Oil steadied after rallying more than 2% Tuesday on Saudi Arabian and Russian production cuts.Global benchmark Brent erased an earlier drop to trade above $76 a barrel. The two OPEC+ linchpins announced their latest batch of curbs on Monday, with a supply-cut extension by Riyadh and a fresh pledge to reduce production from Moscow.

The UAE won’t be joining voluntary oil cuts at this time, the country’s energy minister said. Saudi Energy Minister Prince Abdulaziz bin Salman said Russia’s latest oil cut is meaningful as it will affect exports.

Morgan Stanley cut its fourth-quarter forecast for Brent to $70 a barrel from $75 in a note published after the latest curbs were made public.

“We still model stock draws in 3Q but expect oil price softness to continue as the market’s focus shifts to 1H24 when balances look in surplus,” analysts including Martijn Rats and Charlotte Firkins wrote.

Crude has slumped this year amid China’s stuttering economic recovery and after central banks in the US and Europe raised rates to quell inflation, jeopardizing energy demand.

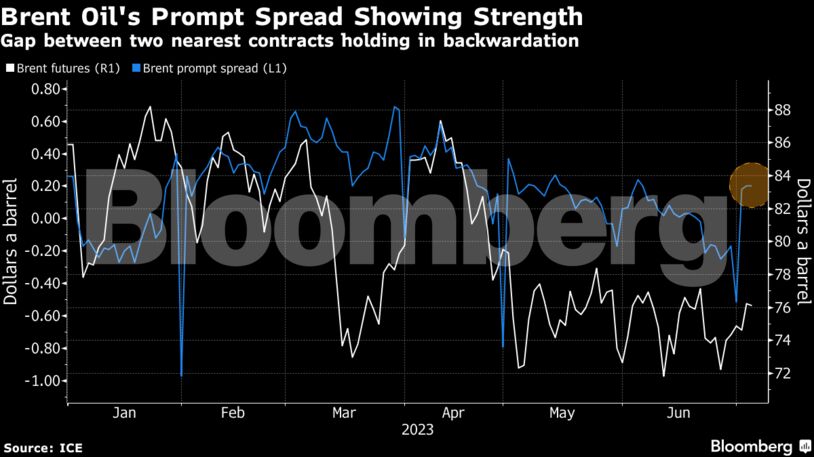

Still, key metrics are now strengthening. Brent’s prompt spread — the gap between the two nearest contracts — is back in a bullish, backwardated structure, a sign of a tightening market.

There have also been pockets of fundamental strength in recent days. Kazakhstan’s CPC crude has faced disruption as a result of power outages in the country. Separately, one refiner in Germany is limiting diesel supplies, a sign of regional supply tightness.

Share This:

Next Article