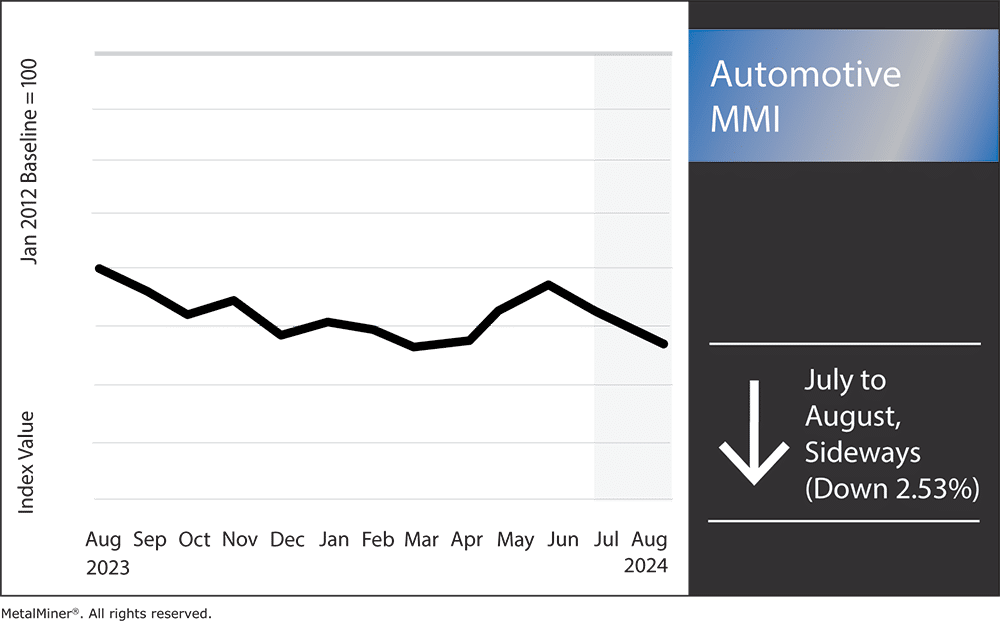

The Automotive MMI (Monthly Metals Index) maintained a steady sideways trend month-over-month, only moving down 2.53%. Overall steel demand remains tepid, which left little bullish sentiment for hot-dipped galvanized steel. Meanwhile, other metals prices, including copper, dropped after their speculative rallies cooled off in July. Overall, the components of the automotive index had little to show in terms of bullish price action, leaving metals prices fairly level.

The automotive market has only managed to add a little support to most metals, with demand as a whole remaining quite weak. As EV continues to fail to meet estimates, metals like copper and rare earth elements can not get the boost they need.

Low metal demand? Get proactive with MetalMiner’s weekly newsletter. Subscribe now and stay ahead of demand pitfalls.

Metals Prices Lower than Expected Amid Weakening EV Demand

In recent years, experts projected that the “electric vehicle revolution” would increase both metal demand and metal prices, especially when it comes to rare earth elements and crucial raw materials like lithium, cobalt, and nickel. However, the U.S. metal markets continue to suffer from lower-than-expected EV demand.

Several variables prevented the expected boom in EV adoption from happening at the predicted rate. The high cost of EVs continues to hinder the market’s growth, as does the lack of a widespread infrastructure for charging them and persistent consumer anxiety regarding range. All in all, consumer acceptance of electric vehicles has not kept up with the output of automakers like Tesla, Ford and General Motors.

Metals markets are more severely affected by slowdowns in EV demand than other markets. EV batteries require large amounts of lithium, cobalt and nickel. However, global demand for these essential raw resources continues to decrease due to EV production rates failing to meet projections. In the cases of cobalt and lithium, this continues to stoke an excess supply, causing prices to stagnate and hindering investment in new mining operations.

MetalMiner’s monthly free MMI report gives monthly trends for 10 different metals prices, including copper, stainless, aluminum and precious metals. Sign up here!

Slower EV Growth Could Hinder Climate Targets and Metals Prices

The ramifications of lackluster EV growth go far beyond these metal components. For instance, the decline in demand also continues to negatively impact the manufacturing and processing sectors of the metal industry. For example, manufacturers of EV infrastructure and battery parts are also seeing slower growth, which affects the labor market and economic activity in areas dependent on these businesses.

Another issue revolves around delays in the expected environmental benefits of mainstream EV adoption. The fact that there are fewer EVs on the road than anticipated means greenhouse gas emission reduction efforts are falling short of targets, which puts larger climate goals at risk.

The U.S.’s weakening demand for electric vehicles is a reminder of the challenges that come with adopting new technologies. While the electric vehicle revolution is still in its early stages, its trajectory is proving to be not quite as straight as predicted. This fact has important ramifications for the metal markets, which were counting on a strong increase in demand for EVs. Going forward, stakeholders will need to recalibrate expectations and plans as they traverse this changing terrain. This will help ensure that both are in line with real market dynamics.

Will U.S. Vehicles Restrict Chinese-Made Software?

The U.S. is considering banning certain types of Chinese-made software in autonomous vehicles. This decision, driven by mounting security concerns, could reshape the landscape of the automotive and technology sectors.

In the past few years, concerns over national security and data security have become more and more prevalent. Since most autonomous cars rely on intricate software systems to operate, they are vulnerable to hacks from various bad actors.

Meanwhile, the use of Chinese software presents an even larger concern because these cars gather a lot of data, which could potentially include personal and location information. Authorities worry that foreign entities may access and utilize this data, jeopardizing user privacy and national security.

The possibility of cyberattacks and security breaches remains the primary source of anxiety. There is also the issue that Chinese software companies may be required to give the government sensitive data due to Chinese government laws. Autonomous vehicles pose a significant concern as they are not just a transportation innovation but also an essential part of the infrastructure.

Removing the possibility that Chinese software could obtain confidential information would enhance both national security and vital infrastructure. It would also emphasize the significance of protecting digital systems against external attacks and set a precedent for other high-tech enterprises.

Strengthen Cybersecurity Amid Potential Chinese Software Crackdown

Prohibiting certain types of Chinese software could also promote economic growth, as it would incentivize U.S. businesses to create their own software solutions for driverless vehicles, resulting in a rise in R&D spending. This might lead to a more competitive tech sector where American companies would lead the way in developing cutting-edge technologies.

Additionally, the ban could fortify ties with other nations that have similar reservations about Chinese technology. In such an event, the U.S. and its partners could unite against possible cyber threats by exchanging in best practices and working together on security measures. Beyond the auto industry, this collaboration may impact more general defense and technological plans.

Automotive MMI: Notable Shifts in Metals Prices

Are you under pressure to generate metal? Make sure you are following these 5 best practices of saving money on your metal sourcing.

- Lead prices moved sideways, dropping a slight 0.79% to $2,687.24 per metric ton.

- Hot-dipped galvanized steel prices also fell. In total, prices dropped by $1,067 per short ton.

- Lastly, Korean aluminum 5052 coil premium over 1050 traded flat, remaining at $4.18 per kilogram.