Despite Monday’s lackluster price movement, there have been steady gains for gasoline and diesel as a spate of refinery outages ramps up premiums for the fuels. That’s also helping to boost demand for some Middle Eastern crudes.

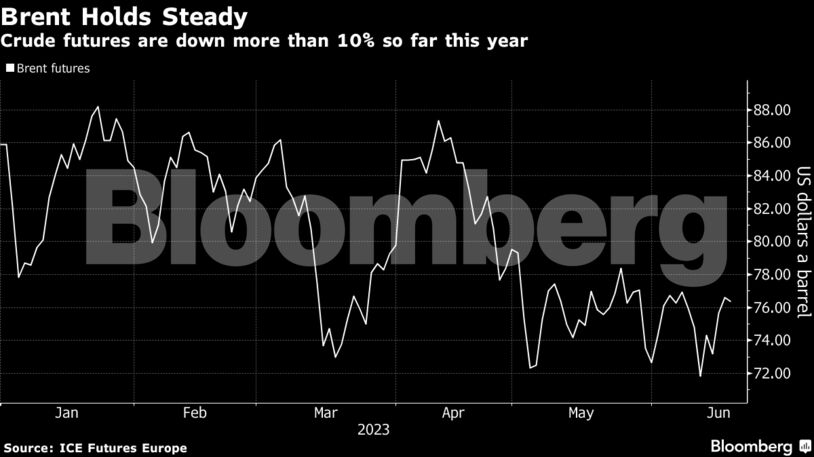

Oil has retreated in the first half of the year as China’s recovery from Covid Zero missed lofty expectations while global supplies, including from Russia, remained abundant. In a bid to stem the slide, the Organization of Petroleum Exporting Countries and its allies have announced production cuts, including a voluntary reduction from Saudi Arabia of 1 million barrels a day in July.

“We are back to focusing on Russian oil supply and the slowing of the Chinese economy,” said Arne Lohmann Rasmussen, head of research at Global Risk Management. “There is a growing risk that the $75 floor will not hold, and that the rise in Brent above $76 last week was due to short-covering.”

Both OPEC and the Paris-based International Energy Agency have forecast that the market will tighten substantially in the second half. Still, crude stockpiles at the key US hub of Cushing, Oklahoma, have hit a two-year high.

WTI for July delivery fell 0.4% to $71.47 a barrel.

As oil eased, other leading industrial commodities including copper also dropped.

Share This:

Next Article