Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

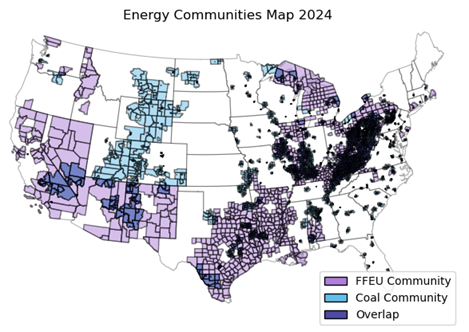

For the first time, the Inflation Reduction Act of 2022 included place-based federal tax incentives for projects located in “Energy Communities,” which might alter the economic equation of where projects should be located. Storage projects may be eligible for a 10-point increase in the Investment Tax Credit (e.g., from 30% to 40%), whereas wind and solar projects may be eligible for either the ITC bonus or a 10% increase in the Production Tax Credit (e.g., from $27.5 to $30.25/MWh). Energy Communities are defined as locations having historical linkages to fossil fuel businesses, communities with high unemployment rates (FFEU), closed coal mines or power stations, or contaminated properties (see map below). The intent is to identify places in the United States that would benefit the most from economic revitalization.

Joachim Seel, Mel Moyce, and Sydney Forrester from Lawrence Berkeley National Laboratory provide more insight into this with a new report, Clean Energy Deployment Baseline for the Energy Community and Low-Income Tax Credit Bonuses.

The report investigates how new federal tax credit incentives are influencing renewable energy deployment patterns and offers historical baselines against which future changes may be measured. To provide actual examples of investments in energy communities, they include a few case studies of renewable energy initiatives that are explicitly targeting places that have recently been impacted by coal power plant closures. However, this publication does not examine how much of the incentive benefits are transferred from clean energy providers to hosting communities.

“Key highlights include:

- As clean energy projects take multiple years to conceptualize and develop, it is likely too early to see shifts towards Energy Community locations either among newly built projects or those that entered interconnection queues in 2023.

- Approximately 35% of onshore wind, 50% of solar, and 60% of storage capacity built in 2023 and the first half of 2024 are located in Energy Communities, making them likely eligible for bonus incentives. While these bonus incentives were not available to projects coming online before 2023, we used 2023 Energy Community definitions to classify whether past projects were built in what is now considered an Energy Community. The deployment levels for 2023-2024 are similar to recent years (2020-2022) for solar and storage but slightly lower for wind.

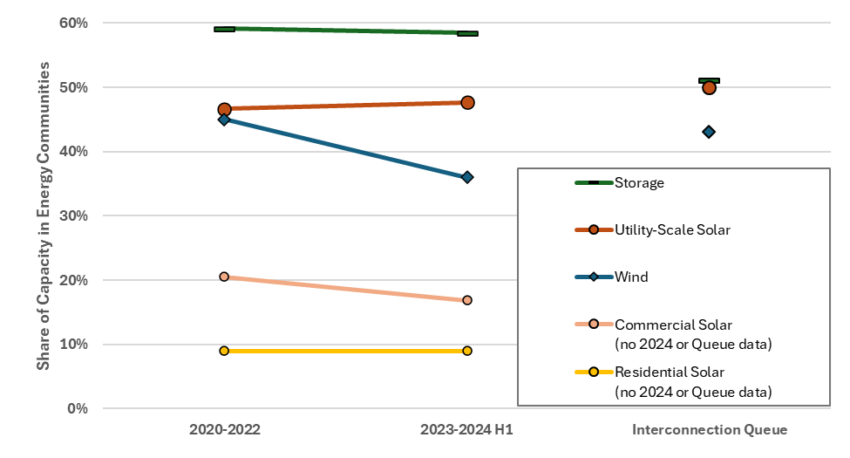

- Clean energy capacity has surged in the interconnection queues over the last few years, with about 45-50% of both recently proposed and total queued capacity being located in Energy Communities. While the amount of capacity in Energy Communities has also grown, its relative share is either stable (solar and storage) or slightly lower (wind) among projects that entered the queue in 2023. The graph below shows all projects that are either currently active in the queue or have already completed their interconnection agreements.

- Clean energy projects can be built at lower costs in Energy Communities. The levelized cost of energy after incentives was on average $9/MWh (24%) lower for solar projects and $2/MWh (6%) lower for wind projects built in 2023, relative to projects not located in Energy Communities. Wholesale electricity values at Energy Community locations relative to the rest of the market vary by region. The average value was often higher for wind projects (-$3 to $11/MWh) but lower for solar projects (-$6 to 0/MWh).

- Distributed solar that is owned by commercial entities is eligible for the Energy Community bonus and also, potentially, a Low-Income Community bonus. Residential solar installations in qualifying Energy Communities that are third-party owned represent about 10% of the total residential market. Larger commercial and industrial solar installations in Energy Communities make up 17% of the total market in 2023. Nearly 2 GW of distributed solar was built in areas qualifying as Low-Income Communities in 2023, exceeding the available annual program cap of 700 MW.”

Summary of Findings from Berkeley Lab Presentation:

- We have established historical baselines of clean energy build-out in ECs.

- ~35% of onshore wind, ~50% of solar and ~60% of storage in 2023 and H1 2024.

- Since the IRA was passed, overall clean energy capacity has surged in the interconnection queues.

- ~45-50% of both recently proposed and total queued clean energy capacity is in ECs.

- While the amount of capacity that is proposed in ECs has also grown, its relative share is either stable (solar, storage) or has slightly declined (wind) among the 2023 queue entrants (graph shows total active queue, not just recent additions).

- Wind and solar can be built in ECs at a lower levelized cost of energy (LCOE).

- LCOE after incentives was $9/MWh (24%) lower for 2023 solar projects and $2/MWh (6%) lower for 2023 wind projects.

- Wholesale market value premiums vary by region: Compared to non-EC locations in the same market, the value tends to be lower for solar projects (-$6 to 0/MWh) but higher for wind projects (-$3 to $11/MWh).

- Only distributed solar that is owned by commercial entities is eligible for the EC bonus.

- Energy Community-eligible residential capacity grew in 2023, both in absolute MW as well as market share (9%). It is primarily concentrated in California.

- 17% of the non-residential capacity built in 2023 can qualify for the EC credit.

- Projects can earn additional low-income community (LIC) bonuses in addition to the EC bonus, but LIC deployment was nearly 3x greater than the available annual program caps.

- We provide three case studies that illustrate the ways in which the EC bonus is being used and highlight construction and longer-term employment effects as claimed by the developers of clean energy projects.

Continued tracking of these trends will be important for system planners, investors, and local communities. The full slide-deck report with detailed geographic analyses is available here.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy