Lithium has rapidly become a critical element in the race to dominate the tech and energy sectors, resulting in a powerful and profitable global lithium market. This is mainly because the element plays an indispensable role in lithium-ion batteries, which don’t just “charge” our smartphones and laptops but also power electric vehicles. As the global push for green energy intensifies, lithium’s importance continues to skyrocket, making it a key player in the urgent drive toward a sustainable future.

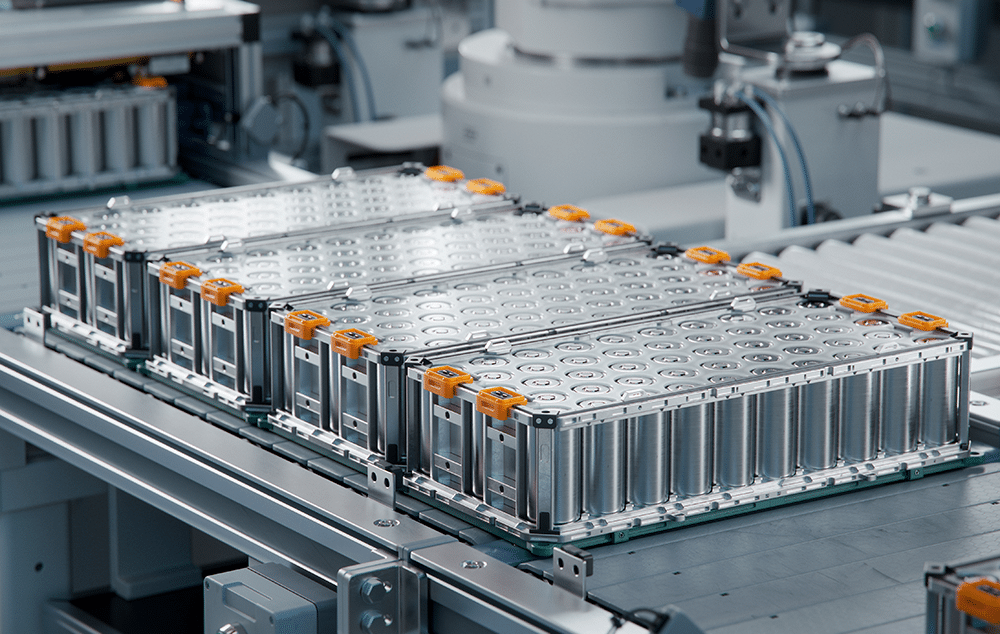

With their high energy density, long cycle life, and relatively low self-discharge rates, lithium batteries continue to drive advancements in industries ranging from consumer electronics to large-scale renewable energy storage. But does lithium demand truly match some experts’ predictions?

While lithium remains invaluable to green energy initiatives, over-mining and processing, particularly in China, have led to large stockpiles worldwide. It begs the question: will the ramp-up of green energy initiatives generate enough demand to drive significant bullish price action in the lithium market?

MetalMiner customizes price points, price forecasts and procurement solutions based on the specific battery metal type your company purchases. See MetalMiner’s full metal catalog.

Factors Fueling the Global Demand for Lithium

Lithium consumption continues to rise globally due to a host of factors. Currently, the fastest growth stems from the rapidly expanding market for electric vehicles. This comes as governments worldwide continue to pass stricter emissions laws and provide financial incentives to encourage the use of EVs. The European Union’s Green Deal, which aims to achieve carbon neutrality by 2050, exemplifies how policy continues to drive the increasing demand for lithium-ion batteries.

The need for advanced energy storage technologies to manage the intermittent power generation of the renewable energy sector is also driving demand for lithium. Lithium-ion batteries are the most popular choice for large storage devices in terms of collecting energy from sources like solar and wind.

Make informed sourcing decisions! Access MetalMiner’s free Monthly Metals Index report to understand economic metal price drivers through metal price charts and expert analysis.

Potential Lithium Market Speed Bumps: Challenges and Limitations

Despite this optimistic prognosis, several obstacles could hinder the progress of the global lithium market. The primary concern is whether the supply system can meet the rapidly increasing demand. After all, the complexity and resource-intensive nature of lithium mining and processing often cause significant supply bottlenecks.

Geopolitical considerations could also increase volatility. For instance, Australia, Chile, and Argentina have the largest concentrations of lithium reserves. Any political unrest or trade disputes in these regions could disrupt the supply chain, leading to unexpected price increases or even shortages. Stay ahead of geopolitical tensions which could impact your metal purchases with MetalMiner’s weekly newsletter.

The Counter-Argument: Why Some Analysts Predict a Slowdown

Despite the anticipated increase in lithium demand, many analysts advise caution regarding hedges related to the metal. Their reasoning stems from the speed at which the technology is developing, which may result in the invention of new techniques for storing energy. Solid-state batteries are one of the improvements that researchers continue to develop, with many believing they could someday outperform their lithium-ion counterparts.

Concerns of market saturation within the electric vehicle sector also continue to rise. These worries point to the fact that previous strong growth rates may slow down as the industry ages. Many also believe there may be less demand for fresh lithium extraction if the technology for battery recycling and reuse advances further.

Financial worries also come into play. Some analysts feel that demand for lithium could eventually decline if there is a downturn in the world economy, which would discourage investments in cutting-edge technology and infrastructure.

Lastly, the expansion of these markets has led to a huge push in lithium mining, causing large stockpiles to build up in some parts of the globe, like China. Such stockpiles can cause lithium prices to drop, offering buyers relief from higher costs. However, they can also cause global imbalances in the lithium market, which could contribute to supply chain disruptions. To stay ahead of market pitfalls and supply chain disruptions, read MetalMiner’s free resource Squeezing Out Costs in a Falling Demand Market.

Balancing the Scales: A Comprehensive Overview of Lithium’s Future

The growth of the global lithium market depends on a series of intricate, interrelated factors. On the one hand, the demand for lithium continues to increase due to the pressing need for sustainable energy solutions and the unstoppable rise of the IT industry. The push for innovation in electric vehicles and renewable energy storage systems highlights lithium’s key role in the current energy landscape.

However, significant obstacles, such as limited supply, environmental concerns, and impending technological advancements, stand in the way. These challenges may temper high expectations and lead to a more controlled growth trajectory.

While the global lithium market remains poised for substantial growth, navigating the potential obstacles with foresight is crucial. By addressing these challenges head-on, the industry can carve out a sustainable path forward, ensuring lithium’s continued critical role in the world’s urgent transition to a greener, more technologically advanced future.

Visually see where 2025 battery metal costs are projected to land with MetalMiner Insights’ comprehensive short and long-term price forecasts.