The nickel price remained within a strong downtrend throughout November, hitting its lowest point since April 2021. While prices appeared to stabilize during the first half of December, the nickel market has overwhelmingly proven itself the worst-performing base metal, with a roughly 45% year-to-date drop.

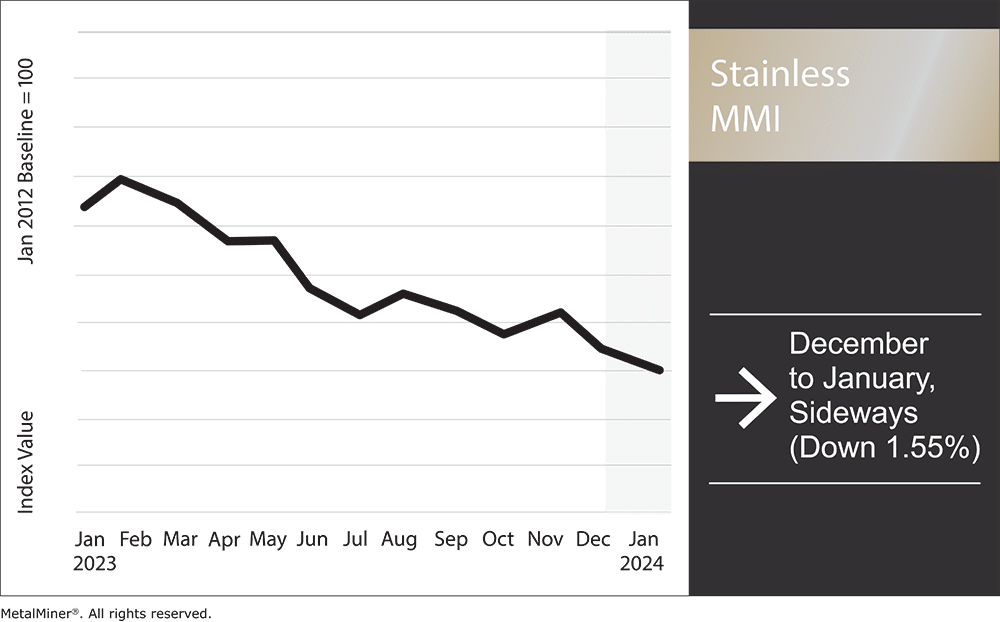

Overall, the Stainless Monthly Metals Index (MMI) moved sideways, falling 1.55% from December to January.

Nickel markets are constantly shifting. Get all of the latest nickel prices and market updates with MetalMiner’s weekly newsletter.

Stainless Market Closes 2023 on a Quiet Note

For the stainless steel market, 2023 went out like a lamb. Indeed, NAS’ 304 base prices remained unchanged for the 24th consecutive month, while declining raw material prices saw the surcharge drop to its lowest level since April 2021. One service center saw little change within the market month over month. Meanwhile, slow demand triggered processors to stop running lines while end-users continued to purchase in limited volumes with no effort to rebuild inventories. Ultimately, this translated to little change in average monthly mill lead times.

While December’s muted market conditions remained typical of seasonal patterns, it led to concerns over the seasonal pickup historically seen during Q1. One service center still expected an uptick in orders during early 2024, but indicated it would likely fall short of previous years. Meanwhile, bearish conditions in major market segments will surely challenge any producer’s efforts to increase base prices without a meaningful and sustained turnaround. That said, December’s flat nickel price will likely limit the downside for next month’s surcharge.

We know what you should pay for metals — MetalMiner should-cost models are the ultimate savings hacks, showing you the “should-cost” price for gauge, width, polish, and finish adders. Explore what value they can add to your organization.

Outokumpu Expects Q4 Volumes to Remain at the Low-End of Projections

Outokumpu released its pre-silent conference call on January 4 as the market awaits its quarterly reports. The company’s CFO noted that their Q4 projections had global delivery volumes rising between 0-10%. Meanwhile, early data for the quarter showed results will likely fall closer to “the lower boundary of this range.” The producer mirrored the sentiments of U.S. distributors, stating that the market showed little change from the previous quarter. Ultimately, buyers remain reluctant to make long purchases until there is evidence of a shift in market conditions.

In Europe, import volumes remained low, with CFO Pia Aaltonen-Forsell describing the overall market as “challenging.” She also said she expects recovery in the region to “take time.” Q3 was described as the bottom of the market in terms of both demand and prices, although order books appeared relatively short into February. In the Americas, analysts described market sentiment as “weakening,” with import levels helping to push down domestic prices. Unlike Europe, conditions appeared to worsen quarter-over-quarter, with no clear evidence of the market finding a bottom.

Do you have a buying strategy based on the nickel price trend? MetalMiner’s Monthly Buying Outlook Report provides monthly price forecasts and purchasing strategies for 10 different metal types. View a free sample copy.

Bearish Nickel Price Not Stopping Miners

Despite rising surplus projections and bearish prices, miners have yet to slow output. This is especially true in Canada, which continues to see new investments. For instance, Magna Mining, which owns multiple mine operations in Ontario, will continue plans for production and test mining at the Crean Hill mine in 2024. The company will also restart output at Shakespeare within two or three years.

According Vice President Paul Fowler, the company will leverage its higher-quality reserves and more environmentally-friendly operations to remain profitable under the current market conditions. However, Magna Mining is not alone in its desire to increase nickel capacity in Canada. Agnico Eagle recently announced a new venture with Canada Nickel, which is currently working to develop the Crawford nickel sulphide deposit.

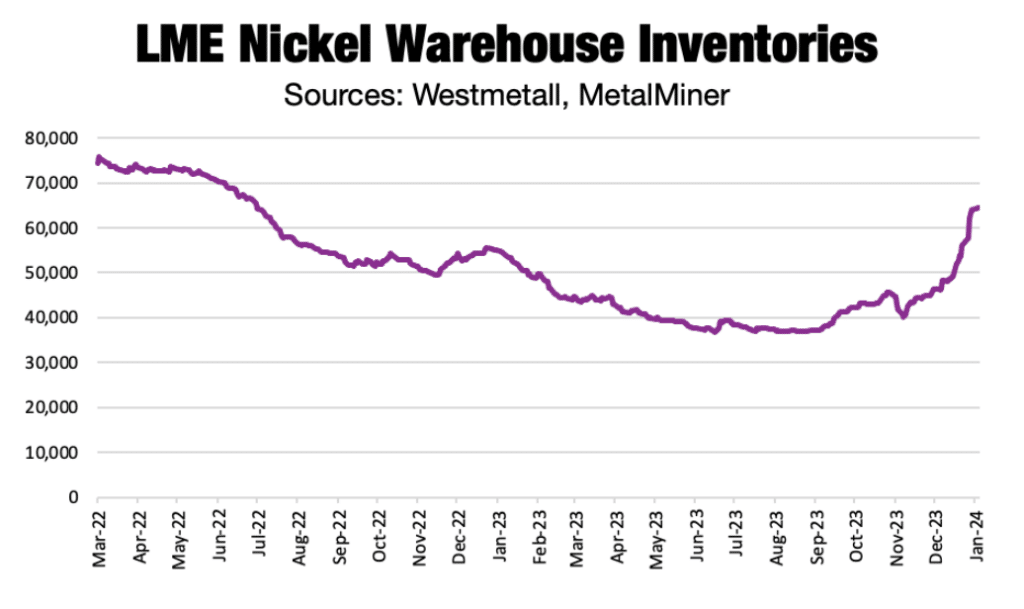

Meanwhile, Indonesia remains the nickel market heavyweight, with booming production levels expected to continue flooding the market. While this mainly benefits the Class 2 market, LME inventories have also shown a considerable rise since the end of August. Indeed, stocks recently rose from their lowest levels in more than a decade to their highest since July 2022

Political Tensions Threaten Indonesia’s Nickel Dominance

Much of Indonesia’s production remains Chinese-owned, a fact that is becoming increasingly more precarious amid rising political tensions between China and the West. Indonesia also utilizes coal to fuel its processing facilities, which contrasts with green efforts in the West.

With no signs of a meaningful slowdown in Indonesia and increased Western capacity, the nickel market surplus will likely remain a downside weight to the global nickel price. This will probably fuel the overall bearish sentiment within the stainless steel market, as the long-term downtrend in nickel prices continues to drag the overall surcharge.

Read next: 5 Mistakes Buyers Can Make When Sourcing Stainless Steel.

Biggest Stainless Steel and Nickel Price Moves

- Chinese ferromolybdenum lump prices saw the largest (albeit modest) increase of the overall index, with a 2.22% rise to $29,682 per metric ton as of January 1.

- Chinese ferrochrome lump prices also moved sideways with a 1.87% increase to $1,943 per metric ton.

- Meanwhile, Korean 304 cold rolled coil prices edged lower, with a 1.87% decline to $2,662 per metric ton.

- Chinese 316 stainless steel prices traded down with a 12.52% decline to $2,337 per metric ton.

- Chinese 304 stainless steel prices saw the largest decline, dropping 13.66% to $1,287 per metric ton.