These deficits likely will slow global decarbonization efforts by raising supply-chain costs and, consequently, the prices of lower-carbon products, McKinsey said in a report released Wednesday. Trafigura Chief Executive Officer Jeremy Weir and BloombergNEF have expressed similar concerns.

Nickel, necessary for the lithium-ion batteries that power electric vehicles, is expected to face shortages of about 10% to 20% by 2030, while dysprosium, a rare-earth element commonly used in electric motors, may experience deficits of as much as 70%, McKinsey said. Supplies of copper, lithium, cobalt, iridium and tin also may be crimped.

Metals Worth $6 Trillion Needed for Global Energy Transition

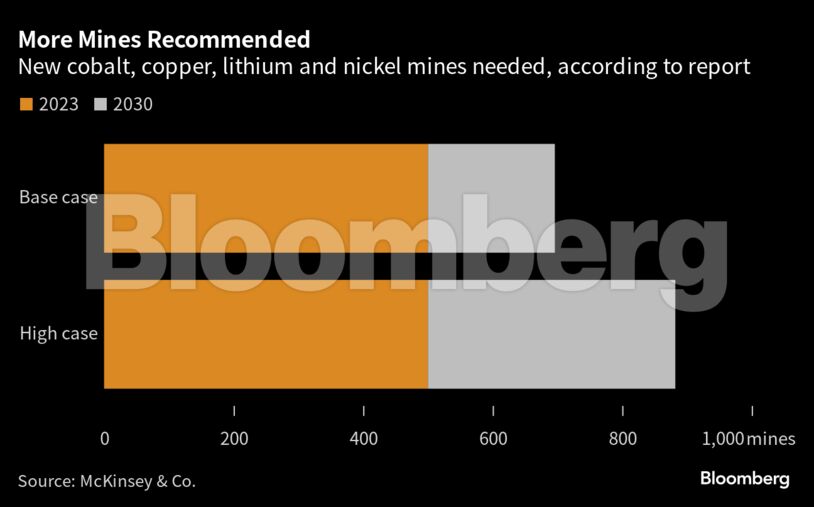

The number of the approximately 500 cobalt, copper, lithium and nickel mines operating today will need to increase by as much as 76% to almost 900 in order to meet demand for batteries, the McKinsey analysts wrote.

The materials shortage would result in an additional 400 million-600 million tons of greenhouse gas emissions in 2030, the report estimates. That would blow through international plans to limit global temperatures as set out in the Paris climate accord.

McKinsey recommends investments in mining, refining and smelting increase to between $3 trillion and $4 trillion by 2030 — a 50% annual increase compared with the previous decade.

Share This: