Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Plugin vehicles are all the rage in the Chinese auto market, with plugins scoring 887,000 sales (in a 1.73-million-unit overall market). That’s up 33% year over year (YoY), and the second best month ever, while the overall market is down 3% YoY. And expect August to be a record month….

Looking deeper at the numbers, growth basically came from the PHEV side — BEVs were up by just 6% in June, while PHEVs jumped 87% in the same period, to 419,000 units, which is a record month for the second straight time. Breaking down plugin sales by powertrain, BEVs had 53% of sales, or some 468,000 units, below this year’s average of 58%. Clearly, there’s rising popularity of plugin hybrids in this market.

The BEV slump, with July being the second consecutive month of single-digit growth, together with the recent uptick in PHEVs, must make one reflect on the reason for such events. Are long-range plugin hybrids the silver bullet to cut through the mainstream market?

With BEVs at a little more than a quarter of the total market, the ones buying PHEVs aren’t the early adopters — those have already joined the BEV bandwagon. Rather, they are in the “early majority.” So, maybe PHEVs are indeed needed to convince that more conservative part of the population to go EV today?

Anyway, back to sales. The year-to-date (YTD) tally is around 5.2 million units, a significant rise over the 3.9 million units in the same period of 2023.

Share-wise, July saw plugin vehicles hit a record 51.4% market share! Full electrics (BEVs) alone accounted for 27% of the country’s auto sales. This pulled the 2024 share to 45% (26% BEV), and with the market still with plenty of room for growth, the year should end at around 50%.

Comparing this result with July 2023, at the time, the plugin share was 36% (25% BEV), which means that, while BEVs are experiencing moderate growth (25% vs. 27%), the PHEV share is growing faster (11% vs. 24%). At this pace, we should have the Chinese market fully electrified around 2030, if not sooner.

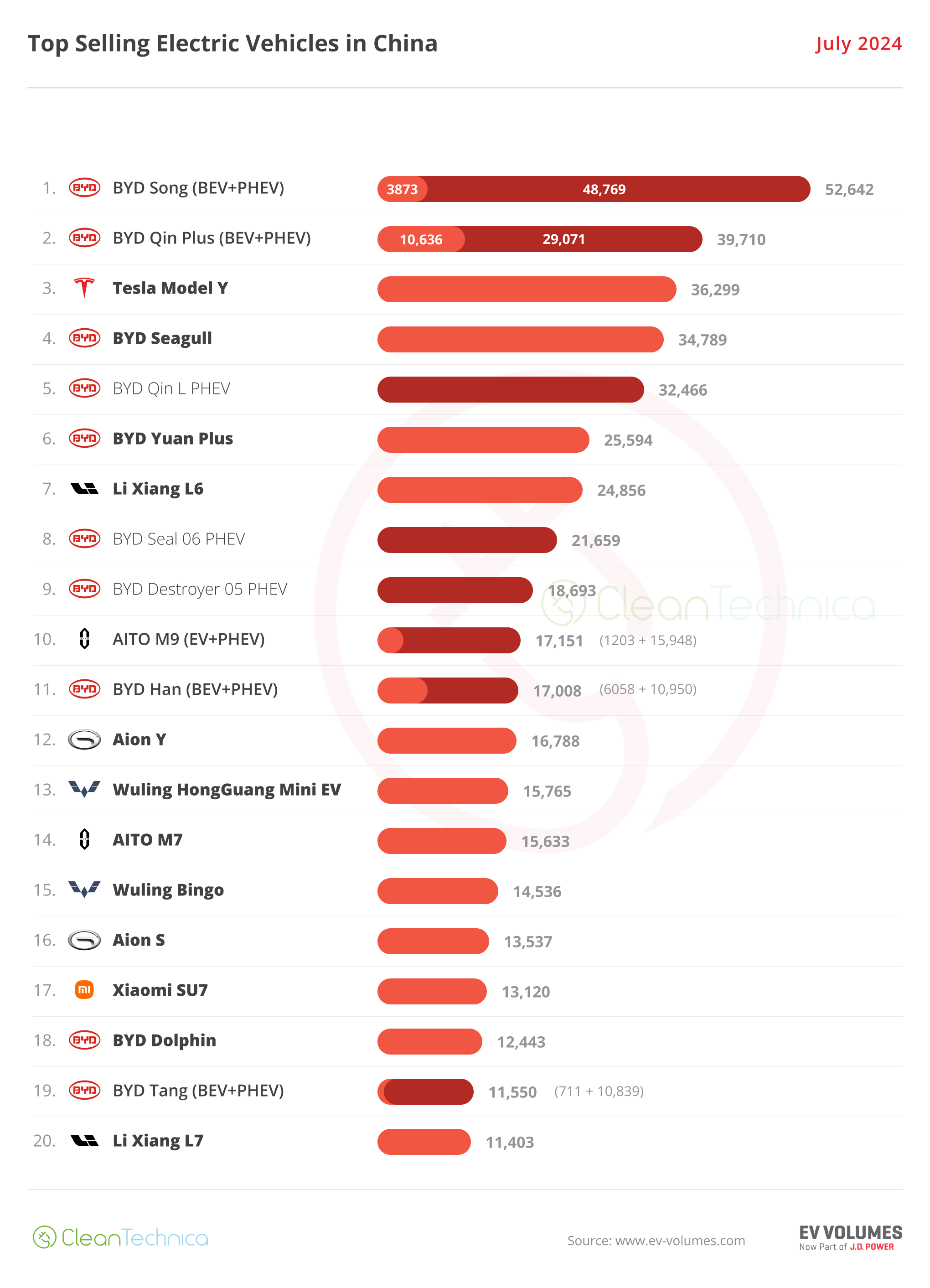

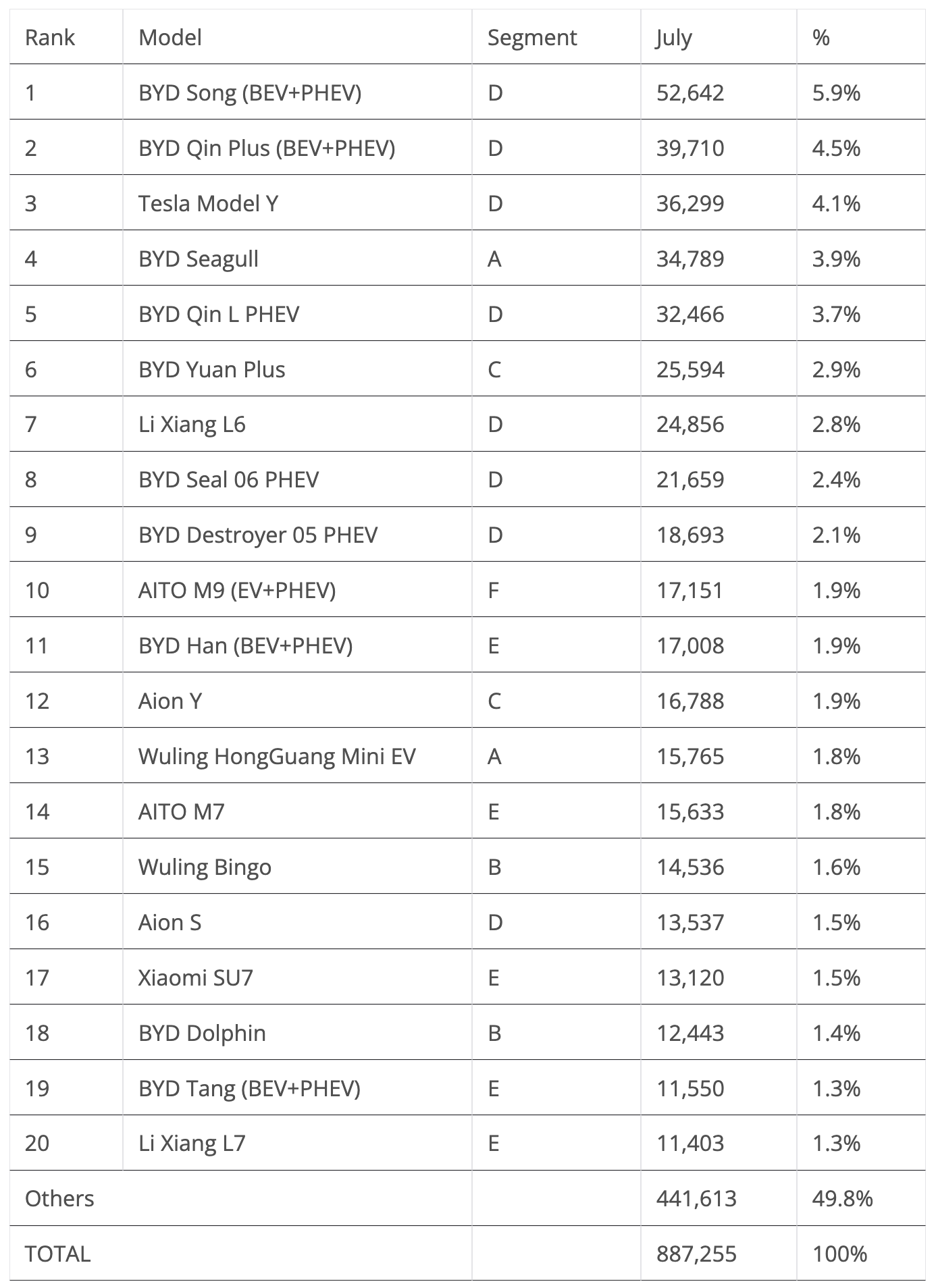

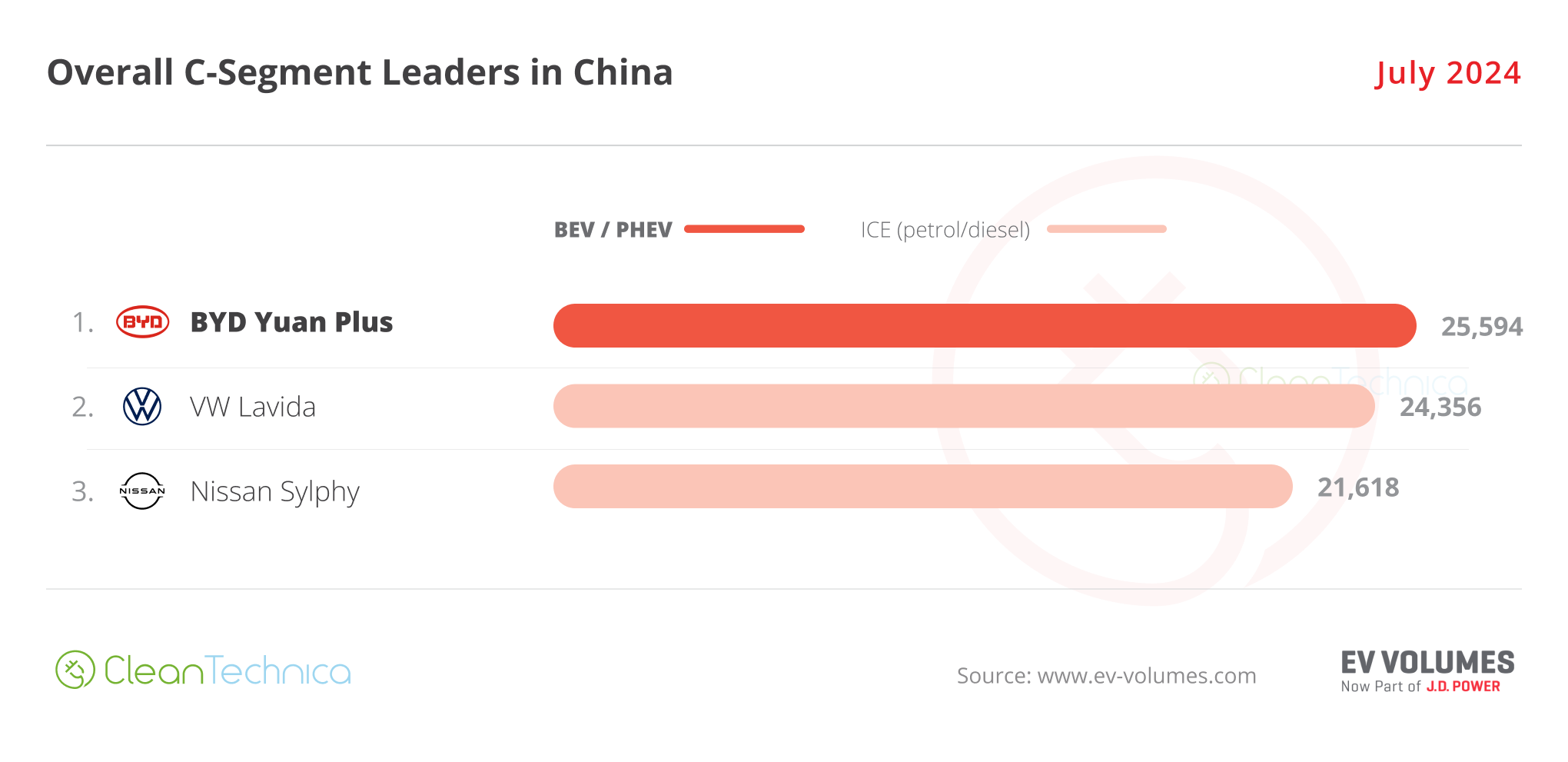

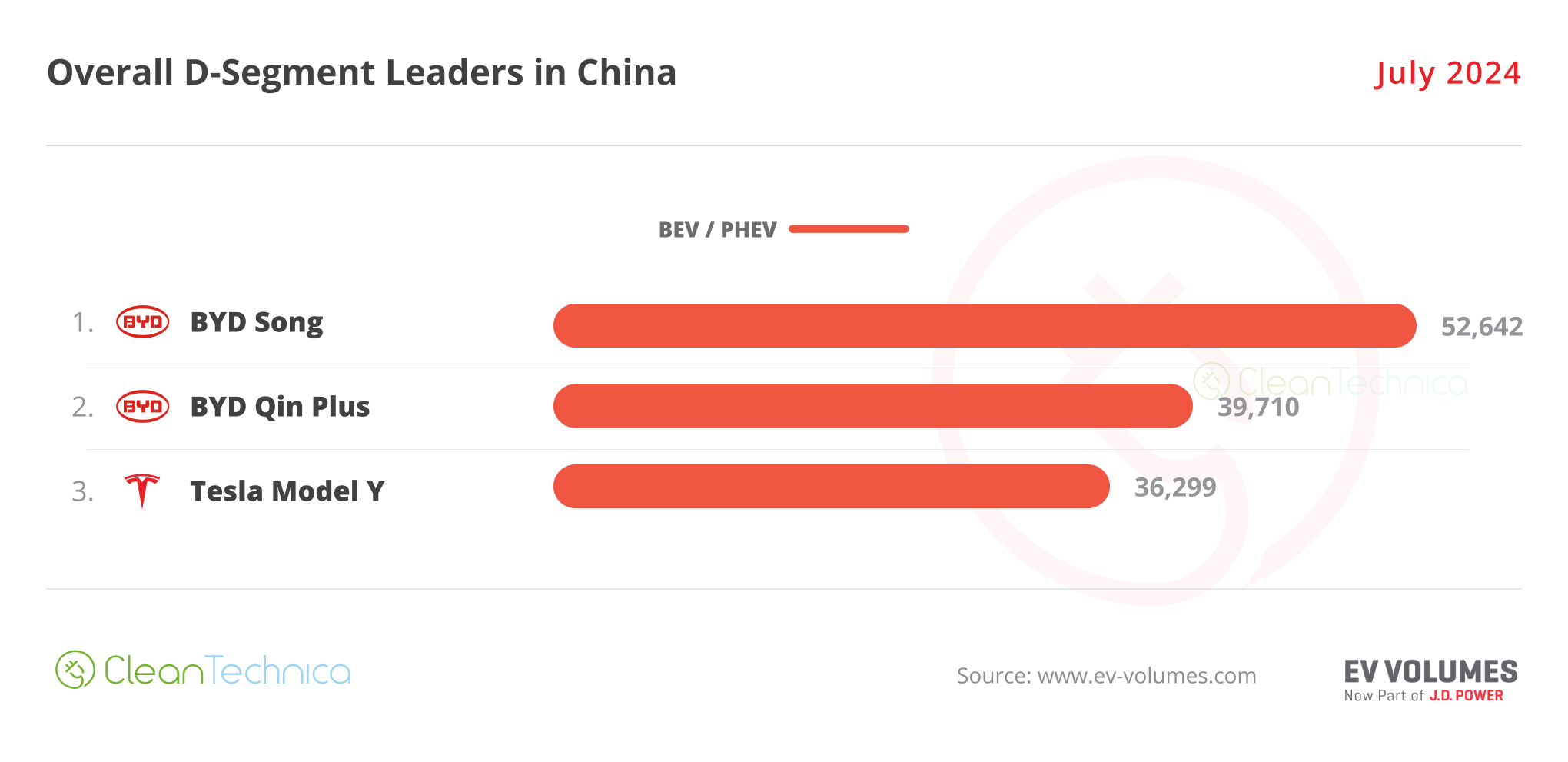

The overall top 7 was 100% plugins, with the Tesla Model Y being the best selling non-BYD model, in 3rd. The best selling ICE model was the Volkswagen Lavida, in 8th, with some 24,000 units sold. Highlighting the current shift in demand, the two only-ICE models in July’s overall top 10, the #8 VW Lavida and #10 Nissan Sylphy, are seeing their sales fall significantly. The German sedan dropped 16% YoY, while its Japanese counterpart performed even worse, crashing 27% YoY.

In July, out of the eight plugin models in the overall top 10, six belong to BYD! The price cuts from the Shenzhen make are pressuring not only the ICE competition, which might be kicked out of the top 10 sometime in the second half of the year (September?), but also its plugin adversaries.

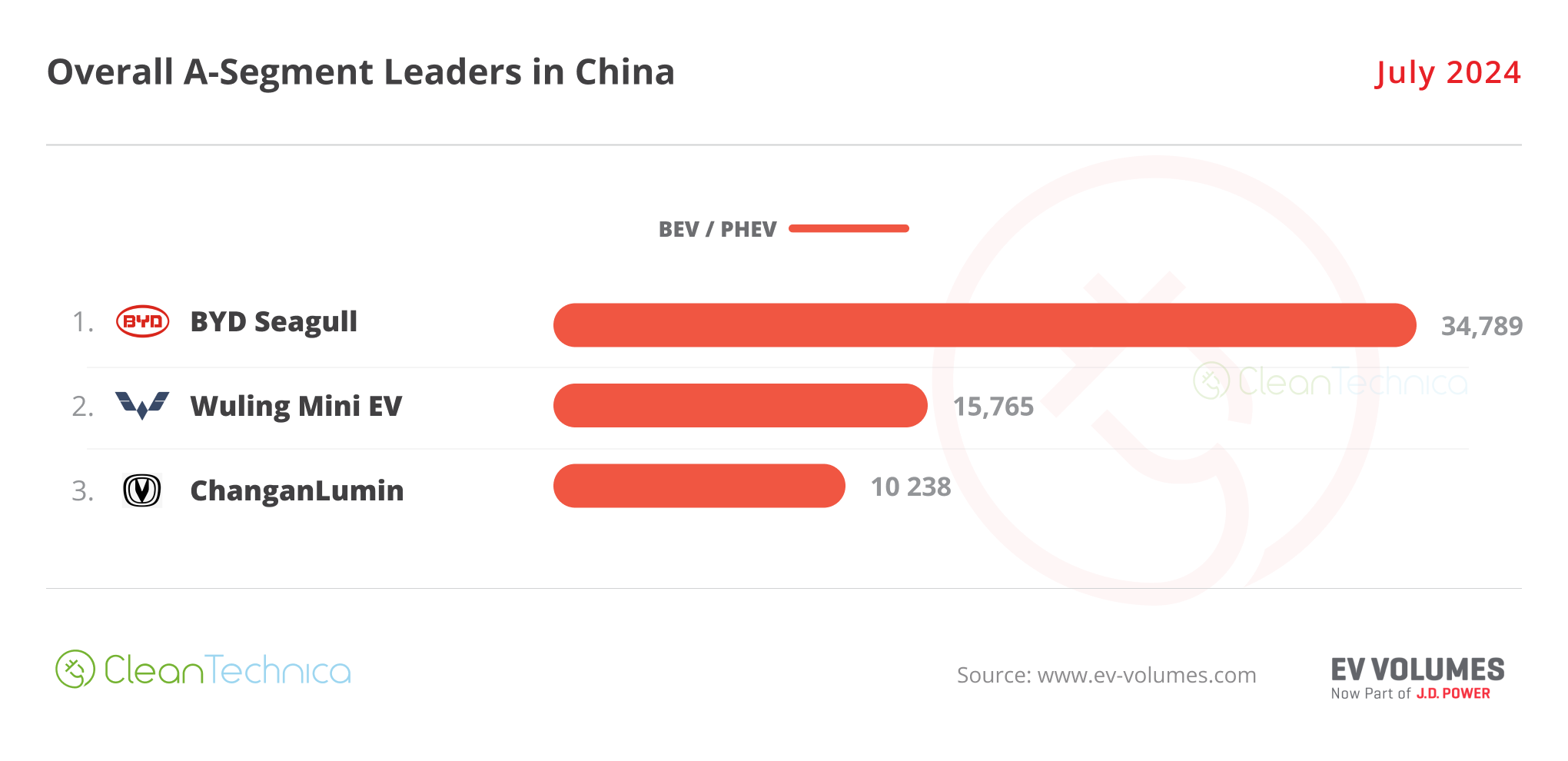

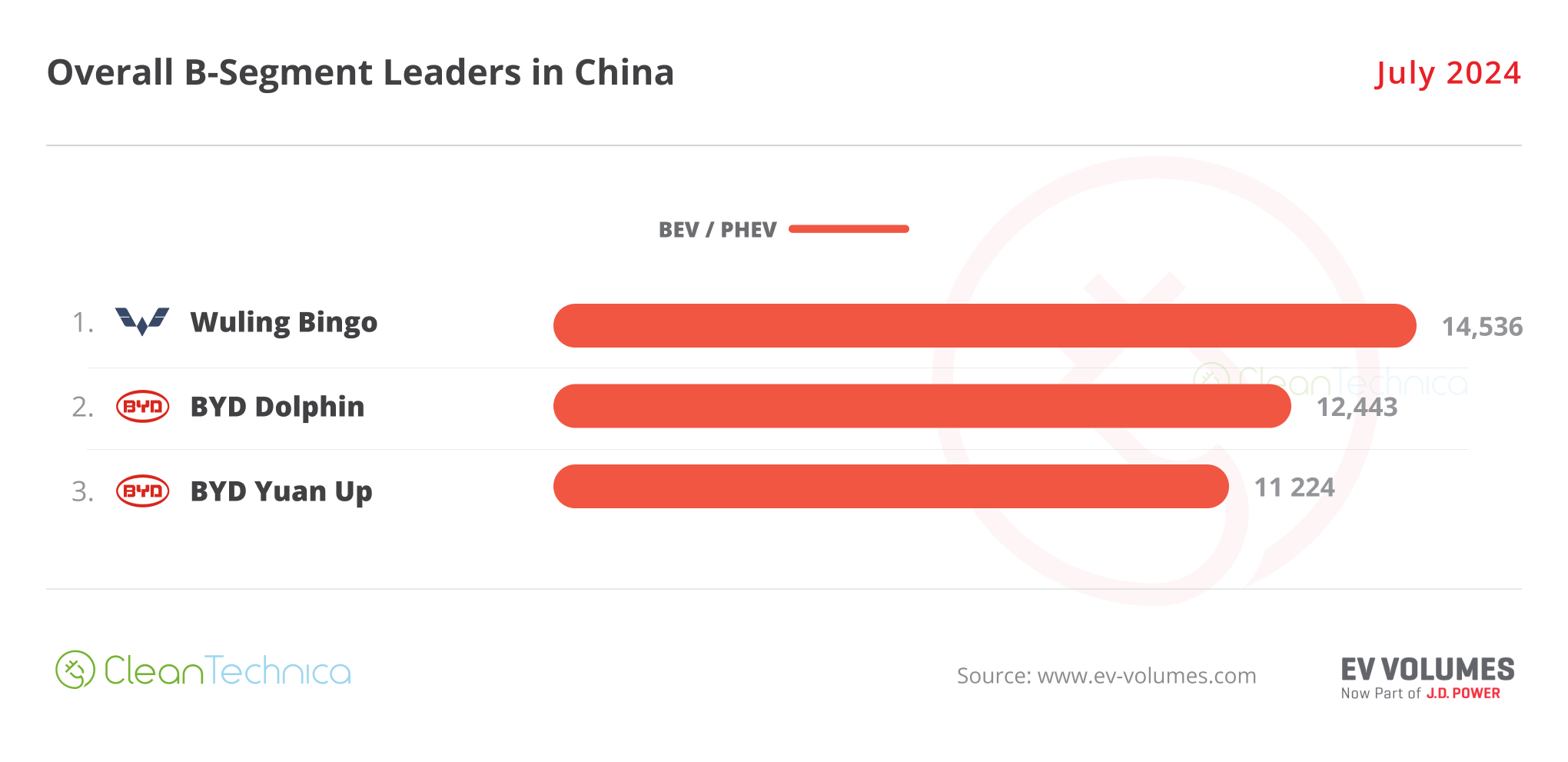

Looking at several categories, all the vehicle segments have 100% PEV podiums with the exception of the C (compact) segment, which is the only category where ICE vehicles are still present. Still, BYD’s Yuan Plus is leading the charge in that category, while the upcoming (not so) compact hatchback, the Seal 06 GT, will surely help things for the EV side.

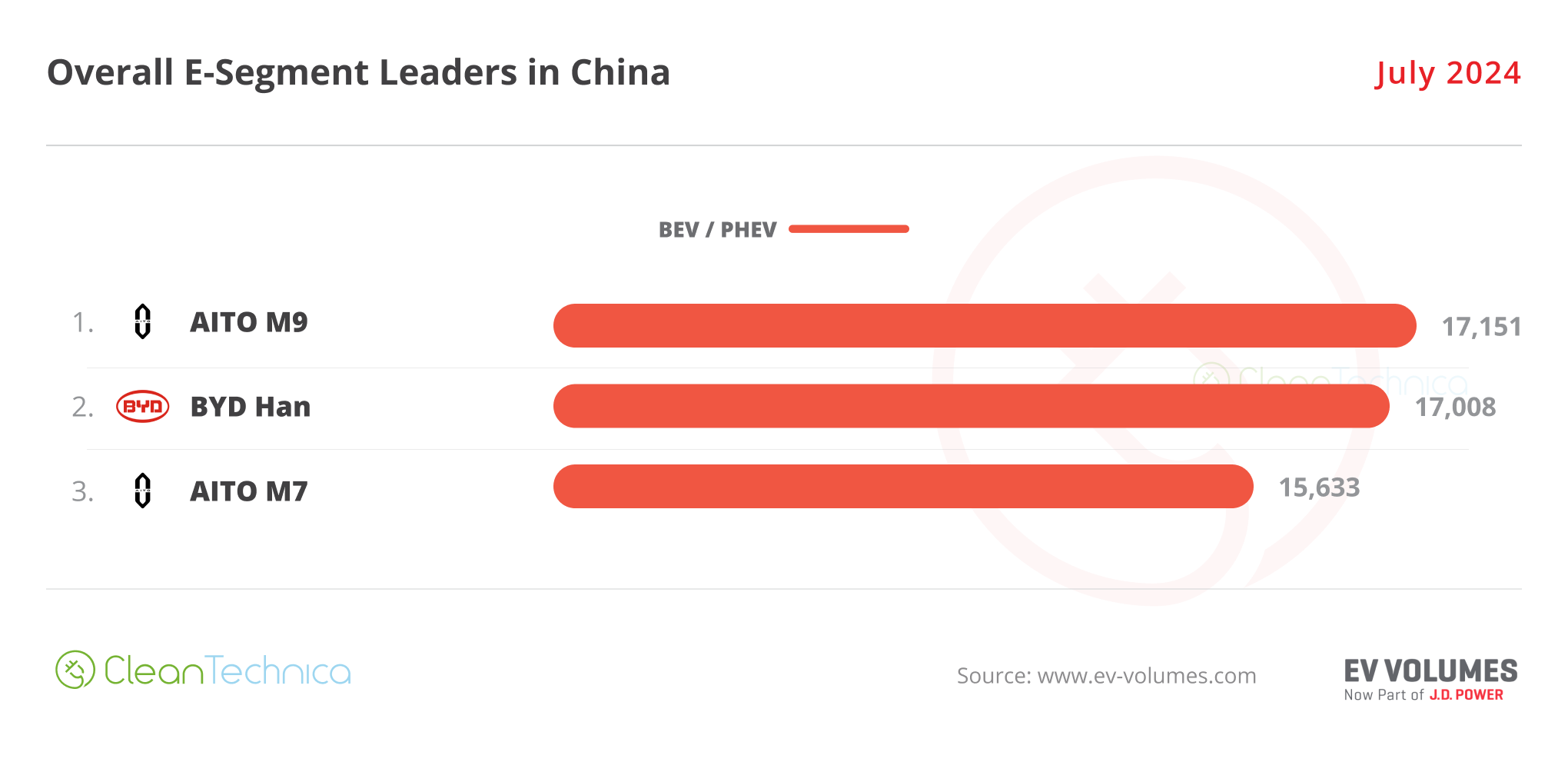

BYD is ahead in three vehicle categories, losing the best seller trophy in subcompacts (B segment), where the Wuling Bingo managed to surpass the BYD best sellers in the category. The Wuling Bingo did profit from split sales in the BYD field — between the established Dolphin (12,443 units) and the new Yuan Up (11,224 units). The big surprises this month are coming from the full size category, with the recently introduced AITO M9 beating the previous leader, the BYD Han, by some 100 units. Not bad for a XXL luxury SUV that starts at $66,000…. We should have a close race between these two in the following months. The other surprise is that AITO managed to place a second model on the podium, the M7, in the 3rd position. That mean that this category was 100% plugin — and it’s also a 100% domestic podium. So, this is another category that legacy OEMs can say bye bye to.

Best Selling EVs — One by One

Regarding last month’s best sellers table, the top 5 best selling models in the overall table exactly mirrored the ones in the EV table — which once again proves the merging process that we are witnessing between the two tables. Here’s more info and commentary on July’s top selling electric models:

#1 — BYD Song (BEV+PHEV)

BYD’s midsize SUV is the uncontested leader in the Chinese automotive market, and the star player retained the leadership position in July, keeping its rival, the Tesla Model Y, at a good distance. The midsize SUV scored 52,642 registrations, with just 3,873 units belonging to the BEV version. Will the Song continue to rule in the Chinese automotive market? Well, it will depend on the competition, especially the internal competition. In the near future, the Song will have to compete against tough internal competition, like the recently introduced Song L and Sea Lion 07 (5,522 units in July) as well as the premium car-on-stilts Denza N7 (a car that sits somewhere between the Tesla Model Y and the Zeekr 001). All of these models also want a piece of the pie. This is probably too much competition inside BYD’s midsize SUV portfolio for the Song to continue clocking 50,000 sales/month, a necessary threshold to continue leading the cutthroat Chinese auto market. But thanks to its recent price cuts, the Song is continuing its success story.

#2 — BYD Qin Plus (BEV+PHEV)

Along with the Song, the BYD Qin has been a bread and butter model for the Chinese automaker for a long time. The midsize sedan reached 39,710 registrations in July (10,636 units belonged to the BEV version). This allowed it to be second in the overall market. Prices start at 80,000 CNY ($12,000), and demand is bound to stay high. Despite the strong internal competition — just look at the new, fancier Qin L, in 5th, and the Seal 06 PHEV, in 8th — expect BYD’s lower priced midsize sedan to continue posting strong results at the cost of the competition, EV or ICE, all while keeping its external direct competitors — the Tesla Model 3, Wuling Starlight, and GAC Aion S — at a safe distance.

#3 — Tesla Model Y

Tesla’s star model got 36,299 registrations, which allowed it to land in 3rd in the overall ranking. Still, it was a great month for the US crossover, as it saw its sales jump 54% YoY in July. The Model Y keeps Tesla relevant in the Chinese market — no small feat considering current market trends (the Tesla Model Y was the only foreign model in July’s top 20). Interestingly, its lower-to-the-ground sibling, the Model 3, also had a good month in July, with 9,928 sales, up 27% YoY, but the Model Y is still growing faster than its facelifted sibling.

#4 — BYD Seagull

Things continue to go well for the hatchback model, with the small EV securing another top 5 presence thanks to 34,789 registrations. With part of production now being diverted to export markets, it seems demand for the little Lambo is at cruising speed in China, at around 35,000 units/month. The perky EV is now a regular in the top 5. Even with its attention now diverted to other geographies, like Latin America and Asia-Pacific, expect the little BYD to continue being part of the BYD pack that populates the Chinese top 10. What about export prospects to Europe? There are talks that the model will be launched in Europe towards the end of the year. Of course, do not expect the low prices in Europe that the Seagull has in China. When the city EV lands, as the Dolphin Mini, European prices will be significantly higher for a number of reasons (tariffs, VAT, etc.), but I wouldn’t be surprised if it started at 17,999€ … which would still be a killer price considering the direct competition is north of 20,000€.

#5 — BYD Qin L

This new sedan is basically the 3rd generation of the BYD Qin, but because the second generation is still running strong, BYD added the suffix “L” to the new one to separate the two. In any case, it has landed with a bang, jumping to the top 5 in only its second full month on the market! The Model 3 sized sedan ended July in 5th, thanks to 32,466 sales. And it has done this without hurting the sales of the regular Qin Plus! At this moment, BYD has a sort of Midas touch, transforming into gold (almost) everything it launches to the market, and it has launched a lot of metal recently…. Just to have an idea, if we were to add the July sales of the Qin Plus with the sales of the Qin L and the sales of the #8 Seal 06 (which is a sort of left-field trim line of the Qin L) and the #9 Destroyer 05 (the left-field trim line of the Qin Plus), we would get more than 112,000 registrations! That’s double the number of the current #1 BYD Song….

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

BYD’s Domination in the Top 20

Looking at the rest of the top 10 list, there were seven BYDs in total in the top 9 positions. And that’s not all….

… Looking at the rest of the table, we have three more BYDs, with the Han in #11, the Dolphin in #18, and the Tang in #19, thus making it ten BYD representatives in the top 20! (And then the BYD Yuan Up was #21.)

This kind of domination is happening at a time when BYD has several potential best selling models either ramping up or landing. Sure, at this point, these models will likely cannibalize existing BYD models, but they will likely also steal sales from the competition.

One does start to wonder at what point BYD’s new model launch fever will start to get counterproductive…. How much is too much?

More Top 20 Notes

Outside the BYD Galaxy, the big highlight is the Li Xiang L6 midsize SUV, in 7th, which had 24,856 deliveries in only its 4th month on the market. Will we see it break into the top 5? It could well be a breath of fresh air in the top 5, which has been under the leadership of BYD and only the Tesla Model Y breaking the dulness of the Chinese automotive top sellers.

Another model on the rise is the AITO M9, which was in 10th with a record 17,151 deliveries, 1,203 of them belonging to the BEV version. The flagship AITO is the make’s newest model, and probably the best from the make so far, so expect the 5.2-meter (205-inch) land yacht to become a frequent presence in the table and a serious contender for the XXL SUV category title.

Another highlight was the Wuling Bingo hitting 14,536 deliveries, a new year best for the small hatchback, providing some good news for an OEM, SAIC, in real need of them. But more on that in the OEM section….

Outside the top 20, as usual, there was a lot to talk about, like Changan’s UNI-Z PHEV. The Changan crossover sold a record 7,681 units. There’s also Chery’s Fengyun T9 PHEV crossover, which delivered 8,309 sales in July, an impressive result for a model that is only in its 3rd month on the market.

On the startup field, the highlights were Leap Motor’s C10 compact crossover, which hit a record 7,386 units, and its older and larger sibling, the midsize C11, which got 6,811 sales, a new year best.

Hozon saw its Neta L midsize SUV get 5,628 sales in only its 4th month on the market, delivering valuable volume to a startup in dire need of it. And NIO saw its ES6 best seller reach 8,112 units, the SUV’s best result in 11 months.

On the Geely galaxy of brands, the … Galaxy L6, a sharp suited sedan, hit a record result, 6,424 registrations. Meanwhile, its crossover sibling, the L7, also shined, by delivering 6,559 units, its best result since January. On the Lynk & Co side, the striking 07 sedan delivered 6,001 units in only its 3rd month on the market, and it thus became the Gothemburg-based make’s best selling model.

Looking at foreign OEMs, the only highlight refers to the Volkswagen ID.3, which had a year-best score of 8,282 units.

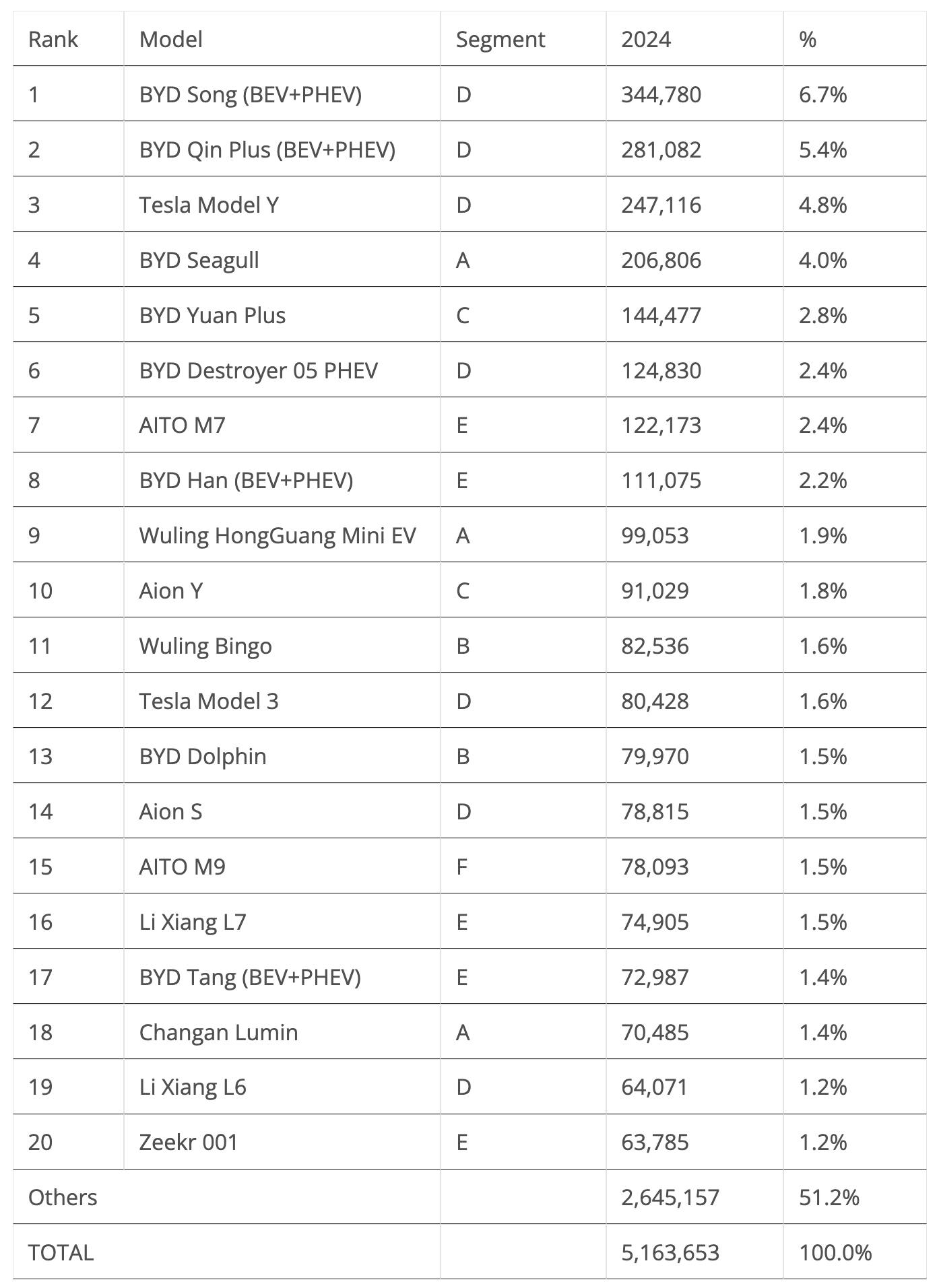

The 20 Best Selling Electric Vehicles in China — January–July 2024

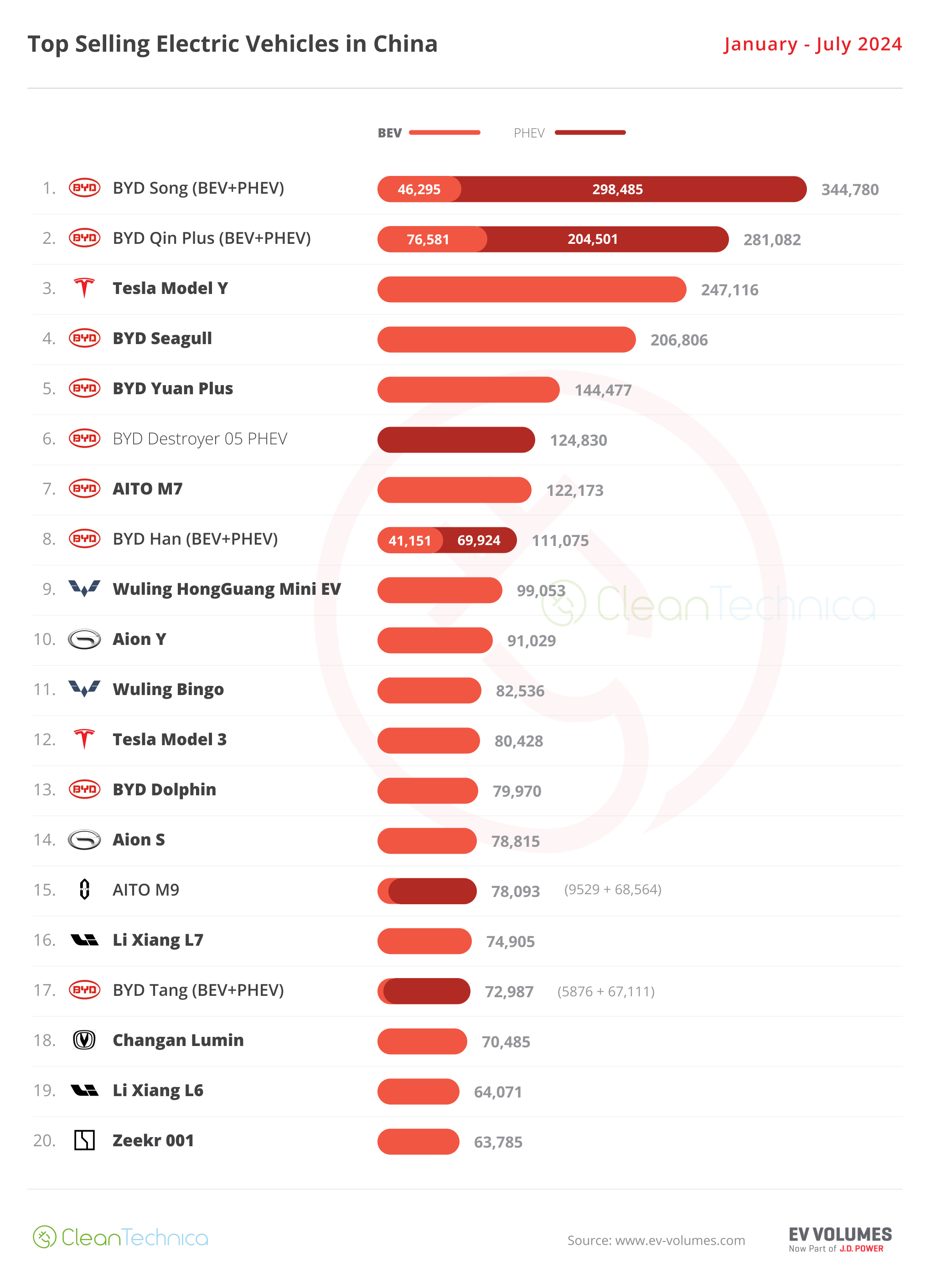

Looking at the 2024 ranking, there’s nothing new in the podium positions, with the podium bearers BYD Song, BYD Qin Plus, and Tesla Model Y safely in their positions.

The same can be said about the 4th placed BYD Seagull, which has distanced itself from the competition — more than 40,000 units separating the little Lambo from the #5 BYD Yuan Plus or the #3 Tesla Model Y.

With the top 4 positions already secured, we have to go down to the 6th position to see some action. The rising BYD Destroyer 05 has surpassed the big SUV AITO M7 and is now 6th, thus making it five BYDs in the top 6.

Further down, the Wuling Bingo profited from a good July to climb one position, to #11, with the small hatchback looking to keep this position at the end of the third quarter.

Regarding the lower positions on the table, the AITO M9 yacht full-size SUV also had another positive month, climbing to its current #15 spot.

The veteran, and soon to be replaced BYD Tang, was up one spot, to #17, allowing the SUV to keep the expectations of a top 20 presence by year end.

Finally, in #19, we have an important model joining the table, as Li Auto’s L6 midsize SUV is now on the YTD radar, and should jump a few more positions by the end of the year. I am betting that it will jump to #16 in August, #13 in September, and #9 by December.

Changes in the Overall Brand Ranking

In July, the top three positions mirrored the 2023 full year ranking, with BYD on top followed by Volkswagen and Toyota. The dynamics are quite different, though. BYD (299,000 sales) grew 36% YoY, doubling the sales of #2 Volkswagen (149,000 sales), which was down by 17%, and #3 Toyota (125,000 sales) fell by 7%. So, while the first place automaker is still rising fast, the other two are losing significant ground in a fast changing market.

Confirming the domestic takeover, #4 Geely (80,000 sales) is firm in its position, while below it, Chery (54,000) surpassed Honda (52,000 sales) in the race for the 5th position. Worse still are the dynamics between these two, with the Chinese make jumping sales by 23% YoY while the Japanese one crashed 43% YoY. At this rate, Honda’s future looks bleak in China….

Still, there are others worse than Honda, and just giving some examples of famous brands, Buick was down 47% in July; Cadillac dropped by 49%; Chevrolet did even worse, cratering a worrying 81%(!); and not wanting to make this a GM-bashing show, Citroen was down by 47% — not that surprising, considering that Stellantis has basically given up on China. But it is surprising to see a fully electric brand, like Ora, cratering 53% YoY. Such is the pace of the Chinese market, even fully electric brands can bleed, in the current market dynamics.

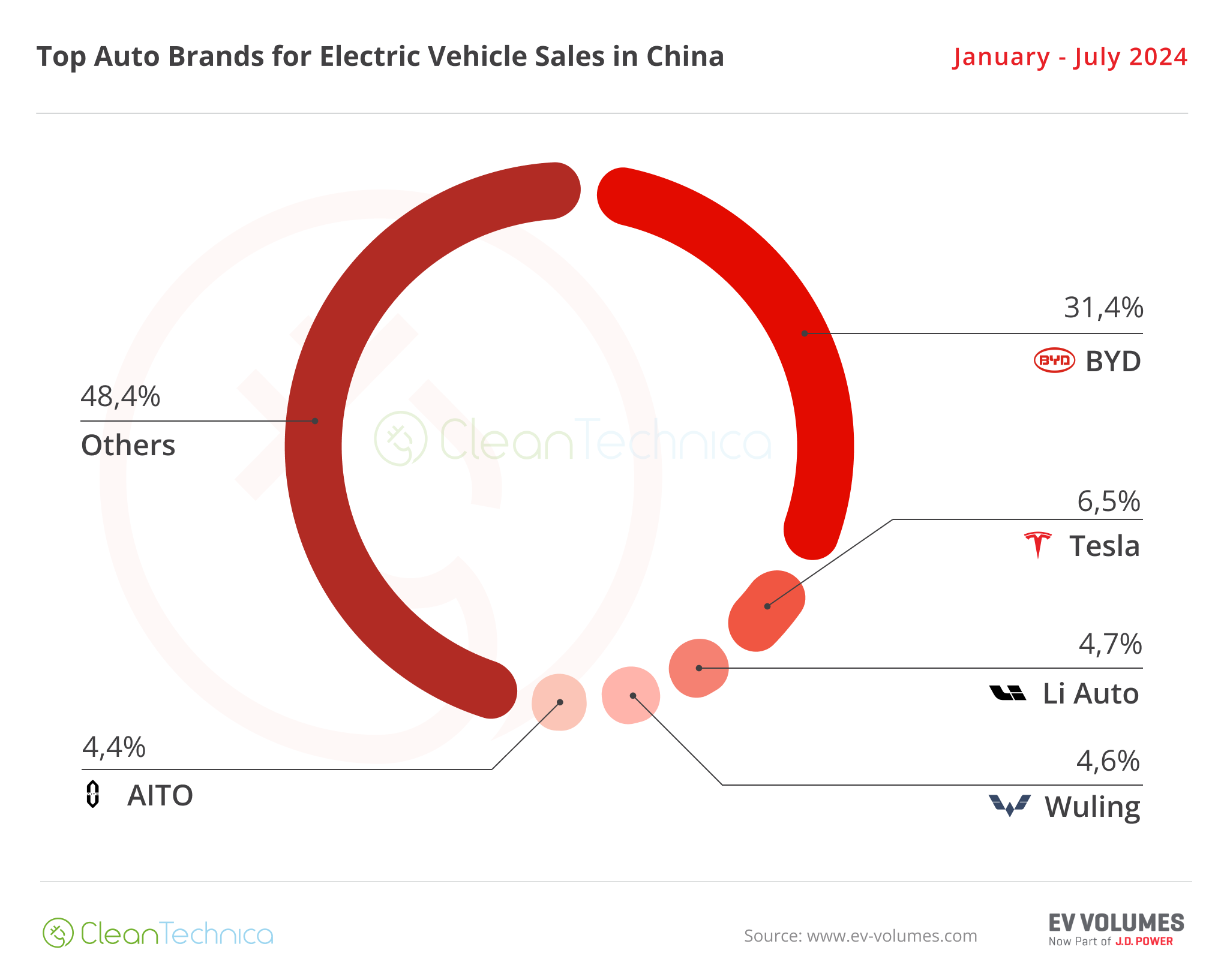

Auto Brands Selling the Most Electric Vehicles in China

Looking at the auto brand ranking, there’s no major news. BYD (31.4%, up 0.6% from June) is firm in its leadership position, and there’s really no way to see this domination ending anytime soon.

Things get more interesting below, though. Tesla (6.5%, down from 6.8%) is comfortable in the runner-up spot, while Li Auto (4.7%, up from 4.6% in June) is benefitting from the popularity of its new L6 model to gain precious distance over #4 Wuling (stable at 4.6%).

#6 Geely saw its Galaxy L6 & L7 siblings shine, and has seen its share climb 0.1%, to 4% in July, inching a little bit closer to #5 AITO (4.4%).

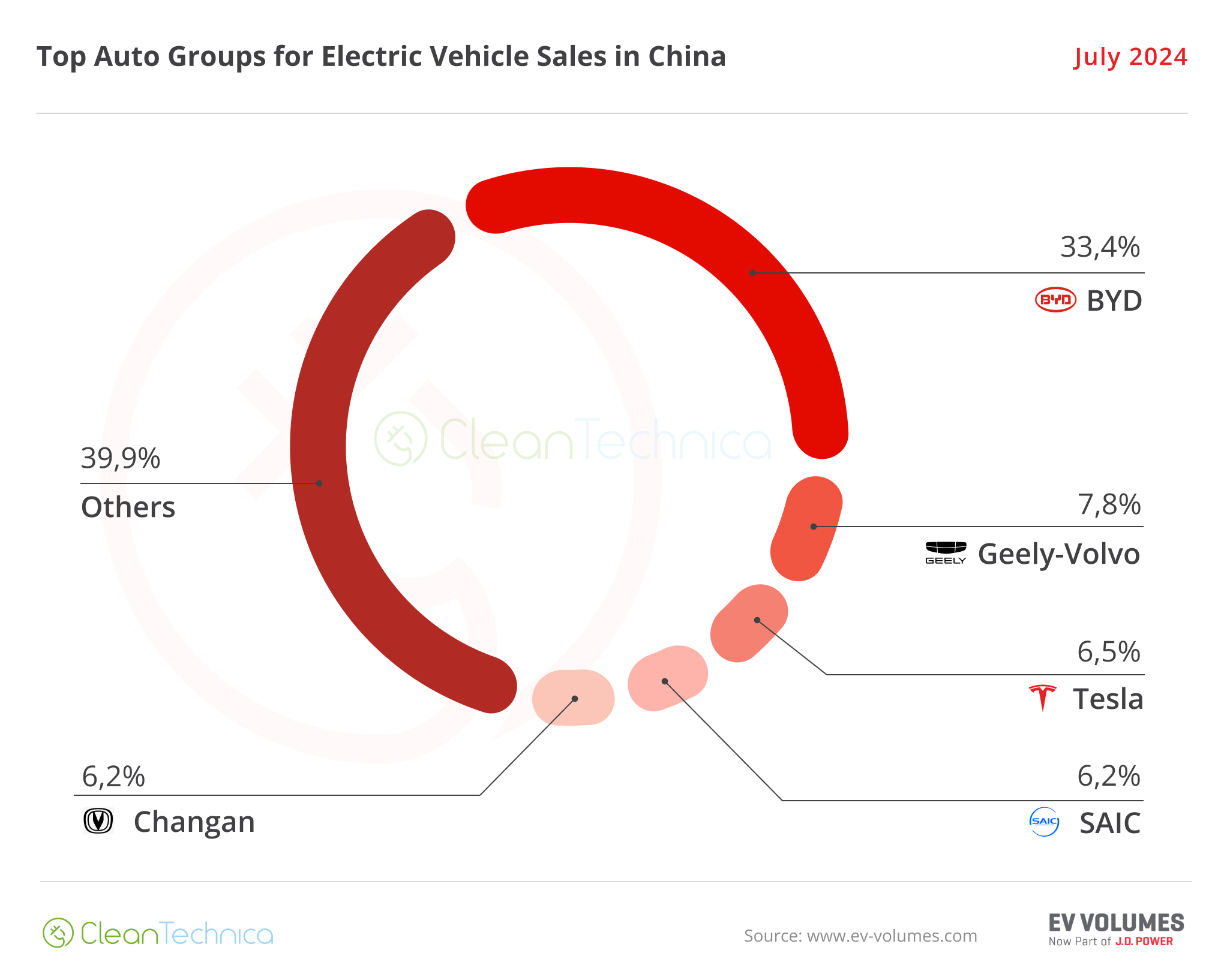

Auto Groups Selling the Most Electric Vehicles in China

Looking at OEMs/automotive groups/auto alliances, BYD Group is comfortably leading, with 33.4% share of the market. That increase in share is mostly thanks to the strong results of the namesake brand, as its daughter brands counted together actually lost share (0.1%, to be more precise). So, while the main brand goes from strength to strength, Denza, Fang Cheng Bao, and Yangwang are not doing their part when it comes to increasing the OEM’s profit margins. Hey, one can’t have everything, right?

At this moment, it seems BYD has its domestic market domination well assured, replicating what Tesla is doing in the USA.

Geely–Volvo is a distant runner-up, with 7.8% share, having lost 0.1% in July as some brands of its lineup (ahem, Zeekr, ahem) had a slow month.

#3 Tesla (6.5%) lost share, but because SAIC (6.2%, down from 6.7% in June) lost even more share, the US make maintained its podium position.

Shanghai Auto’s (SAIC) position in the Chinese market looks fragile right now, with its foreign partners, GM and VW, in trouble. SAIC needs its own brands to keep afloat in the overall market, but in July, red was the main color among them. For example, MG dropped 49% and Maxus was down by 44%, just to name the two best known brands from the OEM. True, its new premium brand, IM Motors, jumped by 249% YoY, but with just 6,000 units sold in July, it barely moved the needle. While SAIC is one of those too big to fail companies, something needs to be done to it.

Back to the OEM table, #5 Changan lost share (now at 6.2%, down from 6.4% in June), but with SAIC falling off a cliff, expect the Chongqing-based company to climb to 4th in August.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy