Iran attacked Israel on Saturday with about 320 drones and missiles, but only a few got through the air defense system.

The barrage was in retaliation for an Israeli strike on Iran’s consulate in Syria, which killed 13. It was Iran’s first strike on Israeli territory from its own soil.

The big question is what happens next. Many are saying that Iran’s operation was “just theater” because it gave Israel ample warning and knew most of its projectiles couldn’t penetrate air defenses.

It wasn’t theatre and I can guarantee it won’t be “theater” when Israel strikes back. I don’t anticipate a nuclear strike, or Iran’s oil production facilities to be hit, but there will be a military response. It might be the same number of drones and missiles, fired with pinpoint accuracy and with better technology.

Israel’s President Netanyahu said in a tweet after the attacks that Israel “will win”. The War Cabinet is united on how and when to respond.

According to Al Jazeera, if Israel retaliates, Iran’s response would be “much larger” than the overnight bombardment, according to a report by the Reuters news agency…

Iran also warned Washington that backing Israeli retaliation would lead to the targeting of US bases…

President Biden made clear that the US will not participate in any offensive operations against Iran.

After warning Iran not to attack Israel Biden did an about face and the US will now not participate in Israel’s response. Reminds me of Obama’s Red Line being crossed and the US’s response. It’s very hard to get respect, and keep it, when people understand there are no consequences when you cross their red lines.

Immediately after the attack, bitcoin fell $6,000. Gold spiked the day before, reaching $2,426 on April 12, then lost about $100 the same day. Over the weekend gold weakness continued, and on Monday, April 15 it slumped to $2,232, before recovering to $2,357 at time of writing.

Source: Kitco

Gold and bitcoin are often touted as safe-haven assets, but in this particular conflict, it’s the US 10 year Treasury yield and the US dollar that appear to be attracting the most safe-haven demand. Over the past three months the US dollar index DXY has gained 2.7% to 106.10 and the US 10-year Treasury yield is up nearly 14% to 4.59, at time of writing.

Source: CNBC

Retail investors are selling gold bars, coins and jewelry to capitalize on record-high prices, and why wouldn’t they? We know they aren’t buying gold exchange-traded funds because more gold is flowing out of gold ETFs than in. Gold has had a fantastic run so far this year, up 16%.

Gold and the dollar are inversely correlated but lately gold and the buck have risen in tandem. The demand for Treasuries — which many investors foreign and domestic hoover up during wars (like now) and economic crises — is lifting yields and supporting the dollar.

Which is the safest haven during a crisis? Definitely not bitcoin.

King Crypto is down 9.5% over the past five days, and is showing a sell signal according to StockCharts. This despite looming Israeli retaliation and a dangerous escalation of the Israel-Hamas conflict.

Source: Google

As we wrote previously, gold is still the preferred safe haven asset given its four advantages over cryptocurrencies: volatility, liquidity, regulations, and utility.

Volatility

Cryptocurrencies are extremely volatile, and even a “safe” one like bitcoin is more of a risk-on asset like stocks. On the other hand, gold is a known commodity that has been fundamentally embedded in the financial system for decades. It has no positive correlation with the stock market, and therefore is less vulnerable to its ups and downs.

Liquidity

Another factor that comes into the gold vs. crypto debate is liquidity: how easily the asset can be converted into cash. Although bitcoin and other cryptocurrencies trade 24 hours a day, they are less liquid than other asset classes. Transactions involving bitcoin et al. generally come with a cost and/or time delay, which is also a contributing factor to its price volatility.

Meanwhile, gold has always been an extremely liquid asset; most of the time, bullion can be easily exchanged for cash, as it’s universally recognized around the world. Nearly 90% of the world’s annual gold production changes hands each day.

In fact, data from the World Gold Council shows that the precious metal is actually the second most liquid asset after S&P 500 stocks.

Source: U.S. Global Investors

Regulations

Because gold already has an established system for trading, weighing and tracking, the regulations that govern it are generally clear and rigid. Unlike stocks and currency, gold cannot be manufactured on the spot and must be mined. This also makes forgery difficult, protecting gold owners.

Crypto, however, does not offer investors the same degree of protection. Since this market is still in its infancy, the regulatory infrastructure to ensure that users are safe is not yet in place. While it’s true that a major cryptocurrency like bitcoin is less vulnerable to theft thanks to its encrypted and decentralized system, it is not immune to its own regulatory risks.

For example, central banks worry that crypto could undermine the stability of the monetary system, and therefore have taken measures to control this emerging market.

Utility

Unlike crypto, which mostly serves as a medium of exchange in the form of a digital currency, gold has a variety of uses across many industries, such jewelry and electronics. Gold’s place in human history is also much richer, dating as far back as 5,000 years; today, the precious metal is still worshiped by cultures all over the world.

Given its multi-functional utility and revered status as a symbol of wealth, gold has been able to withstand the ravages of time and maintain its prominence through every era of civilization.

Rarity

What really underpins gold’s value is its rarity. For every billion kilograms of the Earth’s crust, there is about 4 kg of gold. This fraction is even less than other precious metals like silver and platinum.

It is estimated that all the gold metal mined throughout history would fit into a square box with 20-meter sides.

Although some cryptocurrencies like bitcoin are also rare given the limited supply, investors always have a wide selection of digital assets to choose from.

Gold investors, meanwhile, have only a limited number of options aside from buying the physical metal; they can either place money into funds that replicate the value of gold (i.e. gold-backed ETFs), or consider options and futures contracts that give them the right to buy gold later.

There have been several studies done showing that bitcoin is closely linked to the stock market, which sharply reduces its safe-haven utility during times of crisis.

A 2021 article in ‘Economic Research’ asked whether bitcoin behaves any differently from foreign exchange markets and gold, and whether it offers any diversification, hedging or safe-haven potential.

The paper employed a regression model to determine the relationship between bitcoin, economic activity, forex markets, financial markets, energy and gold. It found that “Bitcoin exhibits a positive relationship with equity markets in both the bullish and bearish regimes, a positive relationship with the Forex markets and Gold in the bullish regime, and a negative relationship with Energy in both regimes…”

“It may, therefore, be concluded that Bitcoin fails to provide any potential safe-haven properties as characterized by Gold, rather it may act as a diversifier or a hedge, at best.”

A more recent article in ‘Cogent Economics & Finance’ examined the safe-haven role of gold, the US dollar, and bitcoin over three periods: the financial crisis, the covid-19 pandemic and the Russia-Ukraine war.

Research was conducted in eight countries that are major trading partners of Russia and Ukraine.

The study found that gold lost its role as a safe-haven asset during the pandemic, but this role was restored in the Netherlands, the US and Germany during the Russia-Ukraine conflict. Similarly, bitcoin was not a safe-haven asset during the pandemic, but it was a strong safe haven for the stock markets of some European countries.

The study also found that only the US dollar acts as a stable safe haven through periods of crisis, except for Russia, which is de-dollarizing.

A third article published by TD Bank Senior Economist Vikram Rai, is titled, ‘Cryptocurrency: Not a Safe Haven in 2022’.

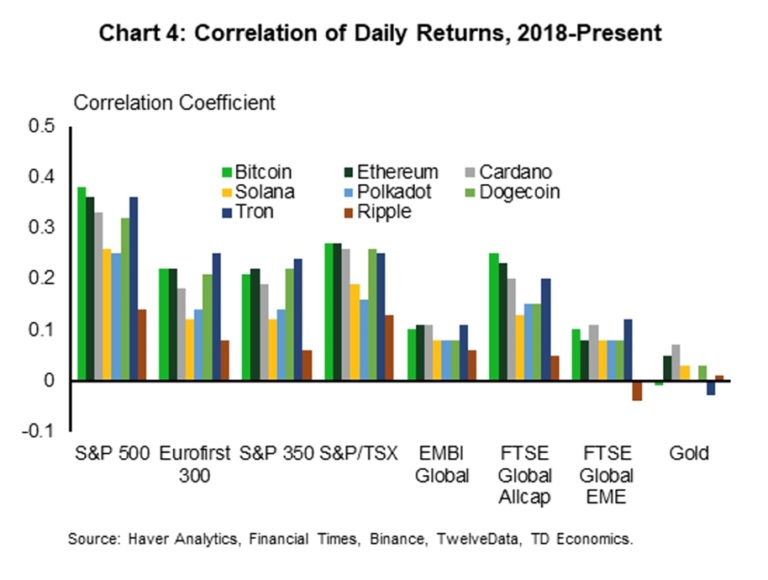

The article states that the most important thing for investors seeking to gain protection from stock market risks is whether cryptocurrency returns are correlated with those of traditional risk assets. The chart below shows there has been a strong correlation with the S&P 500, the stock index most closely linked to the US business cycle.

The chart also shows that gold prices have little correlation with cryptocurrencies and certainly far less than equities do. (Note that “Present” in 2018-Present means end of August, 2022)

Conclusion

Investors love gold because for thousands of years it’s been proven to hold its value. They see gold as a way to preserve their wealth, unlike fiat currencies which are subject to inflationary pressures and over time, lose their value.

When the dollar falls, investors flock to gold, hence the inverse relationship between the two.

When the dollar slumped between 1998 and 2008, gold prices nearly tripled, reaching $1,000 an ounce in early 2008 and nearly doubling between 2008 and November 2011, when gold hit $1,903 on the risk of the US defaulting on its debt.

Gold is seen as a hedge against inflation, because its price generally rises as the cost-of-living increases. This certainly seems to be the case now. Despite inflation coming down from 40-year highs, the two items not measured in so-called “core” inflation data, food and fuel, continue to soar. So has gold, which is trading above $2,300 an ounce.

Gold investors love nothing more than a war, economic crisis or any type of geopolitical instability to watch the value of their bullion grow. Heightened global tensions such as terrorist attacks, border skirmishes or civil wars scare investors into putting their funds into safe havens like gold and stable, high-yield sovereign debt.

For example during the 1970s, which saw a number of upheavals in the Middle East including the Iranian Revolution, the Iran-Iraq War, and the Soviet invasion of Afghanistan, gold rose 23% in 1977, 37% in 1978, and 126% in 1979, the year of the Iranian hostage crisis.

Gold also spiked when the US bombed Libya in 1986, right after the Gulf War in 1990, and when ISIS attacks put oil supplies in the Middle East at risk. However it is interesting to note that the price of gold “tends to rise in anticipation of a conflict, but often falls when tensions turn into a full-blown war,” writes Simona Gambarini, an analyst with Capital Economics.

Gold is protection against “the unthinkable.”

Most people consider their bank accounts, art, antiques and properties to be stores of value. The proof of having a good-sized pile of cash is a debit card, from which we control online bank accounts where we can add, withdraw and transfer funds by clicking a mouse or by tapping an app. The certainty of electronic banking is rarely if ever questioned, let alone the credit/ debt monetary system it is based on.

Nowadays the only people and institutions who own physical gold are central banks and those who distrust the monetary system — people who see gold as a hedge against inflation and want to own it as insurance against some calamity (e.g. banking system collapse, war), when getting access to cash is difficult or impossible, and paper currencies plummet in value.

(Think about how useless your bitcoin would be in the event of a long-lasting blackout. The numbers on a screen are useless if you can’t turn on your computer/ tablet/ phone, or the internet is down.)

Most people think such an event is so unlikely, they disregard the idea of owning gold or returning to the “barbarous relic”, as economist John Maynard Keynes referred to the gold standard in his 1924 book on monetary reform, suggesting gold had outlived its usefulness.

In reality there are many instances in history of how gold came to the rescue of states on the verge of collapse, and a number of frankly terrifying scenarios that could destroy the meaning and value of today’s money in a heartbeat.

I own gold bullion, not bitcoin, because the Boy Scout motto ‘Be Prepared’ still resonates with me.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

*********