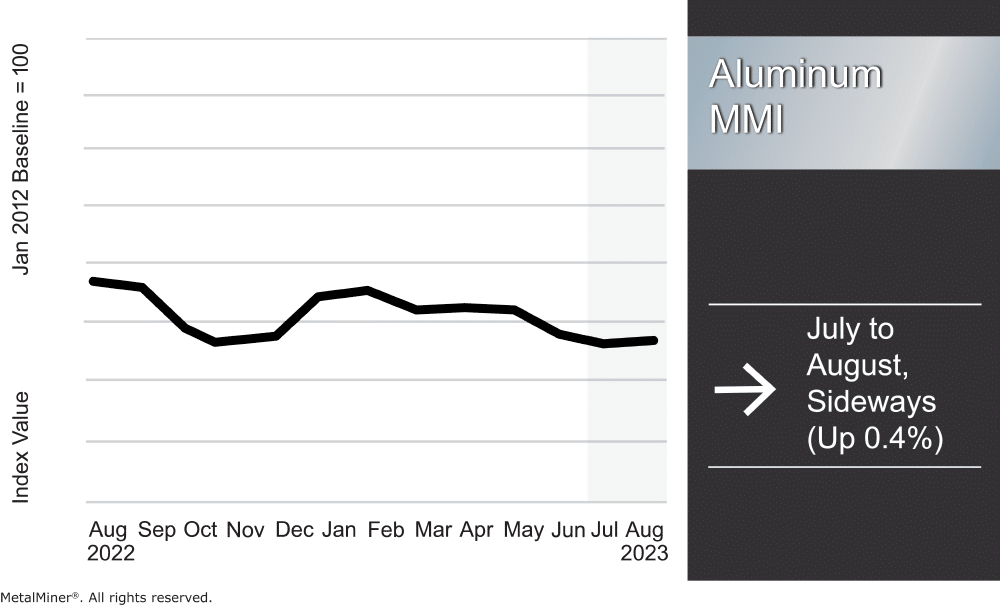

Although aluminum prices started to rebound in the short term, they have yet to breach ranges that would signal the beginning of a new trend. Indeed, prices continue to create an uncertain environment for the aluminum market due to the lack of direction.

Overall, the Aluminum Monthly Metals Index (MMI) moved sideways, rising a modest 0.4% from July to August.

MetalMiner’s 2024 Annual Budget & Forecasting Workshop is happening this Wednesday at 10 AM CST! Opt in to receive the recording VIA email if you’re unable to attend, as well as other free materials and resources from MetalMiner. Click here.

Norsk Hydro, Alcoa See Q2 Demand Fall, Impacting Aluminum Prices

While prices rose modestly during July, aluminum producers felt the pinch of lower demand last quarter. According to the company’s recent Q2 earnings report, Norsk Hydro’s EBITA (earnings before interest, taxes and amortization) saw a nearly 39% year-over-year drop during Q2. The company also noted lower aluminum, alumina, and extrusion sales, which weighed on its quarterly results. And though improved raw material costs helped offset weaker market conditions, Q2’s EBITA still marked an almost 6% drop from Q1.

Norsk Hydro was not alone in its results, as Alcoa also saw an even sharper decline. The company’s adjusted EBITDA fell almost 85% from Q2 2022. This reflects a nearly 43% drop from Q1. Yet despite these declines, Alcoa CEO Roy Harvey noted, “we expect to see financial improvement in the third quarter of 2023.”

Does your company have an aluminum buying strategy based on current aluminum price trends?

Falling Premiums Suggest Demand Remains Muted

Alcoa may feel optimistic about Q3, especially as Q3 opened with an over 4% rise in LME aluminum prices during July. However, the market continues to reflect pressured demand.

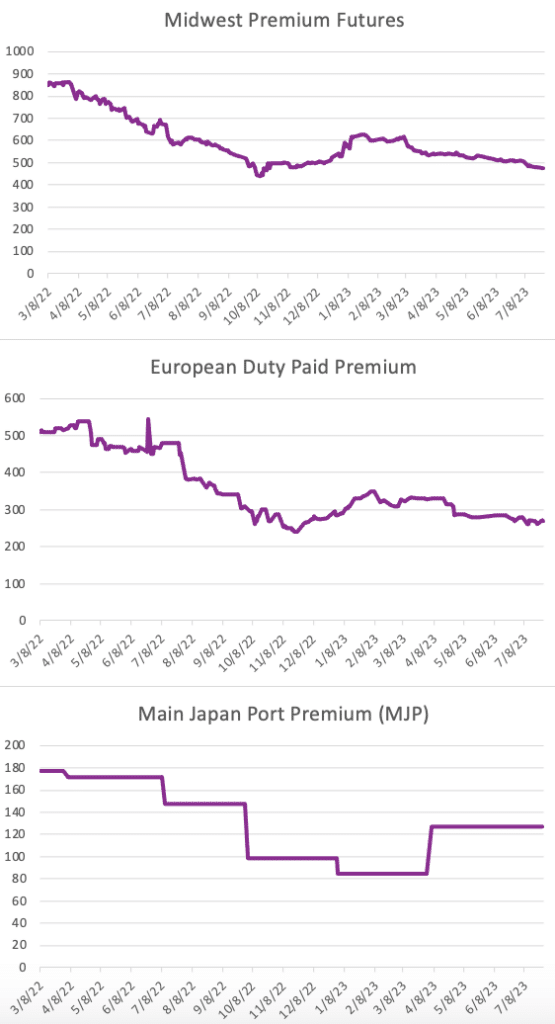

In the U.S., the Midwest premium has remained bearish since January, and currently sits at its lowest level since October 2022. While certain sectors, including the automotive sector, continue to post robust sales, weakness elsewhere has translated to lower demand and, thus, a lower regional premium. Meanwhile, the ongoing contraction of the U.S. manufacturing sector has yet to show any meaningful turnaround. Until it does and funding delays related to infrastructure projects resolve, the U.S. market appears likely to remain soft.

Meanwhile, the European duty paid aluminum premium also continues to decline. Prices peaked weeks after the Midwest premium but have nonetheless fallen over 23% since early February. As in the U.S., Europe’s manufacturing sector also remains weak. In July, the Eurozone Manufacturing PMI fell deeper into contraction territory to 42.7, the lowest in three years.

Finally, the Main Japan Port Premium appears relatively stable. This serves as a proxy for Asian demand, as Japan remains the leading aluminum importer within Asia. Still, the Q2 premium fell slightly from the Q1 range of $125-130/mt to $127.50/mt. However, muted Asian demand poses a downside risk to prices, especially as Chinese capacity returns from drought-related outages and economic Chinese growth continues to disappoint markets.

These metrics are significant for the US aluminum industry and will benefit buyers, producers, and traders looking to manage price risk. Related article: The 5 Golden Rules for Sourcing Aluminum.

Amid Declines, Norsk Hydro Calls For Russian Aluminum Sanctions

Tighter market conditions and lower performance among aluminum producers appear to have renewed calls to sanction Russian material. According to Reuters, Norsk Hydro recently sent a letter to the LME urging the exchange to reconsider its position on admitting Russian-origin aluminum.

Indeed, Russian aluminum made up 80% of LME stocks in June. This was a considerable increase from the roughly 18% seen in October 2022. According to Norsk Hydro, Russian material carries an estimated $100-300/mt discount over material sourced elsewhere. Clearly, this could begin to weigh on LME pricing amid Russian aluminum’s current dominance within warehouses. Throughout the year, China leaned heavily on Russian supply. In fact, aluminum imports rose 10.7% during H1, with most of it coming from Russia. It still remains to be seen if this will affect aluminum prices long-term.

As capacity returns in China, it begs the question of whether the country can sustain such import volumes amid muted economic growth. If not, the likely consequence could be more Russian aluminum deliveries into LME warehouses. LME and CME prices have yet to see a meaningful bifurcation, which will likely prevent the LME from shifting its position in the short term. Moreover, some market participants remain in support of the LME’s current policy. To nobody’s surprise, Russian producer Rusal, which accounts for 6% of global supply, strongly rejected Norsk Hydro’s position. In a statement, the company noted, “Rusal considers these comments to be aimed at destabilizing the market and driving anti-competitive behavior…hence to the benefit of the competitor.”

Want monthly price trends for 10 different metal industries? Sign up for MetalMiner’s free monthly MMI report.

Biggest Changes with Aluminum Prices

- Chinese aluminum prices saw the largest increase, with a 5.1% rise to $2,074 per metric ton as of August 1.

- LME primary three month aluminum prices rose 4.18% to $2,242 per metric ton.

- European 5083 aluminum plate prices rose 3.66% to $5,341 per metric ton.

- Meanwhile, Chinese aluminum bar prices saw a modest 0.89% decline to $2,783 per metric ton.

- European 1050 commercial sheet prices fell 1.0% to $3,792 per metric ton.