With gold prices hitting record highs, junior explorers are attracting investment. Australian Mining looks at two advancing projects in proven provinces.

When asked in September for the best time to be in gold exploration, Falcon Metals managing director Tim Markwell didn’t skip a beat.

“The 1850s,” he said, referencing Victoria’s legendary gold rush. “But right now is a very close second.”

With gold prices surging past $US4000 per ounce in October, Markwell’s optimism is shared across Australia’s junior exploration sector.

On the other side of the country, David Richardson has watched this moment approach for years. The Magmatic Resources managing director points to a pattern that has played out since the global financial crisis. When gold rallies, major producers recover first, then months pass before investors look further down the value chain.

“Juniors take three to six months to follow the majors after a recovery,” he said. “At some stage, investors have to come down the value chain.”

That shift appears to be underway. With consolidation at the producer level making new acquisitions harder to find, and years of under-investment in greenfields exploration, institutional and retail investors are turning attention to junior explorers with projects in proven Australian gold provinces.

Falcon’s Blue Moon prospect in Victoria and Magmatic’s Weebo project in Western Australia fit that bill perfectly, and each company is gaining a lot of attention as a result.

Window of opportunity

Investor reluctance to back junior explorers has deep roots. Since the global financial crisis of the last decade, consolidation among major producers has dominated the gold sector, often leaving exploration budgets stretched.

The current gold rally also differs from previous cycles. Richardson said gold is responding to risk and geopolitical uncertainty, with central banks increasing their gold reserves.

“Gold is the alternative to the US dollar now,” he said. “For junior explorers, the challenge is capitalising on the window. Our challenge is to find gold that can come out of the ground while we’re up [at high gold price levels].”

Falcon Metals entered the market at an opportune moment. The industry’s attention was centred on a spectacular new discovery at Fosterville in Victoria, giving the company the chance to quietly secure a section of a historic mine just 25km away.

“While everyone was so focused on Fosterville, no one was paying any attention to Bendigo,” Markwell said.

The company pegged an exploration licence in late-2021 that had drawn minimal interest, despite sitting along strike from a goldfield that is known to have produced 22 million ounces between 1851 and the First World War.

More importantly, the northern extension had never been drilled.

Falcon had studied the existing records extensively, even hiring a historian to comb through library archives of the old Bendigo mines. The company targeted the Garden Gully Line, which had produced 5.2 million ounces on its own and extended right to the tenement boundary.

That first hole on the northern extension and subsequent wedge holes intersected multiple mineralised structures from surface to 800m depth, with high-grade zones returning 543 grams per tonne (g/t) gold, 185g/t gold, and 48.7g/t gold.

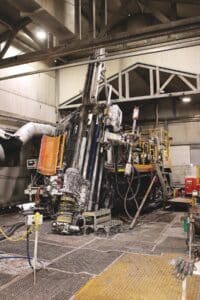

The company has since completed several more wedge holes across the fold structure and has recently raised $20 million to accelerate the program. A second drill was due to mobilise in October, with plans to step out at 200m spacings along an initial 2km strike.

“We have all these lines of reef already laid out for us,” Markwell said. “It really is just a matter of drilling these holes and seeing what’s there.”

Near-term potential

Magmatic Resources is taking a different approach to the same opportunity. While the company has a joint venture with Fortescue Metals Group targeting tier-one copper-gold potential in New South Wales, Richardson sees Weebo as an immediate chance to generate near-term results in the current gold price environment.

The project sits within 30km of five operating gold mines in Western Australia, all with resources exceeding two million ounces. Three of those mines sit on the same greenstone belt as Weebo, with historical drilling at the project returning high-grade results.

Richardson said the initial results of Magmatic’s maiden drilling program completed at Weebo in September had delivered further high-grade intersections, providing momentum for the company with its next drill program expected to commence in November.

“We’re on the right rocks,” he said.

At the Ockerburry prospect, air-core drilling confirmed extensive shallow gold mineralisation associated with a 5km structure. Meanwhile, a single line of slim-line reverse circulation drilling at the Scone Stone prospect confirmed high-grade mineralised structures.

Beyond Magmatic’s upcoming drilling programs at Weebo, the next major inflection point will be delivering a maiden mineral resource estimate.

“If you release a resource that highlights how many ounces are in the ground, the grade, and there’s confidence it can be mined economically, that’s when you have something to sell,” Richardson said.

The Weebo project’s historical high-grade results combined with the positive returns of Magmatic’s maiden drill program give the company confidence as it moves towards resource drilling.

With $3.5 million committed to exploration at the Myall Project JV with Fortescue over the coming months providing regular newsflow, and a focused drilling program underway at the Weebo Gold Project, Magmatic is working towards that objective.

Richardson and Markwell are drilling in proven provinces with strong technical teams and funded programs. Whether the high gold price window stays open depends on factors beyond their control, but both are moving quickly to make the most of it.

This feature appeared in the November issue of Australian Mining magazine. Get 50 per cent off your Australian Mining annual magazine subscription during our Black Friday sale. Visit our subscription page and use the code: AMBF25. Ends on 27 November 2025.