The oil market is finally starting to show signs of tightening, a relief for traders who have grappled with fading optimism around China’s recovery and concerns over the global demand outlook.

A series of supply cuts by OPEC+ and its defacto leader Saudi Arabia over the last few months have failed to dispel the gloom, but there are indications that the latest reductions are having an impact. Across the derivatives market, key gauges have turned more bullish over the past few days.

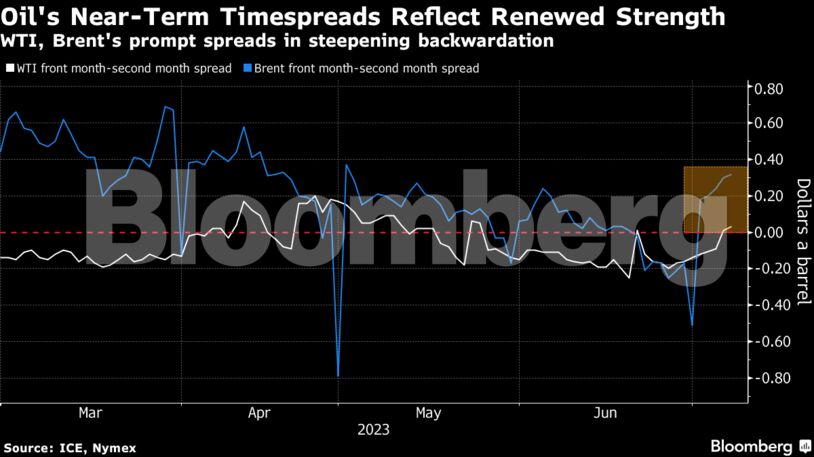

Swaps contracts tied to physical supplies have been rallying, while in options markets, the premium of bearish puts over bullish calls has narrowed. Prompt spreads for benchmark futures have also climbed out of a contango structure that reflects oversupply, as trading of real-world oil shows some strength.

The gains across the oil futures curve follow Saudi Arabia’s pledge this week to keep its output cuts in place for August, while Russia announced export curbs to help prop up prices. An improvement in US demand during the summer driving season has added to the strength, with refiners ramping up activity.

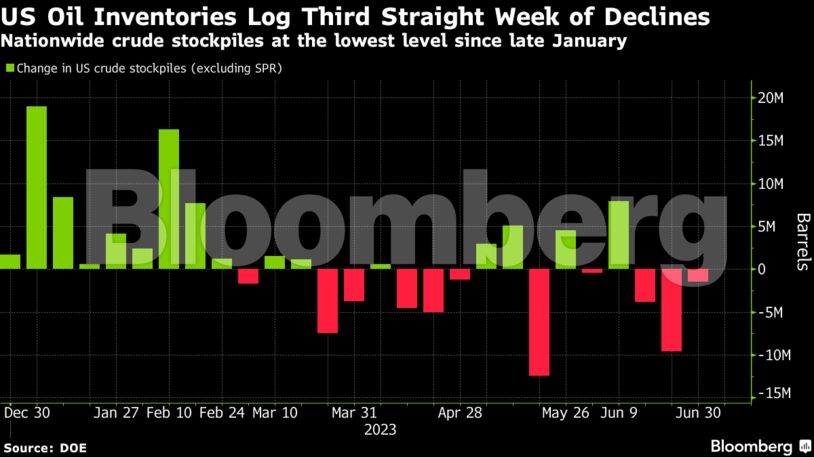

OPEC+ has been strategic in where its supply cuts have been most material, namely West of the Suez and the US, traders said. Some analysts see the moves as a catalyst for global inventories to shrink in the second half, with American crude stockpiles already at the lowest level since January.

“We believe we are at the verge of consistent, and rather deep, global inventory declines,” said Helge Andre Martinsen, a senior oil analyst at DNB Bank ASA. “The market is in a state of ‘seeing is believing,’ and we are about to see,” he added.

Brent’s front-month contract is also commanding its biggest premium to the third month since early May in a bullish pattern known as backwardation. The spread for West Texas Intermediate also firmed after recent dips into the opposite contango structure.

“We think that backwardation will extend for Brent,” Bob McNally, founder of Rapidan Energy Advisors, said in a Bloomberg TV interview this week. “You’re starting to see that tightness in the sour crudes, the beginning waves of those export cuts. We think that will intensify further.”

Other bullish pointers for oil include:

- Weekly swaps contracts in the North Sea known as contracts for difference are trading in the biggest backwardation since mid-May, when just over a week ago they were trading in contango.

- Brent put options were commanding smaller premiums relative to bullish calls, according to data compiled by Bloomberg.

- The premium of Murban futures climbed to more than $2 a barrel over the Dubai benchmark on Thursday, a sign of tightness in a key part of the Asian crude market.

- Backwardation in Europe’s diesel market surged this week, underscoring strength in fuel markets.

- In the US, prices of sour crude barrels that could serve as a replacement for OPEC barrels have surged. Mars, considered the benchmark sour grade, has jumped to the highest in nearly 3 years.

- Sweet crudes are also showing signs of strength though. WTI at Houston, known as WTI MEH, a key export grade, is trading at the highest level since March.

The picture isn’t totally rosy, however. There are signs Forties crude — the largest stream that prices the Brent contract — has been softening, RBC Capital Markets LLC Commodity Strategist Michael Tran said in a note. There’s also a glut of unsold cargoes from Nigeria that were initially earmarked for July, he added.

Much of the oil market weakness has been due to momentum-driven traders, which typically follow patterns stemming from macro events and wider market movements rather than fundamentals. Positioning by non-commercial players such as hedge funds is the most bearish in more than a decade, and that needs to be unwound before prices rally significantly, traders said.

“Bottom line is that the oil market looks better now than it did a few weeks ago with generally strong margins on everything but petchems, which is good for prices,” said Scott Shelton, an energy specialist at ICAP.

Share This: