Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Plugin Vehicles Grew to a Record 1.84 Million Units in November!

Global plugin vehicle registrations were up 32% in November 2024 compared to November 2023. There were 1.84 million registrations, which is a new record month, the 3rd in a row. BEVs were up by 22% YoY (year over year), to a record 1.2 million units. Plugin hybrids did even better, jumping 55% YoY, its 6th record month in a row!

In the end, plugins represented 28% share of the overall auto market in November (18% BEV share alone).

Year to date, plugin electric vehicle market share was up to 21% (14% BEV), or 15.3 million units (of which 9.6 million were BEVs). Add in the 14% market share of plugless hybrids, and over one third of all car sales in the world have some kind of electrification!

Full electric vehicles (BEVs) represented 64% of plugin registrations in November, slightly above the year-to-date average (63%).

Taking a closer look, if we remove China from the November tally, plugin sales were up a more moderate 7% YoY, but instead of PHEVs pulling the numbers up, it’s pure electrics doing so. BEVs grew by 9% YoY outside of China, while plugin hybrids grew by just 2%.

So, when people say that “EV sales are falling” and “People don’t want EVs,” they are pushing a deceiving narrative, BUT …

It is true that, if we remove the Chinese market, and Chinese EV makers in general, from the picture, numbers are much more sluggish, especially on the PHEV side. So, maybe the reality is closer to this: while China is gaining scale in the EV game, the others are stalling. Most of the conquest/growth sales are going to Chinese EV makers, leaving legacy OEMs and Tesla behind.

Proof of this trend is the increasing share of EV sales happening in China. In November, that market represented over 70% of global sales, no wonder then that the 2024 top 20 is basically the same as China’s — with the addition of the VW ID.3 and ID.4, and the two mainstream Teslas being higher up in the ranking.

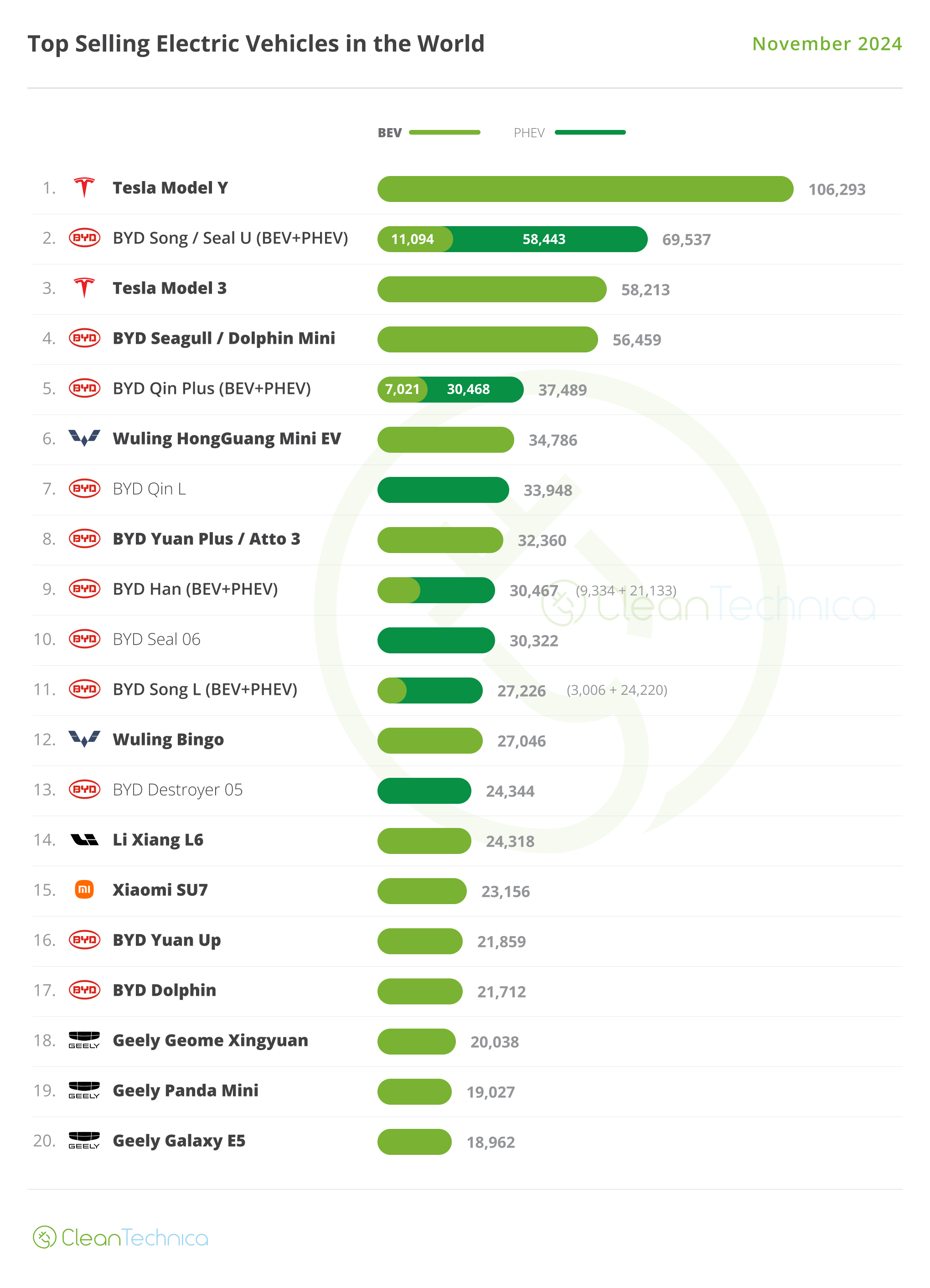

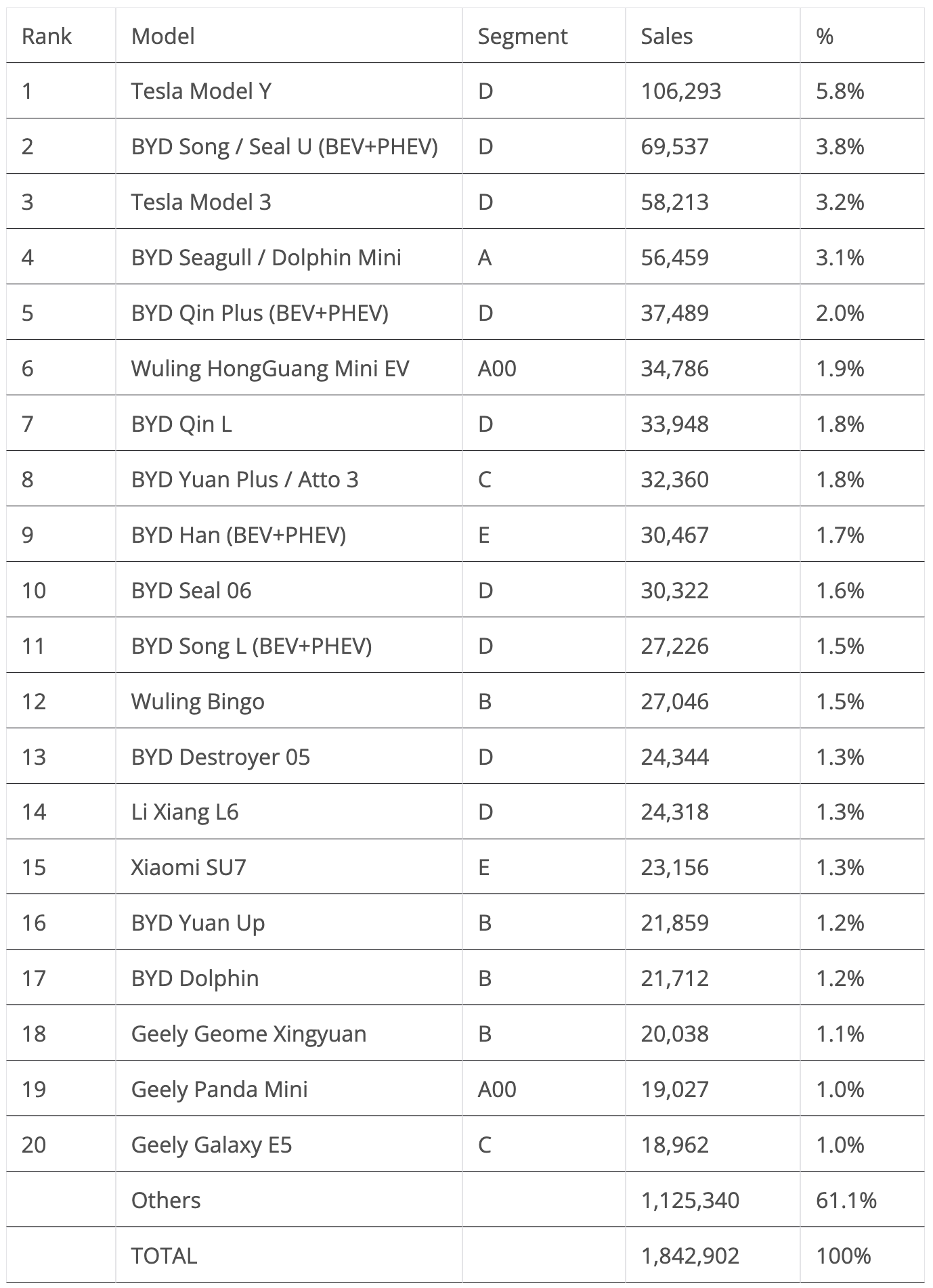

Back to November’s best sellers, the Tesla Model Y was in the lead (as usual), with some 106,000 registrations, which represented a 6% drop YoY. On the other hand, the Tesla Model 3 ended November only in 3rd, with some 58,000 registrations, up 5% YoY.

So, the waiting-for-a-refresh Model Y is down, while the Model 3 is still benefitting from the end-of-2024 refresh. Nothing to see here.

As for BYD, the Shenzhen make placed 11 representatives in the top 20! BYD’s 2024 push is indeed paying dividends.

The best selling non-Tesla and non-BYD was the tiny Wuling Mini EV, which surged to 6th with 35,000 registrations, its best result since 2022.

Elsewhere, a key highlight was the #15 Xiaomi SU7, with a record 23,156 units. Its ramp-up still continues, and Xiaomi’s 2025 sales target of 300,000 units seems not only doable, but actually conservative, especially considering the sales potential of its upcoming YU7 crossover….

Interestingly, while most of the media attention is focused on BYD and Tesla, there is an automaker rising at the bottom of the table — Geely. The Chinese automaker placed three models in the top 20, a first, and thus becoming the brand with most models in the top 20 aside from the all-mighty BYD.

The recently introduced Geely Geome Xingyuan, a BYD Dolphin/Wuling Bingo fighter, just hit 20,038 units, in only its second month on the market. So, expect the B-segment/subcompact class to have another contender in 2025. Going up one size, the also recently introduced Geely Galaxy E5 ended the month at #20, with a record 18,962 sales. With export units of the crossover starting to be delivered in 2025, expect Geely’s EV to continue growing throughout the year, which could be bad news for the current C-segment/compact king, the BYD Yuan Plus/Atto 3.

Finally, in the city car category, Geely’s representative, the cutesy Panda Mini, is also on a record streak, ending November in 19th place, with 19,027 sales. While the BYD Seagull/Dolphin Mini and Wuling Mini EV seem untouchable, if the little EV secures the category’s 3rd spot next year, that is another step in Geely’s quest to reach BYD’s sales numbers.

Off the table, and speaking of Geely’s Mothership Group, there was another model shining, with its premium wing Zeekr delivering a near-record 11,112 units of its 7X midsize SUV, a sizable number for a model still in its 4th month on the market. Will it also reach the table?

Regarding other Chinese OEMs, FAW’s tiny Bestune Xiaoma is ramping up, having reached 13,890 registrations in November, while Changan’s premium brand, Deepal, saw its midzise crossover S7 reach over 12,000 sales in its second record month in a row. On the startup side, the XPeng Mona M03 is also ramping up, scoring 11,960 registrations in its third month on the market.

But the highlight of the month was the landing of the Luxeed R7. Pulling a common trick within Chinese EV makers — selling a Tesla Model X-sized crossover at the price of a Model Y — and with Huwaei’s input on the model’s development, this is probably the best Model Y fighter in the tech giant’s HIMA Alliance. Which means — this is Huawei going after the best selling EV in the world, and the similarly positioned Xiaomi YU7. No pressure, then. With over 11,000 units being delivered in its debut month (11,086, to be exact), one can say that it’s got off to a good start. A top 20 presence in 2025 is the minimum requirement for this crossover to be considered a success, but … how high will it go?

As for legacy OEMs, again, they didn’t have any representatives in the top 20. Their best selling EV was the VW ID.3, with 15,540 units delivered.

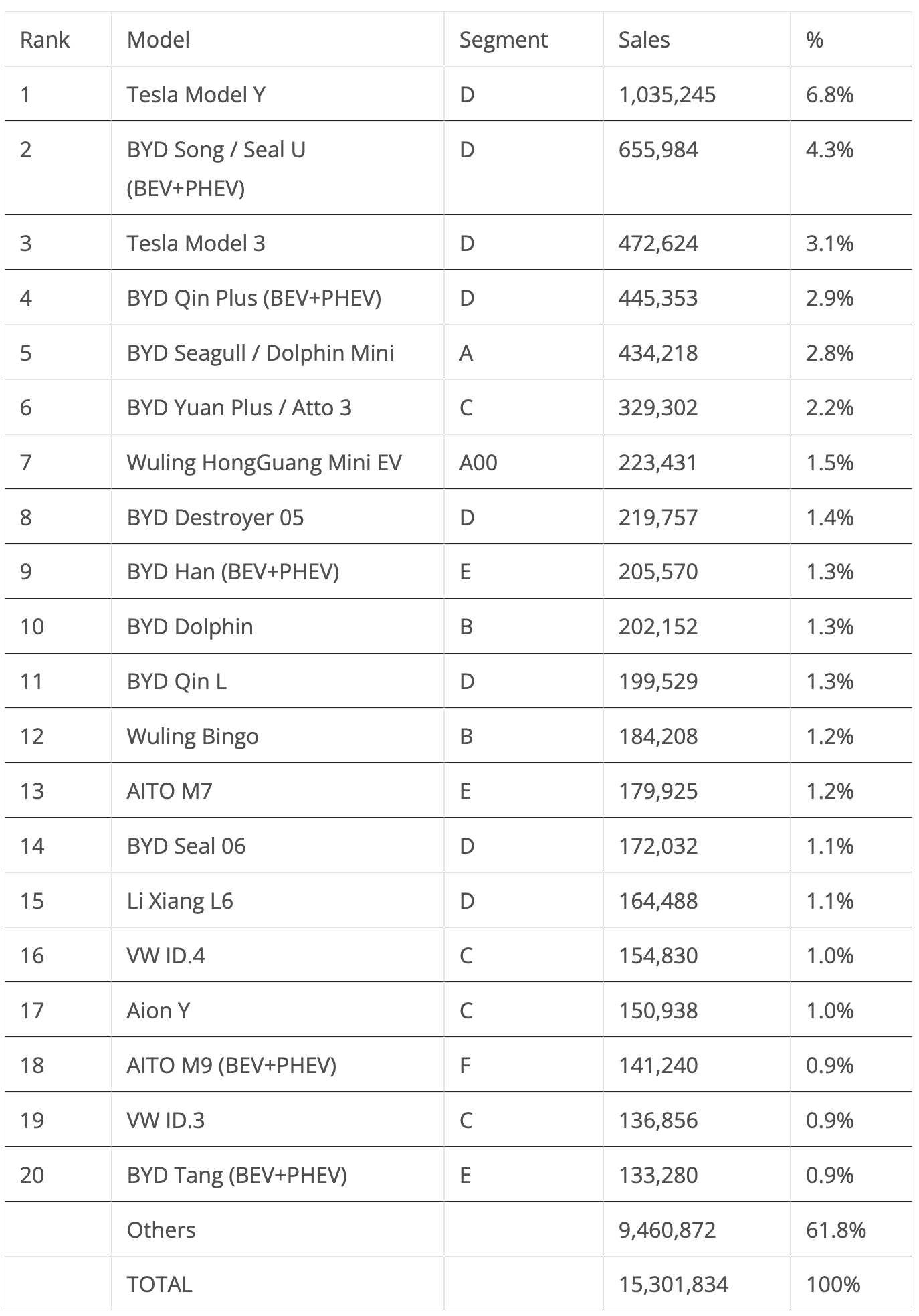

Top 20 EV Models YTD

In the year-to-date (YTD) table, the Tesla Model Y and BYD Song continue firmly in the top positions, while the #3 Tesla Model 3 has gained enough distance (27,000 units) over the aging #4 BYD Qin Plus to keep its 3rd spot, which will be its 3rd consecutive bronze medal and seventh straight year on the best sellers podium.

2025, though? It’s hard to say. Sales in 2024 are stagnant, and with the refreshed Model Y probably stealing some if its smaller sibling’s sales next year, BYD will have a battery of models aimed at taking the Tesla Model 3’s bronze medal (the name Seagull comes to mind). Maybe even the good ol’ Qin Plus, due for a refresh in 2025, could have a go at it.

Speaking of the Seagull, the small BYD EV’s sales are surging (+103% YoY). With only 11,000 units separating it from the #3 BYD Qin Plus, we could see the little Lambo jump into the 4th position in December. And while it is 38,000 units behind the #3 Tesla Model 3, making it impossible to reach this year, with the US sedan stuck at 500,000-something units per year and the Seagull expected to still grow in 2025 (it is said to land in Europe next summer), it is quite possible that BYD’s city EV will secure its first podium presence on the global stage next year.

The following positions seem all secure until 7th place, where the Wuling Mini EV surpassed the BYD Destroyer 05 in November.

But not all is bad news for BYD. The Han flagship sedan was up to #9 thanks to its recent refresh. The Qin L continues to climb positions in the table, now at #11. Expect it to end the year at #10, pushing the Dolphin sibling out of the top 10. All while the Tang SUV re-joined the table at #20.

Finally, another Wuling is on the rise. The Bingo hatchback climbed one position in November, to #12. With its sales growing 31% in 2024, will the B-segment/subcompact EV continue growing in 2025? I mean, it would help if Wuling invested more in export markets….

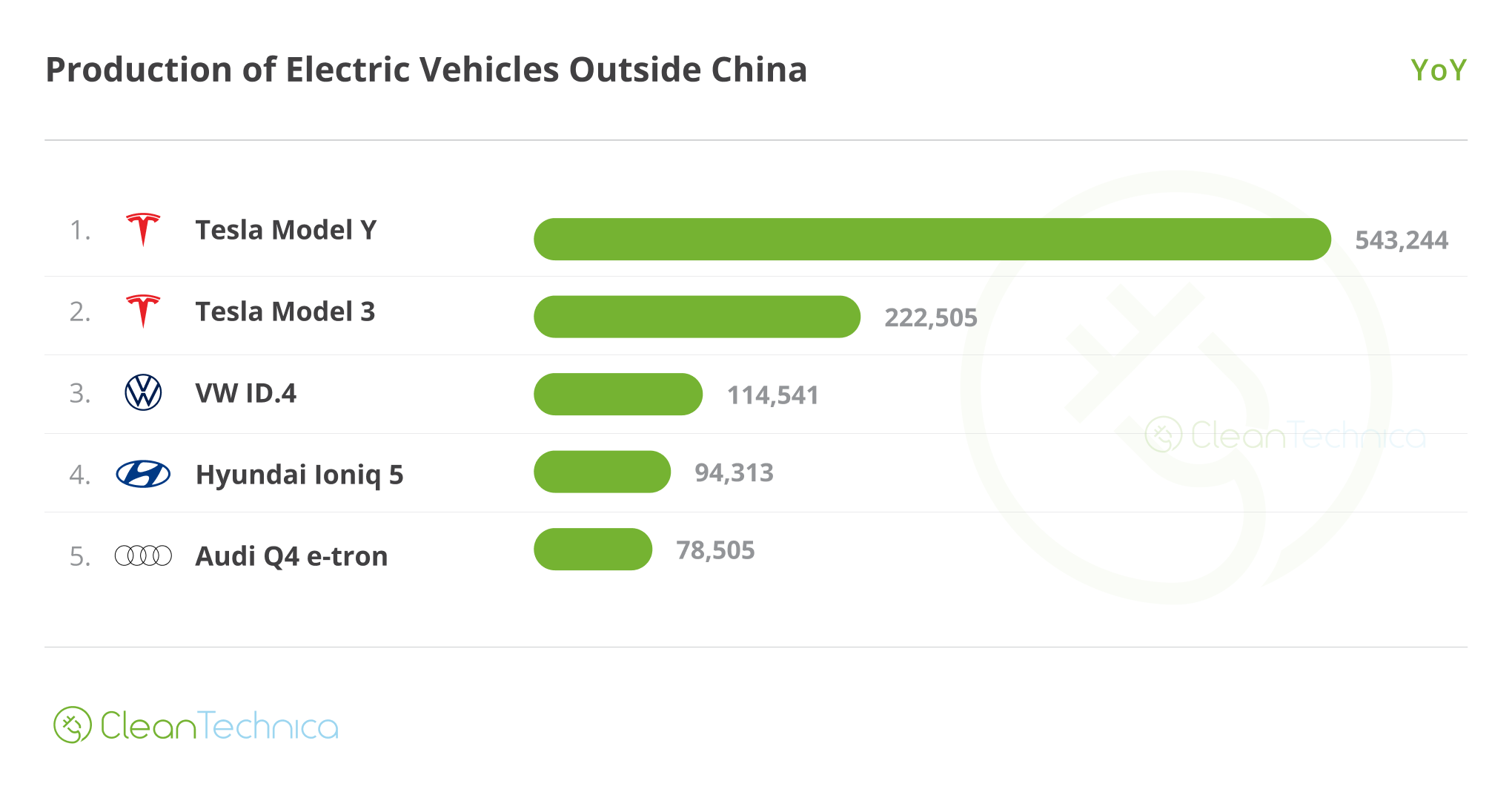

The EV World without China

How about taking out China’s EV production from the table? What would remain?

Here is the answer:

As we can see, and as expected, Teslas would still be on top, albeit with much less volume (48% of the Model Y and 53% of Model 3 production are in Shanghai), while the VW ID.4 would repeat its title as the best selling legacy model (losing only 26% of its volume). They would be followed by the #4 Hyundai IONIQ 5 (+1% YoY) and #5 Audi Q4 e-tron (+6% YoY).

And while the sales trend for the Model Y does not change much (-4% YoY without China vs. -5% globally), the Model 3 does, (0% globally vs -24% without China production). This is explained by the fact that US-made Model 3’s are basically for the Americas, and with the USA increasingly shunning sedans, expect its production output to continue sliding in the foreseeable future.

As for the #3 VW ID.4, there is a slight difference in the sales trend (-24% without China vs -28% globally), which means that the crossover’s downfall in China is even more noticeable there. This is bad news for Volkswagen if it has any hope of remaining relevant in that market….

That’s it for the top selling electric vehicle models globally, but stay tuned for our report on the top selling auto brands and auto groups.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy