Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

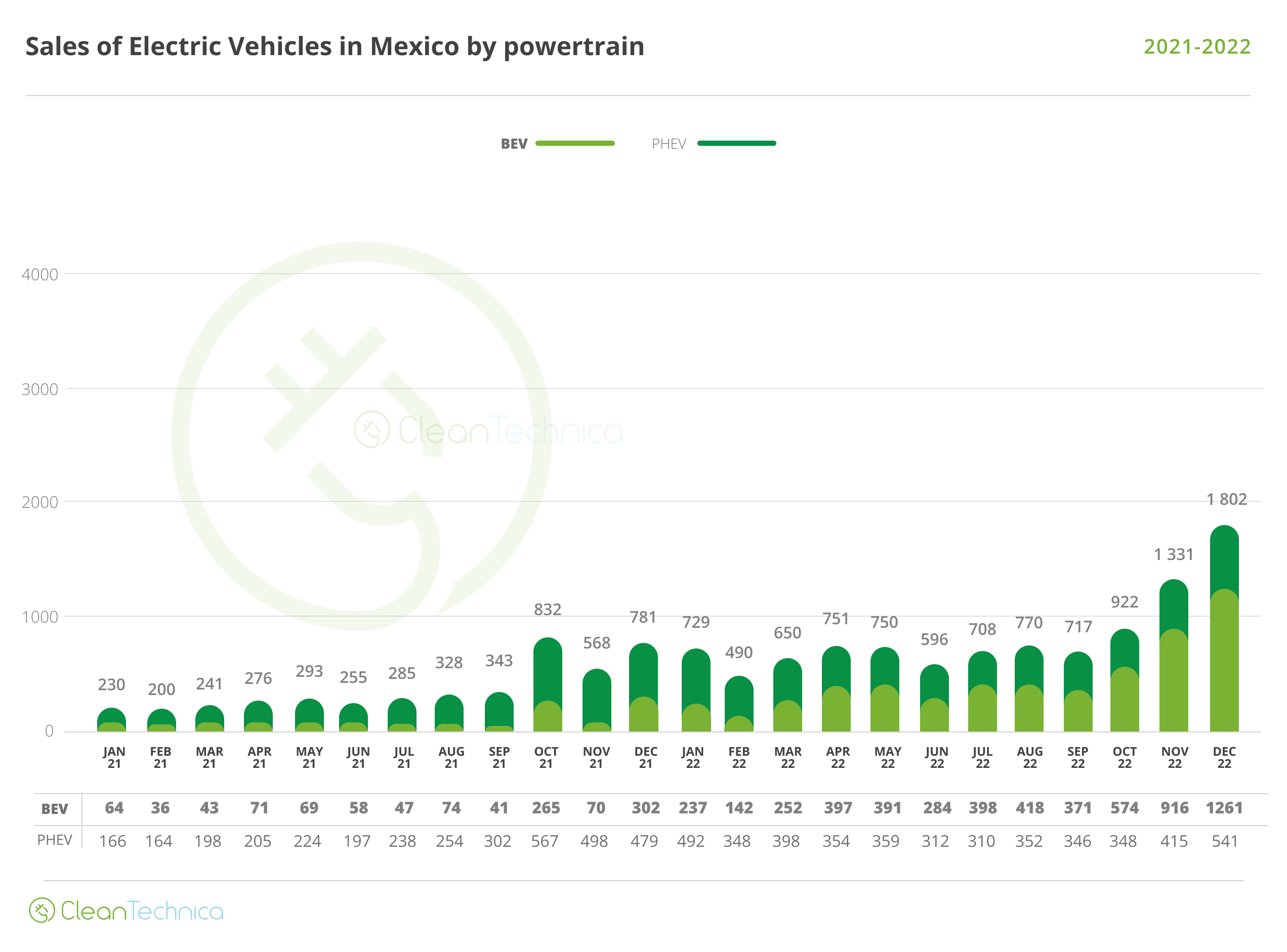

Home to the largest and most competitive auto industry in Latin America, Mexico was a latecomer to the electrification race, presenting marginal EV sales until late 2021 (with sub-0.1% BEV market share). Back then, this was a PHEV-focused market, with plug-in hybrids at least able to make some presence, and BEVs all but absent from the market. See the following chart for 2021–2022:

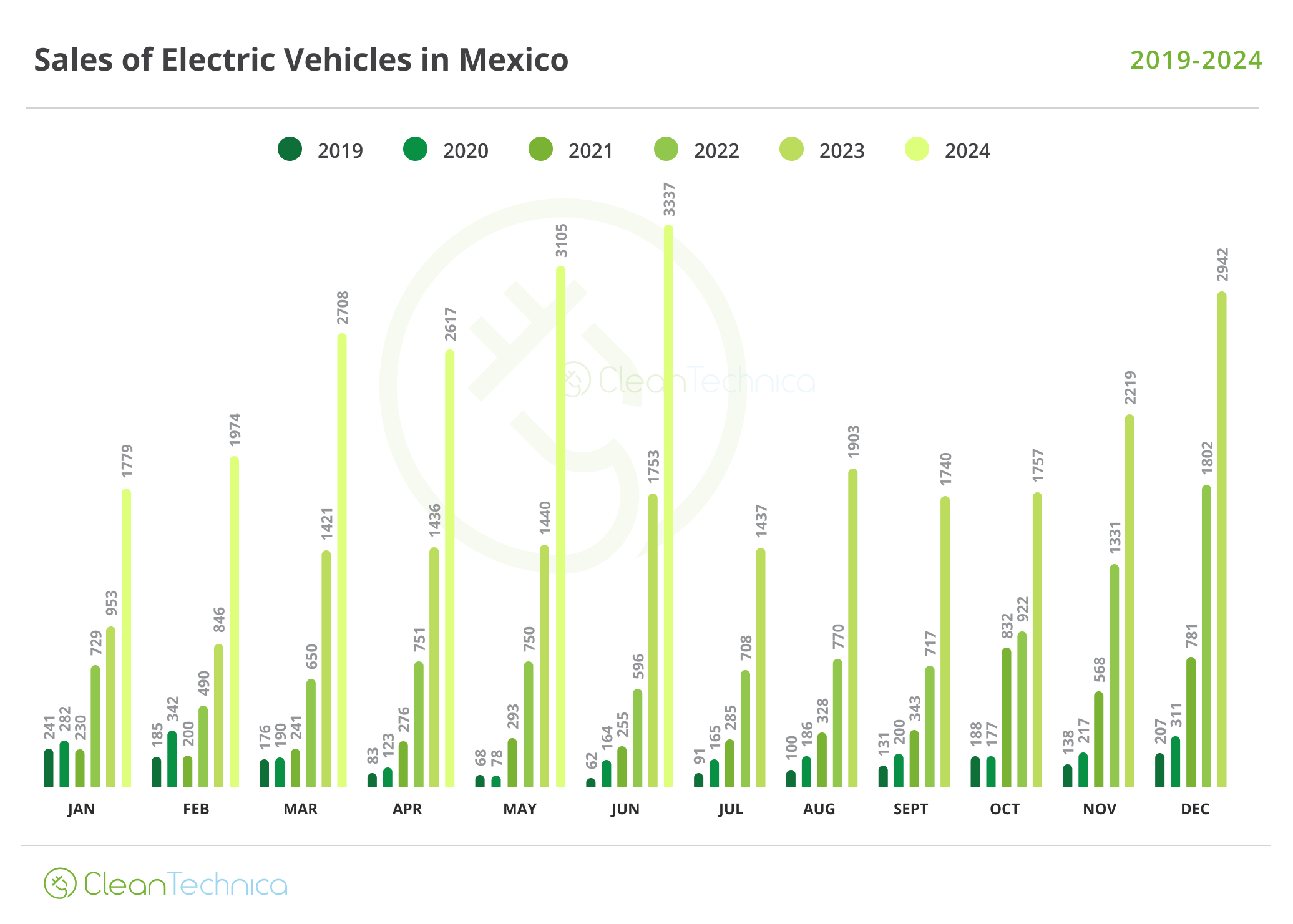

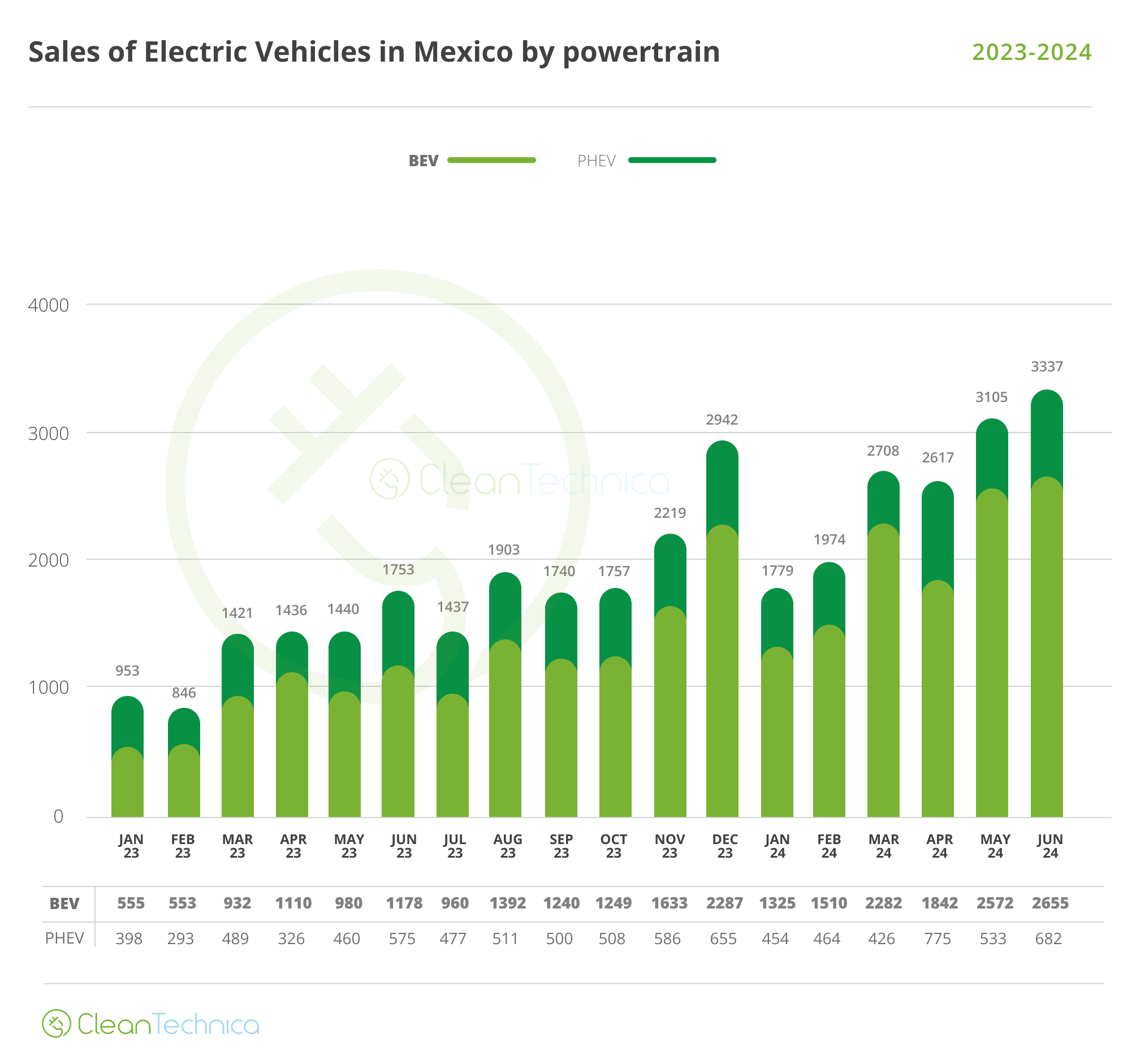

The last three years have brought consistent growth YoY for EVs (~100% each year). Though, it’s BEV sales that have exploded (400% growth in 2022, 300% in 2023) while PHEV sales have grown by much less (~25% growth in 2022 and 2023). EV growth remains high in 2024, and with Mexico becoming an arena where Chinese EV makers will fight established US manufacturers, it undoubtedly remains one of the most interesting markets to follow.

General Market Overview

So far, 2024 has brought consistent growth in EV sales, not only YoY, but also month on month — March, May and June all presented new records in the country.

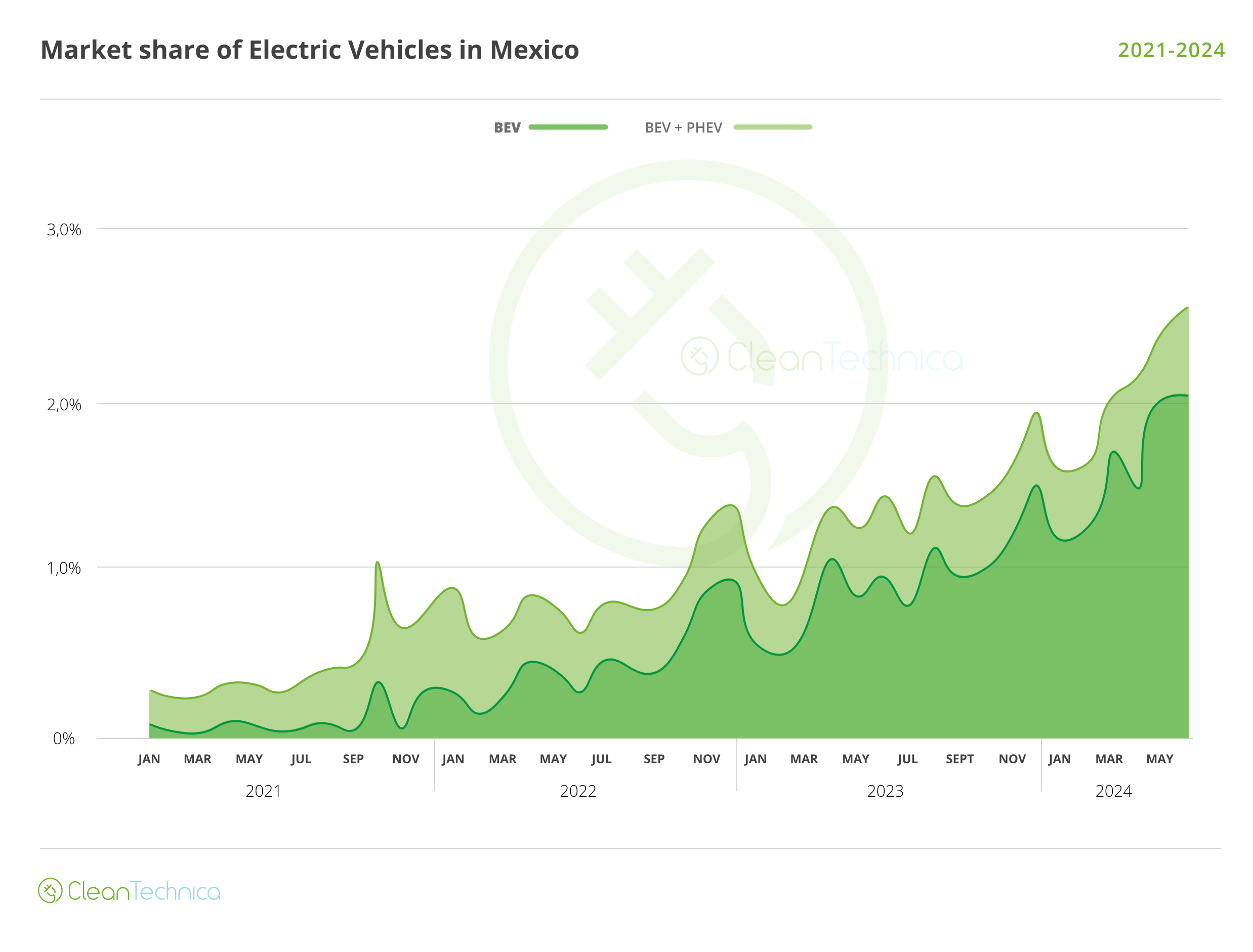

Market-share wise, Mexico lags the regional leaders (Costa Rica and Uruguay) and the “second tier” markets (Colombia and Brazil), but it’s nonetheless an important player, having just surpassed 2.5% share (2% for BEVs alone) in June, up from 1.2% a year ago.

It is clear from this graph that PHEV sales are almost constant, and even though they did increase YoY, this was because they fell in H1 2023:

We Don’t Know The Market Leaders … But We Can Guess

There was an issue when working on this report: we have no idea who’s leading the Mexican market.

The information presented by Mexico’s official institutions only tracks model sales by manufacturers who have joined the Mexican Automotive Industry Association … and the likely leaders of the market (Tesla, BYD, and perhaps SEV) don’t belong to it. This means that even though we have access to aggregate data on EV sales, we only have specific data for models from the other manufacturers.

Checking that very long list and looking for all the EVs that hide in there, we found that the Volvo EX30 has been an unsurprising success, registering 1,561 units during the first six months of 2023. JAC also has a couple of decent selling models (the E-Sunray van, with 1,001 sales, and the affordable E10X, with 874 sales), followed by the ORA 03 (517 sales) and the Renault Kwid E-Tech (250 sales). The presence of China in this list is undeniable even without BYD!

There’s more information we can guess with the available data. Total BEV sales during 2024 have amounted to just over 12,000 units, yet I only managed to track half of them in the list when it comes to models: this means that BYD, Tesla, and SEV own half of the Mexican EV Market. And even though SEV has been making an effort to become a recognized brand in Mexico, I doubt it’s a big player yet. This basically means that BYD and Tesla, together, are likely to have at least 5,000 registrations so far this year, and perhaps a little more. I’d wager that above all, the EVs previously listed lie below the BYD Seagull, Tesla Model 3, Tesla Model Y, and BYD Song (probably in that order).

At last, it’s interesting to note the absence of Hyundai/Kia in this list. The Hyundai Kona is absent altogether, the Kia Niro is only sold as an HEV, and the EV6 and Ioniq 5 have fewer than 60 sales each. Kia is planning EV manufacturing in Mexico in the near future: could it be that it’s waiting for local production not to cannibalize its current factories in the country?

Mexico Ramping Up EV Production

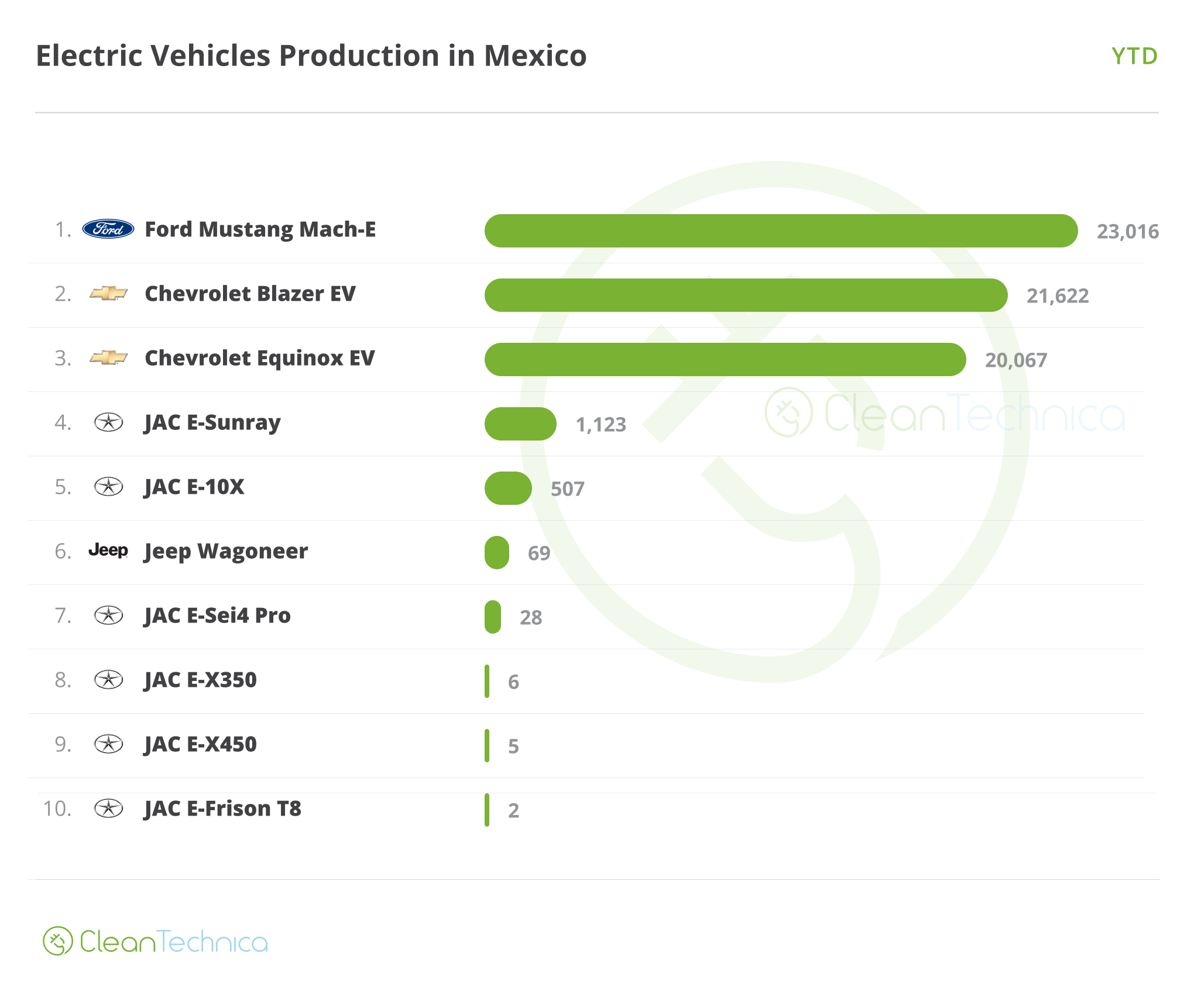

Mexico is perhaps the only country in the world where sales data by model are not readily available, but vehicle production data is. This means that even though we cannot present the market leaders as far as registrations go, we do have some interesting data regarding EV production so far this year:

Much has been said about Chinese brands coming to produce on Mexican soil, but it’s clear for now Mexico remains the turf of US brands, specifically Ford and GM. The aging Ford Mustang Mach-E is the leader as far as production goes, but nearly 100% of these went to the US or elsewhere (only 72 were sold in Mexico); the Ultium siblings follow closely behind (with no registrations in Mexico) … and in a distant fourth place, there’s the JAC E-Sunray van.

Mexican production is determined first and foremost by US demand, so not much can be read into this data regarding Mexico specifically. However, as one of the main manufacturing hubs in all of the Americas, Mexican production can be used as a proxy to find out what’s going on in other markets, mainly — but not exclusively — the US.

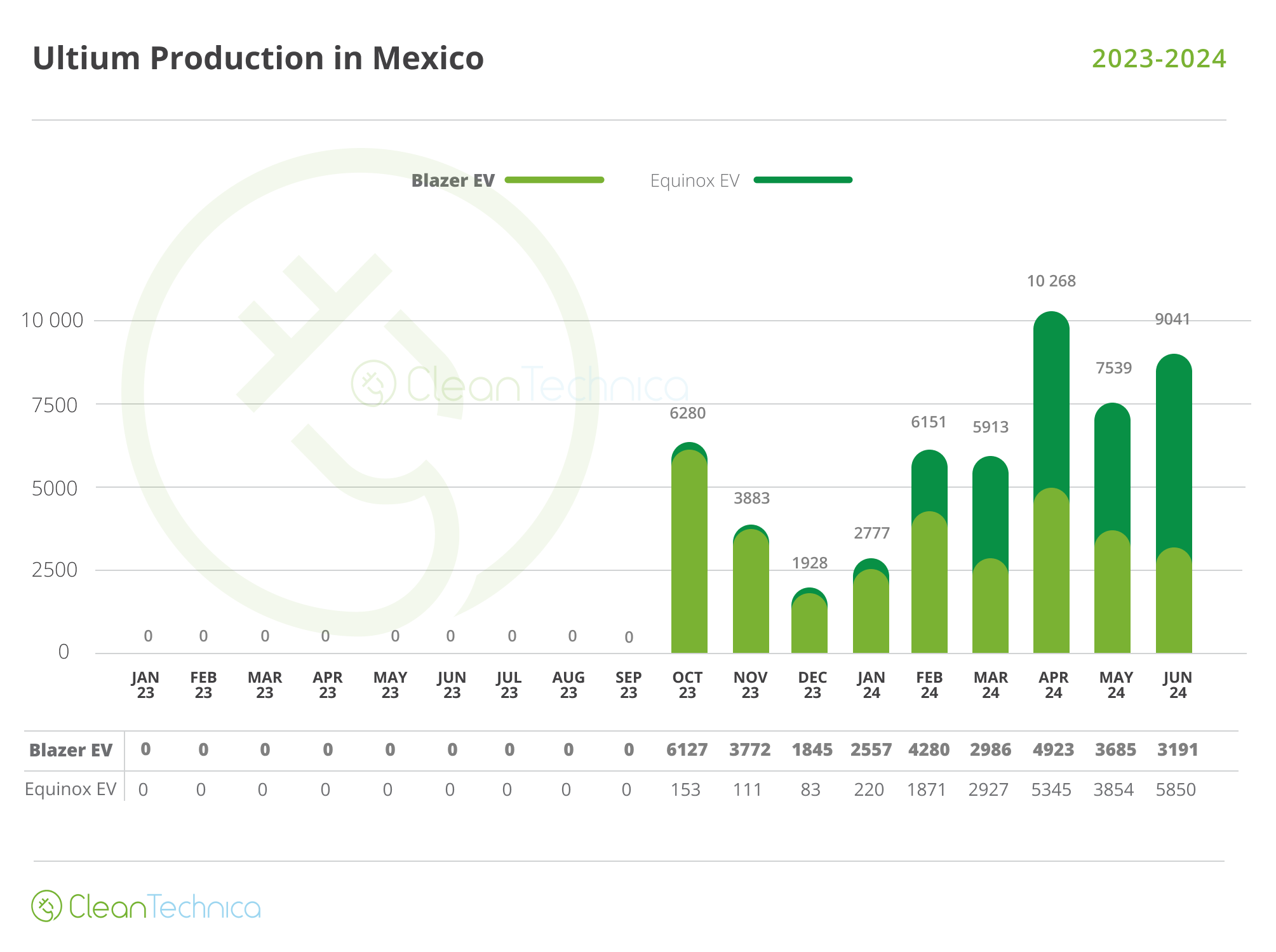

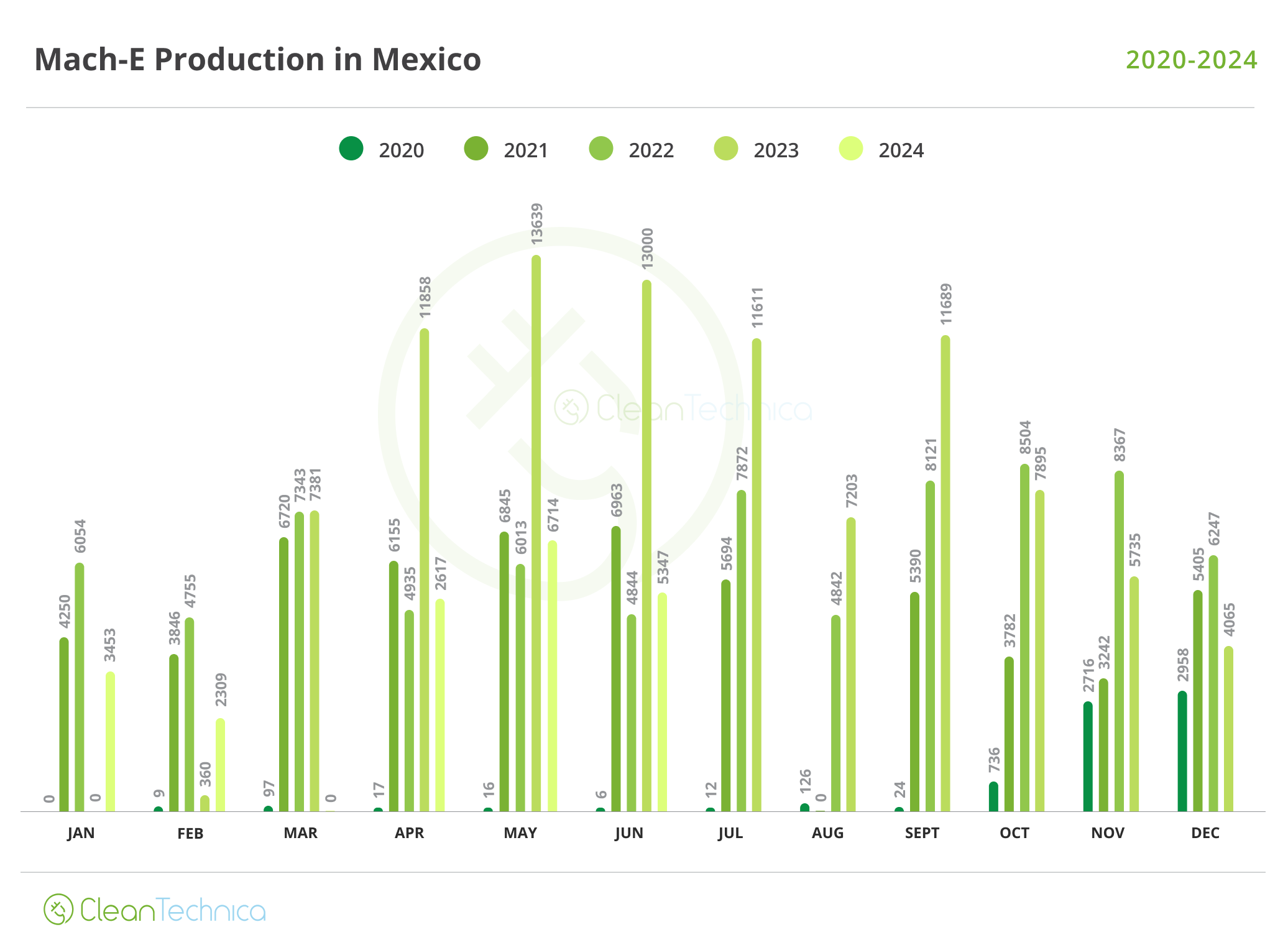

An interesting contrast appears between the ramp-up of the Ultium siblings (Blazer and Equinox EV) and the declining production of the Mustang Mach-E. The former are supposed to become the cornerstone of the Ultium ramp-up for General Motors and will start sales in Mexico in the following months. Production peaked in April, but June wasn’t far behind, and, if sales keep up, we should see even larger numbers in the months to come. I’ve said it before, but it bears repeating: I have high hopes for the Equinox EV in the Latin American market.

(Oh, and don’t let October’s data fool you. The Blazer had been in production since early 2023 — Chevrolet merely registered an entire semester’s production in that one month, and hence the high number.)

Meanwhile, the Mach-E has been suffering from some serious blues, and production nowadays falls far below its peak a year ago. It frankly surprises me that after a 4-year ramp-up, Ford seems to be unable to both make a profit on this vehicle and sell it at a price that brings enough demand to sustain mass production. If (and this is a big if) GM manages to get a profit on the Ultium siblings by late 2024, as Ibarra say they would, it means the company will have managed to do in two years what Ford couldn’t do in four.

Following our list, as far as JAC goes, its production supplies most of Latin America’s demand for this brand, meaning both the E-Sunray and the E10X are the most demanded models south of the Rio Bravo (while the E-Sei 4 and others seems to be on their way out). This fits the information available in other markets … and frankly surprises me: the E-Sei 4 (E40X in some markets) is one hell of a good-looking CUV.

At last, it seems Jeep is starting production of the Wagoneer. I’m not a fan of very large SUVs, but every EV out there is one less ICE vehicle, so I wish this huge Jeep the best of luck. May you eat the market share of your gasoline-thirsty brothers!

Final Thoughts

Mexico departed from a low base, but it’s been growing for a long time now, enough to claim this is a consistent trend. More importantly, as well as YoY growth, there has been growth month on month, which means the arrival of affordable EVs is making a difference and we’re seeing a constant increase in interest.

However, 2.5% is still too low, and particularly so for a market as large as Mexico. Inertia is a powerful force, and while some smaller markets may change much faster, I have my doubts Mexico will be able to do so before significant EV production ramps up in the country. The good news is: that moment should not be too far away.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy