Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

What is it about hydrogen for trucking that leads researchers to deeply low-ball costs at every opportunity? I’ve tried to answer this question several times. In Germany, gruppendenken — groupthink — is clearly involved. With organizations like the ICCT, it appears a desperate attempt to make hydrogen work because they think it’s necessary leads to error after error. Different issues plague other hydrogen for energy reports where major consultancies like DNV produce bad reports for clients who are paying them to get specific results, regardless of reality.

I’ve tended to expect better of the US national laboratories, which have mostly been solid researchers and analysts. But in recent months, I’m finding myself scratching my head at some of the results. A few weeks ago I looked through a DOE NREL report on the hydrogen refueling stations in California. The data there was clear.

The refueling stations were barely being used even at their highest historical volumes, averaging 54 kilograms a day per station during the first half of 2021. The report didn’t mention that very low usage, but instead celebrated a 300 kilograms a day peak usage.

The stations were out of service for 2,000 more hours than they were actually pumping hydrogen, 20% more downtime than productive utilization. But you had dig through the data and do some math to figure that out.

If the stations were operating at full capacity, they would likely have been costing 30% of capital expenditure to maintain per year. Maintenance costs were over $9 per kilogram dispensed. Once again, the data was there, but the conclusion was missing in action.

The report was a masterpiece of misleading the people it was presented to into thinking that things were rosy in hydrogen refueling stations in California. The reality is evidenced by Shell leaving money on the table, refusing $48 million to build more of them and shutting down its seven existing light-vehicle refueling stations.

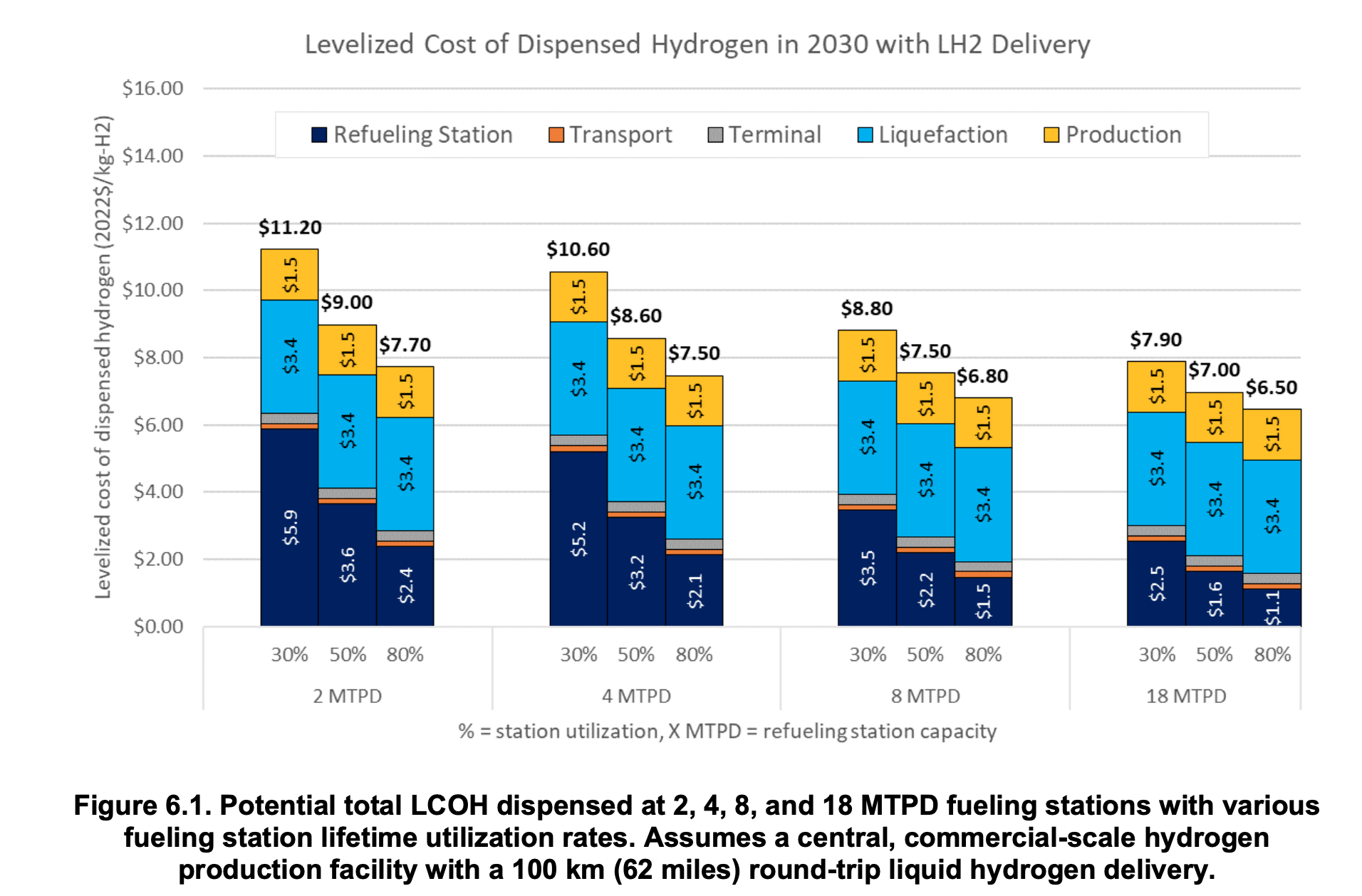

And now a new report from the USA’s National Renewable Energy Lab (NREL), a division of the Department of Energy, one with remarkable assumptions. Levelized Cost of Dispensed Hydrogen for Heavy-Duty Vehicles is hot off the presses in March of 2024. It presents a rosy picture of inexpensive hydrogen costs.

That’s a comforting diagram, isn’t it? As soon as hydrogen trucking is scaled, then refueling will cost only $6.5 per kilogram. That’s only a bit above diesel at its current California rate that’s hovering around $5 per gallon, an equivalent amount of energy. And given that fuel cells are more efficient than diesel engines, that actually means hydrogen is going to be cheaper as a trucking fuel than diesel!

But wait, there’s more.

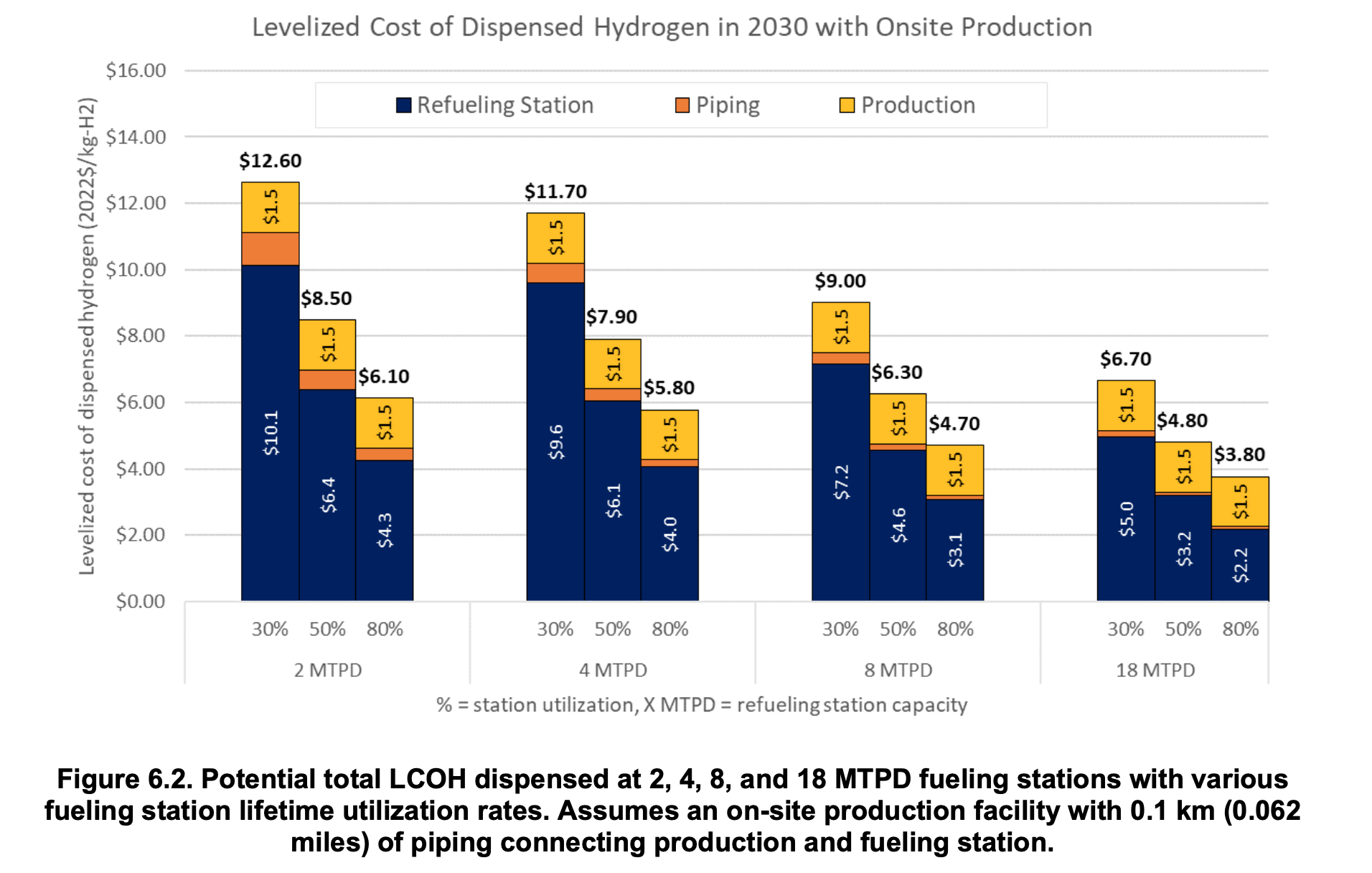

Yes, per this NREL study, hydrogen will be cheaper than diesel for the same energy. Well, problem solved, let’s all go home. Trucking is sorted.

Yeah, not so fast. Take a look at the top of each of those bars, the bit with $1.5 in it. What’s that?

“… the current analysis assumes that the cost of producing hydrogen that is later delivered to the modeled 2030 fueling stations is $1.50/kg-H2”

That’s the current cost of manufacturing gray hydrogen per kilogram in the USA from cheap natural gas at industrial-scale facilities. A US governmental study in 2024 had the opportunity to put in an appropriate cost of manufacturing low-carbon hydrogen and bailed. As a reminder, the average for green hydrogen deals in Europe from 2024 was €9.49 per kilogram or $10.30. No one is thinking that actually low-carbon hydrogen is going to cost $1.50 per kilogram in 2024, yet it’s in an official NREL report and is artificially deflating the price point.

As Boston Consulting Group reported, green hydrogen in 2030 is not even going to get down to the prior consensus figure — a consensus among STEM and economic illiterate hopium addicts — of €3, but would be in the range of €5-€8. The bottom end of that range is still very optimistic. My projection, after cost workups for manufacturing hydrogen on three continents with multiple scenarios, is that green hydrogen will average $6-$8 per kilogram, with some outliers that will be both lower and higher.

But it’s an even worse assumption for making hydrogen at stations. That’s something that the ICCT did in its fatally flawed study, but even the ICCT didn’t get things so wrong as to use a cost point of $1.5 per kilogram.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

The full cost of manufacturing hydrogen in smaller quantities will be much higher than the cost of manufacturing it in industrial-scale facilities for three reasons. First, the refueling station will still need all of the balance of plant, but it will be tiny components, not scaled, cheap for the volume components. Hooking them all together requires all of the electricians, plumbers, chemical engineers, welders, and the like, but they’ll be tiny connections and welds.

The second reason is that stations will be paying somewhere on the order of industrial rates for electricity. The US average is $0.11 per kWh at present and with balance of plant it takes about 55 kWh to manufacture a single kilogram of hydrogen from water. Just the electricity will cost $5,50, $4 above the cost point the NREL study uses. And California’s industrial rates averaged $0.17 over 2022. That’s $9.35 just for the electricity for onsite manufacturing.

Third, an industrial facility has rigorous preventative maintenance and onsite staff to address issues immediately to maintain production. Hydrogen refueling stations won’t have that because the cost of maintaining high-cost labor on them will be prohibitive. They’ll be either out of service a lot more of the time or will be paying for repair staff to be twiddling their thumbs and having high-cost components standing by on site.

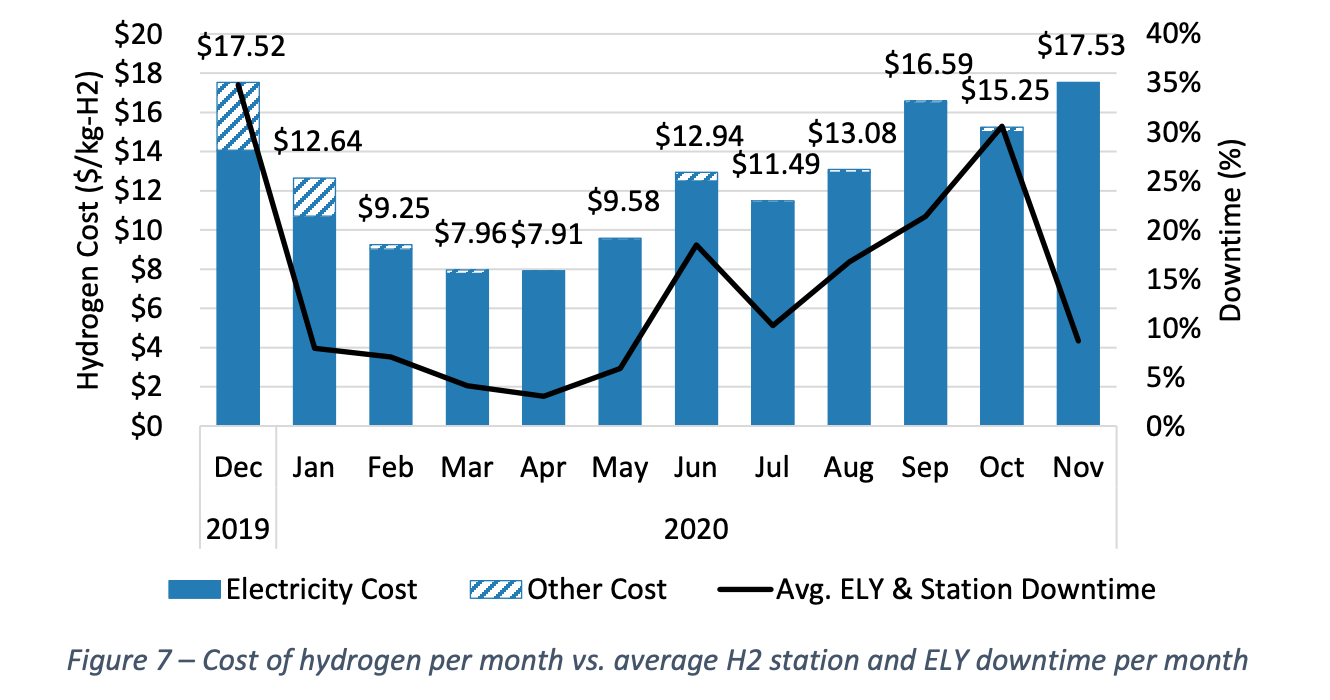

Could NREL have looked at real data and made a better choice about cost point for onsite manufacturing of hydrogen? Yes, they could have looked at the California hydrogen bus data.

That’s an average of $12.60 just for electricity and some minor bits and bobs. It clearly does not include the cost of maintaining the refueling facility, which was out of service due to electrolyzer and balance of plant problems a full 14% of the year. As noted for light vehicle refueling stations, the average cost of maintenance worked out to be above $9 per kilogram.

Also as noted, maintenance costs for pumping hydrogen, or anything really, scale linearly. Compressors, pumps, and seals give out more rapidly with more use. As the heavy vehicle pumping facility data above shows, it’s not restricted to light vehicles at all. 700 atmospheres of pressure in tanks has to exceed 800 atmospheres of compression in order to fill vehicle tanks. That’s a pressure which is the equivalent of being more than five miles under the surface of the ocean. It’s non-trivial to build something with the tolerances to achieve that and compressors at that level fail much more often than compressors for refrigerators.

And no, shifting to liquid hydrogen won’t save money. It just has different large and unavoidable expenses, not least of which that it requires a third of the embodied energy in the form of electricity to run very sophisticated cryogenic equipment to get it down to 20° above absolute zero. Trading one set of costs and engineering compromises for a different set will not result in cheap hydrogen.

This cost of electricity doesn’t have any of the capital costs of the electrolyzer, the cost of capital, the maintenance costs, or any profits. The real cost of hydrogen is undoubtedly over $20 per kilogram. While it’s for an order of magnitude less dispensing of hydrogen per day than the lowest bound of the new NREL study, the costs of electricity are still going to be high.

The NREL study at least adds capital costs to the cost per kilogram, as far as I can tell. The diagrams of LCOH make it clear that for the on-site production scenarios they’ve added $1.1 to $4 to the cost of a kilogram of hydrogen from the cost of the station, but nowhere in the report do they specify what goes into that cost. There is no clarity about electrolyzers, balance of plant, or anything else for the production side.

Presumably this was to allow someone to put a steam reformation plant at a hydrogen refueling station in some deeply backward solution, permitting the technology agnosticism that the report is aiming for around hydrogen manufacturing. Does this stand up to the slightest scrutiny? No.

The cost of natural gas for industrial customers in California is currently $12.52. Hydrogen is a quarter of the mass of methane, which is typically 92% of the mass of natural gas. Other efficiency challenges make a ratio of a kilogram of hydrogen for every five kilograms of natural gas about right. At that rate, just the natural gas input to steam reformation would cost $2.61, over a dollar more than the cost of hydrogen manufacturing assumed in the report. And that’s for gray hydrogen.

Given the small scale of the facility and the need to bolt on carbon capture and do something with the carbon dioxide afterward, the costs are likely triple that.

The $1.50 cost point of hydrogen in the report is only defensible if the assumption is gray hydrogen manufactured in industrial facilities in places where natural gas is cheaper than in California, something that is exactly opposite to the point of decarbonizing trucking with hydrogen. The assumption in the report is that hydrogen is manufactured within 62 miles of refueling stations, so it’s going to be paying local industrial rates for natural gas if that’s the plan.

This report also frames the question as hydrogen vs hydrogen, as opposed to as hydrogen vs electrification. That’s the brief that the team had, and it’s the same brief that one of the researchers had in 2020 when they published Hydrogen Delivery and Dispensing Cost, The top end of that study was half of hydrogen volume as the bottom end of this study, and the results are about the same as the lowest volume scenario, but fully excluded hydrogen manufacturing costs.

In other words, a study from the same organization from four years ago found that just delivering hydrogen was as expensive as the full stack in this cost workup. Maybe they didn’t use the same models? Nope. The model is the same, just a different version, the Hydrogen Delivery Scenario Analysis Model (HDSAM), 3.1 vs 4.5.

Despite four more years of evidence that delivering and dispensing hydrogen is more expensive than estimated and a lot of evidence that making hydrogen costs a lot more than $1.50, this new NREL report actually has end-to-end manufacturing, delivery, and dispensing costs go down.

It’s like validating against the empirical reality of hydrogen for energy or even acknowledging it is not a requirement in the NREL anymore. It’s like the decades of experience with multiple levels of hydrogen refueling stations and delivery of hydrogen is going to be overturned by 2030. That’s disturbing.

Of course, no one in the value chain in the scenarios in this report is making a profit, or even applying a markup to cover their costs. The report clearly states this, but as everyone is going to be looking at the primary graphics, comparing the costs to the retail cost of diesel and breathing big sighs of relief, that’s just not a great choice either.

But they also explicitly exclude all of the possible cost reducing subsidies available for low-carbon fuels:

- Alternative Fuel Vehicle Refueling Property Credit (30C) for qualified alternative fuel vehicle fueling property

- Credit for Production of Clean Hydrogen (45V)

- Qualified Advanced Energy Project Credit (48C)

- Credit for qualified commercial clean vehicles (45W)

Is that relevant? In reality no, but in perception yes. The centralized industrial hydrogen electrolysis manufacturing facility at least has the potential for power purchase agreements that meet 45V requirements for locality, temporality, and additionality of low-carbon generation of electricity. That might get the cost per kilogram down into the $2-$3 range after the subsidy. As noted in my assessment of the ICCT’s flawed report, local refueling stations won’t be able to achieve this. And blue hydrogen will not qualify for 45V and would only get much lower carbon capture credits.

In other words, any remotely decarbonized hydrogen at refueling stations, regardless of pathway, taking off subsidies and adding reasonable assumptions about markups for costs and profits leads to vastly higher than $1.50 hydrogen. It’s just not defensible as a choice in 2024, even for centralized facilities. At small facilities at refueling stations it’s doubly indefensible.

Yet this report and especially its charts are going leave a lot of people with the false impression that hydrogen at refueling stations will be dirt cheap. If they notice the $1.50 at all and are disturbed it, they’ll see all of the rebates and think that they’ll be applicable and things will be fine.

A clear takeaway is that NREL should be reassessing its HDSAM model. It is producing results that aren’t aligned with empirical reality, and the researchers appear to be unwilling or unable to put up their hands and say so. Model reverence is something I pointed out in my assessment of the PIK Potsdam Institute for Climate Impact Research related to its LIME-EU and REMIND models, both of which have very low cost hydrogen costs embedded in them, something researchers in one major report clearly missed. The NREL researchers should be reading Thompson’s Escape from Model Land and have the courage to apply professional judgment.

The NREL report does the discussion around the actual cost of hydrogen for trucking compared to alternatives a significant disservice. Like many other reports, it is artificially low-balling the costs of hydrogen. Why? It’s hard to say. Perhaps because the reality of the costs is clearly not remotely economically viable and they really don’t want to be the ones to stand up and be counted.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

CleanTechnica uses affiliate links. See our policy here.