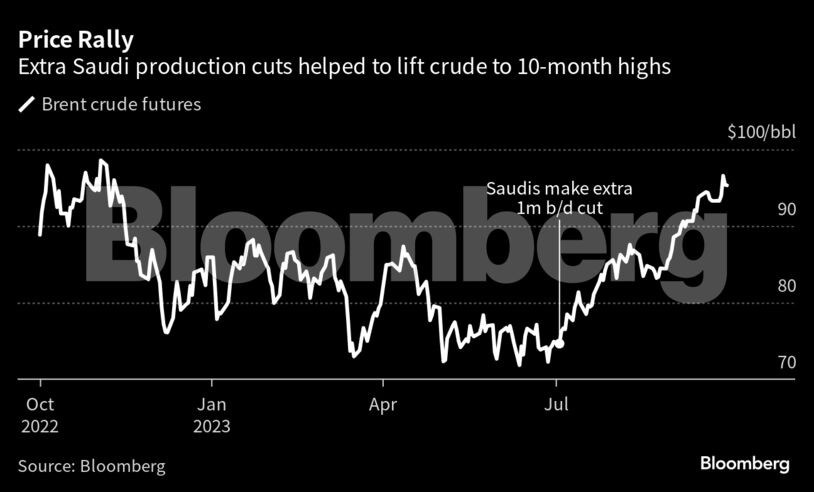

As OPEC+ ministers prepare to review global oil markets, the group is showing no signs of cooling a rally that brought prices near $100 a barrel.

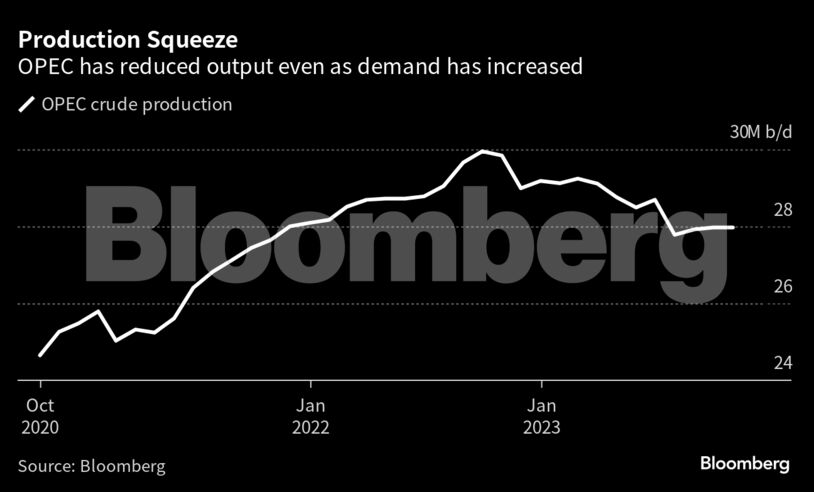

Crude has soared more than 20% in three months as alliance leaders Saudi Arabia and Russia squeeze supplies while world fuel demand hits records. The surge threatens to undermine a fragile global economy, harm consumers with another inflationary spike and derail central banks’ plans to wrap up interest-rate hikes.

Yet delegates from the Organization of Petroleum Exporting Countries and its partners don’t expect Wednesday’s meeting of the Joint Ministerial Monitoring Committee to recommend any policy changes. United Arab Emirates Energy Minister Suhail al Mazrouei said on Monday that OPEC+ has “the right policy.”

High prices are bringing a windfall for Saudi Crown Prince Mohammed bin Salman as his kingdom splashes out on everything from futuristic cities and international telecommunications deals to top-flight footballers and golfers. They are also a vital source of extra revenue for President Vladimir Putin as his country wages war on Ukraine.

“The oil market is getting squeezed and getting squeezed hard — but there’s more tightness to come,” Bob McNally, president of Rapidan Energy Group and a former White House official, told Bloomberg television. “Everything depends really on what Saudi Arabia does.”

Riyadh slashed output by 1 million barrels a day in July, deepening earlier cutbacks made in conjunction with OPEC+ and taking production to a two-year low of about 9 million barrels a day. It committed to keep that limit in place until the end of the year. Russia has pledged a more modest export reduction of 300,000 barrels a day.

The two OPEC+ leaders said they will review the decision each month, but there’s little expectation of any changes stemming from this week’s committee meeting. Most OPEC+ members aren’t participating in the extra output cuts that have driven the price rally, meaning any adjustments undertaken by the Saudis and Russia tend to be announced in separate statements.

For now at least, the OPEC+ kingpins have reason to keep their stranglehold on supplies in place. Brent crude, the international benchmark, rose to a 10-month above $97 a barrel last week, but has since dropped to near $90 in London amid concerns about the strength of the global economy.

Draining Tanks

By restricting supplies just as consumption rebounds from the pandemic, the cutbacks are depleting oil inventories around the world at the fastest clip in years. In the US, storage tanks have been drained so low they may struggle to function properly.

That’s inflicting pain on consumers. India, a major buyer of Saudi and Russian oil, isn’t comfortable with prices at these levels and anticipates some demand destruction, Pankaj Jain, secretary at the Ministry of Petroleum and Natural Gas, said at the Adipec energy conference in Abu Dhabi on Monday. The country is continually telling producing nations that crude is too costly, he said.

Last month, Indonesian energy official Tutuka Ariadji lamented the “big burden” of fuel costs on the world’s fourth-most populous country, while American air carriers including Southwest Airlines Co. and United Airlines Holdings Inc. warned passengers to brace for higher jet fuel prices.

Meanwhile, US policymakers have signaled that interest rates will need to stay higher for longer to contain inflation. There could also be political peril for President Joe Biden as he prepares for next year’s reelection campaign with gasoline near $4 per gallon.

OPEC+ has offered a mixed rationale for its approach, while consistently denying that it’s targeting a particular price level.

Secretary-General Haitham Al Ghais said in Abu Dhabi this week that he’s “optimistic” about demand, while the UAE’s Mazrouei said the group’s intention is to encourage investment in new supplies. Last month, Saudi Energy Minister Prince Abdulaziz bin Salman described the strategy as “proactive” amid uncertainties in China’s economy.

If the cartel’s supply squeeze pushes prices above $100 a barrel, the conversation may turn to whether Riyadh would intervene to stop the market over-shooting. Goldman Sachs Group Inc. expects Saudi Arabia to restore supplies to prevent prices climbing far beyond $105 a barrel, in case that erodes consumption.

Politics may also have some sway over the kingdom. The US, Saudi Arabia and Israel are engaged in complex negotiations in which Washington would offer security guarantees to Riyadh in return for normalizing relations with Tel Aviv.

“The White House is working overtime on a mega diplomatic deal with Riyadh and the question is: Where does energy feature in the bilateral conversations?” said Helima Croft, chief commodities strategist at RBC Capital Markets and a former CIA analyst. “The real play for Washington would be a Saudi Arabia taper of its unilateral cut.”

Share This: