Nickel prices remained within a strong downtrend throughout November, hitting their lowest level since April 2021. While prices appeared to stabilize during the first half of December, the nickel market has overwhelmingly proven itself the worst-performing base metal with a roughly 45% year-to-date drop.

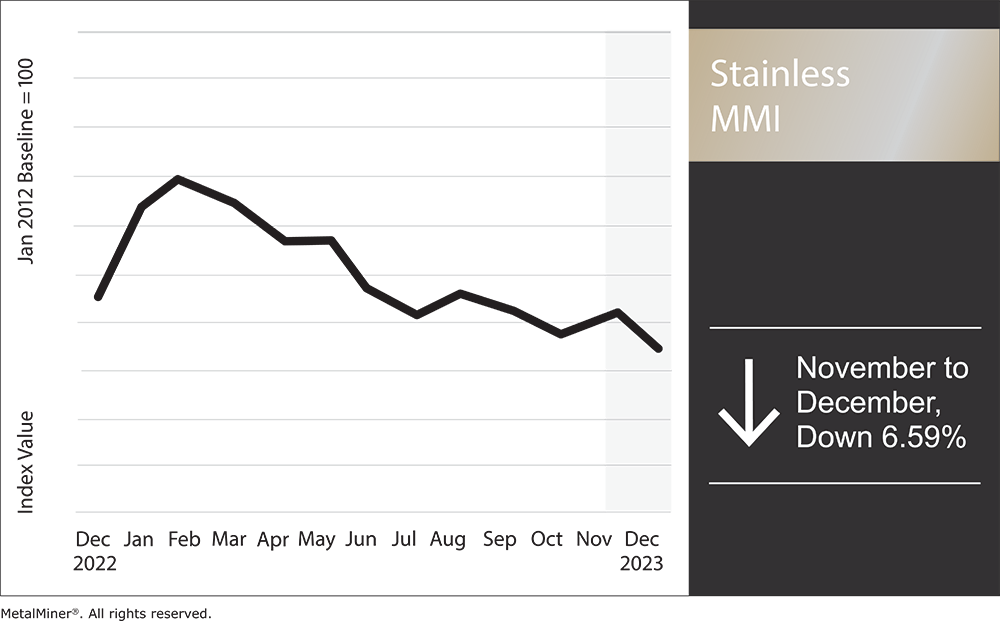

Overall, the Stainless Monthly Metals Index (MMI) remained bearish, with a 6.59% decline from November to December.

Crush the competition by getting access to weekly exclusive nickel and stainless market intel. Opt into MetalMiner’s free weekly newsletter.

Stainless Market Sees Increased Quotation Activity, But No Additional Buying

2023 will wrap up with little change to the stainless market. One distributor noted an increase in quotation activity compared to Q3, but no meaningful uptick in sales. Another source labeled the current state of the market as “grim.”

Inventories throughout the supply chain remained largely unchanged throughout Q4, as they continue to hold at historically normal levels. While under normal conditions those levels would not inhibit buying activity, the bearish market has led to little interest in forward purchasing amid the ongoing devaluation of inventories.

Q1 nearly always experiences an uptick in sales activity, however, it remains to be seen to what extent demand will materialize come the turn of the year. Interest rates, while paused, remain at 22-year highs. This will continue to pressure consumer demand. However, some sectors have remained more resilient than others. Notably, distributors noted steady demand from the aerospace industry, while the food service equipment sector, the primary end use for 304, remains in a slump.

We know what you should be paying for metals — MetalMiner should-cost models are the ultimate savings hack by showing you the “should-cost” price for gauge, width, polish and finish adders. Explore what value they can add for your organization.

Falling Surcharge Outweighs Mill Production Cuts

The current state of the domestic stainless steel market comes in sharp contrast to flat rolled steel prices, which appear decidedly bullish. Both markets experienced considerable output cuts. For stainless steel, melt shop production cuts continued throughout the year, while within the flat rolled market, they occurred more recently toward the end of Q3.

Both domestic markets also boast consolidation among producers. While the latest acquisition of U.S. Steel by Japan’s Nippon avoided a further contraction of domestic suppliers, the consolidation of mills in recent years has allowed those companies to secure greater control over price direction. Meanwhile, within the stainless steel market, North American Stainless (NAS) and Outokumpu represent an effective duopoly in the U.S., pressured only by imports.

Despite these similarities, the use of a surcharge as part of pricing limited the ability of NAS and Outokumpu to control the overall market. Falling prices among raw materials proved enough to limit buying activity and prevent long purchases. This would have tightened supply enough to see base prices climb and mill lead times lengthen.

Consistently bearish nickel prices, which fell over 8% throughout November alone, added a strong drag to the surcharge. While mills managed to keep base prices flat for two years and counting, NAS’ 304 surcharge dropped nearly 22% throughout 2023. While nickel remains the most influential component, the December 304 surcharge was also dragged lower by an almost 16% drop in molybdenum prices and a nearly 7% drop in titanium prices.

MetalMiner’s Annual Metals Outlook, a comprehensive 12-month forecasting report for nickel and 6 other metal industries, just released it’s December update this month. View a sample copy here.

Expanding Surplus to Weigh on Nickel Prices

While nickel prices started to move sideways throughout December, there appears little indication of a near-term bullish reversal. Output remains robust in Indonesia. In its October 2023 press release, the International Nickel Study Group forecasted a 223,000-ton nickel surplus for 2023, which it expects to expand to 239,000 tons in 2024.

By September, LME inventories began to turn around from historic lows, and toward the end of December, inventories hit their highest level since January. Falling prices and rising inventories could eventually translate to output cuts, but that has yet to occur in a meaningful way. Beyond that, end-use demand from industries like the EV sector also didn’t materialized as expected. This could boost the projected surplus even further.

Much could still change in 2024 which might shift the overall outlook. However, by mid-December, LME investors stood decidedly net short in their positions. Investment funds, whose large positions can translate to a strong influence on overall price direction, saw short positions topple over long positions by the largest margin among all base metals. Such steep bearish positioning among funds could translate to volatility within the market, should their outlook begin to shift. Currently, however, it appears the market sees little optimism of a reversal in nickel prices anytime soon.

Nickel markets change constantly, and so should price forecasting. Don’t rely on a single forecasting point, use data science to take market fluctuations into consideration. Learn more by reading Data Science: The Key to Cost-Savings.

Biggest Nickel and Stainless Steel Price Moves

- Korean 430 cold rolled coil prices moved sideways, with a 2.93% month-over-month rise to $1,860 per metric ton as of December 1.

- Chinese ferromolybdenum lump prices saw a modest 2.81% increase to $29,039 per metric ton.

- Meanwhile, the Allegheny Ludlum surcharge for 304/304L coil fell 9.0% a flat $1.00 per pound.

- LME primary three month nickel prices saw a 10.14% drop to $16,575 per metric ton.

- Finally, the Allegheny Ludlum surcharge for 316/316L coil saw the largest decline of the overall index, with a 16.45% fall to $1.48 per pound.