Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

A bloodbath is coming.

The exact timeline we don’t know, not yet at least. But the omens are here already with the Chinese market slowing down and the Chinese EV industry reaping the fruit of early investments, massive economies of scale, and near total control over battery supply chains. After probing the waters in Southeast Asia, China’s EV industry seems to have chosen 2024 as the year to commence a serious offensive all over the world.

This day has been foretold many times on this and other sites, yet seeing it firsthand feels … different. Exciting, even. As Chinese EVs become more affordable, as options increase and people gain confidence, as we move ever closer to price parity, it’s a given that sales will increase … at the expense of legacy ICE vehicles. The US, the EU, and/or Japan may yet resort to protectionism, but that won’t help them in foreign markets, including (most recently) Latin America.

Most of you probably guessed the BYD Dolphin Mini (BYD Seagull rebranded for foreign markets) is the reason for my words, and that’s part of it … but only part. Several factors have coalesced: besides the arrival of the Dolphin Mini at a surprisingly affordable price in three markets in the region (Brazil, Uruguay, and Mexico), we have the price wars heating up in China and the competition from other Chinese EV makers that, finally, seem to be able to lower their prices and compete in strength not against other EVs, but against legacy ICE vehicles. The time of reckoning may be upon them.

Mexico: BYD triggers a price war, JAC and SEV respond in kind

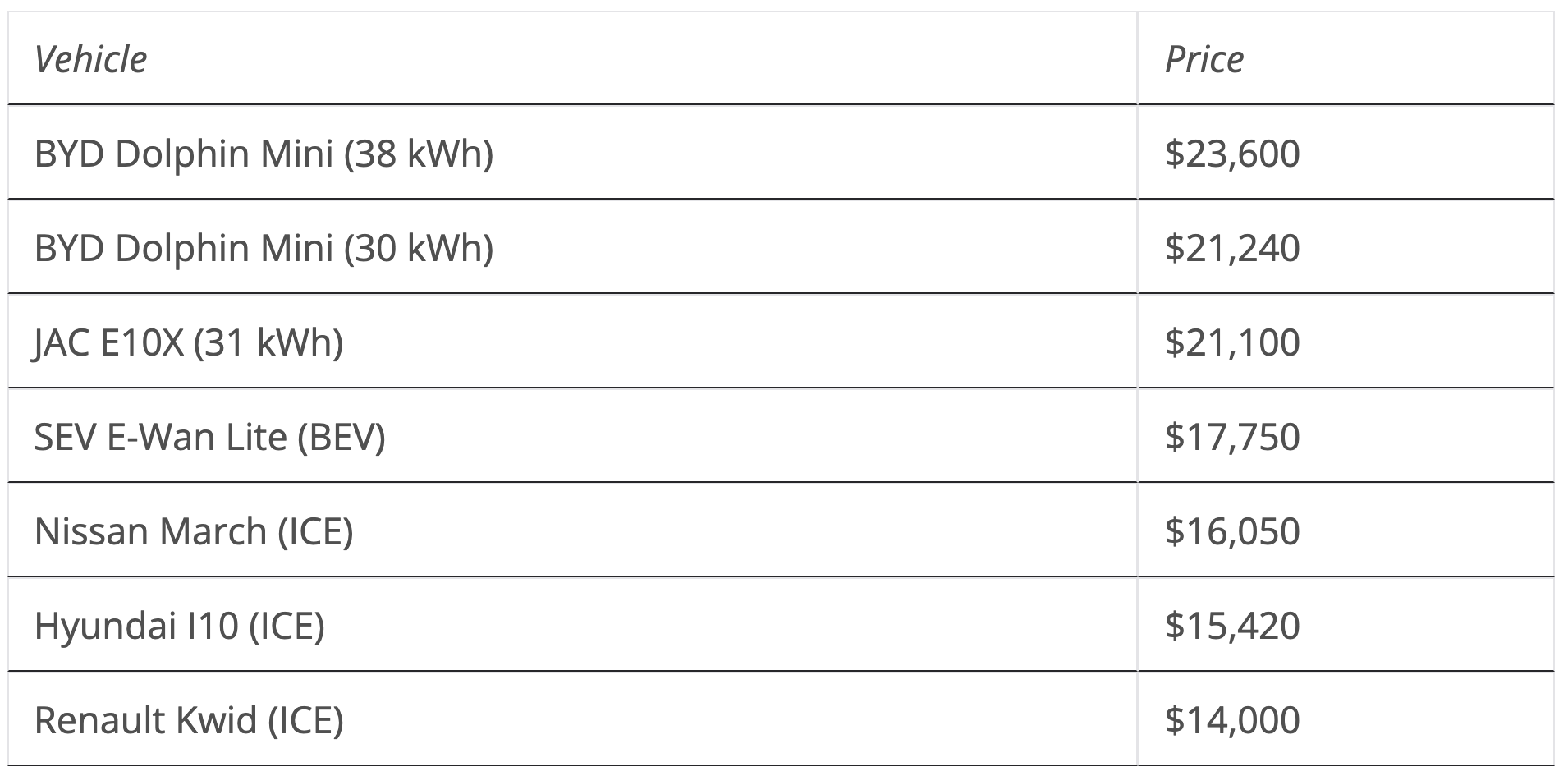

Zach already reported about the arrival of the BYD Dolphin Mini in Mexico at prices that bring it much closer to ICE competition: a 30 kWh version being offered at MXN$358,800 ($21,000) and a 38 kWh version at MXN$398,800 ($23,000).

The 38-kWh version is revolutionary in and by itself: it’s the first time a city-car boasts significant range (up to 380 km/236 mi in the optimistic NEDC). Up until today, city-cars with 31 kWh batteries at most had been the norm in Latin America, useful for the city and around it, but unable to reliably handle anything much longer than 220 km (137 miles) on a road trip.

The fact that this long(ish)-range version arrived at lower prices than the short-range versions already available has forced the hand of the competition. BYD seems to have triggered a price war in Mexico, with JAC responding in kind and lowering the price of its E10X (31 kWh) to MXN$357,000 ($21,100).

JAC wasn’t the only one dropping prices, though. SEV, a Mexican brand offering Chinese EVs that’s also to start local manufacturing, also announced surprising price cuts, bringing down the price of its E-Wan to an impressive MXN$299,000 ($17,750) and even offering a new, more affordable version for MXN$279,300 ($16,500)! I’m still checking if these have the same 30 kWh battery. Hopefully that’s the case.

The fact that they responded so quickly and decisively to BYD’s challenge indicates that JAC and SEV have the margins and the capabilities to offer affordable EVs in significant numbers. JAC also has the backing of Mexico’s richest person, so there’s that. As BYD also aims to manufacture in Mexico in the near future, the fight is likely to become local.

Regarding the road to price parity:

EVs are becoming cheaper and better, and the most affordable options have already reach parity with some ICE city-cars. Mexico stood at 1.3% plug-in market share in 2023, with much fewer options and much worse prices. It’s clear that growth should be exponential under the new market conditions, but change has been so fast and dramatic I’m unable to make any predictions. There’s also the fact that other segments may present similar improvements as the year goes on, increasing pressure on ICEVs all over their line-ups.

And every EV sold will be one less ICEV for Legacy Auto.

Colombia: Auteco Blue signals the arrival of price parity with the Dongfeng S50

Here in Colombia, we’re still waiting for the BYD Dolphin Mini, but since pricing has been consistent all over Latin America, I expect no surprises.

This isn’t about BYD, but about Auteco Blue, the motorcycle company that chose to bet everything on EVs a while back. The company is working on increasing its lineup and has also reduced prices on several of its available EVs, but it recently presented a car that got everyone by surprise: the Dongfeng S50.

This is a Model 3-sized sedan boasting a 57 kWh battery (sadly, not an LFP one) that will only be sold — for now — to fleets or as a taxi: according to Auteco, the car should be able to go some 415 km (258 mi) on one charge. And the pricing is out of this world: COP$104,000,000, or $26,630, for the taxi version (the fleet version being slightly cheaper).

At this point, it isn’t EVs that must get cheaper to compete, but ICEVs: this Dongfeng basically beats all competition regardless of powertrain. The VW Jetta, for example, starts at $27,900.

I’m not sure why Auteco is not bringing this as an option for the general market: they may be scared it will cannibalize every other model because it is insanely cheaper. As an example, the comparable JAC EJ7 may be much sexier but boasts similar specs and costs a staggering 50% more: $40,450.

I don’t know what game Auteco is playing here, but I’m hopeful this is a move to start price reductions in all of their lineup, bringing them closer to the most advanced market in the region: Costa Rica (where these vehicles are already much more affordable).

A small snippet of news: Chevrolet has reduced the local price of the Chevy Bolt by 20%, down from nearly $50,000 to $40,000. It’s clear that this isn’t a move to make the model more popular (as they are sadly not being built anymore), but to clear out the inventory left from 2023. It turns out that when you bring an affordable vehicle at nearly twice the price, it won’t sell as much. Heh, who would’ve thought?

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Brazil, Uruguay: the BYD Dolphin Mini arrives at an affordable price

In Brazil and Uruguay, for now, the news is limited to the Dolphin Mini. Which is still great, of course.

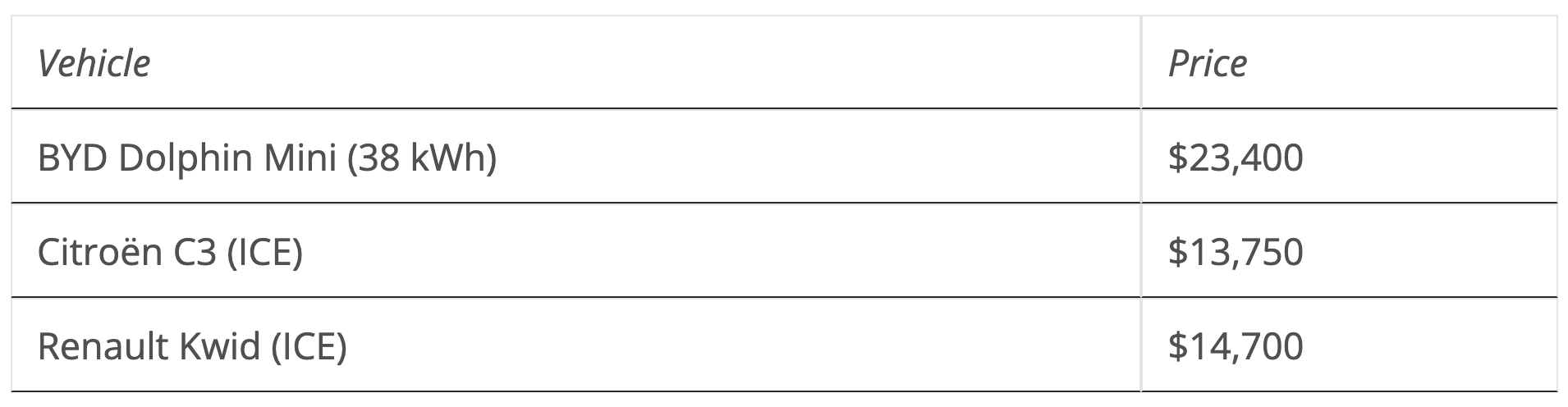

The car is to be produced in BYD’s new plant in Brazil (expected to be operating in late 2024), but for now, it will come from China at a price of BRL $115,800 ($23,400) for the 38 kWh version. Though, those who reserve early can get a BRL $10,000 ($2,000) discount. This price includes taxes and a type 2 charger that comes with the car.

Brazil’s market has been quite competitive since the arrival of the cheaper BYD Dolphin in 2023, and has so far maintained over 5% plug-in market share in 2024. The arrival of the Dolphin Mini will no doubt make a splash, and I’m starting to wonder if we may be able to reach 10% market share by the end of this year. A simple price comparison may lead you to believe that this vehicle will make little difference in the market, but the gist of the matter is that the Dolphin Mini is a much better vehicle than the EV competition, so it’s a given it will force JAC, Chery, and Renault to lower their own prices and bring them closer to ICE city-cars.

In Uruguay, the Dolphin Mini arrived in two versions, the 38 kWh one being sold at $23,990 and the 30 kWh one at $21,990. Just like Brazil, Uruguay is a relatively developed market where BEVs have surpassed 3% market share, so the arrival of the Dolphin Mini could help the market to reach 6% or perhaps even more this year.

It’s not only the Dolphin Mini, though. The BYD Dolphin arrived in Uruguay in July 2023 at a price of $40,990, yet today it’s being sold at $28,990, which means it was discounted by 30% in the last few months! If you recall our report on Latin American EV sales, Uruguay was absolutely dominated by BYD, and it’s likely that this will remain and perhaps even increase in 2024.

Final thoughts: on the future of the Latin American EV market

The promise of more affordable EVs has been told for years, but here in Latin America, it’s only now that we’re finally seeing it. As the markets move beyond 1% BEVs and get closer to (or hopefully above) 10%, a new set of questions and challenges arise.

I was once of the thought that as soon as price parity was achieved, the game would already be over for ICEVs, and we would move to 100% BEVs (or nearly) in a matter of weeks. I now question that premise, for the most successful market in the region (Costa Rica) is already very close to price parity, and yet EV sales, though booming, are still under 20% of total vehicle sales in the country.

It’s clear the market will need to develop and brands will need to gain trust and confidence. Though, some have advanced pretty far in this matter (BYD and JAC, at least). As fast as this process may be, it’s unlikely that we’ll see it finish before the end of the decade, and every year that we’re not at price parity is one more year this will take.

This does not necessarily mean good news for legacy automakers. Latin American markets are not particularly growing, and already, local examples such as Costa Rica and foreign ones such as Thailand have shown that with adequate pricing, new EV brands can gain market share at electrifying speed. Even if we take a while to get to 100%, growth can take a country from 1% to 20% EV market share in a couple of years, as we just saw happen in Thailand. Every EV sold is one less ICE vehicle, and legacy brands are likely to struggle more and more as their market share shrinks.

But, given the above, I do wonder if the process will be slow enough to allow them to survive based upon their own EVs that may not yet be on par with the Chinese, but that are also getting better every year. The Renault 5 is likely to be a success in the region, and there’s also hope for Chevrolet’s electrified lineup in the upper segments (I can see a $40,000 Equinox EV being a complete success here). Stellantis is also presenting relatively affordable EVs capable of at least offering some competition to their Chinese peers in Latin American markets.

Paradoxically, as we see ICE vehicle market share evaporate, I believe Toyota will be one of the short-term winners: regular hybrids are its bread and butter, and those are also growing exponentially. Still, as BEVs become better and more affordable I see hybrid market share also shrinking rapidly. When will that be? I want to say that it will be soon (2026 at the latest), but, frankly, I’ve been too optimistic before, so I’ll sit this one out.

At last, as EV sales grow, charging becomes a more pressing issue. Fast charging stations in this region are few and far between, and it’s common to find there’s only one charger on an important road that may already be in use, or, worse, that may be broken. Lines are probably going to get longer, wait times may become unbearable, and chargers will fail more often the more they’re used. And as affordable EVs usually come with relatively small batteries, it’s hard for people to consider one in these conditions. Since governments don’t usually have that many funds to invest in these things, EV companies will have to bear this investment if they wish for sales to grow as fast as they want them to.

I mean, I’ve been annoying my family members about buying an EV for years, but now that it has become a real possibility, I must tell them to wait. The affordable EVs they may be interested in are not able to reliably make the trip from their city to the capital city in one charge (a trip all of them make on a regular basis), and, as only one charger exists in either direction (none with GB/T chargers), it’s too much of a risk to get stranded if it fails. All we need is one good charging station … but we don’t have that yet, and the deployment of fast chargers has actually slowed down in recent months. But this is an issue that will be solved eventually for certain.

As growth increases, challenges will also increase. Still, the future looks bright.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

CleanTechnica uses affiliate links. See our policy here.