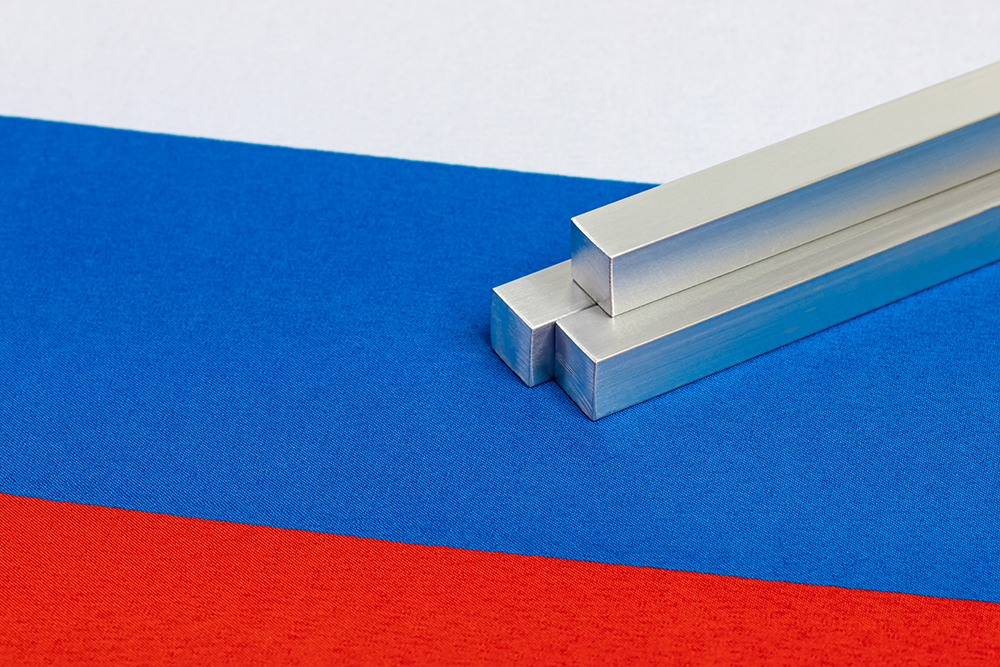

China will undoubtedly become an even more significant buyer of Russian metals following the London Metal Exchange’s ban on newly produced Russian aluminum, copper, and nickel. China has already evolved into a major market for Russian-made products following dwindling demand in the West, and these new Russian sanctions will likely only further cement that position. The LME ban leaves the Shanghai Futures Exchange as the only major bourse to accept shipments of these metals from Russia.

A recent report in the South China Morning Post said the move by the LME will force Russia to direct most of its exports away from the U.S. and UK jurisdictions, mainly in the direction of neighboring China. Incidentally, the latter is the world’s biggest refined copper and aluminum producer.

Meanwhile, China continues to emerge as a leading market player in the supply of nickel via its investments in Indonesia, the world’s largest producer of that metal. Currently, Russia represents around 6% of the world’s nickel production, 5% of aluminum, and about 4% of copper.From sourcing strategies to long-term price projections, MetalMiner’s Monthly Metals Outlook report covers it all. Grab a free sample report.

New Russian Sanctions & A Growing Relationship in the East

Old and new Russian sanctions due to its invasion of Ukraine continue to reshape China’s energy procurement patterns. Russia surpassed Saudi Arabia as China’s leading crude oil supplier last year and is now second in coal imports. The country is also poised to become Beijing’s primary natural gas provider this year.

Reacting to the LME ban, Russia’s biggest aluminum producer, Rusal, claimed the sanctions would not impact its ability to supply aluminum. In a statement, the aluminum major said its operations would remain largely unaffected as its logistic delivery solutions and access to banking, production, and quality systems will remain intact.

Rusal’s move late last year to acquire a 30% stake in Hebei Wenfeng New Materials, a Chinese raw materials supplier, also marked a significant shift in the global aluminum landscape. This strategic investment aims to secure alumina supplies for Rusal, following the loss of access to its Ukrainian refinery. It also helped secure the company’s share of off-take from the Queensland joint venture plant in Australia.

China’s 2024 Story So Far

In the first quarter of 2024, China’s aluminum production increased 6.8% compared to the previous period, with the country producing 10.69 MT. Meanwhile, official data released on Tuesday shows that China’s primary aluminum output in March rose 7.4% from last year. This was mainly due to rising prices spurred by higher demand, which boosted industry profits.

According to this report, even the production of ten nonferrous metals, including aluminum, copper, lead, zinc, and nickel, went up over 7% from a year earlier. Chinese government data indicates that the country produced 3.59 million metric tons of primary aluminum in March of this year.

Meanwhile, a SCMP report describes China’s desire to gain more influence over global commodity pricing due to its substantial dependence on imports. The dynamics surrounding this ambition for the Shanghai exchange are intricate, especially with the introduction of these new new LME regulations.

Experts are now trying to figure out how the new Russian sanctions will play out. This is especially important as the new rules permit the ongoing delivery of old Russian metal to both the LME, the world’s leading benchmark, and the Chicago Mercantile Exchange, the foremost exchange in the U.S.

Anticipating the Results of New Round of Russian Sanctions

An ING report predicts that the new ban will likely bolster prices on the LME, a pivotal benchmark in global contracts. Moreover, LME nickel prices remain particularly susceptible to significant price surges. This was abundantly clear during the nickel squeeze of March 2022, which followed Russia’s invasion of Ukraine and saw a surge in short positions on the exchange. However, the LME has since implemented daily limits to curb excessive price hikes, capping increases at 12% for copper and aluminum and 15% for nickel.

The ING report also suggests that Russian metal will redirect to countries unaffected by the new Russian sanctions. While the LME serves as a last resort market for the physical metals industry, many globally traded metals never reach an LME warehouse. Nevertheless, certain contracts specify LME deliverability. Consequently, Russian firms may face pressure to accept lower prices. For now, analysts expect metals of Russian origin to trade at even steeper discounts and continue flowing to countries unaffected by sanctions, particularly China.

Get early warnings about low material availability and rising prices as a result of geopolitical factors like Russian sanctions in MetalMiner’s weekly newsletter.