As Tiger Gold prepares to list on the TSXV later this year, the company published a preliminary economic assessment (PEA) this month for the Quinchía gold project in Colombia that shows strong economic base case value and exploration potential.

The Vancouver junior secured the Quinchía and Andes projects in June through its first option payment to Australian miner LCL Resources (ASX: LCL). Tiger is paying $12.6 million (A$14 million) for full ownership and has an aggressive infill and expansion drill campaign kicking off this month to grow resources and derisk the project further.

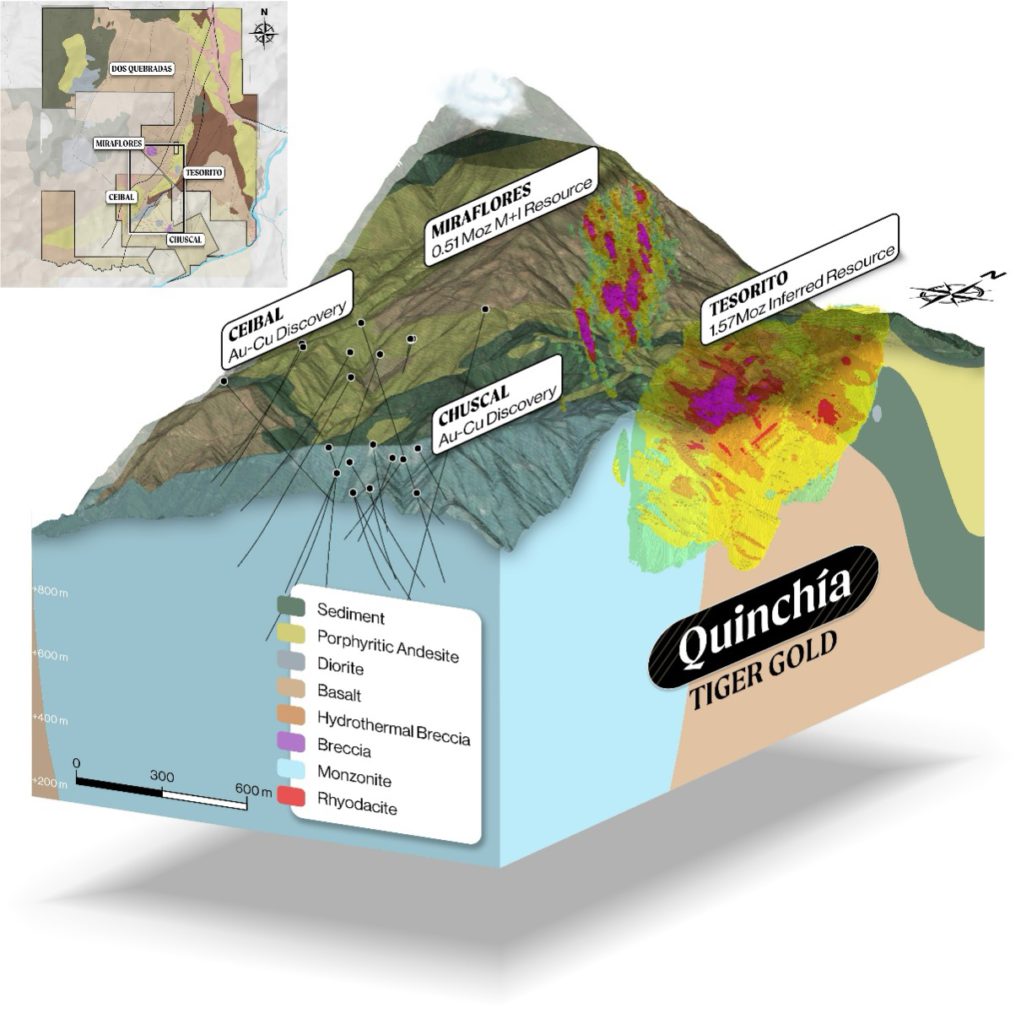

The projects lie in the Mid-Cauca Gold Belt, about 20 km from Aris Mining’s (TSX: ARIS; NYSE-A: ARMN) Marmato mine and Collective Mining’s (TSX, NYSE: CNL) Guayables projects in a prolific part of Colombia’s gold mining region. The large-tonnage system at Quinchía’s Miraflores deposit was originally discovered and drilled by AngloGold Ashanti (NYSE: AU) and B2Gold (TSX: BTO; NYSE: BTG) in separate programs from 2005 to 2007. They outlined a system that may offer more than 3-5 million oz. gold across several resources in a potential new district-scale project opportunity.

“This is a pretty well-known asset in Colombia,” Tiger Gold President and CEO Robert Vallis said. “With the recent exploration expansion at Collective Mining’s Guyables project and Aris Mining’s Marmato in the last year or so, we’re excited to tell this story to North American investors, advance this unique project and derisk it further towards a construction decision.”

PEA results

Quinchía has a base case net present value (NPV) of $534 million (C$750 million) at a 5% discount rate with a 21% internal rate of return (IRR) and 3.8-year payback using a gold price of $2,650 per oz., according to the PEA. At a gold price of $3,700 per ounce, the NPV increases to $1.19 billion with a 37% IRR and a 2.6-year payback.

Initial capital costs would be $480 million with sustaining capital of $219 million and all-in sustaining costs of $1,340 per oz. over the mine’s life. It may produce 140,000 oz. annually over its first five years, according to the PEA.

“We’ve stepped in and become operator and have transitioned the project from care and maintenance to now focusing on aggressively advancing the project,” said Vallis, a former executive at Yamana Gold and Barrick Mining (TSX: ABX; NYSE: B). “There are excellent relationships with the government and with the local community and stakeholders on the ground – and we’re starting with something that’s quite advanced, well-supported and in an excellent location.”

Tiger updated resources at Miraflores and Tesorito to Canada’s NI 43-101 standard for the PEA, the first study to pull both the deposits together into a single development plan. The PEA shows a strong foundation of value for what’s in situ at Quinchía with compelling upside exploration opportunities to grow resources, the company said.

Quinchía’s Miraflores deposit hosts 6.1 million measured and indicated tonnes grading 2.62 grams gold per tonne and 2.28 grams silver for contained metal of 510,000 oz. gold and 440,000 oz. silver, according to the resource dated July. The Miraflores deposit received permits last year and is ready for underground development.

The project’s pitable Tesorito deposit holds 104 inferred tonnes at 0.47 gram gold and 0.58 gram silver for 1.57 million oz. gold and 1.96 million oz. silver.

Dos Quebradas

Quinchía’s Dos Quebradas deposit about 2 km northwest of Miraflores and has a historical JORC-compliant (Australian rules) from 2020 filed by LCL Resources. It shows 20.2 inferred tonnes grading 0.71 gram gold for 459,000 contained gold. The company plans infill drilling as “low-hanging fruit” early next year to bring Dos Quebradas into the project’s current resource since its mineralization is similar to Tesorito.

“There is a possibility of mineral convergence with the immediately adjacent deposits of Tesotito, Miraflores, and the newly discovered Au-Cu zone Ceibal, but we just have no idea what’s happening at depth, so we’re very excited to drill these deposits starting this month to confirm potential links. ” Vallis said. “We’re potentially finding other more valuable zones along the way, but also de-risking the resources we already have.”

The close proximity of the gold zones at Quinchía offers Tiger Gold the potential to optimize capital investment and infrastructure. “That’s quite rare to find,” Vallis said.

‘District potential’

In addition to the primary deposits, there are multiple satellite exploration targets and new gold-copper discoveries. “There’s a huge indication for what I call district potential,” Vallis said.

The company has conducted a full risk management analysis and is prioritizing relationship-building in the region. LCL began the process two years ago and won the 2022 Colombian Gold Symposium’s Environmental Social and Governance Award for its efforts. Now, Tiger is continuing this community engagement work and focusing on supporting the surrounding community and stakeholders.

A plan map of the Quinchía project. Credit: Tiger Gold.

“I would argue the most important program, even above drilling, is our formal stakeholder engagement,” the CEO said. “There are very defined processes for that in Colombia and our team on the ground has developed strong relationships with the community and won awards for their ESG engagement, so we’re honoured to continue that work and support the community going forward as the project’s new operators.”

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by Tiger Gold and produced in cooperation with The Northern Miner. Visit https://tigergoldco.com for more information.