I recently blew the dust off an old Rudyard Kipling poem, “If,” which many have castigated as a bit overly romantic, despite its high praise from Mark Twain and T.S. Eliot to India’s Khushwant Singh.

The fact, moreover, that “If” was written by a Victorian era colonial in 1865 as a father’s advice to a son, could easily put its otherwise timeless insights at risk of being cancelled by the woke elite as potentially misogynistic or regionally insensitive…

Notwithstanding such critiques, financial readers might equally be asking what Kipling has to do with global markets, the currency wars, inflation/deflation tensions or the US bond market?

Well, given the fact that each of these financial topics, when examined closely or even broadly, are now signs of open madness, yet still consistently ignored or down-played by our leaders and media midgets, I could not help but consider the following (and opening) line of advice:

“If You can keep your head when all about you

Are losing theirs…”

Well: Can we?

What is Happening All About You? A Complete Denial of Debt’s End-Game

As headlines from an increasingly distrusted 4th Estate debate everything from a challenged USD (the recent BRICS gold hysteria) and weaponized State Department (Raytheon’s war in the Ukraine graveyard) to an equally weaponized/politicized justice system (Hunter vs. Trump’s legal woes), most of America seems blind to a ticking time bomb.

That is, amidst all the political and social distractions of late, the financial wizards leading an increasingly splintered America have been quietly doing what they do best: Sending the USA into a fatal debt spiral.

I recognize, of course, that bonds, budgets, deficits and yield curves don’t excite the same immediate reactions as, say, Joe Biden’s now undeniably compromised mental state or who or what’s image adorns a can of Bud Light, but as I’ve said so many ways and times: Debt matters.

In fact, debt destroys nations. And not just sometimes, but every time.

Such destruction, hiding in plain sight, is creepy, because, well…it creeps up on us slowly, and then—all at once.

The Latest Creepy Numbers Creeping out of DC

But sadly, debt data and bond markets bore most citizens.

This is why the majority of invisibly taxed and intentionally enslaved American serfs probably haven’t noticed that the US Treasury Department’s quarterly net-borrowing estimates for the second half of 2023 just came out, and that number is a sickening $1.85 TRILLION.

Read that again. $1.85T in 6 months.

This is openly ignored madness. Our experts having officially lost their minds.

We are talking about nearly 2000 billion (or 2 million millions) of new debt to be created/issued in the span of months, the implications of which are staggering.

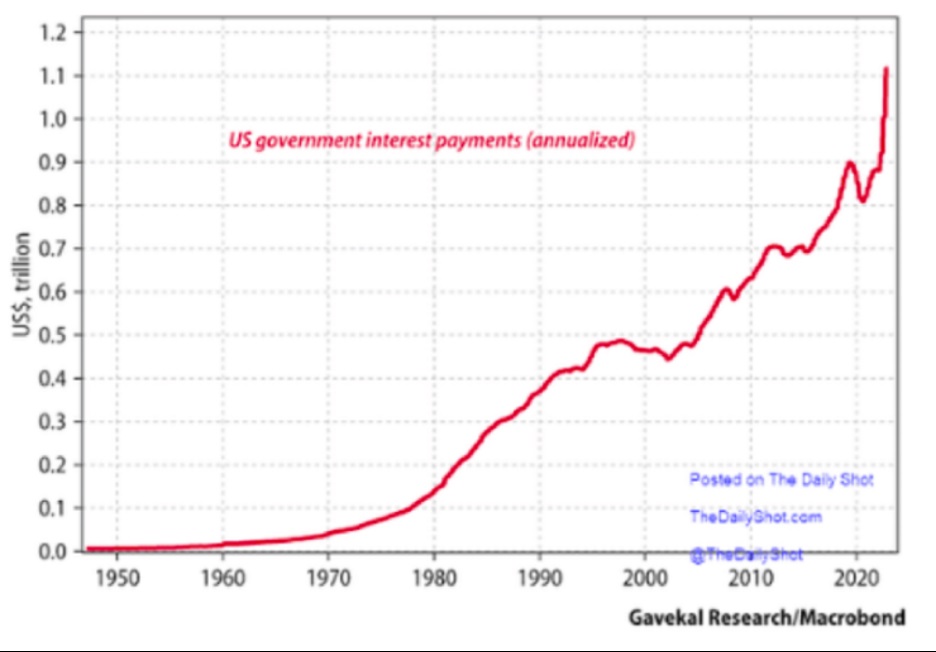

This is especially scary when you add Powell’s 525 basis point rate hikes into the borrowing equation, which only makes the interest-expense of this appalling debt (cess) pool beyond payable without, well…more debt creation.

So, there you have it, American monetary genius: “We can solve a debt problem with more debt.”

Keeping Our Heads When All About Us Are Losing Theirs

But just because the “experts” in DC (who made Faustian bargains with their common sense and advanced degrees in exchange for a DC job title) may have completely lost their ambitious little minds/heads, it doesn’t mean the rest of us can’t hold on to ours.

Fighting Inflation Will Increase Inflation

Powell’s comical, and ultimately disingenuous, war on inflation, for example, is actually poised to end in far greater inflation, something understandable to any whose market attention span is greater than a typical tweet or YouTube short.

As a June white paper from even the St. Louis Fed recently confessed (and folks like Luke Gromen better explained), the US is approaching a grossly paradoxical point called “Fiscal Dominance,” a sober concept of basic math which I boil down to this:

“When a debt-strapped nation with nearly $33T in public debt raises rates to ‘fight’ inflation, the increased cost of servicing that debt becomes so egregious that the only way to ‘pay’ for it will come from a re-ignited mouse-click money-maker at the Fed, which is inherently, well: Inflationary.”

In other words, at some point (and don’t ask me when, but it’s looming), the Fed will pivot from dis-inflationary QT to mega-inflationary QE—all to be conveniently blamed on COVID, Putin and/or the climate.

It has always been my personal view, however, that Powell’s Volcker 2.0 charade of raising rates and trimming (barely) the Fed’s balance sheet to “fight” inflation has been a deliberate ruse.

His hawkish narrative buys him time to replenish the ammunition of his only two monetary weapons (rates and money supply) so that he’ll have more to cut (rates) and expand (Fed balance sheet) once overly-stretched credit markets blow to shreds.

At that point we’ll see: 1) QE to the moon and/or 2) a monetary re-set that will make Bretton Woods look like a pleasant game of international snooker.

Credit Markets, Death by a Thousand Cuts

In fact, this “blowing to shreds” process in the credit markets has already begun, in a kind of death by a thousand cuts.

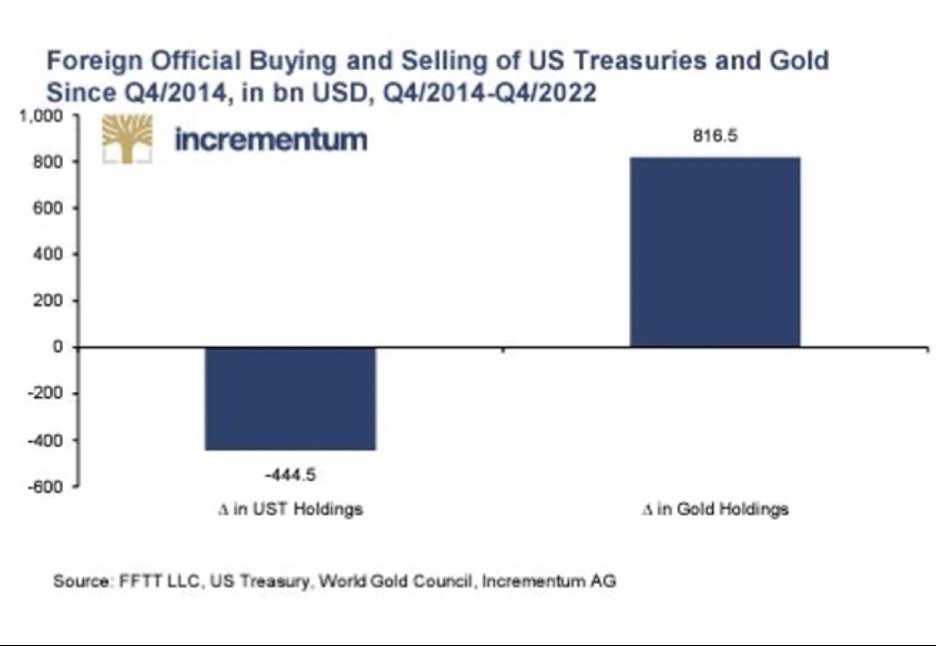

Just ask all those nations dumping USTs, or all those regional banks that have failed and all those bigger banks consolidating (i.e., centralizing); or ask all those mutual fund managers who lost greater than 20% in 2022, or the repo markets back-firing since 2019, or all those foreign sovereign bonds (from gilts to JGB’s) tanking and all those wannabe BRICS+ nations looking for anyway they can to join a sanctioned Russia and patient China to trade outside of an openly weaponized USD.

In other words, it’s not just that change is gonna come, it’s literally all around us, hiding (or ticking) right before our media-distracted eyes.

Buying Time Today as More Things Break Tomorrow

Powell, in the meantime, will stick to his “data dependence” and bide his time going higher for longer until something, i.e., topping markets now riding the AI tailwind (narrative), finally break under their own grotesque weight.

So yes, debt matters. Deficits matter. And supporting Uncle Sam’s otherwise unloved IOUs matters.

This is because, and I’ll say it again and again and again: The bond markets matter.

Why?

Repeat: The Bond Market Matters

Because if no one is buying those over-supplied bonds (see above), their yields spike in a simple supply & demand mismatch, which means the cost of serving US debt—which is the only wind beneath our national/financial wings—spikes too.

Spiking debt costs, of course, are a death knell to a system (from banks, bonds, stocks and Treasury Departments) already drowning in historically unprecedented (and unpayable) debt.

Thus, without more inflationary mouse-click money (QE) to stave off more credit contraction, bank deaths, failed UST auctions, and all those low-rate, extend-and-pretend-addicted companies on an S&P 500 (which is nothing more than an S&P 7 in terms of real market cap), the slow implosion discussed above becomes a sudden implosion.

Recession Denial

And that’s not even factoring in a looming but now Powell-ignored and media-down-played recession, that malleable term of economic art, which, like inflation and employment data, those fiction writers at the BLS and Eccles Building can redefine at their convenience.

Facts, after all, are like math. They are stubborn. This is why the experts are apt to distort them, like a corrupt lawyer who tampers with evidence to win a jury trial. That is, even a witch looks pretty when you hide the warts.

As I’ve argued many times, and based upon recent on-the-ground experience in USA main streets as well as a neon-flashing yield curve, the conference board of leading indicators and the year-over-year change in the M2 money supply, America is already in a recession.

At some point, even Powell’s forked tongue and the DC data manipulators won’t be able to hide a recession which citizens feel despite CNN, The View or their politicos telling them otherwise, especially as gas prices and lay-offs continue to rise into year-end.

Recession, Banana Republic America and the Inflation/Deflation Cycle

Toward this end, we need to keep our heads and think for ourselves about what recessions can do to countries like the USA whose balance sheet and debt levels are quantifiably no better than your average, and once mocked, banana republic.

Like any banana republic, extreme debt and embarrassing deficits spell their doom, as over time such heavy debt tides are inherently inflationary, despite the current (and expected) dis-inflationary period.

After all, crushing the middle class and small business sector with a record-breaking rate hike is dis-inflationary.

In a recession, for example, a nation’s already weakened ability to produce goods and services (thanks to Powell’s rate hikes) at levels high enough to sustain those deficits only gets even weaker.

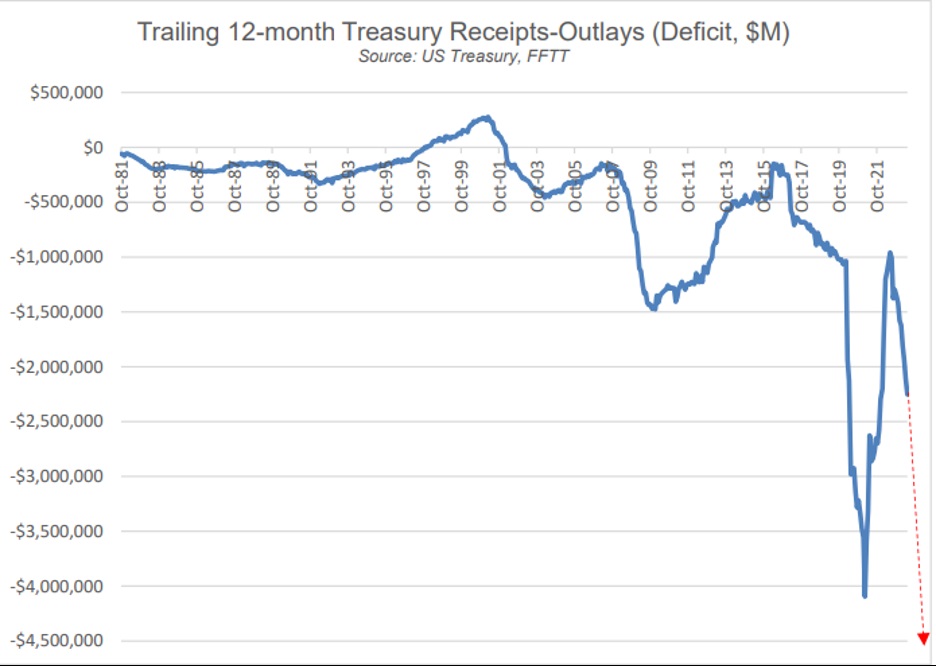

As Luke Gromen again argued, and illustrated below, a recession could easily send the US deficit to $4.5T, or 8% of GDP.

In such an all-too-likely deficit scenario (and all we really have today are bad scenarios), we could see bonds fall into the next official recession (always announced too late), as we saw them fall along side stocks in the 2020 COVID crash.

If bonds fall in a similar manner, this means bond yields, and hence rates, would rise, which would only add more pressure on the Fed to issue more US IOUs then paid for with more inflationary mouse-click Dollars to control their yields.

For now, and as Gromen, and myself, would confess, such a view is still a minority view—but that doesn’t necessarily make it a wrong view, especially in a world figuratively losing it head.

Alternative Scenarios Are No Better

But even the most sober convictions must consider alternative scenarios and views.

Like Brent Johnson, I agree that we could easily see an implosion in the EU markets (Germany now in recession) or even in Japan long before the US markets raise their white flags and surrender to instant, mouse-click liquidity measures.

In such a “foreigners-first” scenario, we could indeed see a flight into the perceived “safety” of the UST and hence USD as the best horse in the global slaughter house.

Such a “milk-shake inflow” (or straw-sucking sound) into USTs could take some temporary pressure off the Fed’s inflationary QE gas pedal. It could also make the USD stronger rather than weaker in the interim.

The End-Game Stays the Same

But no matter which white flag goes up first, from Tokyo to Berlin to DC, the end-game for all debt-soaked nations, regions, currencies and systems is ultimately the same.

That is, and to repeat, there really are no good scenarios left, just more desperate measures to buy time and postpone the inevitable.

As I wrote elsewhere, even the most proud and victory-accustomed armies, from Napoleon’s Grande Armee in 1812 to Lee’s Army of Northern Virginia in 1863, eventually extend themselves too far and suffer a “Gettysburg Moment.”

Nations whose debt levels are too far extended offer no exception to this rule or metaphor.

That is, no brave cavalry or infantry charge by Marshal Ney or General Picket can defy the simple law of too many bullets against too few men.

Too Many Debts, Not Enough Liquidity

Like Japan, the EU and the UK, America has too many debts and not enough natural liquidity to sustain them.

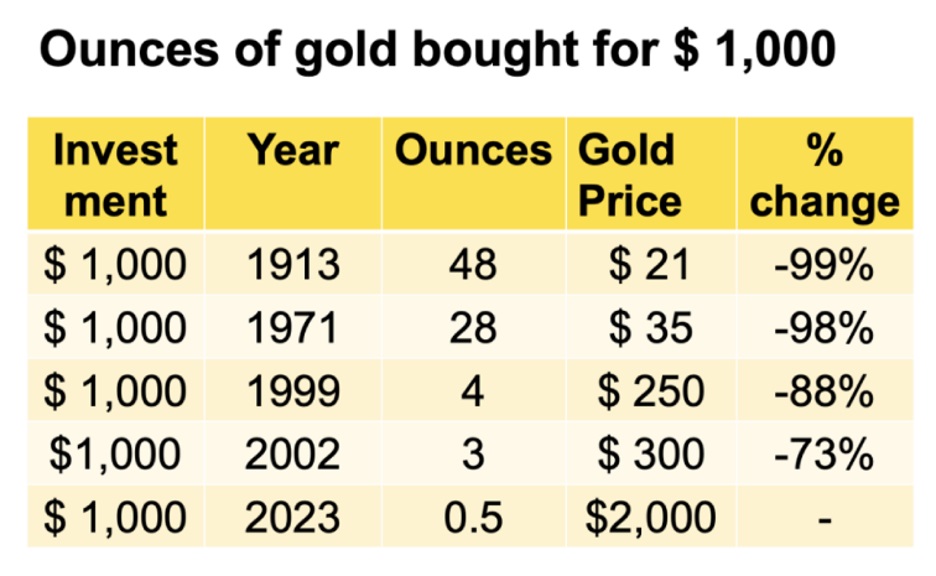

Powell can buy time and headlines, and he can even print trillions of more fake fiat dollars to “save the system,” but in the end, it is always the currency which is left dying last on the field.

For those who understand the stubborn math, history and cycles of fiat currencies, the precise timing of such final currency defeats is impossible to predict with precision, but easy enough to see coming, and thus easy enough to prepare for in advance.

Advanced Preparation—The Minority Which Kept Their Heads

Gold, which is an obvious and historically-confirmed weapon (as opposed to barbarous relic) against such open currency destruction, is an equally obvious and historically-confirmed means of achieving such advanced preparation.

Despite such objective facts (and the media-ignored power of gold as an open threat to fiat money), gold makes up only 0.5% of the global investments.

This, it might be said, makes such lonely “gold bugs” crazy, but as alluded to above, sometimes one must keep their heads when all about them are losing theirs.

The question, then, like the title of Kipling’s poem, is not “If” fiat money dies, but “When.”

The former is obvious, the latter is approaching.

Got gold?

*********