Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

A lot is happening in carbon, and we sat down with Magnus again after speaking with him in 2022.

What are you currently most excited about in the carbon markets?

Two things excite me the most: First, the real, quiet shift towards removal, and second, the increasing adoption of long-term portfolios. While the big-bang purchases of removal remain being executed by a very small number of buyers that essentially stayed the same over the past years and often require payment at delivery in the future, we now see an expansion of removal investments within portfolios that happens more quietly but seems more resilient with actual spot purchases of nature-based, hybrid, and engineered removals.

On average, we’ve seen an increase in removal share of over 30% year-on-year. These are transactions that often come with normal payment terms and allow early cash-in for project developers and aren’t necessarily used for large marketing announcements. It’s rather a real risk perspective that drives them. Similarly, this increase drives companies to think about balanced portfolios for the long term. With net-zero ambitions in 2030, the target years are no longer in a distant future for many companies. As buyers have made their experiences in the market, they’re starting to be more aware of the supply and price risk that is to come. Rather than focusing on short-term project investments with flashy narratives, buyers are starting to construct portfolios with a 3 to 5-year time horizon. At CEEZER, we advocate for this approach, which mirrors the required build-up of high-quality supply. By spreading investments across various technologies, geographies, registries, and years, corporates increasingly pursue a risk-hedging strategy that helps supply-side growth at scale. This strategy enables risk mitigation and offers the opportunity to support high-quality, high-cost removal projects while reducing long-term market risks.

Since we last spoke, how has financing and transparency on the quality of projects developed?

Since our last discussion in late 2022, financing and transparency in carbon projects have seen significant advancements. 2023 posed what I would call “positive challenges” for carbon market players, with declines in carbon credit issuances and retirements of certain credit categories following controversial news that impacted the market’s reputation. Expectations were high for COP28 and Article 6 negotiations to give “UN-sanctioned” guidance, but unfortunately, they did not yield the anticipated results. Something that might have driven a sudden increase in the market.

However, amidst these challenges, regulatory changes and increased public scrutiny have led to elevated quality standards for carbon credits. There are a few private market initiatives that, while early, are prone to wider adoption.

For example, on June 6th, the Integrity Council of the Voluntary Carbon Market announced the first carbon-crediting methodologies that meet its high-integrity Core Carbon Principles. This will allow buyers to eventually look for ‘CCP-labeled’ credits, hopefully giving them confidence that these are aligned with an industry-leading standard. That said, the process of accreditation is still ongoing and it remains to be seen how robust the CCP label will be in a very quickly evolving market. Also, both for buyers and suppliers, the competing quality frameworks are starting to be a bit of a headache. We focus on “credit fundamentals,” i.e. metric-driven properties of carbon credits that we collect, vet, and harmonize to be able to quickly derive adherence to any possible standard. For now, that seems to be the only way to manage the variety of quality definitions out there.

Luckily, deepened collaborations among major players in the Voluntary Carbon Market, including ICVCM, VCMI, SBTi, and others, are at least signaling a concerted effort to build trust and confidence in the market. A quick harmonization will be crucial if we want companies to act.

What spurred controversy was the announcement of the Science Based Targets Initiative’s potential acceptance of carbon credits towards Scope 3 targets, and the VCMI’s beta Scope 3 flexibility claim. There remain large differences within the carbon world on the best and most impactful way to deploy negative emissions as part of the decarbonization journey. While the concern around negative emissions as an “easy way out” is probably shared by everyone, a parallel deployment of removal next to internal reduction is necessary in most market scenarios. First, to make sure supply can grow quickly. Then, to “derisk” the often ambitious decarbonization timelines towards 2050 with removals before target years. In practice, we’ve hardly seen corporates investing significant amounts into removal when an internal decarbonization plan was not in place. Initiatives like the SBTi are central to corporate climate commitments but ultimately also rely on corporations adhering to their principles voluntarily. That is not an easy balance to keep – but even if discussions are controversial, that exchange is crucial at the current time. Removals are part of almost any climate scenario, and the time for “either/or” has long passed.

If you were purchasing carbon credits for an enterprise or a government, how would you approach it?

I firmly believe that no matter who is purchasing carbon credits, it’s essential to adopt a data-driven approach that aligns with long-term climate goals and optimizes the climate impact of investments. In any case, the first step is accurately measuring the carbon footprint across all activities, followed by identifying and implementing abatement initiatives.

Once reduction efforts are initiated, buyers should define a strategy for compensating remaining emissions (ideally both along the way towards net zero, and definitely the residual emissions at net-zero).

Advanced buyers today come with a set of requirements that we help to translate into objective metrics. As said, we’ve seen a significant increase in removals and help our partners understand what differences there are in terms of permanence, reversal risk, co-benefits, etc. When purchasing, CEEZER strongly advocates for creating a balanced portfolio that takes into account these specific risks as well as supply and price risks. Additionally, portfolio design is best done over multiple years, taking into account current and projected market dynamics. For example, it might make sense to secure specific project types like hybrid removals with a smaller pipeline but a large projected demand already today. For other project types, like really experimental technologies, it might be more beneficial to do some initial forward contracts but keep the flexibility to re-contract at lower prices later.

Increasingly, buyers are concerned with the post-purchase part of things, also thanks to regulations like the VCMDA in California or CSRD in Europe. Transparent reporting and communication are important and should be easy. Making sure the use of credits is tracked and logged internally across all parts of the company is equally challenging when working across different registries.

What is useful financing, and what is useless financing?

Useful financing is investing in projects that contribute to tangible climate action and carbon reduction goals.

Maybe this is controversial, but at large I believe the financing gap is less on the VC side of things, but really in project finance. The financial profile of carbon projects is similar to that of energy assets and other comparable investments. You have a relatively high upfront investment that can be earned back over a long period of time with regular issuances. The key difference is that off-take prices for carbon are hard to understand and predict at the moment. That challenges traditional financing solutions like energy project finance with predictable and often state-guaranteed feed-in tariffs. In short, for a bank, carbon projects are pretty risky for the long time horizon they cover. However, there is a real opportunity there for banks and mezzanine capital can play a huge role. It requires a certain risk appetite for sure but should be doable.

In practice, corporate and private buyers can still help. This can include investing in high-quality carbon credits as a long-term off-take contract or supporting early-stage carbon removal technologies to encourage the development of new solutions with the ability to generate significant discounts. Clearly, this requires buyers to take a larger risk. Determining the risk profile of a project requires a thorough, data-driven approach. CEEZER has gathered and analyzed millions of data points and conducts a rigorous vetting process for every project and complements that with external ratings to help guide buyers into the right decision. Further, buyers can engage with high-quality projects early via the CEEZER Carbon Coalition, a collection of early-stage carbon removal players we guide to market. As a player with the data and the firm demand points, we also play our own role in backing long-term carbon portfolios with external financing. This allows later cash-out for buyers and early cash-in for project developers.

Useless financing I’d say is the kind that does not actually happen. A lot of larger removal deals run as “payment on delivery.” So the headline reads that multiple millions went into carbon removal, while the suppliers haven’t yet seen a single dollar. The financing pressure hence remains on the often smaller suppliers. The buyers who truly lead have to do more these days.

What is the main product offering of CEEZER, and what’s the future of your product suite?

