The KCB Group is the largest financial services organization in East Africa in terms of asset size. The Group is headquartered in Nairobi, Kenya, with subsidiaries in Kenya, Rwanda, South Sudan, Tanzania, Uganda, and Burundi. In 2007, the KCB Foundation was established to implement the KCB Bank Group’s Corporate Social Responsibility programs and as a sign of commitment to sustainable development to alleviate poverty and enhance well-being.

According to its website, the KCB Foundation has invested an estimated 3 billion Kenya Shillings in community programs in Kenya, South Sudan, Rwanda, Tanzania, Uganda, and Burundi to date. The KCB Bank Group says it is committed to sustainable development, prosperity, and poverty reduction to address the hardship, high poverty levels, and interconnected challenges that affect communities in Eastern Africa.

The group also says that it is aligning its green loan portfolio to be at least 25% of the total loan portfolio by 2025, including going beyond by allocating capital and steering financial flows towards more investments and assets that are necessary for transitioning low carbon, climate resilient activities. In a major boost to Kenya’s nascent electric motorcycle and tuk-tuk sector, KCB has partnered with the United Nations Institute for Training and Research (UNITAR) to roll out a program that will see 100,000 riders benefit from electric motorbikes over the next 6 years. This is expected to create over 150,000 new green jobs in the boda-boda sector. The Bank will provide green affordable loans to the riders to acquire electric bikes and tuk-tuks through local electric motorbikes sellers.

This is a really big deal for the local electric motorcycle sector assembly and manufacturing sector, along with all the downstream industries around the associated ecosystem.

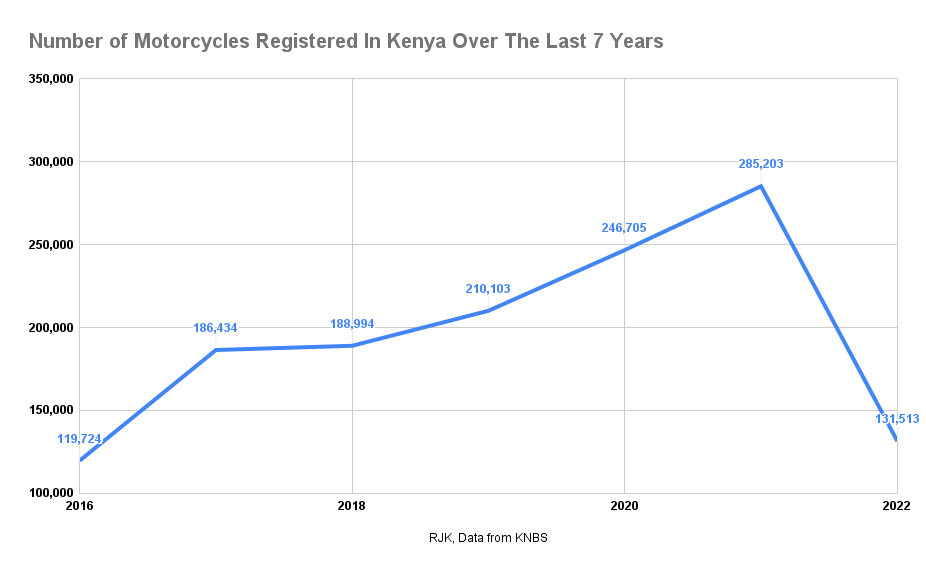

Motorcycle registrations in Kenya over the last 7 years

A look at the number of new motorcycle registrations in Kenya shows just much of a big deal the sector is and why it has attracted so much attention from those looking to electrify the transport sector in Kenya. 1,368,676 motorcycles were registered in Kenya in that time, at an average of 195,525 per year. This has attracted over 20 startups in the country’s electric motorcycle space. New registrations of motorcycles had been increasing each year, including during the coronavirus pandemic, until a sharp drop of over 50% last year. Will the registrations shoot up again in 2023?

All these startups need several conditions to be met to guarantee scale. First is an addressable market and a good value proposition/business case. A lot of them have managed to prove the business case and addressable market to a certain extent through various pilots. Now as they scale, they need their prospective customers to have access to financing to be able to take up electric motorcycles. This financing program from KCB for 100,000 electric motorcycles and tuk-tuks will certainly play a key role in this area.

The project that was commissioned by the Cabinet Secretary, Roads and Transport Hon. Kipchumba Murkomen in Nairobi has been rolled out in Machakos county, with a plan to extend it to all counties through the period.

KCB Group CEO Paul Russo said: “The initiative is in line with our commitment to increase our green lending loan portfolio by working with like-minded partners to enhance green job creation and attaining the net zero ambitions.”

“We seek to make it possible for players in the transport sector to acquire electric motorbikes at an affordable rate and earn a living. At the same time, the boda-boda riders play a key role in reducing carbon emissions in the environment, which is part of our long-term plans to conserve the environment,” Russo said.

The program is aligned to the government’s plans to roll out an electric vehicle public transport system that seeks to bring down the cost of transport for all stakeholders. This is aligned to the government’s economic transformation agenda and climate action, which is also expected to reduce the country’s carbon emissions.

Cabinet Secretary, Roads, and Transport Hon. Kipchumba Murkomen said “The government has prioritized the adoption of e-mobility, to achieve a number of targets. There is need to reduced carbon emissions by 32% by 2030. In 2022 emissions in the transport sector was estimated to be 1.26 million tonnes of carbon dioxide.”

“The adoption of electric motorbikes by boda-boda riders will help the country to achieve this target given that 1CE motorcycle emits more carbon than two saloon cars” added Murkomen.

KCB Group CEO, Paul Russo (front left) with Cabinet Secretary for Roads, Transport & Public Works, Hon. Onesmus Kipchumba Murkomen and Principal Secretary State Department for Investments Promotion- Ministry of Trade, Hon. Abubakar Hassan Abubakar as they handover certificates to Bodaboda riders. This was during the KCB Foundation E-Mobility pilot partnership launch at Ole Sereni hotel.

Over 60 youth boda-boda riders drawn from across Nairobi were the first recipients of the electric boda-bodas today, following comprehensive training on electric bikes, the rule of law, customer service, and mastering conflict resolution. The youth will also get training in Business Development and Entrepreneurship. To qualify for the loan, the youth participants are obligated to undergo a mandatory training covering technical skills training, capital and business management, safety, and peace building under KCB Foundation’s 2jiajiri youth program. This is to enable them to qualify for green loans from KCB micro bankers.

The transport sector is the second highest contributor of greenhouse gas emissions in the country, and has been identified as a focus sector in Kenya’s enhanced National Determine Contribution (NDC) commitments and National Climate Change Action Plan. KCB launched 2jiajiri in 2016, a program that seeks to formalize the informal sector and skill for self-employment targeting the youth and small businesses. It focuses on growing youth micro-businesses in the informal sector and bring them to a place where they can employ others. Since its inception, 20,736 youth have received skills training and the bank has disbursed over KShs. 246 million in loans to the youth as capital and asset financing, which has resulted in 64,380 jobs being directly created. A total of 3,402 small businesses are under incubation within the business development phase of the program.

Images courtesy of KCB

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …