Canada voices concerns over Mexico’s energy and mining policies

Before the tripartite North American heads of state summit convened early this year on January 9, Canada’s federal government voiced concern about Mexico’s energy and mining policies. Pressure had been mounting on officials in Ottawa to rescue home-grown companies caught in tax disputes south of the U.S. border.

Approximately 40% of Canadian investment in Mexico is tied up in the sector, while almost 70% of foreign mining companies operating in the country have Canadian interests. There are currently over 205 companies with Canadian capital established in Mexico.

In a statement issued last year by Canada’s Trade Minister, Mary Ng, made the case that it is important to “create opportunities for businesses” from both countries to grow, indirectly referring to the imposition of heavy taxes on foreign mining companies in Mexico. Ng, who met her Mexican counterpart in Vancouver in the summer of 2022, said at the time that Canada was working with Mexico to maintain “predictable” trade (policies). She was referring specifically to President Andrés Manuel Lopez Obrador’s (AMLO) continuous interventions into the mining industry.

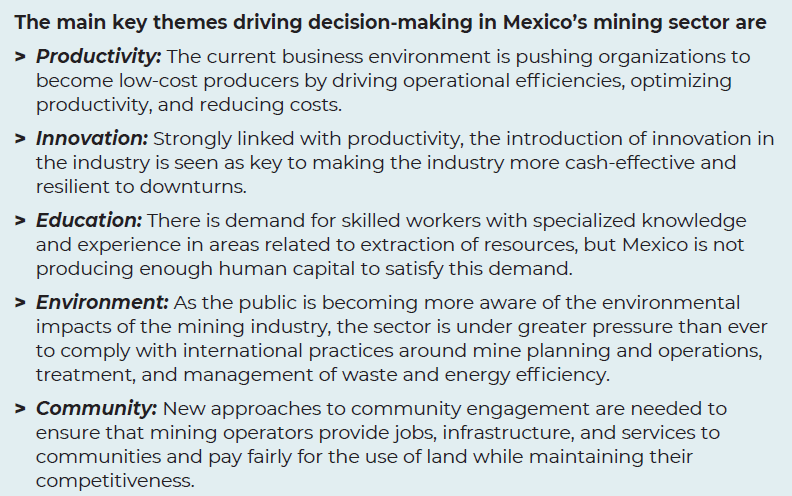

The ruling Morena Party’s rhetoric towards the mining sector has resulted in rising investor uncertainty and will pose downside risks to our growth forecasts. Morena, led by AMLO, is now looking to pass new legislation that will modify regulations related to the environment, OHS, and communities. Besides the potential regulatory changes, mining industry leaders mention five key areas: taxation, royalties, security, community relations, and unionized labour, as the risks associated with operating in Mexico.

Despite these challenges, Mexico continues to have fundamental competitive advantages that make its mining industry attractive, including its vast mineral reserves, low operating costs, and an open business environment. These are keeping Mexico an attractive investment opportunity for foreign mining.

To better understand the dynamics which are at work here, it is important to understand what is going on inside Mexico’s mining sector – which currently ranks fifth in the world after Canada, Australia, the U.S., and Chile. Mexico has a long history of mining in silver, gold, and copper, and it is appearing larger on Canada’s radar.

Mining has long been an important revenue generator in Mexico, contributing 8.3% of industrial GDP and 2.5% of national GDP. It is also a major job provider. In 2017, the sector supported 370,000 jobs directly and over 1.7 million jobs indirectly.

Mexico’s mining industry is undergoing significant restructuring. The previous Peña-Nieto government introduced specific tax and fee reforms, increasing fiscal pressure on mining concession owners, exploration companies, and mine operators. The new leftist president, AMLO, is looking to improve security in the sector, increase infrastructure spending, and expand broadband coverage to remote mining areas.

The value of the Mexican mining sector is forecast to grow over the next few years, supported by low operating costs and a strong project pipeline. It is estimated to increase from US$16.9 billion in 2018 to US$18.7 billion by 2026, averaging 2.8% annual growth.

Mexico is an abundant producer of metals and ores, and the reasons are numerous, including the following:

> The world’s largest producer of silver, with the states of Zacatecas, Durango, and Chihuahua serving as the main production centres.

> The world’s ninth-largest producer of gold.

> The world’s seventh-largest producer of copper.

> One of the top five producers of sodium sulphide, fluorite, celestite, and wollastonite.

> A large coal producer.

> The world’s second-largest fluorspar producer.

> The world’s eighth-largest producer of graphite.

> The world’s second-largest producer of strontium.

According to experts, approximately 70% of Mexico contains outstanding geological potential for mining. Mexico is the world’s fourth-largest foreign direct investment (FDI) destination for mining, and the number one FDI destination in Latin America.

In 2017, the Mexican Central Bank (Banxico) reported that the country’s mining sector attracted US$1.02 billion in FDI. Most investments came from companies in Spain, Germany, Israel, the U.S., and Canada and focused on gold, copper, zinc, and uranium. Companies such as Goldcorp, Fresnillo PLC, Agnico Eagle, and Alamos Gold together produced over 124 tonnes of gold in 2022. Total mining investments grew in 2017, increasing by 14.7% to reach US$4.3 billion. Investment was expected to grow a further 22% in 2018, to reach US$5.26 billion.

Mexico provided one-fifth of the world’s production of silver (4 million tonnes) in 2017, mined by companies including Fresnillo, Goldcorp, and Coeur D’Alene. Copper production amounted to 463,000 tonnes, produced mainly by Grupo Mexico, Cobre del Mayo, and Capstone.

Mexico’s copper production will increase over the coming years, supported by a solid project pipeline and rising copper prices. While Mexico’s total copper production declined by 4% year-over-year to 183,000 tonnes in the first quarter of 2018, but the long-term outlook remains positive. Mexico’s copper output is forecast to increase from 766,000 tonnes in 2018 to 929,000 tonnes by 2027.

In February 2018, workers at Grupo Mexico’s San Martin mine voted to restart the mine, which had been stalled since 2007. The firm plans to spend US$77 million to resume operations by the first quarter of 2019, adding an annual 7.5 kt of copper to the group’s output. Grupo Mexico also expects the Pilares project to begin operating in 2019, producing 35 kt of copper.

Major domestic miner, Industrias Peñoles, continues to develop the US$303 million Rey de Plata polymetallic project, and the mining unit was finally commissioned in the first quarter of 2020. In the firm’s first quarter 2018 report, Teck Resources outlined the drilling programme at the San Nicolas copper-zinc project. The firm completed the prefeasibility study in 2019.

Any list of the key copper projects operating in Mexico should include the following larger ones:

> Alacran – Azure Minerals

> Promontorio – Azure Minerals

> Pilares – Southern Copper Corp.

> Tayahua – Minera Frisco SAB de CV

> San Nicolas – Teck Resources

> La Verde – Equinox Gold/Teck Resources

> Los Verdes – Minera Alamos

Mexico’s silver production is set to continue its solid growth, supported by vast reserves and strong project pipeline. The export-oriented sector will also benefit from growing demand from Asia.

Consultants at BMI now forecast that Mexico’s silver production will increase from 188 million oz. in 2023 to 261 million oz. by 2027, averaging 3.8% annual growth. Mexico will remain the top global silver producer. As a result, junior and major miners are showing increasing interest in the sector.

Top domestic silver miner Fresnillo is ramping up spending to support projects including the San Julian silver mine expansion and near-term growth projects at the Fresnillo and Herradura mines. In the first quarter of 2018, the firm recorded a 14% year-over-year increase in silver production, up to 14.2 million oz. In 2018, Fresnillo maintained a production guidance of 67 to 70 million oz.

In the first quarter of 2018, Pan American Silver reported a slight increase in silver production in its Mexican mines, up to 2.9 million oz. Pan American completed an expansion of the Dolores mine in 2017 that featured a pulp agglomeration plant to process high-grade ore. The mine uses conventional cyanide heap leaching to produce gold and silver doré.

In December 2017, Americas Gold and Silver began commercial production at the San Rafael silver mine. San Rafael mine is currently at full production and mill throughput is exceeding pre-feasibility targets. It is a low-cost silver-zinc-lead underground mine, located approximately 9 km from the Los Bracero’s mill. The mine’s silver production doubled and exceeded 1 million oz. by 2021, driven by production growth from the Main, Central, and Upper zones.

Mexico’s regulatory landscape is generally favourable to mining, focusing on precious metals and, increasingly, copper. The sector’s main pull back is the country’s royalties’ regime, which came into effect in January 2014. Royalties range from 7.5% for base metals to 8% for precious metals. While the royalties’ scheme is amongst the highest in the region, comparatively the country’s overall tax burden is not high.

The Aussies are there too

Mexico has not traditionally been a destination for Australian mining companies. However, the country has strong fundamentals that make it both competitive and attractive. Many U.S. and other Western-based companies are regular exporters to the market. For example, fifteen Australian mining equipment, technology, and services (METS) companies and two Australian mining operators (Azure Minerals and Consolidated Zinc) have established a presence in the market. These two firms have moved from exploration to production. Other large Australian mining groups are actively performing exploration activities in Mexico, including BHP, Newcrest, and South32.

Concluding remarks

Mexico’s mining industry is highly competitive, with more than 500 companies holding roughly 25,000 concessions. However, the market is dominated by large firms. These account for an astounding 97% of main metals’ total output (gold, silver, copper, zinc, and lead) and tend to dominate the most profitable niches, such as precious metals. Cumulatively, investment has risen sharply over the past decade, and it currently hovers around US$5 billion per year.

Mexico remains one of the world’s premier mine development locations in respect to the time frames required for new operations.

The country’s geological potential is still growing, attracting more than 280 national and foreign companies to start new exploration projects, mainly in the northern states of Sonora, Zacatecas, and Chihuahua. According to the General Direction of Mining Development, there are currently 347 mining projects in the country.

Most of these projects are in the exploration phase, accounting for 68%. Another 11% are in pre-production phase and 16.6% of the projects have not been given the development and construction green light, given current commodity prices and the economic environment.

Mexico’s stable business environment and macroeconomic outlook will drive metals demand and support the competitiveness of the country’s mining sector in the coming years. Mexico’s proximity to the U.S. and Canada gives it a significant supply advantage.

Gordon Feller is a freelance writer.