Metal price forecasting is essential for businesses that buy metal, particularly when dealing with commodities like copper, steel, and aluminum. By precisely projecting future metals prices, companies may make educated judgments regarding their purchasing strategy and ensure that they acquire the metals at the most advantageous periods. Companies that understand the importance of metal price forecasts can also increase productivity and cut expenses.

The erratic character of metal markets is one of the primary reasons that metal price forecasting is so important. The price of steel, aluminum and copper may vary greatly depending on a number of variables, including weather, geopolitical events, supply and demand dynamics and economic conditions. Without metal price forecasting, metal purchasing organizations could end up buying metal at exorbitant prices, which raises operating expenses.

Methods for Metal Price Forecasting

Forecasting metals prices is a complicated procedure that includes examining market patterns, historical data, and a number of outside variables. Metal price forecasting relies on a variety of techniques, such as fundamental analysis, econometric models, and statistical models, all of which are covered in MetalMiner’s free resource, Squeezing Out Costs in a Falling Demand Market.

Statistical models make use of mathematical methods to find trends and patterns in past pricing data. Regression analysis, time series analysis, and other statistical techniques often serve as the foundation for these models, ensuring that metal buying businesses can forecast future price changes by projecting these trends into the future.

In addition to historical pricing data, econometric models also account for inflation, interest rates, GDP growth and other economic factors. In order to provide the most accurate projections possible, these models employ statistical approaches to identify correlations between these factors and specific metal commodities.

Fundamental Analysis and Metals Prices

Analyzing the underlying variables that influence metal prices, such as manufacturing costs, supply and demand dynamics and worldwide economic trends, is known as fundamental analysis. Companies that buy metal can more confidently predict future price swings the more they understand these factors. By combining various methodologies and taking as many elements into account as possible, firms can gain significant insights into how they can improve the accuracy of metal price forecasts. Get weekly tips about metal market insights and how price forecasting can revolutionize your purchasing strategies with MetalMiner’s weekly newsletter.

Benefits of Metal Price Forecasting for Metal Purchasing Companies

Metal purchasing organizations can profit from metal price forecasts in a number of ways. For instance, businesses can minimize operating expenses by strategically timing purchases to capitalize on accurately predicted metal prices.

Furthermore, by using forecasting, businesses may recognize and reduce any risks related to changes in the price of metals. Organizations can also significantly reduce the impact on their profits by changing prices proactively and utilizing strategic decision-making.

How MetalMiner Revolutionizes Metal Price Forecasting

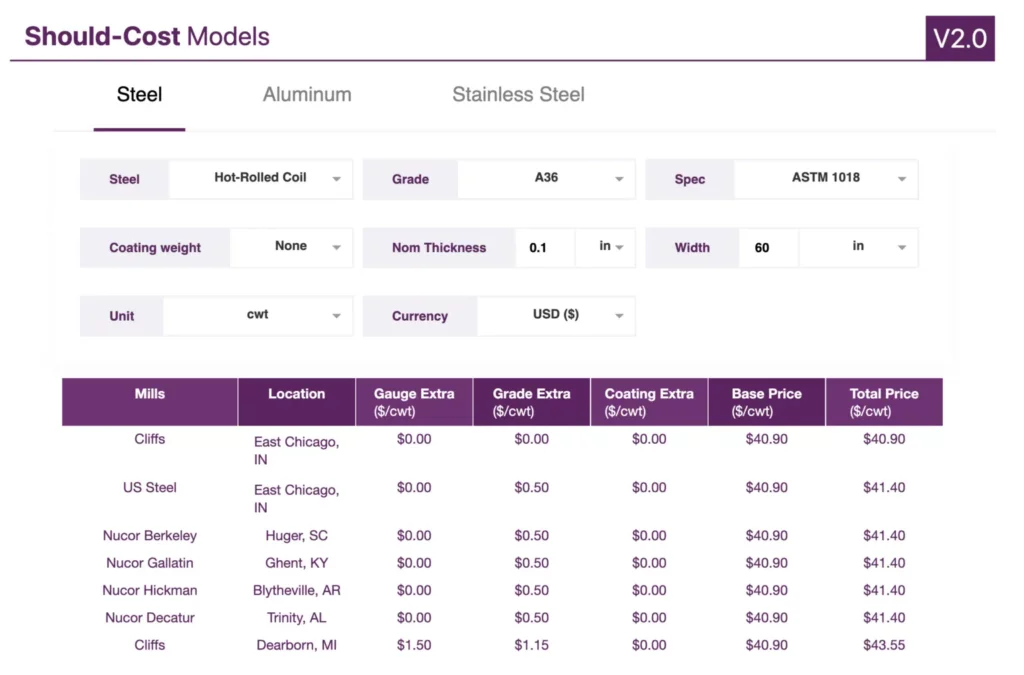

Through its platform, MetalMiner Insights, MetalMiner is revolutionizing the way metal purchasing firms approach price analysis. By utilizing sophisticated algorithms and thorough data analysis, MetalMiner provides dependable and precise metal price projections, assisting businesses in making well-informed decisions.

MetalMiner combines statistical models, economic models, and fundamental analysis to generate precise projections of metals like steel, aluminum, and copper. Its advanced algorithms also examine a tonne of historical data, industry trends, and outside variables to provide useful insights to metal buying organizations around the world.

Accurately report the impact of metal market volatility on your earnings to leadership and executive teams with MetalMiner’s Monthly Metals Outlook and use metal price forecasting to your advantage. Review a free sample report and then subscribe.