Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

The United States has always had a certain schizophrenia about solar panels. Jimmy Carter installed some solar hot water panels on the roof of the White House, but Ronald Reagan had them ripped off as soon as he moved in. During the Obama administration, the federal government issued a $535 million loan guarantee to Solyndra, a US company that manufactured solar panels in Fremont, California. When the company failed, Republicans in Congress excoriated the administration for wasting money on such a hare brained scheme. Electricity from sunlight? What were Democrats smoking?

After the collapse of Solyndra, America went to sleep on solar panel manufacturing, but China saw an opportunity. It took advantage of the technology for making solar panels created in America and used it to create its own manufacturing industry. Eventually, it got so good at it that it could produce solar panels for less money than any other country. When America started to wake up to the promise of solar power, China was pretty much the only game in town and quickly came to dominate sales in the US and in many other countries as well.

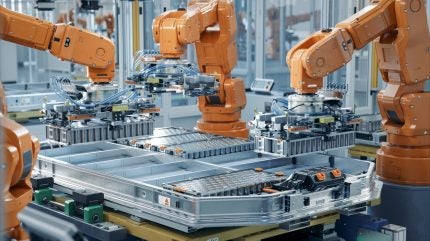

China did the same thing with lithium-ion battery manufacturing, another technology that started in America but was pooh-poohed by conservatives at a time when the prevailing wisdom was to let other countries manufacture stuff because they could do it cheaper than US companies could. Once again, China was only too happy to take that ball and run with it.

The upshot, of course, is that when America needs solar panels or batteries today, it has to get them from China. In order to encourage US companies to do what they should have been doing twenty years ago, America now has to resort to massive incentive programs that cost exponentially more money than it would have to support those nascent industries in the first place. The only way the US has to level the playing field today is to impose tariffs on solar panels and batteries imported from China — which means American consumers pay more than they need to for renewable energy and electric vehicles.

China And Solar Panels

A few years ago, American companies trying to manufacture solar panels domestically complained that China had an unfair advantage, so the US government imposed significant new tariffs on Chinese made solar panels. That caused the Chinese solar manufacturers to pivot. Instead of building panels in China, they built new factories in other Southeast Asian countries like Vietnam, Cambodia, Thailand, and Malaysia to avoid those tariffs.

Noah Kaufman at the Center on Global Energy Policy at Columbia University explained the dilemma recently to Marketplace. On one hand, he said, “We want cheap solar because it will lead to faster deployment of solar, so we’ll deploy clean energy faster.” On the other hand, the US government would like those solar panels and cells to be made in America. “Trade tends to be a game of whack-a-mole,” said Mike Carr, head of the Solar Energy Manufacturers for America Coalition.

These latest tariffs will probably lead Chinese solar panel manufacturers to relocate once again, Carr said, which is why he advocates for a “risk-based approach” that focuses on “producers who have a long track record of circumventing duties. Thanks to tax credits and other financial incentives from the Inflation Reduction Act, Carr said the solar manufacturing industry in America is just starting to get off the ground. “We are talking about for the first time, really in the history of solar, globally scaled factories being built here in the United States.”

US Policy On Solar Panels Changes

For the past few years, US trade policy on imported solar cells and panels has been a wild ride, with the Biden administration first pausing tariffs then reinstating them. During that time, millions of panels were imported duty free, but there was a kicker. They had to be installed by December 3, 2024. Those that were not — and there are millions of them stored in warehouses around the country — are now subject to tariffs that vary by country of origin. Solar Power World has a comprehensive breakdown of the precise amounts, which vary between 21.31 percent and 271.28 percent. According to Bloomberg, the new policy could impose billions of dollars in retroactive tariffs on importers.

“That bill will shock a lot of people,” said Tom Beline, a trade attorney in Washington, DC. Robust enforcement is “tremendously important” to ensure the two-year tariff moratorium doesn’t mean we’re “living with a stockpile of panels that would never be installed.” The new tariff policy increases uncertainty for solar developers and manufacturers as it comes on top of existing trade probes, questions about the longevity of tax credits for renewable power projects, and the next president’s vow to hike tariffs on a wide range of goods and suppliers.

At issue is a tariff holiday President Joe Biden ordered in 2022 to reduce the impact of a trade inquiry that spooked renewable developers and chilled solar installations nationwide. Biden’s order effectively meant tariffs didn’t apply until early June. To counteract a surge in duty-free solar imports from the four Southeast Asian countries that were involved in the investigation, the administration set December 3 as the deadline for using or installing the imported equipment.

Don’t Say We Didn’t Warn You

Federal regulators have spent months warning importers they’ll have to prove modules have been “utilized” or pay duties retroactively. And they’ve taken pains to explain what qualifies, making clear that creative measures — from destroying affected panels to temporarily installing them at warehouses — won’t be enough to avoid the duties. Companies raced to deploy the imported equipment as the deadline got closer, but analysts estimate up to 40 gigawatts of affected imports are still waiting to be used — about two thirds of the current annual demand for solar panels in the US. “Given that the domestic industry is still facing a price collapse and a surge of imports that have left years of inventory still in warehouses, the enforcement of this circumvention regime remains extremely important to the domestic industry,” Tim Brightbill, a trade attorney told Bloomberg.

The enforcement pressure falls on companies listed as importers of record and includes large-scale renewable energy developers as well as the US division of foreign module suppliers such as Canadian Solar, Jinko Solar, JA Solar, and Trina Solar. Representatives of those manufacturers, as well as developer NextEra Energy, didn’t comment on the matter. Chicago-based developer Invenergy said it doesn’t have a stockpile of affected modules, having imported supplies to serve immediate demand tied to its projects under construction. “All modules that we imported into the US have been deployed at project sites to meet domestic energy demand across the country, including a de minimus number of modules being held on site for parts and maintenance,” said Art Fletcher, Invenergy’s executive vice president for domestic content.

Those costs will likely get passed along, making solar installation more expensive, said Steve Cicala, an associate professor at Tufts University. “And the more expensive it is to do that, the fewer people are going to do it,” Cicala said. He sums up the dilemma this way — if we really want to tackle climate change, we should be deploying the most cost effective solar, even if it’s imported. The issue, of course, is that lots of people talk about tackling climate change but few really care to do the heavy lifting necessary, especially if it is contrary to their own self interest.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy