ach week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here.

After a contentious vote, Pipestone Energy Corp (Pipestone) shareholders ultimately approved the deal to be acquired by Strathcona Resources Ltd. (Strathcona). Strathcona will now operate as the 5th largest oil producer in Canada, with a reported pro forma production of approximately 180,000 BOE/day, and a market cap of approximately $8.6B. Following the transaction, Strathcona will become a publicly traded company in Canada.

When assessing this transaction through different lenses using AssetSuite software tools, we looked at each company’s asset profile, plus the combined entity, to gain valuable insight into the transaction.

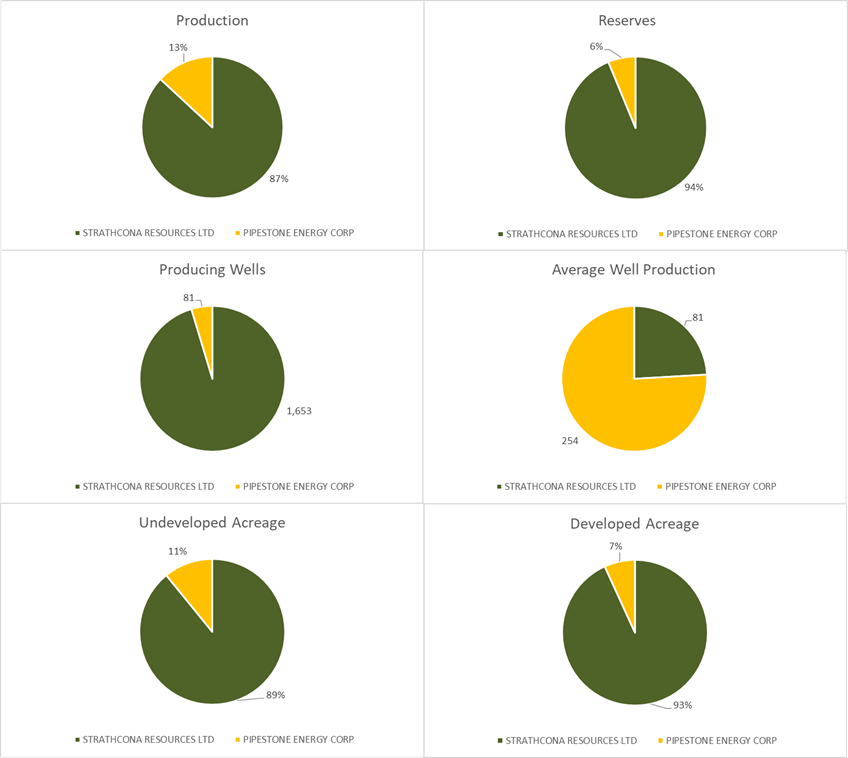

Strathcona contributes 87% of the production to the combined entity. The companies are relatively similar in terms operatorship (licensee on file) in that both have a high percentage operatorship with Strathcona at 97% and Pipestone at 98%. However, Pipestone has more partnerships with an average Working Interest (WI) BOE of 75% compared to Strathcona’s 94%.

Figure 1 – Working Interest values for Pipestone (orange) and Strathcona (green). Source: AssetBook

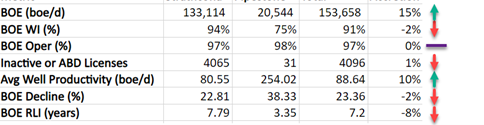

While the absolute numbers tell one story, accretion and dilution metrics tell us more. Looking at the AssetSuite summary, we can calculate some accretion and dilution metrics for this transaction relative to the increase in production.

Per Figure 2 below, Strathcona’s production base grew by 15%, operatorship was neutral and BOE working interest decreased by 2%.

Figure 2: Deal Metrics. Above numbers are based on three-month average to August production with raw gas numbers at a 6:1 gas to oil conversion production. Source: AssetBook LCA Report

As we can see, contribution of inactive licenses did have a net negative effect but by a minimal amount compared to the increase in boe/day and average well productivity.

Of note, in its strategic rationale for the merger, the Pipestone board specifically mentioned the addition of significant tax shelter to optimize. As discussed in XI’s Whitepaper: The Tax Man Cometh – How Strategic Acquisitions Can Help Your Issue, Pipestone was outpacing the replacement of resource tax pools and anticipated generating taxable income in late 2023. The combined entity now has $3B of tax pools which may be used immediately, deferring taxes to 2026.

CORE AREA

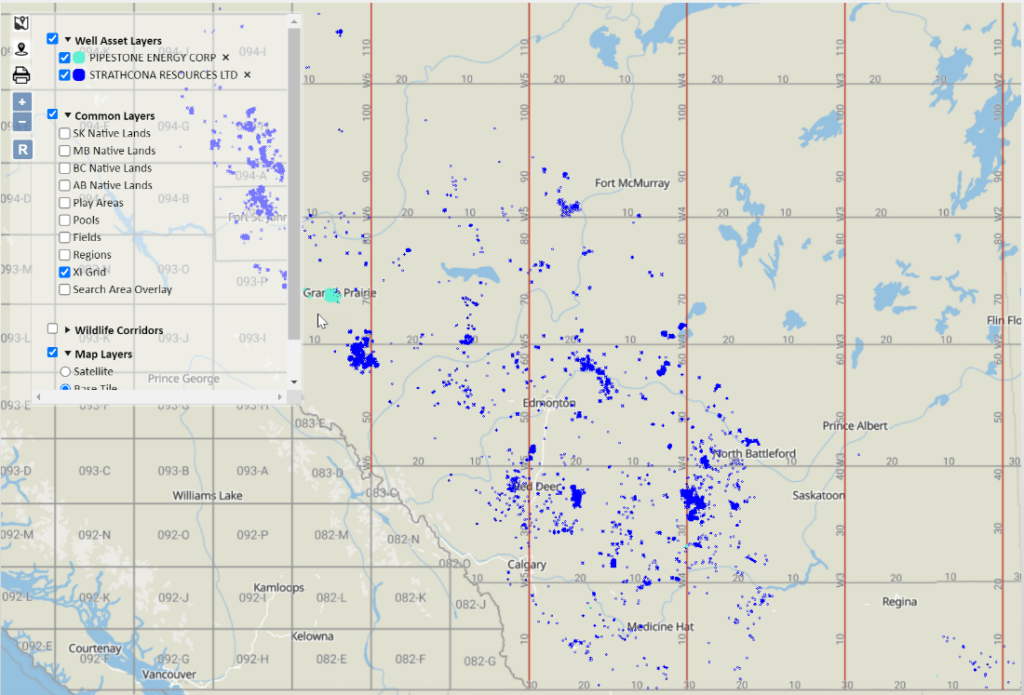

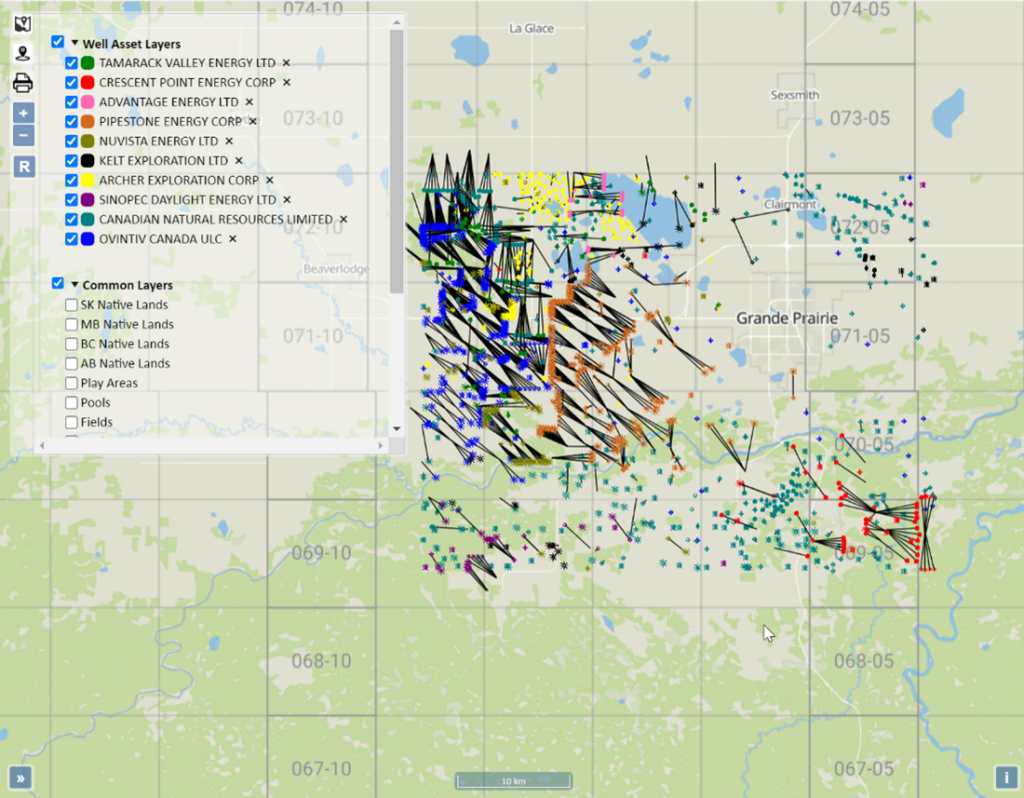

The core of this deal is the Montney in XI’s Grande Prairie Region.

Figure 3 – Map of Strathcona and Pipestone Assets. Source: AssetBook

Augmenting Strathcona’s Montney assets, this acquisition fits well into their portfolio. Strathcona is primarily an oil company with just under 80% of their production from oil and a large percentage of their assets coming from the Clearwater. Pipestone’s assets will fit well as they are liquid rich Montney assets which is also important to Strathcona’s strategy.

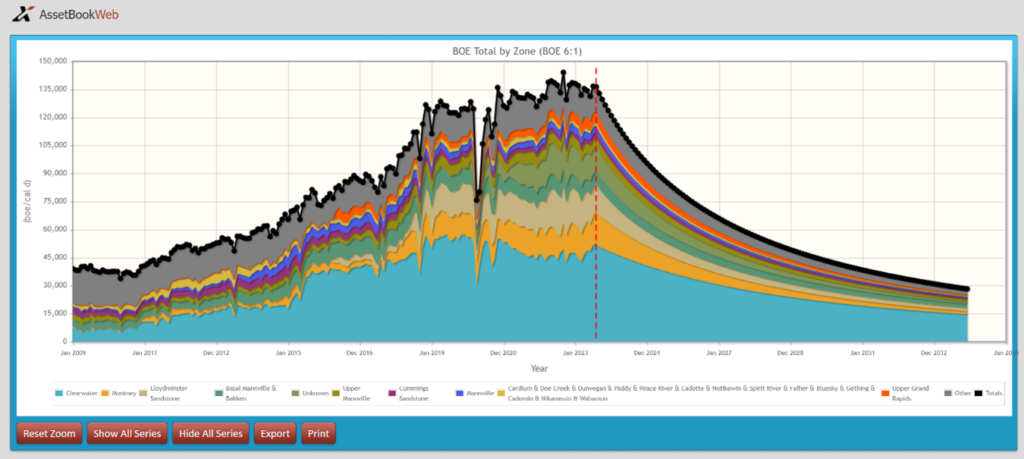

Figure 4 – Strathcona Production by zone. Source: AssetBook

With the AssetBook we can create an area around Pipestone’s assets and see all other players. Ovintiv Canada ULC (Ovintiv) is the largest player in this area with approximately 48,000 boe/d of production. This area makes up 14% of Ovintiv’s production. Notably, this area makes up 56% of Archer Exploration Corp’s production as the 5 largest in the area with approximately 4,550 boe/day of production. There are 85 companies with ten or more boe/day of production in this area. Download more information on the companies in this area here.

Figure 5 – Top 10 companies in Core Area. Source: AssetBook

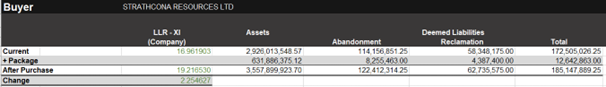

Liability Overview

Using an LLR analysis, Strathcona is in a strong position to absorb these liabilities. This deal is accretive based on original LLR calculations and current public government information, moving Strathcona from a strong 16.96 LLR score to a 19.22 score. According to AssetBook’s LLR Module (which only accounts for licensed assets), Strathcona will absorb $18,355,063 in deemed liabilities, mainly from Alberta.

Figure 6 – LLR for Strathcona – pre and post transaction. Source: AssetBook

While analyzing deals after they are announced is interesting, our tools provide the leg up required to look at your own deals or find deals proactively to create better value. For more results, contact XI Technologies to learn more about how XI’s AssetSuite software can analyze potential mergers, acquisitions, and opportunities, including examining potential liabilities and emissions. Visit XI’s website

Join us for the upcoming webinar on Estimating ARO for A&D on Thursday, October 19 at 10:00 a.m. MT.

When: Thursday, October 19 at 10 a.m. MT

Where: Zoom. Register here

Share This: