Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

After the first part of our report (which, admittedly, was a bit underwhelming), we’re finally getting to the countries where EVs are moving fast!

If you wish to read the first part of this report, you can find it here: Latin America 2023 EV Sales Report, Part 1: The Laggards (Argentina, Perú, Ecuador, Chile, Dominican Republic).

With no time to lose, let’s start!

#7. Panama (1.2% plug-in market share)

48,919 vehicles were sold in Panama during 2023, 434 of which were BEVs (0.9%) and 148 of which were PHEVs (0.3%), for a total of 1.2% market share.

Just like Chile, Panama is a wealthy country with access to affordable, clean electricity, and even shorter distances. But, unlike in Chile, Panama’s government presented Law 295 for electric mobility in January 2023, promoting the purchase of EVs and offering discounts and benefits for EV owners. As a result, BEV sales increased by 170% year on year, making it the first country on our list to surpass 1% plug-in market share. It remains to be seen what will come in 2024, but if the growth trend continues, Panama could become a very interesting market to follow:

PHEV sales in previous years could not be found, so it was not possible to calculate PHEV sales growth for 2023. The most sold EVs in the country were the BMW iX (79 units) and the BYD Yuan/Atto 3 (45 units).

#6. Mexico (1.3% plug-in market share)

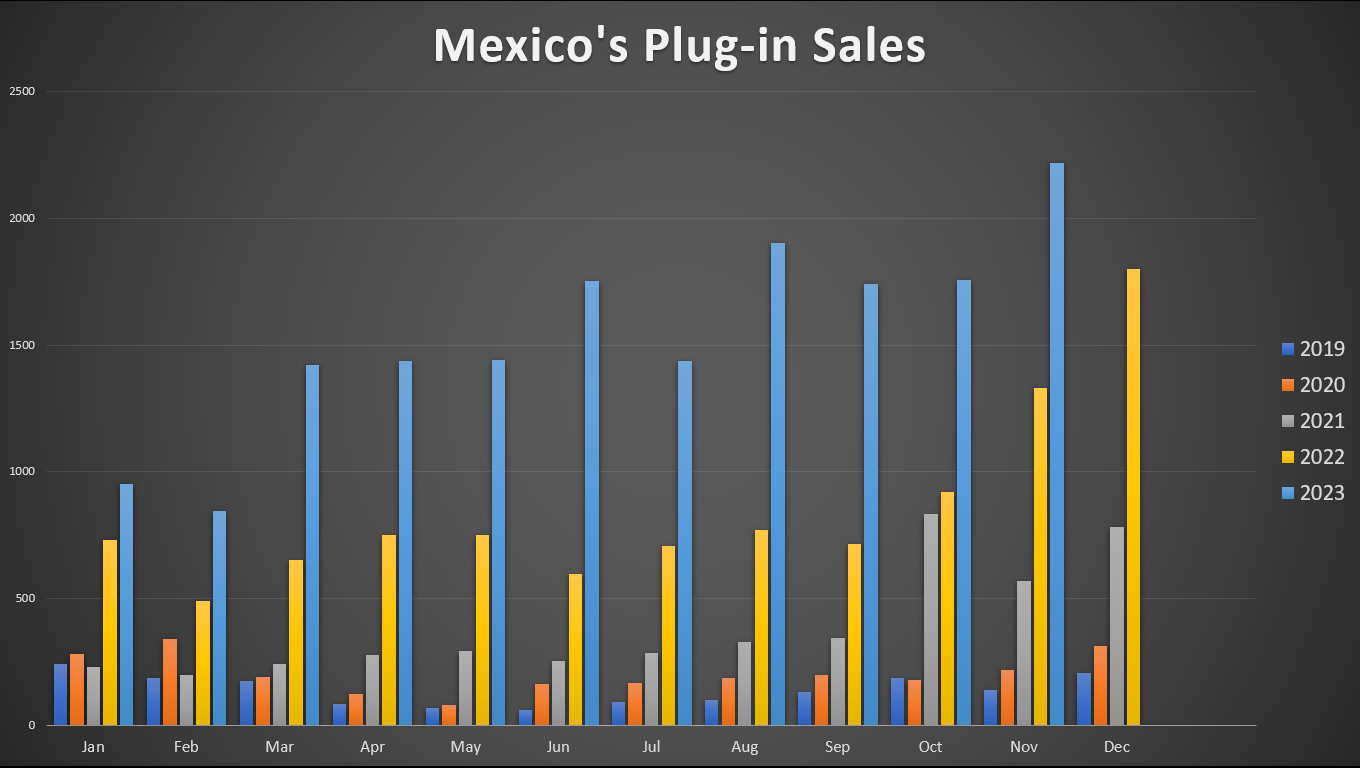

So, a bit of a confession here: Mexico’s report isn’t for the whole 2023, but only for the first eleven months. The report for December will only come out in March, so it was either this or waiting another month.

I feel sort of conflicted here: Mexico, the second largest car market in Latin America, has had a spectacular performance year after year, with 85% EV growth in 2021, 118% growth in 2022, and 101% growth in 2023. I’ve already lost count of the number of EV factories going up in the country, as Nuevo León becomes the new hub for batteries and electrical components. And, furthermore, the arrival of Chinese brands allied with local companies has turned the market into one of the most competitive (EV-wise) in the region. By all metrics, Mexico is crushing it …

… and yet, the region is moving so fast that it barely shows up. Brazil’s performance in late 2023 was so absurd that it makes Mexico’s growth seem lackluster. I mean, this is good news, but I sort of feel bad for Mexico.

In any case, 11,782 BEVs and 5,123 PHEVs were sold in Mexico in the first 11 months of 2023, comprising 0.9% and 0.4% of the 1,315,569 light and heavy vehicles sold in the country in that same period, respectively. If you remember our report about H1 2023, Mexico’s market share stood at 1% back then (0.75% BEV), which means that sales grew quite a bit in the second half of the year. And, indeed, that’s visible when we look at them:

Nearly all of the growth has come from pure electric vehicles. BEV sales grew 168% year on year, while PHEVs only grew by 27%:

2024 should be interesting. SEV, the local brand selling Mexico’s cheapest electric car, seems to be heavily investing in expansion throughout the country, while BYD, GWM, and more recently Zeekr are also landing there. Prices are competitive, and if the trend downwards continues, market share could increase dramatically. This is the first market in which I actually have high hopes for this year.

It’s worth mentioning that 106,180 electric vehicles were produced in Mexico during 2023, mostly the Ford Mustang Mach-E, which amounted to more than 90% of that amount. No information could be found on sales per model.

#5. Brazil (2.4% plug-in market share)

And we get to the star of 2023!

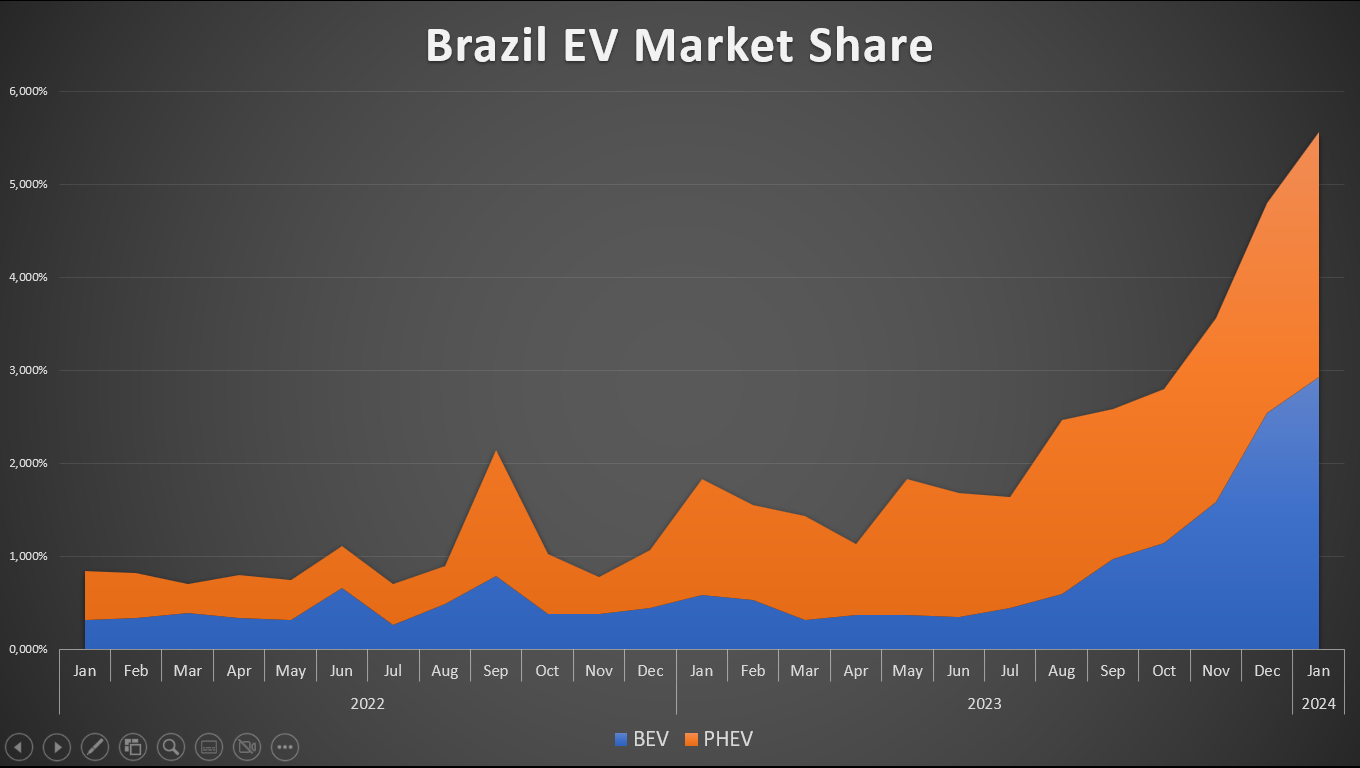

An overview of this market was already presented in a specific article regarding Brazil’s 700% growth YoY, but, in summary, Brazil’s BEV sales had long been relatively stagnant, only PHEVs having significant growth, until BYD announced its factory in Camaçari and the arrival of the BYD Dolphin at $30,000. Suddenly, other brands had to lower their prices, competition intensified, and both the BEV and the PHEV market experienced unreal growth, increasing by sixfold in a year.

There were fears that this amazing feat was simply pulling up demand because of the rising import tax in EVs (that would go from 0 to 10% in January 2024), not unlike we just saw in Germany. But the good news is: January numbers are already here, and this wasn’t the case! Year on year, plug-in vehicle sales grew by an amazing 246% (to 8,267 units) last month! This means that plug-in market share in Brazil stood at an amazing 5.5% in January 2024!

Historically, it had been mostly PHEVs that pulled up EV sales in Brazil, but that changed in August 2023, and even though PHEVs continue growing, it’s now BEVs that do most of the lifting:

Market share wise, Brazil has shown consistent growth since BYD’s arrival, finishing 2023 with 4.8% EV market share (2.5% BEV) and starting 2024 with 5.5% share (2.9% BEV). This means that, as far as 2024 goes, Brazil is already part of the podium:

At this point, even maintaining over 5% EV market share would be a huge increase compared with 2023, but if EV sales keep growing year on year, Brazil could easily end up being second in the region, only behind Costa Rica.

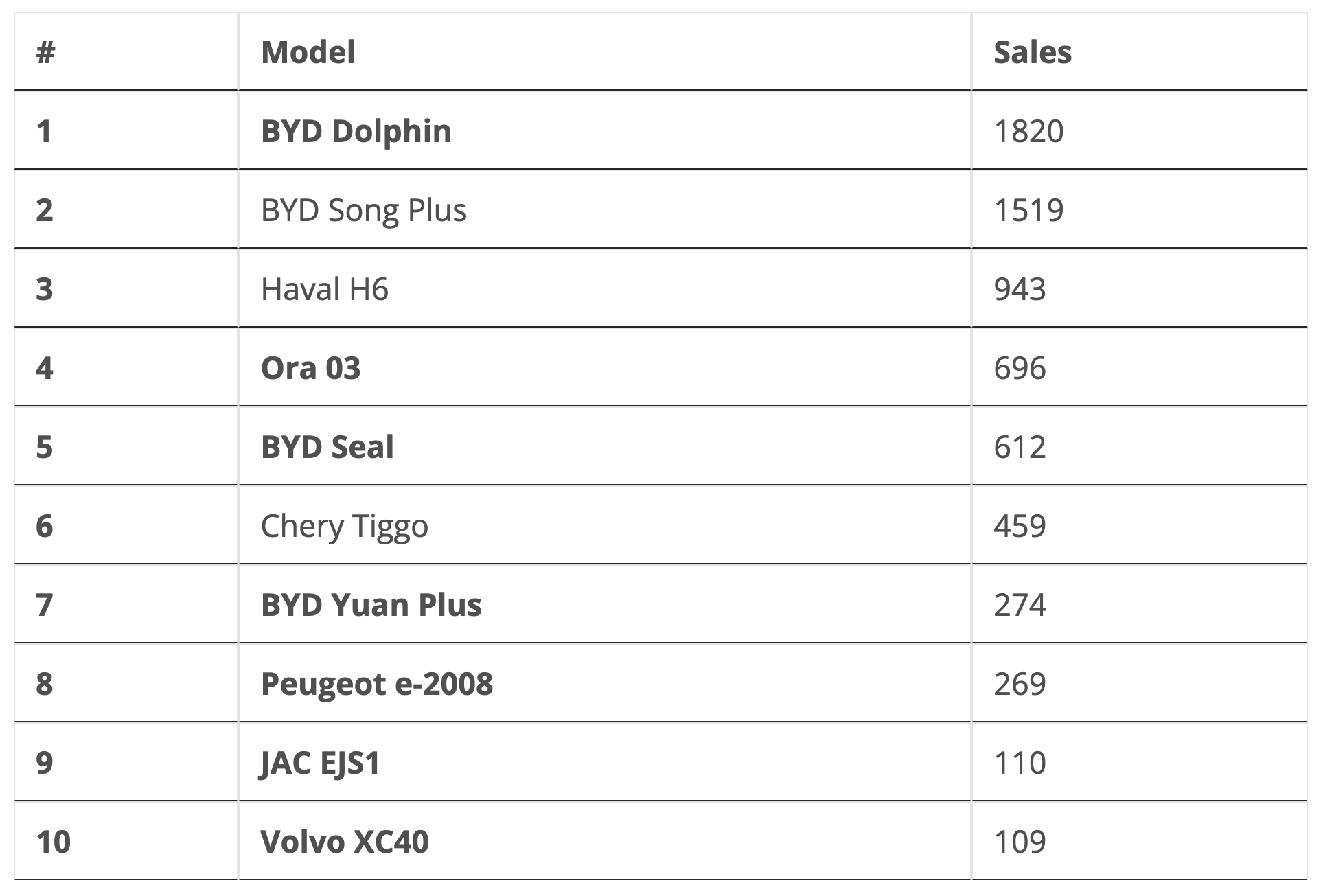

Model-wise, the Chinese have taken over, with 8 out of 10 models being from that country (and that is counting Volvo as European):

Something important to keep in mind is that, together, Mexico and Brazil account for some 70% of vehicle sales in Latin America, meaning that whatever happens in these two markets is far more important than what happens outside of them.

#4. Puerto Rico (2.8% plug-in vehicle sales)

We finish the second part of our report with Puerto Rico. Though not technically a country, it is still a part of Latin America.

As with many other small countries, information is hard to find, but according to local media, Puerto Rico sold 3,674 plug-in vehicles on the island, 2.8% of the 128,531 total vehicle sales in the country. No more details are offered (save for the fact that this amount “does not include Teslas”, so the total should be even higher), but this puts Puerto Rico ahead of most of the region — though, still far behind the US mainland.

In any case, Puerto Rico has a very high income compared with the region, and it’s not a very big island, so I would expect EVs to be more successful than they are.

Stay tuned for the third part of this report, where we will talk about the market leaders!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.