum in the coming days. LME nickel prices have a strong influence on the 304 surcharge, with the two boasting an 86.59% correlation since 2012.

Buy nickel with confidence. MetalMiner’s Monthly Buying Outlook Report provides monthly market analysis, price forecasts, and purchasing strategies for 10 different metal types, including nickel and 304 stainless. See a sample report or subscribe!

Nickel Supply Expected to Jump, While Inventories Continue to Slide

Up to this point, low inventory levels have helped support nickel prices, even as they continue to trend lower. Throughout July, LME inventory levels descended to slide toward 2007 lows. However, this could change ahead of an expected increase in class 1 nickel supply.

According to research from Macquarie Group Ltd. reported in a recent Bloomberg article, LME-deliverable nickel supply could jump by 35% from 2022 levels. While more widely used, other forms of nickel have experienced the lion’s share of the ongoing Indonesian production boom. However, new plants in China and Indonesia capable of processing intermediate forms of nickel into refined nickel for the LME may help soften that balance. By the end of next year, those plants could add as much as 200,000 tons to supply annually. In fact, analysts expect the Chinese plants to completely eliminate China’s need for imported nickel by 2024.

Nickel prices continue to see slow overall price movement due partly to the mass exodus of market participants following the 2022 nickel squeeze. That said, a jump in supply could help add downside momentum to prices. For the stainless steel market, falling nickel prices will likely lead to a falling surcharge and hesitancy among buyers reluctant to purchase large volumes ahead of expected price declines.

We know what you should be paying for nickel and other industrial metals. MetalMiner should-cost models are the ultimate savings hack, showing you the “should-cost” price for gauge, width, polish, and finish adders as well as a 304 surcharge forecast. Explore what value they can add for your organization.

Biggest Moves in Stainless Steel and Nickel Prices

- Chinese ferrochrome lump prices surged during the month, increasing 58.24% to $1,912 per metric ton as of August 1.

- LME primary three-month nickel prices rose 9.52% to $21,905 per metric ton.

- Chinese primary nickel prices rose 7.47% to $24,484 per metric ton.

- Meanwhile, the Allegheny Ludlum surcharge for 316/316L coil fell 4.17% to $1.75 per pound.

- The Allegheny Ludlum surcharge for 304/304L coil saw the largest drop of the index, falling 6.47% drop to $1.14 per pound.