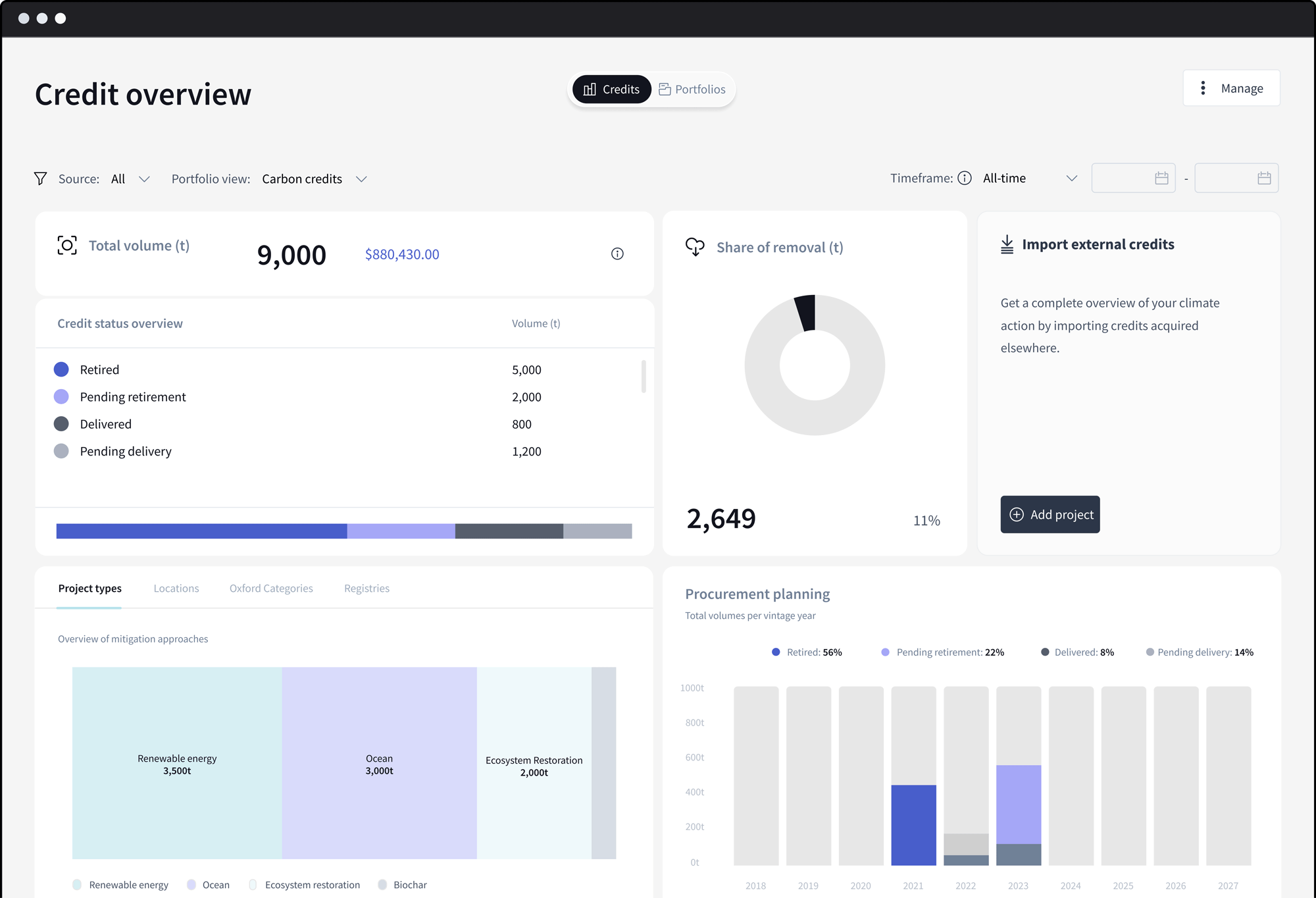

CEEZER’s platform enables enterprises to screen, purchase, and manage negative emissions. CEEZER uniquely combines the broadest supply overview with harmonized quality data to direct investments into impactful projects in balanced portfolios. We allow buyers to focus on mitigating risk and maximizing impact – while CEEZER takes care of the rest: Transaction handling in the registry, retirement, payment alignment, and post-purchase management of carbon assets.

I feel like we are unique in how we look at quality and risk, with a data- and science-driven approach that is ingrained into every part of the platform. We allow you to leverage over 13 million data points on quality, volume, and pricing and have up to 530 data points for a single project that we can translate into meaningful information. In sum, we offer a tool that simplifies carbon purchases, reduces long-term quality and volume risk, and facilitates accurate reporting and communications from CDP to CSRD.

Looking ahead, we focus on three things. First, the need for longer volume commitments requires a different view on long-term risk within projects, both around quality and volume availability. We are actively testing new ways to manage and mitigate that risk right on platform to make sure buyers get what they need, when they need it. Second, we’re offering additional tooling to manage already purchased credits within your organization — or make them available to external parties like suppliers and customers in case they want to. Transparency and a bullet-proof record are key there of course. Lastly, we have a larger role to play in financing carbon credit portfolios. As said above, the worst kind of financing is the one that doesn’t happen. A lot of what we do we can leverage to make carbon portfolios more bankable — allowing timely cash-in for the supply side.

What trends do you think are overlooked in cleantech and climate?

In the public debate and news coverage the fact that buyers, and especially large corporates, are increasingly quality-conscious, is cut short. There is an actual shift towards improving climate action that we see in every portfolio we manage, going far beyond the few landmark deals that are being talked about. Companies are starting to think about their climate strategy in longer cycles, leading to an increasing share of long-term off-take agreements and a shift towards higher-quality removal.

Additionally, we see many companies that were considered traditional buyers are now looking at carbon as a potential revenue stream. Particularly in the process industries, companies with existing technological capabilities and suitable supply chains are realizing that deploying DACCS and BECCS within their supply chain is not only a means to reduce their own emissions but might be a potential source of income in a net-zero world. This will bring significant opportunities for equipment manufacturers, verifiers, and other players. That said, the practical use cases are far from clear. There are quite some questions around the additionality and applicability of CDR from traditional industrial supply chains that remain open — and will likely be subject to emerging regulation as well.

Where would you like to see CEEZER in 3 years?

In 3 years, I see CEEZER playing a pivotal role as the global carbon infrastructure, facilitating scalable CDR portfolios for every company, not just a few. We’re really looking at three perspectives on the way there.

First, we focus on large corporates in approaching carbon management with the same rigor as financial performance. By providing robust tools and data-driven insights, we help make informed decisions and integrate negative emissions into crucial decisions.

Second, we continue to focus on balanced portfolios to lower the entry threshold into permanent removals. If done right, this maximizes climate impact today while helping secure supply in the future.

Last, we continue to invest in the broader ecosystem that brings together different stakeholders across the whole carbon value chain. There are gaps at every stage and we have a careful eye on where we can add value. In the current phase of the market, I believe it makes sense to look at where the market should be going forward and do your part to get it there.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy