A junior resource company’s place in the food chain is to acquire projects, make discoveries and hopefully advance them to the point when a larger mining company takes it over. Discoveries won’t be made if juniors don’t have boots on the ground, if they aren’t out in the bush poking around and busting rocks.

Indeed juniors have one of the toughest jobs in the industry. Finding and advancing new projects is difficult and capital-intensive. The kicker is the juniors have no revenue stream to finance their exploration activities; they typically rely on outside sources for funding.

Investing early in the development cycle of the right gold junior, one that has an excellent project in a safe jurisdiction led by experienced management with the ability to raise money, can reap huge rewards — 5, 10, even 20 times your money isn’t uncommon.

At the beginning, these companies are often financed by accredited investors who buy shares in private placements. The junior then tries to advance its project, beginning with prospecting, through to drilling and completing economic assessments and feasibility studies.

Few exploration companies have the money or technical expertise to “go mining”. For many, the goal is to hit upon a deposit that’s good enough to attract a major who will acquire the asset. Another pathway is for the junior to partner with a larger company. An option or joint venture (JV) agreement is a way for juniors to gain access to the financial and technical resources needed to build the mine.

Juniors are extremely important to major mining companies because they are the firms finding the deposits that will become the next mines. In this way, juniors help the majors to replace the ore that they are constantly depleting in their operating mines – put another way, juniors find the resources for major’s to turn into mineable reserves.

‘Indispensable’ mining and juniors’ place in the food chain

Financings/ capex drying up

One source points out that senior miners have been allocating a relatively small portion of their revenues to exploration spending, with most expenditures invested in developing existing mines and measures to reduce operating costs.

If the seniors aren’t exploring, and when was the last time you heard of a major mining company making a discovery, it falls to the juniors. But junior mining financing has pretty much dried up; global exploration budgets in 2021 were half of what they were in 2012.

Capital expenditures in mining fell from approximately $260 billion in 2012 to $130 billion in 2020 (corresponding to 15% and 8% of industry revenues, respectively), McKinsey & Company found.

According to Natural Resources Canada, in 2023 exploration spending by juniors declined to $2 billion, down 19% from $2.5 billion in 2022.

Macro environment

Gold is seemingly breaking records almost daily. Silver is threatening to bust out. Copper is, despite recent negativity, in a structural supply deficit that is only going to grow. China is threatening more, and tougher, trade restrictions on critical metals.

Silver looks ready to rip — Richard Mills

We live in a finite supply world, yet our demand is infinite.

And juniors, the owners of the world’s future mines, cannot get financed, or are doing financings at lows we’ve never seen.

M&A

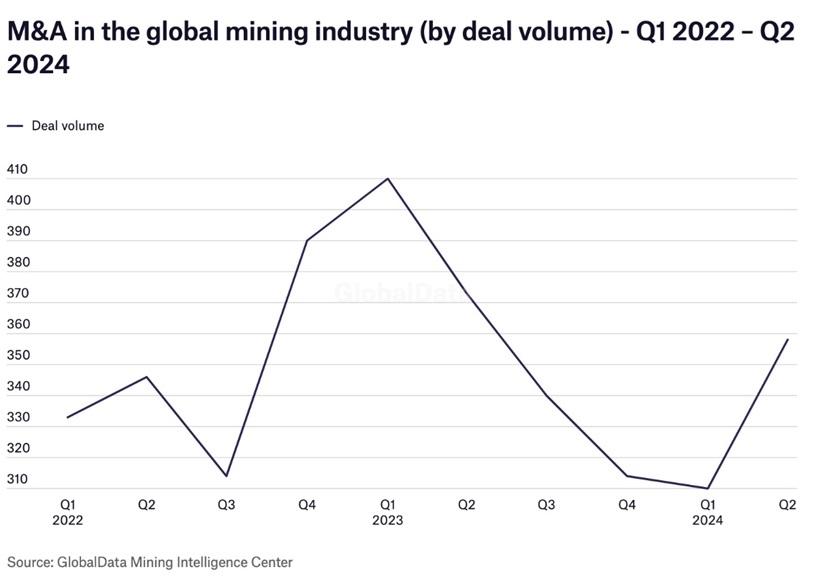

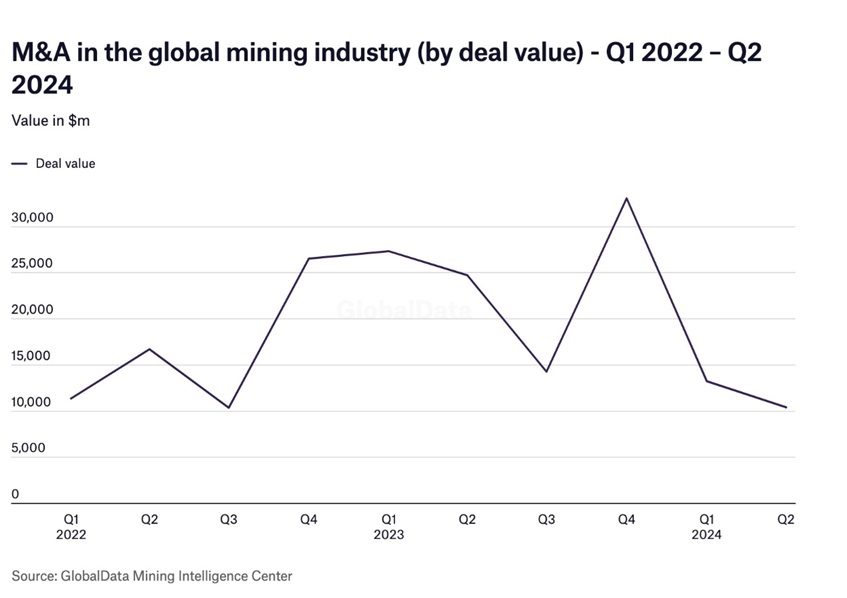

Low share prices have encouraged a smattering of deal-making in the mining industry in recent months. The number of deals is up in the second quarter compared to the first, although the value is down.

According to Mining Technology, there were 358 M&A deals announced in Q2 2024, worth a total value of $10.4 billion, according to GlobalData’s Deals Database.

The largest deal was the $2.5 billion acquisition of Vale Base Metals by Manara Minerals Investment. Mining Technology states:

In value terms, M&A activity decreased by 21% in Q2 2024 compared with the previous quarter’s total of $13.2bn and fell by 58% as compared to Q2 2023. Related deal volume increased by 15% in Q2 2024 versus the previous quarter and was 4% lower than in Q2 2023.

Notably, foreign direct investments (fdi)-related deals accounted for a 37% share of the global mining industry’s M&A activity in Q2 2024, up 16% over the previous quarter.

Source: Mining Technology

Source: Mining Technology

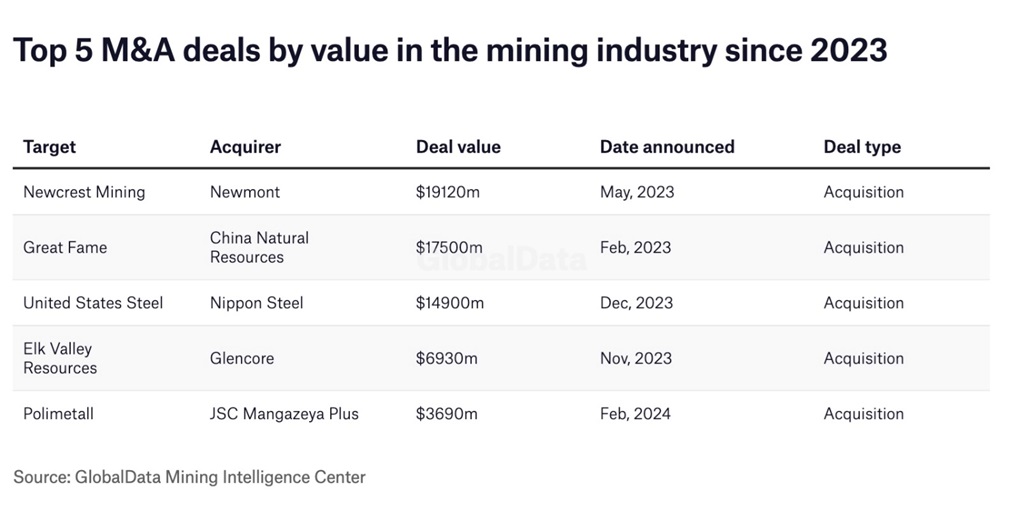

Source: Mining Technology

One trend to watch out for is more government restrictions on mining M&A, particularly critical minerals. Not just China but Canada too. In July, the Canadian government warned the industry that any major deals targeting producers of critical minerals would only be approved “under the most exceptional circumstances.”

The trigger for the restrictions was Glencore’s $6.93B acquisition of Teck Resources’ metallurgical coal-making business. Glencore originally wanted Teck’s copper assets but Teck said no to that.

Back to juniors, gold has risen 23% this year and silver has gained 20%. Not bad considering we were in an environment of high interest rates, relatively high bond yields and a strong US dollar.

If the Fed follows through on its telegraphed interest rate cut on Sept. 17/18, it will cause bond yields to weaken further, the dollar to weaken more and commodity prices to strengthen.

I’m sticking with my prediction of a quarter-point cut in September and possibly another 25 basis-points reduction before the end of the year, with the rate easing cycle continuing well into the new year. I do not see a recession until late 2025.

Uninverted yield curve signaling recession — Richard Mills

The general consensus is that precious metals will continue to thrive over a longer horizon. If that’s the case, what should an investor interested in leveraging higher gold and silver prices do? I’ve always argued juniors off the best opportunity for gains – historically they have offered the best leverage to rising metal prices. But not just any junior. Below are three junior categories I’ve identified for investment.

One example would be Silver North Resources (TSXV:SNAG, OTCQB:TARSF).

Silver North offers exposure to one of the most prolific silver districts in Canada — Keno Hill in the Yukon Territory.

Keno Hill is seeing major investment from Hecla Mining (NYSE:HL), the largest silver producer in the United States, following Hecla’s2022 takeover of Alexco Resources.

Silver North’s underexplored Haldane project demonstrates high-grade, high-width potential akin to the veins being mined at Keno Hill.

SNAG’s recent news release shows 2 drill programs already paid for, one already done and one just getting underway, results from both programs are coming.

Silver North Resources

TSXV:SNAG, OTCQB:TARSF

Cdn$0.10 2024.09.05

Shares Outstanding 43.3m

Market cap Cdn$4.7m

SNAG website

Earn-ins

Some juniors have projects so large it makes sense to bring in a senior partner.

The major adds creditability to the project and pays for exploration, reaching higher ownership percentages as capital is expended. These earn-in agreements are becoming increasingly popular.

One example is Max Resource Corp (TSXV:MAX, OTC:MXROF, Frankfurt:M1D2).

Max recently discovered a Manto-style mineralization target of significant size.

Max Resource discovers Manto-style mineralization at Sierra Azul

There are several benefits of investing in a company that has an earn-in partner. You don’t have to worry about raising money, you just let the major go to work, spending their own money, while the junior gets to keep ownership until the expenditure goals are reached. Many earn-in agreements also grant the junior a net smelter returns (NSR) royalty, which can be worth millions, depending on what the major finds.

Juniors in this category whose shareholders suffer property dilution, not share dilution, will also do well with their senior partners funding exploration & development of any discoveries.

The downside risk is minimal compared to an earlier-stage project.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.08 2024.08.22

Shares Outstanding 176m

Market cap Cdn$12.3m

MAX website

Another example would be above-mentioned Silver North Resources (TSXV:SNAG, OTCQB:TARSF).

New or near-term producers

The third group of juniors I like is new or near-term producers. These companies may have just started producing or are nearing production, but their share prices have slipped due to macro-economic conditions beyond their control.

Many are funded to production or starting production, offering potential shareholders a de-risked opportunity. Also, because they have reached the furthest development stage in a junior’s life cycle, production, they are the first group to move higher in the junior sector when commodity prices rise.

Three examples are Snowline Gold (TSXV:SGD), Vizla Silver (TSXV:VZLA), and Lion One Metals (TSXV:LIO, OTCQX:LOMLF).

Snowline Gold’s 2023 hole returned 2.5 grams per tonne gold over 553 meters at the Valley discovery, making it one of the best holes ever drilled in the Yukon Territory. (Kitco Mining, March 18. 2024)

Vizsla Silver is advancing its Pacuno project in Mexico. The company received its preliminary economic assessment (PEA) in July. Annually, the mine is projected to produce an average of 15.2 million silver equivalent ounces. (Kitco News, Aug. 20, 2024)

Lion One Metals announced significant new high-grade drilling results as mechanized production has started at its Tuvatu gold mine in Fiji, a style of mining that has not taken place in the island nation until now. (Streetwise Reports, June 10, 2024).

Conclusion

I continue to maintain my belief that junior resource companies offer the best leverage to rising commodity prices.

Three groups of juniors to consider are early stage/ greenfield developers, later-stage juniors with earn-ins/ joint ventures with larger companies, and new or near-stage producers.

Whichever group of juniors you decide to invest in, always conduct your own due diligence.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

********