Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Jack Welch was the quintessential American capitalist, feted by Wall Street, dined by global politicians and harkened to by his innumerable acolytes. He destroyed General Electric personally, and his legacy is destroying Boeing, the only major commercial aircraft manufacturer left standing in the United States. That doesn’t bode well for decarbonization of key sectors.

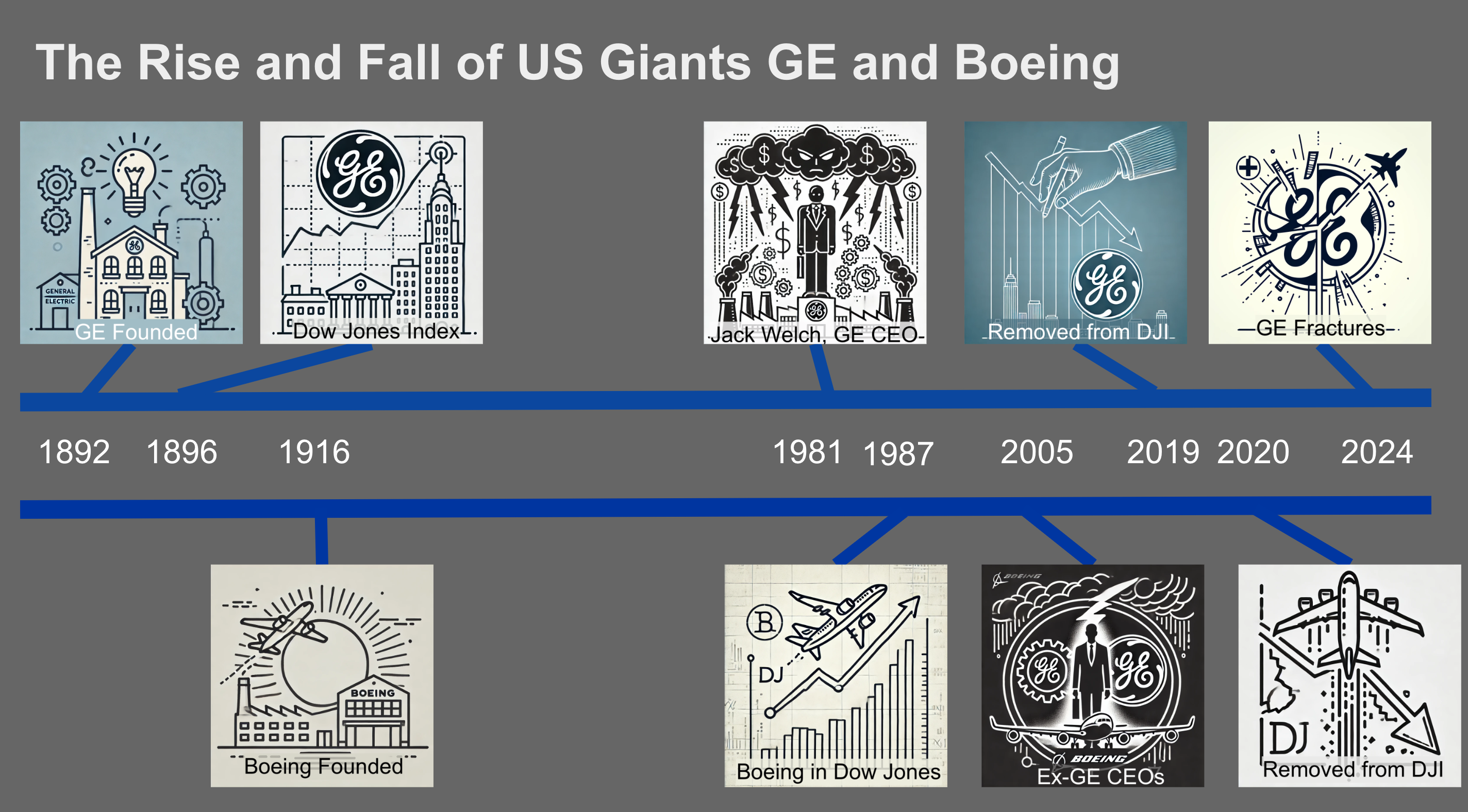

General Electric (GE) was founded in 1892 through the merger of Thomas Edison’s Edison General Electric Company and Thomson-Houston Electric Company, creating a powerhouse in the burgeoning electrical industry. Just four years later, in 1896, GE made history by listing on the New York Stock Exchange (NYSE), marking its entry as a major player in American industry. That same year, GE became one of the original 12 companies included in the newly formed Dow Jones Industrial Average, symbolizing its central role in the U.S. economy. In 1981, Jack Welch assumed control and maintained it for 20 years, with his acolytes taking over after him. GE had remained a fixture in the Dow for over a century, but in a dramatic turn, it was ejected from the index in June 2018, ending a 122-year run that reflected both its rise and its struggles in the face of changing economic tides. On April 2nd, 2024, GE dissolved. A year after spinning off its medical division, it split into two more separate firms, each struggling with the legacy of Welch’s reign in different ways. GE Aerospace has the GE stock symbol, for what that’s worth, but in reality, GE has left the market.

Boeing was founded in 1916 by aviation pioneer William Boeing, initially as the Pacific Aero Products Co., before rebranding to Boeing Airplane Company in 1917. The company quickly established itself as a leader in aerospace innovation, contributing to both commercial and military aviation. Boeing became a publicly traded company in 1934, listing on the New York Stock Exchange (NYSE), where it would grow to become one of America’s most iconic industrial giants. In 1987, Boeing joined the prestigious Dow Jones Industrial Average, underscoring its significance in the U.S. economy and its role as a global aerospace leader. Boeing completed its merger with McDonnell Douglas in 1997, significantly expanding its presence in the defense sector but adding a company poisoned by Welch-inspired Stonecipher to the still naive, engineering-focused Boeing with disastrous effects. Welch acolyte and former GE executive James McNerney followed, and then later another Welch trained corporate disaster, David Calhoun. After decades of success, Boeing’s position was tested by a series of challenges, including the 737 Max crisis, leading to its removal from the Dow in August 2020.

The two giants of American industry have had a string of engineering and product debacles in recent years as a result of the decades of sidelining and firing their engineering talent, eliminating their cultures of quality and safety, and focusing solely on quarterly stock analyst sentiment.

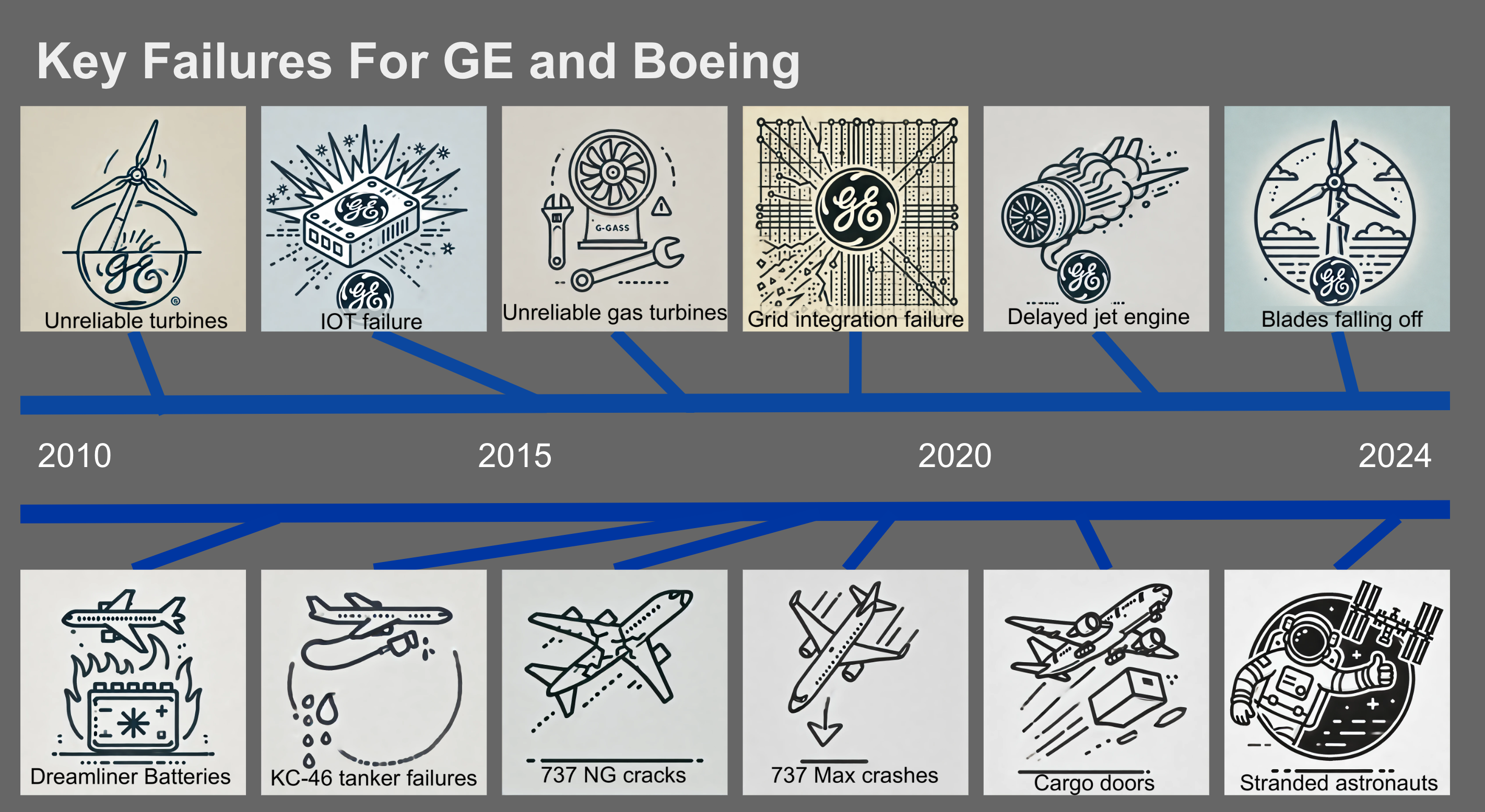

Between 2013 and 2015, the company’s Vernova wind turbines suffered from performance issues that undermined their reliability and market appeal. GE’s ambitious push into the Industrial Internet with its Predix platform floundered between 2015 and 2018, plagued by technical issues and poor market adoption. In 2015, GE leaned heavily into its natural gas generation business, which was a problem, as from 2017 to 2019, GE’s H-class gas turbines encountered significant technical problems, including blade failures, leading to costly repairs and a loss of customer confidence. The company’s Grid Solutions division struggled from 2016 to 2019 with integrating renewable energy into existing power grids, compounding GE’s challenges in the rapidly evolving energy sector. The GE9X aircraft engine, developed for Boeing’s 777X, faced delays from 2018 to 2020 due to durability concerns and certification challenges, further straining GE’s aviation business. Now blades are falling off of GE Vernova’s offshore turbines in the North Sea and in the coastal waters of the United States.

Since 2010, Boeing has grappled with a series of major product problems that have severely impacted its reputation and operations. The most notable issues include the global grounding of the 737 MAX following two fatal crashes linked to flawed MCAS software, and the battery fires on the 787 Dreamliner that led to a temporary suspension of the fleet. The KC-46 Pegasus tanker has faced persistent technical deficiencies, while the 777X program has been plagued by certification delays and engine problems. Structural cracks in older 737 NG aircraft, manufacturing flaws in the 787, and software issues with the Starliner spacecraft have further tarnished Boeing’s image. Most recently, Boeing’s quality failures stranded astronauts on the International Space Station, who will now be returned to earth by SpaceX.

What does this have to do with American climate action?

With the continued failings of GE’s energy business, including its pivot toward gas generation instead of renewables, America’s only major wind turbine manufacturer lost momentum and focus. Quality problems that crossed the entire GE spectrum of products due to the intentional dissolution of its culture of quality and engineering hammered the renewables and grid-oriented divisions as well. Just as with Siemens Gamesa, renewables firms are looking in alarm at GE’s quality issues and questioning whether to place more orders.

In 2015, GE was the third largest manufacturer of wind turbines globally by both capacity and revenue, trailing only Vestas and Siemens. By 2023, it had fallen to 8th and had a more limited geographical market than either Siemens Gamesa or Vestas. Its flagship Haliade-X offshore turbines keep having blade problems, most notably and amplified on the northeast coast of the USA where, heaven forbid, fragments of non-toxic composites washed up on rich people’s beaches to enormous hew and cry. As GE has been dissolved into multiple lesser companies, it’s no longer too big to fail or likely to be bailed out in the event of another economic challenge.

The firm is having trouble raising capital or debt financing. It’s inherited a bunch of GE’s debt load. The company is still cutting costs instead of focusing on quality, refusing to learn the lesson that led to GE’s dissolution. It’s trying to focus solely on higher growth markets. It’s facing headwinds in global markets because Chinese turbine manufacturers are offering better, more reliable products at a lower price.

The odds of GE Vernova failing entirely in the coming years is increasing, not decreasing. Its ability to grow to service the US domestic onshore and offshore market is in question. Both Vestas and Siemens Gamesa have US plants, so considerations of Made in America won’t save it.

As part of its ongoing dissolution, GE spun off its rail locomotive division to Wabtec in 2019, making that firm the dominant locomotive provider in the market. While that’s good news for the locomotive division, it’s not good news for climate action as the rail industry in the USA claims falsely that what works just fine in every other major geography and economy in the world, rail electrification, can’t possibly work in the USA. The sale is effectively a moot point.

GE is yesterday’s company, a shadow of its former self, and decarbonization needs the industrial giants of America’s past.

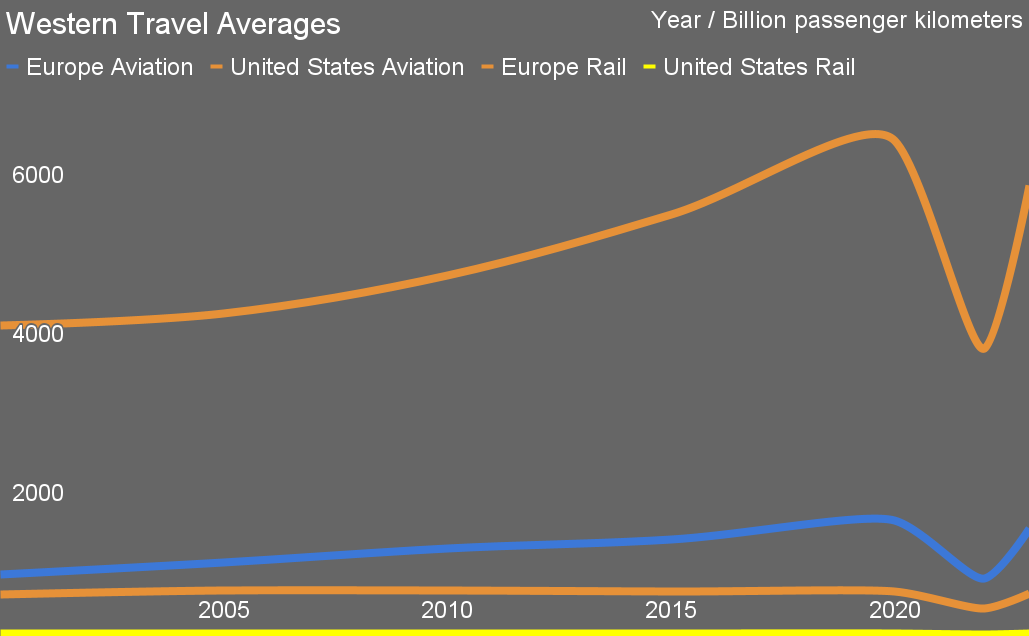

As for Boeing, Americans fly vastly more than any other equivalent region’s citizens. As the last substantive commercial airplane manufacturer left in the country, its current culture and management are deeply at odds with forward facing solutions to aviation decarbonization. This is a company which refused to build a new plane for new and more efficient engines, but instead bolted them onto a decades-old airframe and screwed it up in multiple ways, leading to the loss of 346 souls.

Boeing is incompetent to build an electrified or hybrid turboprop. It’s dissolved the engineering and quality culture necessary to safely certify its aircraft for biokerosene sustainable aviation fuels, and to be clear, that was with the Federal Aviation Authority and US Congress’ complicity. The failures of the past decade are failures of Welchian capitalism applied to a safety-critical organization, but also a betrayal of the amazing record of civil aviation safety that the USA was so instrumental to creating. The FAA is no longer a trustworthy certifier of aircraft, at least not with Boeing. Maybe with others, but that’s to be seen.

Boeing asserts it’s focused on biologically sourced sustainable aviation fuels, but it’s wasting time with electric air taxis and hydrogen for aviation. It’s certainly not building a hybrid electric turboprop for regional markets, a clear path forward for US aviation.

Boeing’s failure on the military industrial, aerospace, and aviation fronts shows in its stock price, 40% of its frankly bizarre 2019 peak. In the U.S. military-industrial complex, Boeing faces competition from Lockheed Martin, Northrop Grumman, General Dynamics, Raytheon Technologies, and Textron Aviation, all of which are key players in supplying military aircraft and related technologies. For orbital work, SpaceX is eating its breakfast, lunch and dinner. For commercial aviation, Airbus is delivering better, safer, more modern aircraft that are better for pilots to fly, and now so is China’s COMAC, which is much more likely to be providing aircraft to Asian, South American, Indian, and Latin American operators than Boeing in the coming years.

The possibility of Boeing failing completely is entirely realistic, and there’s no reason to believe that it is too big to be allowed to fail either. It’s unlikely to be part of a real climate solution, either in the USA or globally. It’s possible it will fail and the maintenance business will be bought by some organization to keep the planes in the air until they’ve all been retired, much like Bombardier’s diminution to a maintenance organization for aging executive jets.

The hollowing out of these once great American industrial giants is a sad story, and unfortunately that story has repercussions that will be felt for years to come as the country tries to come to grips with its intractable emissions problem. Although not the only root cause, a remarkable amount of the culpability rests on Jack Welch and his destructive take on capitalism.

For readers who haven’t read either of The Man Who Broke Capitalism: How Jack Welch Gutted the Heartland and Crushed the Soul of Corporate America―and How to Undo His Legacy or Flying Blind: The 737 MAX Tragedy and the Fall of Boeing, I’d recommend putting them on your list of books you’ve purchased and haven’t read.

The Man Who Broke Capitalism is a compelling book by David Gelles which delves into the controversial legacy of former GE CEO Welch, whose aggressive management style and relentless pursuit of short-term profits are argued to have profoundly shaped modern American capitalism. Gelles chronicles how Welch’s strategies, including mass layoffs, outsourcing, and an obsession with quarterly earnings, set a precedent that many corporations followed, leading to widespread economic inequality and a focus on shareholder value over employees and long-term growth. The book paints a critical portrait of Welch, positioning him as a pivotal figure whose influence has had lasting, often detrimental, effects on the corporate world and society at large.

Flying Blind by Peter Robison offers a compelling investigation into how Boeing’s decline can be traced back to the influence of former General Electric executives, Welch acolytes all, who took the helm of the company. After Boeing’s merger with McDonnell Douglas in the late 1990s, GE-trained leaders, including CEOs Harry Stonecipher and James McNerney, steered the company toward a relentless focus on financial performance over engineering excellence. Robison argues that this shift, rooted in GE’s management ethos, led to aggressive cost-cutting and a culture that prioritized shareholder value at the expense of safety. These decisions culminated in the flawed development of the 737 Max, which tragically resulted in two fatal crashes. Robison’s book reveals how Boeing’s embrace of GE’s profit-driven leadership style had devastating consequences for its employees, reputation, and the broader aviation industry.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy