Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

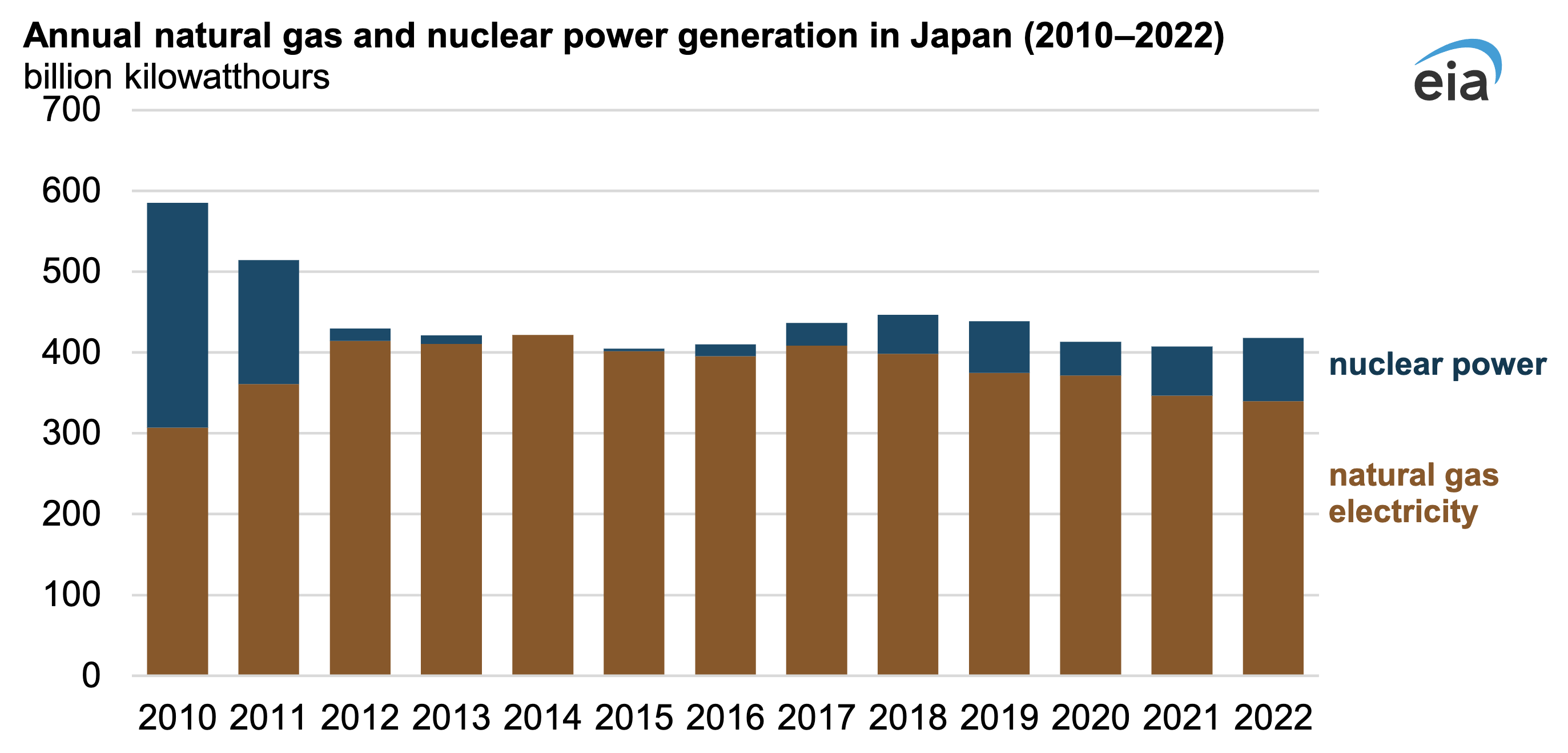

After the 2011 Fukushima Daiichi accident, Japan suspended operations at all of its remaining 48 nuclear power reactors by 2013 and relied almost exclusively on imported natural gas to replace the lost electricity generation. In 2015, Japan allowed its first nuclear power reactor to resume operations. As of December 2022, 11 gigawatts (GW) of Japan’s nuclear capacity have returned to service, which reduced liquefied natural gas (LNG) imports for electricity generation.

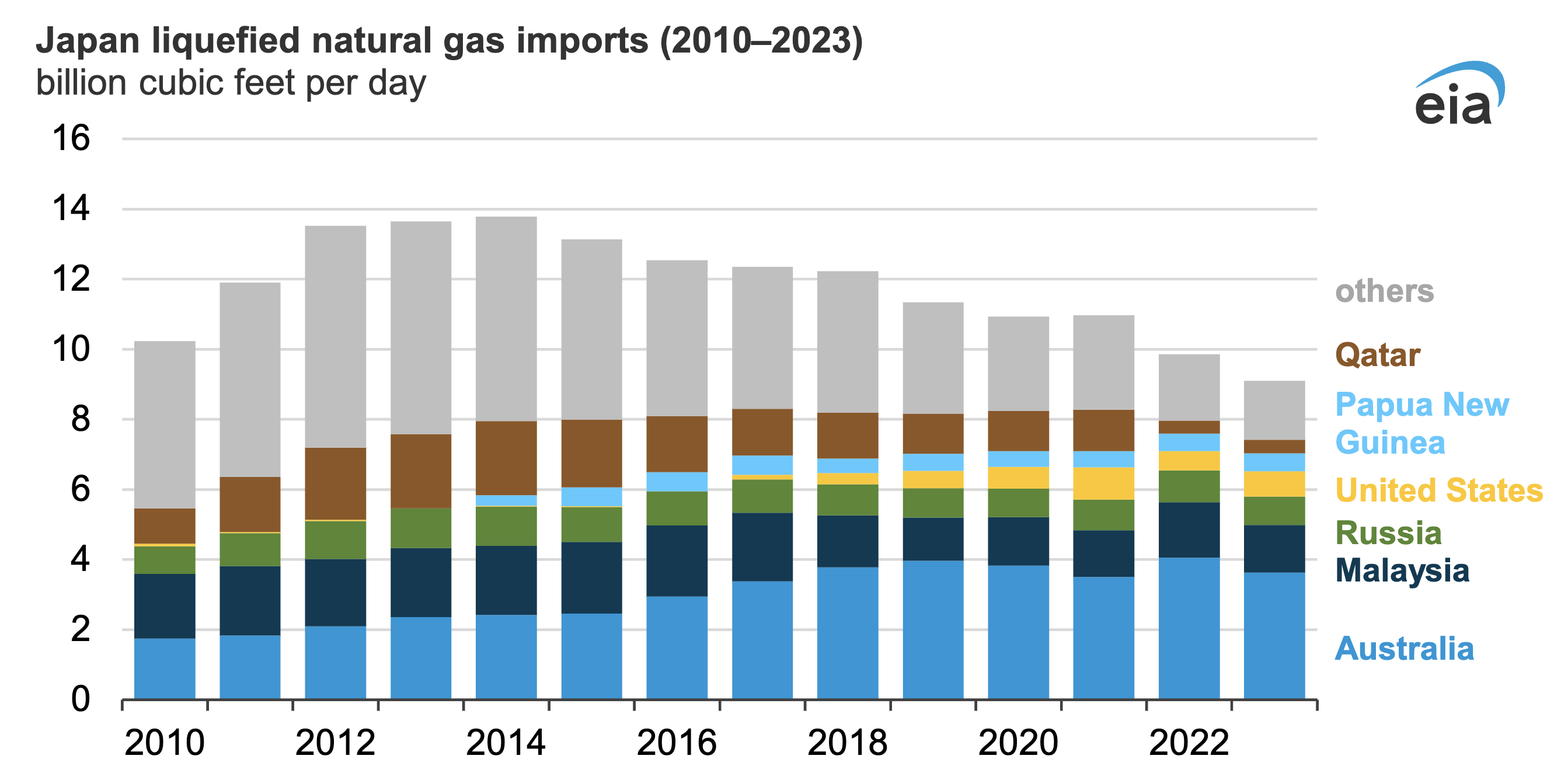

Since 2015, increasing nuclear generation has been replacing generation from fossil fuel sources in Japan, mainly natural gas. In 2022, Japan’s LNG imports declined by 15%, or 1.7 billion cubic feet per day (Bcf/d), compared with 2015, and we expect LNG imports into Japan to continue declining. In 2023, Japan restarted Takahama Units 1 and 2, adding about 1.6 GW. Japan also passed the GX Decarbonization Power Supply Bill last year to establish a decarbonized electricity system, designating nuclear power as the main component of the country’s baseload electricity.

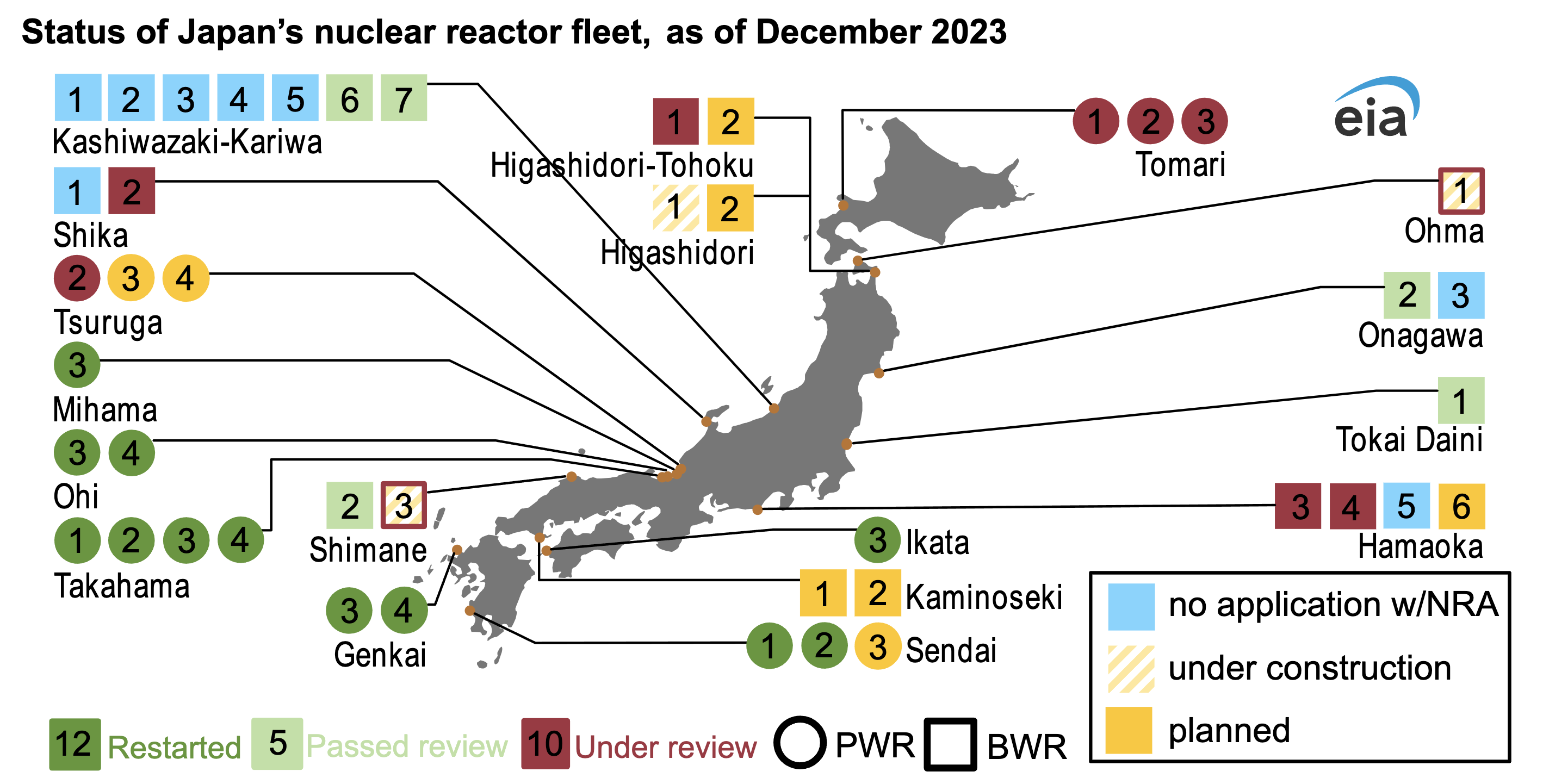

Nuclear restarts have been slow since 2015. Japan has restarted 12 units, bringing currently operating nuclear capacity to 11 GW. Japan has 10 more units under review and 5 more that have passed review but have yet to restart.

Japan focused on restarting pressurized boiling water reactors as opposed to boiling water reactors out of public safety concerns. The six-unit Fukushima Daiichi plant, a boiling water reactor facility, is being decommissioned along with its sister plant, Fukushima Daini.

Energy resources are scarce in Japan, and it imports most of the fossil fuel it uses for electricity generation. In 2022, fossil fuels accounted for 71% of generation, with natural gas accounting for 35% of that share. Japan’s LNG imports have declined as more nuclear reactors have restarted. After Japan restarted five nuclear reactors in 2018, Japan’s LNG imports declined by 7% (0.7 Bcf/d) in 2019 and by another 7% (0.7 Bcf/d) between 2019 and 2022.

Japan has a large portfolio of long-term LNG contracts, which supply up to 90% of Japan’s LNG imports each year. The remaining share of imports is supplied under short-term and spot contracts from as many as 20 countries (including re-exporters).

Australia has been Japan’s largest LNG supplier for 11 years; its share of Japan’s total LNG imports more than doubled from 18% in 2012 to 42% in 2023. Qatar—which was ranked second in 2012—is now the seventh-largest LNG supplier to Japan. Qatar provided 4% of Japan’s LNG imports last year, down from 18% in 2012, in part because some of Japan’s long-term contracts with Qatar expired. In 2023, Malaysia was Japan’s second-largest LNG supplier, accounting for 16% (1.4 Bcf/d) of LNG imports. However, in 2012, before Australia took its long-standing top spot, Malaysia supplied 19% of Japan’s LNG imports and was the largest supplier. Other significant LNG suppliers in 2023 included Russia at 9% (0.8 Bcf/d), the United States at 8% (0.7 Bcf/d), and Papua New Guinea at 6% (0.5 Bcf/d).

You can find more information about Japan on EIA’s International web page.

Principal contributors: Slade Johnson, Jonathan Russo, Victoria Zaretskaya

Data visualization: Jonathan Russo

Courtesy of U.S. EIA.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.